Europe: The Sovereign Debt Bubble Domino

Winter approaches for Europe. The United Kingdom discusses energy stimulus plans at more than 5% of GDP. Asian economies scramble for supply while China lockdowns suppress demand.

European Energy Crisis Progressing

In last Thursday’s dispatch, we covered the dynamic of this inflationary bear market, where the conditions of the global macro landscape are rapidly repricing global interest rates higher. Similarly in our “Energy, Currency & Deglobalization” series,

Since our latest release, the response from European governments to “combat” surging energy costs have been astounding.

In the United Kingdom, newly appointed Prime Minister Liz Truss has already unleashed a draft plan as a response to rising consumer energy bills. The policy plan could cost £130 billion over the next 18 months. The plan details the government stepping in to set new prices while also guaranteeing financing to cover the price differences to private sector energy suppliers. Using 2021 annual numbers, the plan would be roughly 5.9% of Gross Domestic Product. The U.K.’s stimulus at 5% of GDP would roughly be the equivalent of a $1 trillion stimulus package in the United States.

There’s also a separate plan costing £40 billion for U.K. businesses. Counting both, they represent roughly 7.7% of GDP for what’s likely to be a conservative first pass of stimulus and spending to offset a longer, sustained period of much higher energy bills across all of Europe the next 18-24 months. The initial policy scope doesn’t seem to have a cap on its spending so it’s essentially an open short position on energy prices.

Ursula von der Leyen, president of the European Commission, tweeted the following.

The supposed price cap of Russian oil is important for a number of reasons: The first is that with Europe’s solution for the incumbent energy crisis seeming to be stimulative fiscal packages and energy rationing, what this does to the euro and pound, both currencies of energy importing sovereignties, only compounds its problems.

Even with the European Central Bank (ECB) and Bank of England supposedly rolling back pandemic-era easing programs, the solution that the western voters likely demand is “energy bailouts.” Some are calling this Europe’s Lehman Moment, in reports yesterday from Bloomberg, “Energy Trading Stressed By Margin Calls Of $1.5 Trillion.”

“Liquidity support is going to be needed,” Helge Haugane, Equinor’s senior vice president for gas and power, said in an interview. The issue is focused on derivatives trading, while the physical market is functioning, he said, adding that the energy company’s estimate for $1.5 trillion to prop up so-called paper trading is “conservative.” - Bloomberg

Similarly, Goldman warned of a dismal outlook for markets.

“The market continues to underestimate the depth, the breadth, and the structural repercussions of the crisis,” the Goldman Sachs analysts wrote. “We believe these will be even deeper than the 1970s oil crisis.”

The energy crisis is currently projected to cost the continent of Europe approximately €2 trillion, or 15% of GDP.

"At current forward prices, we estimate that energy bills will peak early next year at c.€500/month for a typical European family, implying c.200% increase vs. 2021. For Europe as a whole, this implies a c.€2 TRILLION surge in energy bills, or c.15% of GDP.”

While this number is likely reduced by the fiscal subsidized prices, the currencies are meaningfully falling against the dollar (still the incumbent unit of trade for global energy), while the dollar itself has been repriced lower in terms of energy.

However, the business sector is one of the losers, as energy rationing and soaring costs hammer the European industrial producers.

“Metal Plants Feeding Europe’s Factories Face An Existential Crisis”

“Europe’s Top Aluminum Plant Will Cut Output 22% On Energy Costs”

“German Factory Orders Fall For Sixth Month Amid Energy Squeeze”

The above chart is German factory orders by month heading into the fall.

“Europe Aluminum Cuts Get Deeper By The Day As Power Crisis Bites”

“The curtailments add to the extreme toll that the energy crisis is having on Europe’s metals industry, which is one of the biggest industrial consumers of power and gas. A group representing the region’s biggest producers wrote to European Union politicians warning that the energy crisis could cause ‘permanent deindustrialization’ in the bloc, unless a package of support measures are implemented.”

Aluminum, which takes approximately 40 times more energy than copper to produce, is quite energy intensive.

Source: Bloomberg

“This is a genuine existential crisis,” said Paul Voss, director-general of European Aluminum, which represents the region’s biggest producers and processors. “We really need to sort something quite quickly, otherwise there will be nothing left to fix.”- Bloomberg

What is being demanded due to the structural energy deficit in Europe is the populous and the business sector demanding the public balance sheet assume the risk. Subsidies for energy bills or price caps does nothing to change the absolute amount of molecules of high-energy density fossil fuels on the planet. The price caps and subsequent response from Russian President Vladimir Putin is what makes all the difference, and it has the potential to create potentially devastating outcomes in financial markets.

No government is going to allow their citizens to starve or freeze; it’s the same story throughout history with sovereign nations loading up on future debt obligations to solve today’s problems. This just happens to come at a time when a handful of European countries have astronomical public debt-to-GDP ratios well over 100%.

A sovereign debt crisis is brewing in Europe, and the overwhelmingly likely outcome is that the European Central Bank steps in to contain credit risk, perpetuating the devolution of the euro.

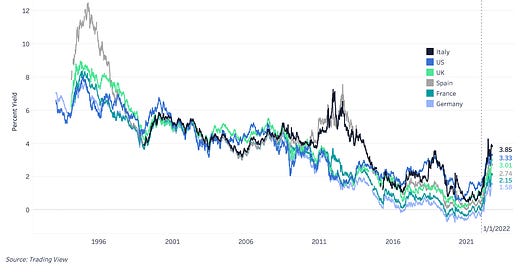

We’ve talked at length about the drastic rise and rate of change in 10-year yields in the United States, but it happens to be the same picture across every major European country despite slower actions from various central banks to hike rates.

Bitcoin 2023 Miami (May 18-20, 2023) and Bitcoin Amsterdam (October 12-14, 2022) ticket prices increase Friday! Save an extra 10% with code: “BMPRO” ✨ (https://b.tc/conference/)

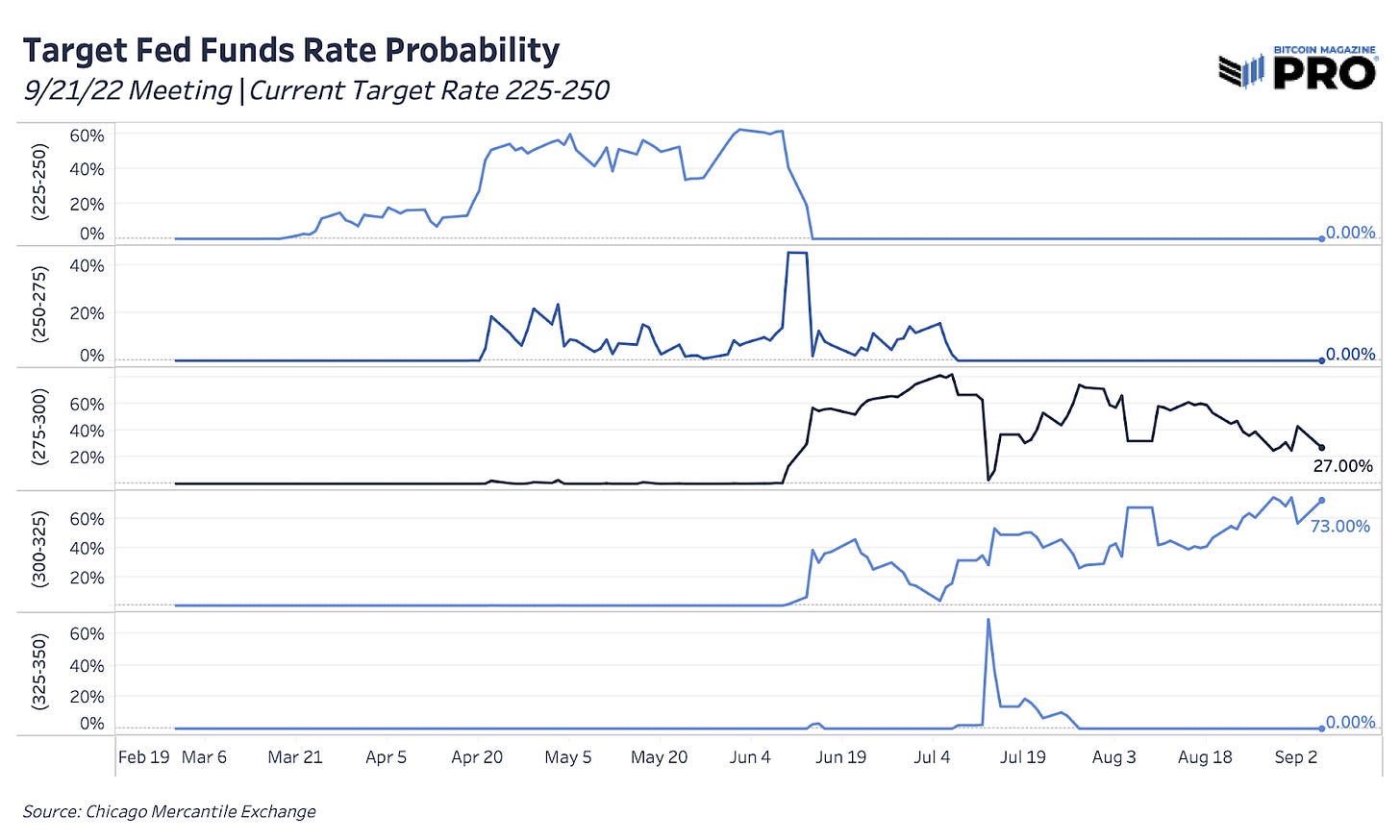

European debt yields, also accounting for future inflation expectations, are still not showing signs of slowing down. The Bank of England is projecting 9.5% Consumer Price Index inflation through 2023 (read “Bitcoin’s Seven Daily Candles” where we cover their latest August monetary report) and the European Central Bank expects a 75 basis point rate hike in their announcement tomorrow, after just recently raising from negative rates. For what it’s worth, the probability for a Federal Reserve rate hike to 75 basis points for the Federal Open Market Committee meeting two weeks away is currently at 80% (intraday pricing versus 73% for September 6).

With political pressures mounting, the high inflation prints, even showing small signs of some deceleration recently, continue to leave central banks no other viable option. They must “do something” in an attempt to maintain 2% inflation targets even if it only partially causes adequate demand destruction. This is largely where investors who have a thesis around peak rates and “Fed can’t hike rates” have gotten crushed. Although rising government yields are not sustainable to service debt interest payment burdens in the long term, we’re still awaiting that breaking point that forces a directional change.

The second-order inflationary effects of unloading more fiscal stimulus policies and/or a seizure in U.S. Treasury collateral markets are what to watch for.

It’s Not Just A Europe Problem

It’s not all about energy prices in Europe. The largest Asian economies are net importers of energy and especially natural gas. There’s been a rush to secure natural gas supply in the spot market for the winter across Asia. Liquefied natural gas (LNG) prices are up 7x in just one year as a result.

It was even announced that China will start paying for Russian gas deliveries in yuan instead of U.S. dollars while coal prices are hitting new all-time highs across Asia. As one can expect when the world’s largest gas supplier starts taking supply off the market, prices will soar and demand will rush to other viable alternatives in one of the world’s most inelastic markets.

This also has come at a time when China’s LNG demand is actually declining this year amidst self-imposed lockdown restrictions. China was the largest buyer of LNG last year but as demand falls, the largest buyer spot goes to Japan.

The duration of lockdowns (one was extended today in major city Chengdu) have suppressed additional demand across natural gas, coal and oil. From our learnings, one would expect an additional wave of demand to enter the market when lockdowns and zero-COVID policies are lifted completely. Latest flight data from the top 20 Chinese airports show the latest reopening efforts quickly reversing course.

Japan is now creating a plan for the government to step in and buy LNG winter supply even if private companies are unable to do so. It's an unprecedented move and symbolizes how far governments will go in the name of energy security and to protect their citizens this winter.

Yet, this makes sense since Japan is one of the largest net energy importers in the world and just posted its largest half-year trade deficit ever ($57 billion) in the first half of 2022, as energy prices soared with the yen now down nearly 20% year-to-date relative to the U.S. dollar. Although Japan’s yield curve control efforts seem to be needed to stabilize rates and avoid a debt default implosion, the yen’s value is getting sacrificed during a time when global energy resources are getting scarcer and U.S. rate hikes aren’t stopping.

Most of Japan’s energy imports are priced in dollars so as energy prices have taken off, more yen is needed to secure more dollars to secure more energy at a time when a global dollar shortage is becoming more apparent. A vicious cycle ensues where countries are left with little choice but to print or create more domestic currency (likely creating more debt that needs to be capped at a specific rate), and devaluing their own currency in the process to acquire more energy.

A weaker yen should help Japan’s exports growth and inflation goals, but imports are growing at nearly double the pace so far this year as we head closer to a global recession with decaying foreign consumer sentiment indicators and manufacturing data (PMI metrics) in nearly every major economy.

Data for Asia Pacific LNG tanker carrier rates are surging yet again as ship availability to actually transport LNG grows tighter by the day.

Brewing Credit Crisis

A sovereign debt crisis is brewing in Europe. Due to the nature of western democracies and the ability to issue currency (for Europe, the structure is similar but more fractured), political issues are met for demand for political solutions. The main tool in the toolkit for policymakers today is racking up debt.

The friction here is that central banks have stated their intention to drastically tighten monetary conditions, in an attempt to combat consumer inflation. This game of chicken likely leads to overwhelming volatility and liquidity/solvency worries for many.

As Europe’s banking system (that spent much of the last decade with a negative cost of capital) faces the reality of soaring yields and deteriorating credit risk and client margin calls, expect things to get volatile.

Falling Productivity + Soaring Energy Costs + Falling Currency

Europe is facing an emerging market-like debt crisis.

Three-month Euribor* rate - Overnight indexed swap rate (OIS) spread is reaching its highest points since the Great Financial Crisis.

*Euribor : the Euro Interbank Offered Rate is a daily reference rate based on the average interest rates at which Eurozone banks offer to lend unsecured funds to other banks in the eurozone.*

The difference between the two captures factors other than interest rate expectations, such as credit and liquidity risks.

Credit risk is on the rise, and the continued strengthening of the U.S. dollar relative to other major currencies strengthens our belief in a global dollar shortage that leads to an ultimate correlation to 1.0 moment.

A global dollar shortage will lead to a response from the Federal Reserve and/or U.S. Treasury to aid market turmoil, ultimately leading to increased devaluation of the dollar against real goods, services, and assets.

To quote our recent piece,

“With this being said, we think what “breaks” is liquidity in the U.S. Treasury market, as a soaring dollar, skyrocketing energy prices and subsequently contracting global productivity lead to a sell-off in dollar-denominated assets.

“There still is a massive implicit short dollar position around the world (USD-denominated debt).”

We don’t think that time is now, but rather, that is the inevitable outcome, with some pain likely to occur before then. Every day that you see the dollar soar higher (relative to other currencies) and increased yields in global debt markets is a day closer to when global markets “break” to the downside.

Opportune investors will scoop up hard assets and undervalued equity during times of a global margin call (liquidity/debt crises). Our choice for the other side is bitcoin, but our thesis on a global deleveraging event is unchanged.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! If you found this article useful, please leave a like and let us know your thoughts in the comments section. Today’s article is free to the public, so please share it far and wide.

Legend has it, this article made Liz Truss flip on energy. few.