FULL REPORT: Binance Revisited - Warning Signs At The World's Largest Bitcoin Exchange

Binance’s accounting practices have brought scrutiny and regulatory pressure, but what is the whole story? This article digs into on-chain behavior and website history to uncover more details.

We originally released this in-depth report for paid subscribers first. Both the article and the PDF download is now available to all subscribers.

The Binance Black Box

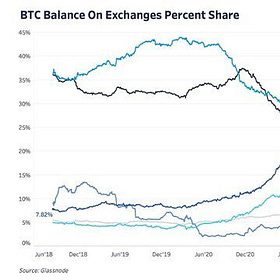

Founded in 2017, Binance, the world’s largest crypto exchange, has carved out a reputation as the preeminent trading venue and derivatives marketplace. It is the main cryptocurrency exchange for users around the globe and holds over 500,000 bitcoin in addition to all the other cryptocurrencies held on the company’s balance sheet.

Yet, beneath the surface of its apparent success lies a complicated web of practices and circumstances that have prompted serious scrutiny.

This report seeks to shine a light on what has been previously overlooked: the company’s potentially questionable accounting practices and how this accounting may be influencing the market valuation for both the company and its ecosystem of various blockchains and tokens.

Steering clear of conclusive declarations, this article intends to offer a perspective that may inspire a general rethinking of Binance and its native BNB token. Our aim is to provoke thought about the accounting practices of the world’s largest crypto exchange, and to stress the importance of vigilance in a rapidly evolving landscape where consumer protection is often an afterthought.

In this report, we’ll focus first on what we believe may be evidence that Binance is commingling its own funds in the same accounts as customer assets, and how these commingled funds look to have been used for a proof-of-reserves attestation.

Next, we examine assets issued on Binance’s BSC blockchains and address how a $150 million hack may have added to a hole in Binance’s balance sheet and created an important liquidation level.

Lastly, we look at similarities between the behavior of BNB and the FTT token, of which the latter collapsed in spectacular fashion right before the downfall of another major crypto exchange, FTX.

While we are not claiming that Binance is engaging in the same type of outright fraud, we aim to bring attention to what we perceive as possible unorthodox behavior at Binance that may call into question the value of its token.

If this information is true, and the BNB token is eventually repriced by the market, it could be a significant downside catalyst for an industry that has faced numerous setbacks in the last year.

$1 Billion “Bailout Fund”

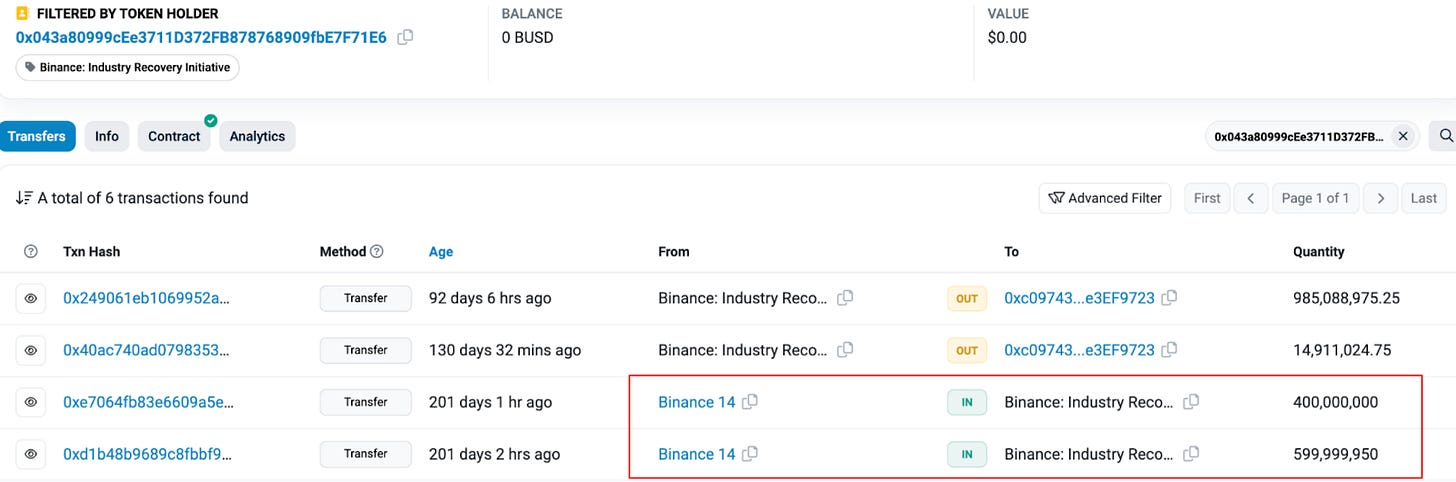

In November 2022, Binance announced an Industry Recovery Fund, which it subsequently funded with 1,000,000,000 BUSD worth $1 billion.

Many people had concerns about the company’s announcement and questioned the source of the funds. Thanks to an article on Fortune Crypto, We now know the recovery funds came from the Binance 14 exchange wallet, which looks to have held both user assets and exchange assets in the same wallet.

In response to the controversy, Binance released a blog post that tacitly admitted company funds were commingled with user assets for what were deemed security reasons.

Here is an excerpt from their post on November 25, one day after announcing the Industry Recovery Fund Initiative (emphasis added):

“Why do we use Binance wallet infrastructure to safeguard user assets and Binance’s assets?

“As one of the largest custodians of assets in the crypto space, security is at the top of our priority list. In order to enable this, we spend hundreds of millions of dollars on security, hiring the best people and employing the best technology. It is one of the single largest investments that we make each year. We believe that our wallet infrastructure is one of the most secure in the industry and that Binance is the best place to safeguard crypto.

“We have considered the use of third party wallet software. However, we have reviewed other wallet vendors and are much more confident in the security of our own ecosystem than what we have seen from other vendors.

“For the reasons above, we safeguard our assets, as well as our customers’ assets, on Binance.”

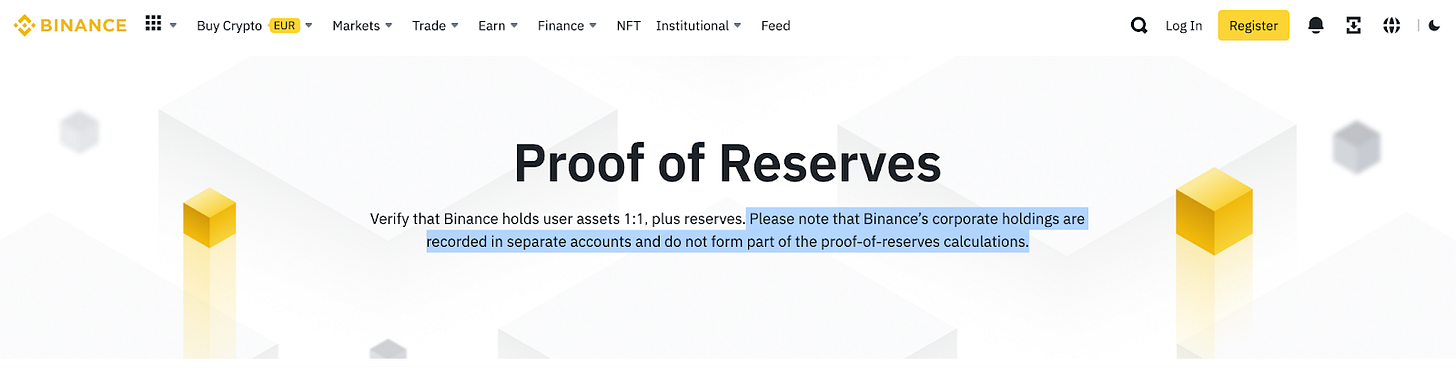

This statement seems to suggest that Binance keeps corporate funds in the same wallet addresses as customer funds, though its now-deleted proof-of-reserves website claims that the company assets are recorded separately.

“Please note that Binance’s corporate holdings are recorded in separate accounts and do not form part of the proof-of-reserves calculations.” — Binance

Suspicious Behavior For Pegged Assets

Now, let’s turn the focus to potentially questionable practices for Binance’s blockchain assets, specifically the BUSD stablecoin, but other B-tokens as well.

In early January, Bloomberg reported that Binance had issued billions of dollars worth of BUSD without 1:1 backing by the Ethereum-based Paxos issued BUSD.

“Data compiled by Jonathan Reiter, co-founder of blockchain analytics company ChainArgos, and analyzed by Bloomberg News shows that Binance-peg BUSD was often undercollateralized between 2020 and 2021… One of the issues here is that the procedure that’s outlined in their documentation for how Binance-peg BUSD is supposed to work wasn’t followed.”

Only one month after the story broke, the New York State Department of Financial Services (NYDFS) ordered Paxos to halt the issuance of new BUSD tokens. As a result of the regulatory directive, Paxos announced the cessation of BUSD issuance from February 21, and its intention to sever ties with Binance.

In addition to possibly commingling corporate and customer funds, nearly two weeks after their initial discovery about the undercollateralized BUSD, Bloomberg reported that more than $500 million worth of wrapped blockchain assets on Binance Smart Chain, called B-tokens, were pledged using Binance 8, an exchange cold wallet. The article reinforces claims we will shed light on the exchange’s commingling of funds.

“That wallet contains significantly more tokens in reserve than would be required for the amount of B-Tokens that Binance has issued. This indicates that collateral is being mixed with customers’ coins rather than being stored separately, as has been done for other Binance-peg tokens according to the company’s own guidelines.”

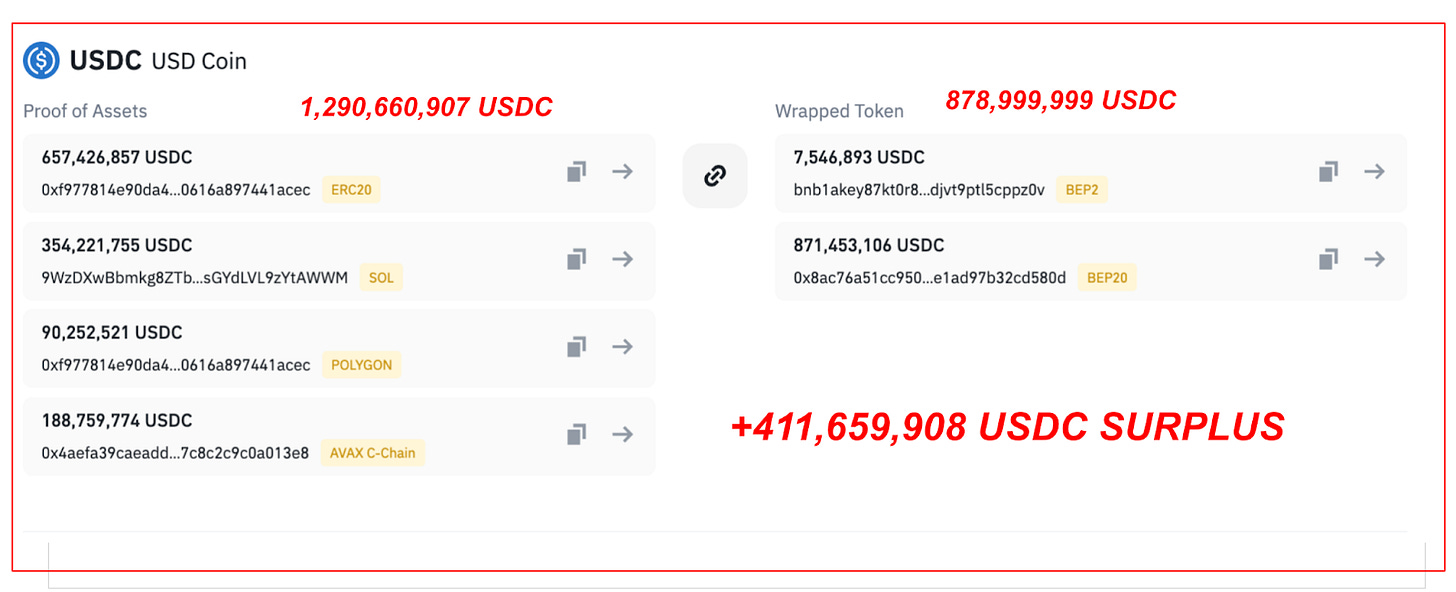

Though the Bloomberg article explains how the overcollateralization demonstrates the mixing of assets, what the report didn’t cover was the fact that there were also billions of dollars worth of assets that were likely being double pledged in the B-token peg-in process, including 1,904,674 ETH plus 5,700,000,000 USDT and 1,290,660,907 USDC, among other assets, as shown in the November 15 snapshot in tandem with historical wallet data.

We urge readers to explore the history of the page themselves, with a particular focus on the input addresses and collateralization ratios.

It is not clear why an asset that is supposed to be pegged 1:1 with another asset would need to be overcollateralized – customers deposited USD into BUSD with the expectation they would be able to redeem BUSD for those same dollars.

While it may be tempting to derive confidence from the fact that the bitcoin peg in this instance is greater than 100% collateralized, it might just be representative of the company’s lax approach to wallet segregation and accounting.

Similarly, the history of the aforementioned proof-of-collateral page shows that Binance's ETH and USDT reserves appear to be severely overcollateralized. But the real red herring is that the ETH address and the Tron USDT address are proclaimed to be exchange reserves by Binance. Since these addresses are claimed as exchange reserves, they could potentially allow for there to be an artificially inflated supply of tokens trading on Binance smart chain that don’t have an underlying backing, due to the double-counting of said assets against two sets of liabilities.

The ETH address (Binance 8) and Tron USDT address (Binance-Cold 2) can be seen on popular blockchain explorers such as Nansen or Etherscan.

Similarly, looking at the peg in addresses for USDC in November, shows more than a $400 million surplus from pegged wallet addresses to pegged out B-tokens. Interestingly, when the wallet addresses are examined more closely, all are identified as Binance cold storage wallets, which are supposed to be entirely segregated from the B-token peg-in process, as per the company’s own documentation and reserve processes.

This lack of separation may have allowed Binance to temporarily issue new “pegged” USDC tokens from tokens that were sitting in the exchange’s wallet, but which actually belong to users. The overcollateralization wouldn’t then be a show of a resilient peg, but instead a sloppily managed internal accounting system where assets could be rehypothecated unbeknownst to users of the platform.

For readers that want to verify this for themselves, the USDC peg-in addresses:

ERC-20: 0xf977814e90da44bfa03b6295a0616a897441acec

SOL: 9WzDXwBbmkg8ZTbNMqUxvQRAyrZzDsGYdLVL9zYtAWWM

Polygon: 0xf977814e90da44bfa03b6295a0616a897441acec

AVAX C-Chain: 0x4aefa39caeadd662ae31ab0ce7c8c2c9c0a013e8

The screenshots above were displayed on the Binance website on November 10, a mere five days after Binance CEO Changpeng “CZ” Zhao tweeted out the Binance blog post, “Our Commitment To Transparency,” in which BTC, ETH, BSC, BNB and TRX addresses for customer funds were revealed.

On Binance’s current Proof of Collateral for B-Tokens page, it states, “Please note that this page only refers to Binance Bridge pegged tokens. This is not the proof of reserve page for Binance.com.”

The quote above seems to show that Binance distinguishes between its pegged tokens and its exchange reserves. Currently, there is no overlap of wallet addresses and holdings, with evidence pointing to all major tokens being backed 100%. It is good to see that these changes have been fixed, but the reporting and on-chain behavior is indicative of potentially a larger problem for Binance, at least in the past, where the firm issued new tokens without a clear and segregated backing.

While Binance responded to the Bloomberg article and allegations of commingling funds, the exchange’s response doesn't address the specifics nor assuage the concerns.

In a statement made to Bloomberg News, a Binance spokesperson said, “Binance 8 is an exchange cold wallet. Collateral assets have previously been moved into this wallet in error and referenced accordingly on the B-Token Proof of Collateral page, Binance is aware of this mistake and is in the process of transferring these assets to dedicated collateral wallets.”

Looking at the on-chain and reported behavior, there is evidence of two different types of mismanagement:

The commingling of corporate reserves with user assets.

The double-entry accounting of using these commingled funds for pegged assets.

The real question is if the move to fix this apparent mistake has created an internal hole on the Binance balance sheet that was masked by the original setup of the token pegs and their subsequent addresses.

Fool Me Once, Shame on You. Fool Me Twice, Shame on Me.

To recap, it appears as though Binance may have commingled user assets on the Binance 14 wallet, used the pool of assets to back its BUSD stablecoin, whose issuance was halted by regulators, and to prop up other B-tokens using the Binance 8 wallet, ostensibly operating as a fractional reserve bank of sorts.

The previous examples show how Binance was likely using one asset to back two different sets of liabilities: the pegged token on BNB chain and the customer’s claim to the same asset, which is visible via the customer user interface, but is not necessarily available should all users go to withdraw their double-pledged assets at the same time.

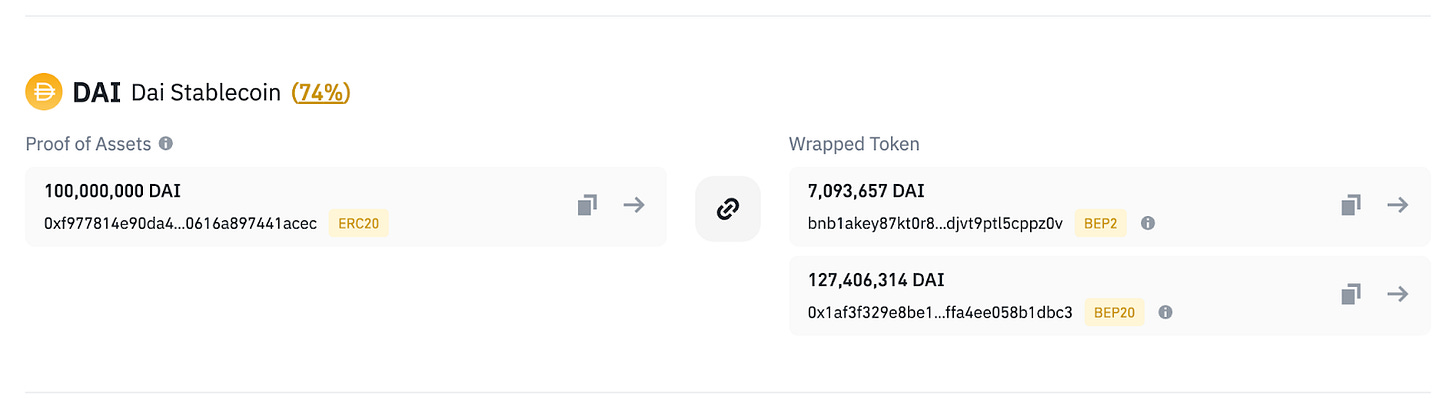

There are various other cases where assets are significantly undercollateralized, including a time where 100,000,000 tokens of the DAI algorithmic stablecoin were representing approximately 134,000,000 of pegged DAI on Binance chain — a mere 74% backing.

It is again worth noting that Binance’s current website now shows that these assets are 100% backed, from different addresses than the ones first listed on their webpage. Thankfully, the internet [archive] never forgets.

Adding to our questions about whether these assets are fully backed, Binance made a pre-production testnet page that included information about B-tokens’ backing, with different addresses from a variety of Binance cold wallets “backing” the pegged assets.

Even though the exchange seems to have been doing a type of performative dance to prove their customer assets are fully backed, we’ve found evidence that this was not always the case and may still not be the case to this day. The testnet website page for the B-tokens is still up at the time of writing and can be seen here. Interestingly, it is titled “Proof of Assets” rather than “Proof of Collateral for B-Tokens.” Here is the accompanying Internet Archive link for posterity, with many of the asset backings having entirely different wallet addresses and collateralization ratios.

The Problem with Fractional Reserves

In the crypto industry, a 1:1 reserve ratio for customers’ crypto assets is the expectation.

This is fueled not just by promises made by industry leaders, such as Binance, but also by the inherent principles of the underlying blockchain technology behind digital assets, which brings transparency, auditability and property rights through cryptography.

When exchanges deviate from maintaining a full reserve (whether properly disclosed or not), it contradicts these principles, creating potential risks and eroding trust.

Unlike traditional banking where a central authority can intervene during insolvency, the nature of the crypto industry lacks such safeguards, thereby making fractional reserves a high-risk practice.

A full reserve model is essential if cryptocurrency exchanges are to avoid insolvency risks and uphold the integrity and trust of the crypto ecosystem. So, while it may be standard practice for commercial banks in the legacy system, the standard is different in crypto, something that Zhao himself has reiterated on multiple occasions.

Proof Of Reserves: Deception Presented As Transparency

One way that exchanges can attempt to prove their solvency and above-board accounting is through an audit. An audit is an official inspection of a company’s accounts, usually performed by an independent body. This is different from an attestation, which is a type of service where a third party performs specific procedures agreed upon by the company and reports the results without expressing an opinion or assurance on its validity. This is entirely different from an audit where the auditor provides an opinion on the financial statements. To put a finer point on the two practices, an attestation is in no way an audit and firms typically make a distinction between the two.

In a now-deleted attestation, Mazars audit firm released an agreed-upon procedures engagement with Binance. Even though this attestation was deleted, readers can find the document here, once again restored by the Internet Archive.

After the attestation, CZ took to Twitter, proudly claiming that Binance had conducted an “audit.”

Never mind the fact that CZ incorrectly claimed it was an audit, here’s a summary of what the attestation found:

The nominal balance (quantity of assets) of each of the public addresses were independently obtained from the Ethereum blockchain and confirmed to be consistent with Binance's records, with no discrepancies greater than 1%.

The report found evidence suggesting Binance owns the private keys associated with the public keys and addresses, indicating they control the funds. This was confirmed by combining methods, including linking public keys with multiple child addresses, instructing Binance to move funds from specific addresses, verifying the transactions on the blockchain and checking that the addresses have been “tagged” as belonging to Binance on Etherscan.

Scripts used by Binance to extract their Customer Liability Report from their database were inspected to ensure accurate and complete extraction of customer liabilities for ETH holdings. No discrepancies were found.

The Customer Liability Report was inspected for any duplication of user IDs, with no duplication found. This helps ensure the reliability of data concerning customers’ ETH holdings.

However, there is no mention of any pegged token addresses in the attestation. For those not following the logic, it again seems as if Binance was counting the same assets against two separate liabilities: user balances and pegged B-tokens.

A screenshot of the Proof of Collateral for B-Tokens page from November 29, a week after Mazar used the same addresses to attest the balances of the Binance exchange, shows evidence of this dynamic.

It is quite convenient that Binance moved 584,999 ETH, the exact amount of ETH that was issued as B-tokens, one day before Mazars published their attestation (and after Binance had already provided figures for Mazars to attest).

Not only did Binance post an address for its B-tokens collateral with greater than three times the amount of Ethereum necessary for the token backing, but Binace then moved said Ethereum into a “segregated” address a mere one day before the attestation was published, and after which CZ championed the report as a proper audit.

As mentioned earlier, Binance's initial claim of a 3:1 collateral backing can be seen as an indicator of inconsistent accounting practices and potential commingling of company and user funds. The company seemed to select any exchange wallet that had sufficient funds to “back” their tokens, potentially against multiple user claims, suggesting a lack of rigor and precision in their financial management. The subsequent shift from a 3:1 backing, counting the same address in their “proof of reserves” attestation, to a 1:1 backing in a segregated address just one day before the attestation was published raises further concerns, given that the initial Ethereum wallet address was counted in the proof-of-reserves attestation that CZ promoted as an audit.

Commingling Corporate & Customer Funds To Facilitate BUSD Growth?

Next, we can look at a recent report released by Reuters, where Binance’s obfuscated corporate structure was brought to light, detailing a tangled web of entities that were used to commingle corporate and customer funds.

According to the report, Binance used accounts at Silvergate Bank, including an account for its corporate entity (Binance Holdings) and an account for receiving customer funds (Key Vision), where surplus funds from both accounts were transferred to another account (Merit Peak), resulting in the commingling of corporate and customer funds.

Money from the commingled Merit Peak account was then sent to Paxos, which issued Binance’s BUSD token. When Key Vision needed dollars to meet customer withdrawals, Binance would redeem BUSD at Paxos (the issuer of BUSD), which would send dollars to Merit Peak’s Silvergate account in return.

The dollars would then be distributed to other accounts as needed. Between January 2020 and December 2021, Paxos transferred at least $18 billion of BUSD to Binance.

Further compounding the negligence, all of this was happening at the same time that Binance was similarly issuing the unbacked IOUs of the Paxos BUSD token on its own BNB Beacon Chain and BNB Smart Chain.

In mid-2021, Silvergate Bank informed Binance that it was closing the Key Vision account due to improper transactions for a custodial bank account. Following this, Binance began using a Key Vision account at Signature Bank to receive customer funds.

Both the Silvergate Exchange Network and Signet, 24/7/365 dollar rails offered by now-shuttered Silvergate and Signature Bank, were used to facilitate said transactions.

“1:1 reserves. Problems go away.”

It’s not simply just on-chain sleuths, internet detectives, Reuters, Bloomberg, the CFTC and the SEC that are skeptical of CZ and Binance, but industry incumbents as well. Kraken then-CEO, Jesse Powell, had problems with CZ’s claims:

One might say, “But CZ said Binance doesn’t have any loans outstanding! Just ask around!”

Given the scale of operations at Binance, which handles hundreds of billions of dollars annually and custodies significant amounts of on-chain assets, a history of management practices that include potential fractional reserve accounting can raise concerns.

For instance, the particular incident mentioned above where Binance moved 584,999 ETH one day before Mazars published their attestation, could be an example of doubling counting customer assets because it was the identical amount issued as B-tokens and the exact amount being used for both purposes is highly improbable.

While Binance may not have liabilities outstanding to other entities, the repeated issuance of wrapped B-tokens without a clear and transparent backing makes us skeptical.

The Benefactor

If it’s true that Binance had egregious sums of stablecoins that were not fully backed, what was the purpose of these opaque accounting practices?

When observing periods of significant BNB/BTC outperformance, they coincide remarkably with instances of large-scale unbacked BUSD issuance. Although it's crucial to avoid asserting a definitive cause-and-effect relationship without concrete evidence, this correlation is striking and undeniably noteworthy.

Indeed, an accompanying chart illustrates how peaks in BNB/BTC value synchronously occur as the market cap of BUSD takes a significant dip. This is now more relevant than ever as the intervention of the NYDFS restricts the issuance BUSD. While this correlation does not inherently imply causation, the relationship between these two occurrences, however potentially spurious, is compelling.

Not Binancial Advice

Relevant Past Articles: The Everything Bubble: Markets At A Crossroads Collapsing Crypto Yield Offerings Signal ‘Extreme Duress’ The Contagion Continues: Major Crypto Lender Genesis Is Next On The Chopping Block The Crypto Contagion Intensifies: Who Else Is Swimming Naked?

BNB was among the only crypto tokens in existence (certainly the only large-cap token) that outperformed bitcoin both in 2021 and continued its outperformance in 2022, to break new all-time highs against the BNB/BTC pair.

The outperformance of BNB was noteworthy and triggered a series of important questions as to what was leading it. A look at the volume profile of the asset tells a story, similar to those of the fabled tokens from the depths of crypto lore, and one that often ended in tears.

What could have possibly been behind the price of BNB soaring with immense volatility in the early weeks of 2021?

One potential driving factor could have been the billions of dollars in open interest that appeared in the BNB derivatives market native to the Binance platform, which served to lift its price at the start of 2021. The volume side profile and the Binance open interest are telling.

Interestingly, the timeline between the beginning of the issuance of BUSD stablecoins and the surge in open interest lines up. Directly related or not, the timelines should be noted.

The Volatility Story

The volatility of BNB is another potential tell. It’s rare for a high beta asset to outperform the market benchmark (BTC) in a bear market, but that is exactly what BNB did, as it seemingly became absent of downside volatility during the bear market. It leads one to believe something unusual is happening underneath the surface.

BNB is financialized, meaning it is no different than some of the other largest crypto currencies that melted down during 2022. While CZ claims Binance never borrows against it, Binance users do, and Binance subsidizes the financing costs against it through lower interest rates, among other select deals. The fact that it is financialized, just like bitcoin, ether or any other asset that can be posted as collateral and borrowed against, subjects BNB to margin calls in the case of market turbulence.

Given the cross-collateralization present in the crypto market, particularly on the Binance platform, the performance of BNB during the 2022 market crash is highly suspect. Together, with all the other instances of asset commingling, undercollateralized tokens and wash trading (per the SEC’s recent allegations), our view is that BNB may have been the primary beneficiary of obfuscation and accounting gimmicks.

We believe there is a probability that Binance has had a consequential asset/liability mismatch in the past due to numerous instances of complicated and opaque accounting, which may still be true today. The concentration of BNB tokens as an asset — one that CZ claims to be 99% of his portfolio and that he will never sell — is sitting near multi-year support, while the token is now just recently down 50% in bitcoin terms from its market peak.

The confluence of decreasing fiat rails (Silvergate, Signature Bank, Paxos-issued BUSD), SEC enforcement and a BNB/USD chart hanging above multi-year support with little volume transacted below hints at a situation that has the potential to deteriorate quickly.

Still, Binance has approximately $54 billion of assets on the platform, including 515,189 bitcoin at the time of writing. If there is any asset/liability mismatch present, it can be masked for quite some time, but the figurative clock may be ticking if this speculation proves true.

CFTC and SEC charges have been pressed, and with Binance hiring a criminal defense team, one could infer that the U.S. Department of Justice could be the next to get involved. Further, with the collapse of Silvergate and Signature Bank, Binance’s access to fiat rails is dwindling.

Meanwhile, on derivatives marketplaces, the game is no longer being played on CZ’s home turf.

The presence of speculators and short-sellers looking to profit on an overvalued asset is nothing new. With the newfound increase in open interest on platforms other than Binance, there is now more pressure than ever from short-sellers.

This dynamic could lead to price discovery, which might spell trouble for the exchange rate of BNB. There are historical examples of crypto exchange tokens appreciating in price while trading primarily on their own platforms; the FTT token from FTX is the most well-known example from recent memory.

Decentralized In Name Only

In October 2022, an exploit occurred on a Binance Smart Chain bridge, where a hacker gained access to a large amount of BNB and immediately used the tokens to borrow stablecoins using the stolen BNB as collateral, specifically using the Venus “protocol” to borrow $147.5 million against approximately 900,000 BNB.

The hacker then transferred the stablecoins across a variety of bridges and swaps to get into bitcoin, ether and other assets besides stablecoins and assets on BNB which were subject to being frozen. Dismissing the supposedly “decentralized” nature of Binance smart chain if assets can be frozen in the first place, we’ll instead focus on the liquidation risk this presents.

Instead of the “decentralized” finance protocol handling the liquidation automatically, Venus voted via its centrally owned governance token to have BNB Chain (Binance) handle the liquidation risk.

The liquidation level for the 900,000 BNB will be reached when the BNB exchange rate is $218, which is approximately 7% below the current market price. If this level is reached, nearly $200 million worth of BNB will have to be exchanged for roughly $150 million in stablecoins. By the looks of the agreement between Venus and Binance, this loss could indirectly go on Binance’s books.

Final Note

As this situation continues to evolve, we encourage readers to carefully monitor the BNB/BTC exchange rate along with exchange flows into Binance.

The mounting evidence presented fosters concerns about Binance’s financial health and the future trajectory of BNB. The array of questionable practices outlined, including the reported exchange asset commingling, its issuance of insufficiently backed tokens and the unusually robust performance of the BNB token, contribute to an unsettling snapshot of Binance’s financial situation.

However, without a comprehensive look at Binance’s liabilities, it is not within our bounds to make any definitive claims about Binance’s solvency.

Yet, the evidence at hand certainly suggests caution. It is of utmost importance that market participants keep a vigilant eye on how this story develops and we always recommend getting bitcoin off exchanges and into self-custody. In these uncertain times, prudence should be the foremost guiding principle.

Finally, it's worth considering the potential impact of BNB's performance on Binance’s overall financial stability. While it's not our place to assert direct claims of insolvency, the connection between BNB’s performance and Binance’s financial health cannot be entirely dismissed. This relationship warrants further exploration and understanding, thus further emphasizing the need for careful observation and cautious interpretation of market developments.

We’ve seen countless exchanges go down over the years, taking user assets along with their demise. Even if Binance is financially secure and entirely stable, it is never a bad time to take ownership of your bitcoin by withdrawing it from third parties. As always, we cannot overemphasize the importance of holding your own private keys.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!