Perfect Setup in Bitcoin Metrics as Quarterly Expiration Looms

Profit-taking might be over as on-chain metrics reset and demand is insatiable. Derivatives are mixed ahead of expiration with slight downside hedging. Global macro tightens.

Introduction

Overall, today’s data is consistent with continued bullish sentiment in the Bitcoin space. On-chain and price metrics have moderated where they were grossly overheated, yet maintain bullish trends in key areas. The derivatives data provides insights into strategic hedging and investor sentiment as we approach a significant end-of-quarter expiration—an early one this time, with traditional markets closed for Good Friday. The global macroeconomic environment is tightening and slowing, giving Bitcoin the opportunity to stand out as a vibrant new asset, outside the frailties of a waning credit-based system.

Perfect Setup for On-chain Metrics

Our on-chain data paints the picture of growing confidence among investors, despite the recent consolidation in price, with key indicators suggesting a relatively early stage in the overall bull market.

The Realized HODL Ratio has cooled off in the last week after its massive recent rise seen in the 30-day change. The MVRV Z-Score, which is slightly up from both 7 and 30 days ago, the relatively slow pace of increase here implies steady confidence rather than speculative excess. Similarly, the Reserve Risk's increment over the last 30 days points to growing investor confidence, with current prices seen as attractive for long-term holding.

A significant aspect to note is the increase in 90-Days Coin Days Destroyed, indicating heightened activity by long-term holders, which points to LTH redistribution at the previous ATH. This redistribution is also hinted at by the STH LTH Costs Basis Ratio's decrease over 30 days. Coins are definitely moving.

Investor Insights

Phase in Market Cycle: The data reflects a continued growth confidence in Bitcoin, with key indicators like the MVRV Z-Score and Realized HODL Ratio indicating a favorable phase in the market cycle for entry points, especially with the reserve risk and profit ratios signaling accumulation behavior.

Bubble Concerns: The gradual and consistent increases across several metrics suggest a market driven by genuine investor confidence rather than speculative bubble behavior. The rising realized price and profit percentages imply a solid foundation, potentially reassuring investors about the market's stability and long-term viability.

Price and Derivatives

The 50-Day Moving Average (DMA) has seen a substantial increase, moving from $45,575 to $59,386, which is a 30.31% change, indicating a strong bullish trend in the short term. Similarly, the 100 DMA and 200 DMA have also increased, showing gains of 17.30% and 15.58%, respectively, suggesting a consistent upward momentum across different time frames. These moving averages are all rising in order, which means the market is firmly in a bullish trend. It would take a sustained move down under the 50 DMA to bring the overall trend into question.

Also of importance is the fact that the 50 DMA is over the STH Realized Price ($56,067). The latter can be viewed as the weak-hands level. If price gets down there, the likelihood of a liquidation event increases. The 50 DMA is currently providing support above the STH Realized Price and at the round number of $60k.

Investor Insights

Strategic Holding vs. Profit Taking: With Bitcoin's price near ATHs, long-term holders may be restructuring their positions, indicated by the slight drop in LTH Realized Price. If LTHs were waiting for price to reach the ATH before selling, they have likely sold by this point. This also presents a scenario where the LTH selling is over and the anticipated supply squeeze is taking shape.

Market Sentiment and Entry Points: With the amount of buying from the spot ETFs and other market participants added to the firm support levels under price and in a bullish stance, dips will be small. The risk of volatility is to the upside.

Derivatives

Incorporating the Bitcoin derivatives market data with the price metrics provides a broader perspective on the market's dynamics. The Perpetual Futures (Perps) Funding Rate has decreased from 23.10% to 14.54% over the past week, reflecting a much needed cooling in the short term. Despite this, the rate remains high compared to 30 days ago, indicating sustained positive momentum. The Futures Annualized Rolling Basis for 3 months has slightly declined, again suggesting a mild, much needed cooling in futures market optimism.

The Options 25 Delta Skew shows a significant shift from slightly positive to negative, moving from 0.33% to -4.71% over the week. This change indicates a growing caution among options traders, possibly reflecting increased demand for downside protection or less confidence in immediate upward price movement. This could be more directly affected by ETF flows, which options traders are likely watching closely.

Investor Insight

Mixed Signals and Expiration: The Perps Funding Rate, considered alongside the Options Skew, can provide early signals of changing market sentiment. The current data suggests a mix of strong optimism paired with a slight shift in caution toward downside protection. This could be due to the $9 billion expiration this Friday. Traditional markets will be closed Friday for Good Friday, meaning their futures expire on Thursday. This provides a possibility for volatility.

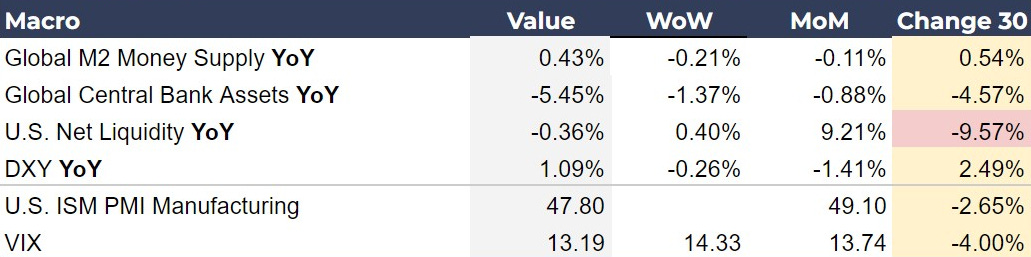

Global Macro

The Global M2 Money Supply's YoY growth is minimal, suggesting that the rapid money supply expansion seen in recent years is over. Despite the common perception of Bitcoin as an inflation hedge, its role has evolved in a destabilizing monetary environment. The decline in Global Central Bank Assets is from last week due to an error in the data provider. There is a notable shift in central bank rhetoric toward more easy policy, but that has not shown in the actual data yet. However, the shift in rhetoric itself is an indicator not all is well in the economy.

The U.S. Net Liquidity's YoY decrease reflects a tightening liquidity environment, which could influence market dynamics, including those affecting Bitcoin. Despite a generally contracting liquidity scenario, Bitcoin's non-reliance on the global credit-based financial system positions it outside many of those systemic concerns. The DXY's is strengthening, traditionally seen as negative for assets like Bitcoin, however, Bitcoin’s unique mix of properties as a technology, digitally scarce money, and exciting new asset class will likely drive investor interest higher as the global economic contagion spreads.

Investor Insights

Diversification in a Tightening Economy: As traditional monetary indicators show signs of tightening, Bitcoin's non-credit-based nature could appeal to investors seeking diversification. Its commodity-like aspects may provide a hedge against potential disruptions in credit markets, aligning with your contrarian view.

Baltimore Bridge Incident: Last night, a containership ran into the Francis Scott Key Bridge in Baltimore. The debris is now blocking one of the busiest port areas in the US, and will likely have a noticeable impact on consumer prices. This could also exacerbate recessionary pressures in the US, as it follows Japan, Germany and China into an economic slowdown.

Chart of the Day

Today’s chart of the day is via Bloomberg Intelligence. It shows the performance of the new bitcoin spot ETFs in their first 50 trading days relative to the 30 other best performing funds in history. As you can see, both Blackrock’s IBIT and Fidelity’s FBTC are in a league of their own. No other funds have ever come close to acquiring as many funds in the first 50 days. It is truly a historic event and one that must be sending shockwaves through C-suites around the world. No one is laughing or ignoring this. Elite FOMO is coming.

Source: Eric Balchunas, Bloomberg

Bitcoin Magazine Pro™ Market Dashboard

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

Missed out on this week's Bitcoin Magazine Pro insights? Here's your opportunity to catch up:

Don't miss these essential reads to stay ahead in the world of Bitcoin!

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!