Exchanging Discontent: SEC Sues Coinbase And Binance

The recent SEC complaints against Coinbase and Binance are major legal moves against the largest cryptocurrency exchanges in the world and will have implications for the industry as a whole.

Relevant Past Articles:

SEC Sues Coinbase And Binance

It's been an eventful two days in the crypto ecosystem, with the U.S. Securities and Exchange Commission filing suits against the world’s two largest crypto exchanges, Binance and Coinbase. On Monday, we briefly reported on the SEC’s lawsuit against Binance and its founder, Changpeng “CZ” Zhao, for alleged violations of U.S. securities laws. The SEC’s accusations include misleading customers, misdirecting funds to CZ's personal investment fund, operating unregistered entities and selling unregistered securities, such as BNB and BUSD.

Just one day later, Coinbase was added to the SEC’s list of targets, with the SEC filing a suit against the firm early Tuesday morning. This was not unexpected, considering the fact that Coinbase was issued a Wells Notice by the SEC in March of this year. A Wells Notice is a letter from the SEC stating its intention to legally pursue an enforcement action, giving the entity time to respond/prepare before officially filing. The pushback from Coinbase is that the SEC has refused to provide further guidance as to what defines a security.

On the same day, the SEC filed an emergency motion asking to freeze the assets of Binance U.S. highlighting:

“The SEC respectfully submits that this relief is necessary on an expedited basis to ensure the safety of customer assets and prevent the dissipation of available assets for any judgment, given the Defendants’ years of violative conduct, disregard of the laws of the United States, evasion of regulatory oversight, and open questions about various financial transfers and the custody and control of Customer Assets.”

It’s important to highlight that there’s a clear difference between the accusations of securities violations among both exchanges and the additional allegations against Binance for fraud. Many have known that some form of securities regulation was going to happen across the industry, especially for exchanges, but the comingling of funds and motions to freeze assets is a much more severe accusation.

The SEC accuses Coinbase of listing unregistered securities and offering its staking program without appropriate securities registration, and they further argue that Coinbase previously held the same stance on the nature of tokens as potential securities, citing Coinbase's own document from 2016.

“Since at least 2016, Coinbase has understood that the Supreme Court’s decision in SEC v. W.J. Howey Co., 328 U.S. 293 (1946) and its progeny set forth the relevant test for determining whether a crypto asset is part of an investment contract that is subject to regulation under the securities laws. And, as part of its public marketing campaign to position itself as a ‘compliant’ actor in the crypto asset space, Coinbase has for years touted its efforts to analyze crypto assets under the standards set forth in Howey before making them available for trading.

“But while paying lip service to its desire to comply with applicable laws, Coinbase has for years made available for trading crypto assets that are investment contracts under the Howey test and well-established principles of the federal securities laws. As such, Coinbase has elevated its interest in increasing its profits over investors’ interests, and over compliance with the law and the regulatory framework that governs the securities markets and was created to protect investors and the U.S. capital markets.” — SECURITIES AND EXCHANGE COMMISSION, against COINBASE, INC. AND COINBASE GLOBAL, INC. Filing

Against this backdrop of escalating regulatory scrutiny, both Binance and Coinbase have voiced their disappointment and frustration. In a blog post responding to the charges, Binance argued that the SEC is trying to unilaterally define the structure of the crypto market. They labeled the regulator's approach as an example of “regulation by enforcement,” a strategy they believe is ineffective and detrimental to the U.S. position as a global financial innovator.

Coinbase's response echoed a similar sentiment. During his congressional testimony, Coinbase Chief Legal Officer Paul Grewal criticized the SEC for choosing litigation over legislation, emphasizing the need for transparent and fair rules for digital asset regulation.

Seemingly, the disagreement between the SEC and crypto industry giants is rather simple. The SEC believes that current securities laws, particularly the Howey Test, still stand, while the exchanges think the laws need clarification and updating.

But what are the current guidelines and how will this enforcement action impact the market? Let’s find out…

The Howey Test, deriving from SEC v. W.J. Howey Co. in 1946, set out a four-prong framework to determine if an investment contract, and hence a security, exists. The four criteria are:

An investment of money,

In a common enterprise,

With the expectation of profit,

To be derived from the efforts of others.

In 2019, the SEC provided guidance on how this framework applies to digital assets with “Framework for ‘Investment Contract’ Analysis of Digital Assets.”

First, the investment of money is typically satisfied when digital assets are acquired in exchange for value, whether in the form of real (fiat) currency, another digital asset or other type of consideration. Second, the SEC finds that a "common enterprise" generally exists in digital assets situations. The primary focus typically rests on the third and fourth criteria: the expectation of profits derived from the efforts of others. The SEC suggests that if purchasers reasonably expect to derive profit from the essential managerial efforts of a promoter, sponsor, other third party or an affiliated group of third parties, this test is met, meaning the asset qualifies as a security.

Proponents of crypto assets broadly, many of whom are against the stance of SEC, argue that the decentralization spectrum of crypto assets deem incumbent securities laws irrelevant, or outdated at the very least. In our view, the waters are murky, with the “crypto industry” being rife with fraudulent actions that have gone unchecked for years, given the relative ease at which tokens can be created and solicited to the public.

To be clear, we are in no way championing state intervention for the purpose of asserting bitcoin’s dominance in the broader crypto ecosystem. Instead, as proponents of bitcoin as an emergent monetary phenomenon, our base case has always been that state intervention — no matter the vector or transmission mechanism — was always inevitable. It’s the fact that Bitcoin, as a truly decentralized protocol, is the equivalent of a ten-million-headed hydra. Altcoins and centralized exchanges have exploitable chokepoints, including in regards to enforcement action or regulatory compliance. We don’t entirely care what individuals choose to do with their own money, whether that entails investing in regulated securities or buying unregulated tokens in the domain of the Crypto Wild West … but the SEC does care. Recognizing this as the current reality of the situation isn’t cheering for state intervention or supporting the SEC, it’s just acknowledging reality.

“For better or worse, the wild wild west days of unregulated crypto appear to be coming to a close. Our position is not that bitcoin wins because nearly everything else gets regulated into submission. Instead, our position is that nearly everything that exists in the crypto ecosystem except bitcoin can get regulated, due to centralization forces or clear single points of failure. If a flaw can be exploited, it will, and that appears to be what’s unfolding.

“For crypto natives who envision a future of a trustless, multi-coin, multi-chain world where all financial interactions are done on “decentralized” platforms utilizing their own unique token with its own distinguished value proposition, the long arm of the law — in this case the SEC — would say otherwise.

“On the other hand, the more realistic and perhaps pessimistic take, is that 99.9% of the ‘crypto economy’ never was resistant to a state-level attack in the first place, and crackdown on various single points of failure were always inevitable. This is why our publication is Bitcoin focused, and bitcoin-only in regards to our stated support of the crypto ecosystem. While we expect various forms of the ‘crypto ecosystem’ to survive in a permissioned fashion under the purview of the state, we are strongly held in our belief that bitcoin and bitcoin alone is the sole cryptocurrency that is purpose built to become global money, made for enemies.” — Bitcoin Dominates During A Crackdown On Crypto

Despite the SEC's complaint, Grewal stated that Coinbase would continue to operate as usual.

The aftermath of the SEC's decisions against Binance and Coinbase represents a key juncture for the crypto industry. The potential fallout and future litigation outcomes could have a profound impact on the regulatory landscape for digital assets. As these developments unfold, we will continue to provide thorough analysis and insights into their implications.

Market Impact Of SEC Enforcement

The Coinbase and Binance news is another blow to exchange businesses and will likely lead to a significant reduction in retail trading revenues across the industry. It also puts staking revenue in question and induces increased customer withdrawals at the same time as regulatory risks grow larger.

As for bitcoin customer withdrawals, there has been some heightened activity for bitcoin leaving Binance over the last 24 hours, but less than what we saw in November and December 2022.

Nansen highlights that Binance users have withdrawn $3 billion across all chains compared to still holding $54 billion in their known wallets as of yesterday. Overall, two data points here to show that exchange outflows are negative but not significant so far. Coinbase outflows are negligible as well. Over the next month, it will become more clear on how users react to the latest SEC actions.

Moving forward, apart from risks of bank runs, the larger market impact is on exchange business models. Thanks to Coinbase’s publicly available data, we can analyze how SEC enforcement could impact their revenue streams. Consumer retail revenue from transaction fees still make up nearly 50% of the company’s total revenue. That’s across BTC, ETH and other crypto assets. “Other crypto assets” make up 46% of that transaction revenue so roughly 25% of Coinbase’s total revenue is now under increased SEC pressure just on the retail trading side. That doesn’t even include institutional revenues or staking revenues. It’s also not clear what portion of tokens mentioned by the SEC complaint makeup Coinbase’s other crypto assets revenue.

Overall, Coinbase’s total revenues have largely been buoyed by USDC interest income and higher U.S. interest rates across the board rather than significant growth in other business lines.

Coinbase Q1 2023 highlights:

Other crypto assets make up 50% of Coinbase transaction revenues.

Transaction revenue used to make up around 87% of total revenue and now make up a little less than 50%.

Interest income from USDC has ballooned from $10.5 million to $240.8 million in just one year.

Coinbase is just one example of what all exchanges in the industry now face. They also face potential penalties from the SEC if the previous BlockFi settlement is any precedent for future actions. In the BlockFi settlement, the company paid $100 million to the SEC and 32 states for misrepresenting their over-collateralized loan book to retail.

Yet, this wasn’t even an outright unregistered securities violation and BlockFi’s near-$10 billion in assets under management are nothing compared to the $130 billion of assets on Coinbase. One potential outcome is that we see a much higher ballpark of penalties and fines along with changes in the listing and marketing of certain tokens. Another outcome is increased regulation around splitting up the distinct functions of trading, custody and brokerage of digital assets, which is a key part of the SEC’s complaints.

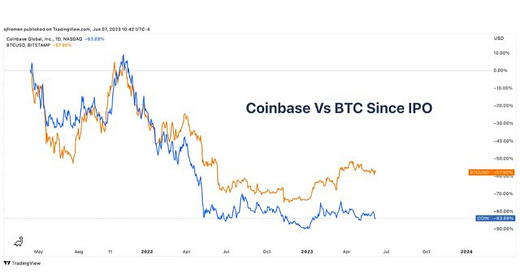

What does that mean for equity values of exchanges? As a proxy, looking at Coinbase performance since its IPO makes it clear that exchanges have underperformed bitcoin in many ways. With added business and regulatory pressures on the horizon, we’re likely to see the divergence between the two grow larger throughout this year.

A final market impact is the rising market dominance of bitcoin over time. The coins highlighted by the SEC as unregulated securities make up over $70 billion in current market capitalized value with a majority of that value coming from BNB. Already today, Binance.US has halted the trading of various crypto pairs. Second-order effects like these will continue to weigh on the trend of declining market liquidity and overall retail availability for a number of tokens.

Final Note

There are a couple silver linings in all of this news. First, it’s that the U.S. is now on a path towards a more clear regulatory framework for the entire industry. Many have been waiting for a stance to be taken and in the future. This will open up the door for more institutional capital that’s been sitting out of the game on the sidelines. Second, it’s clear that bitcoin is not part of this and outlines why it’s important to separate distinctions from bitcoin and “crypto” at large.

It’s been evident that a large subset of cryptocurrencies have made a habit of exploiting hype that rides on a wave of promotional rhetoric and immediate liquidity in order to manipulate prices and secure profits. In essence, these entities are detaching the value of their projects from the underlying fundamentals, leveraging temporary price inflation to dump their bags, leaving unsuspecting investors to bear the brunt of subsequent price corrections.

Second, maybe it’s time to acknowledge that our securities laws have not kept pace with the rapid evolution of technology and finance. One could make the argument that the current legislative frameworks in place are archaic, originally sculpted in an era that couldn’t foresee the digital revolution that is currently unfolding in the 21st century. In an age where anyone can engage in high-risk speculation with a simple click of a button, it’s crucial that regulatory oversight is not only fair and comprehensive, but also designed to cope with the nuances of an increasingly digital landscape. This isn’t a simple tweak; it’s a monumental task that necessitates legislative intervention, potentially involving Congress, to redesign the scaffolding that holds up the structure of our financial market. The tightrope balance of a fair and a comprehensive regulatory environment in a globally interconnected world of 24/7/365 capital markets is complicated, and is likely to take some time and deliberation to get right.

In the meantime, Bitcoin is continuing to work as designed and the market impact of these lawsuits is only a temporary one.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Excellent, thank you