Core Inflation Remains Hot As Fed Officials Expect Recession

Inflation continues to compound above the Fed's target; FOMC minutes reveal recession expectations from the Fed.

It’s another US CPI day, let’s recap and break down the highlights.

In their initial reaction, markets across equities and bitcoin welcomed a slightly below expectations slow down in the US March headline CPI data today which came in at 5.0% YoY versus 5.1% expected. Core CPI came in line with expectations at 5.6% YoY and 0.4% MoM. The Core CPI numbers are really the key data points here in our view as it shows another monthly increase and a fairly sticky 5.6% annual number that’s yet to turn over in a significant way. One of the best ways to view the trend of the data is to look at the 3-month annualized change which is still at 5.1% versus the Fed target of 2%. Core CPI with a big focus on services via wage growth and shelter doesn’t abate and fluctuate as quickly as headline CPI.

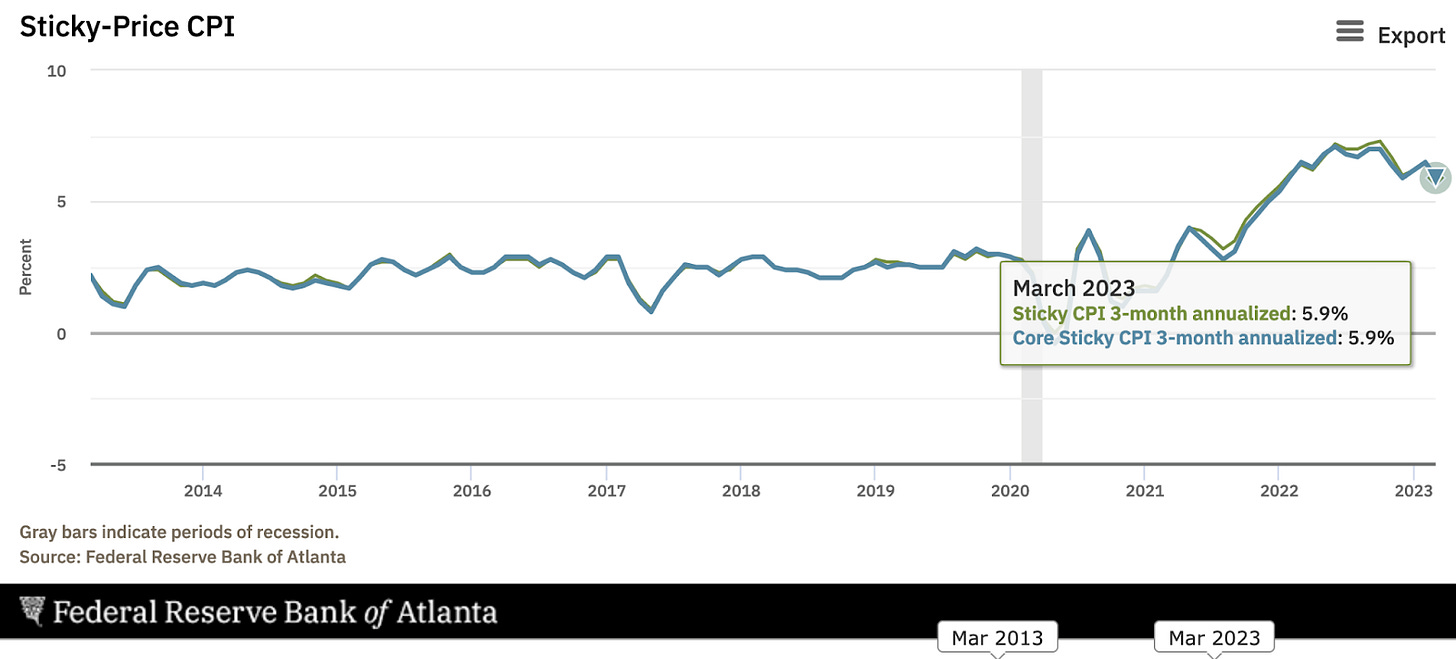

We can see that in the Atlanta Fed’s “sticky” CPI and Core CPI measures as well with both 3-month annualized measures at 5.9% for March.

Although many of the core components remain sticky, there are more signs of the overall disinflation process underway in the US. This would be consistent with the view that recessionary pressures are accelerating, starting to make their way through the economy. The biggest sign in this data release was seeing energy disinflation for the first time since pandemic.

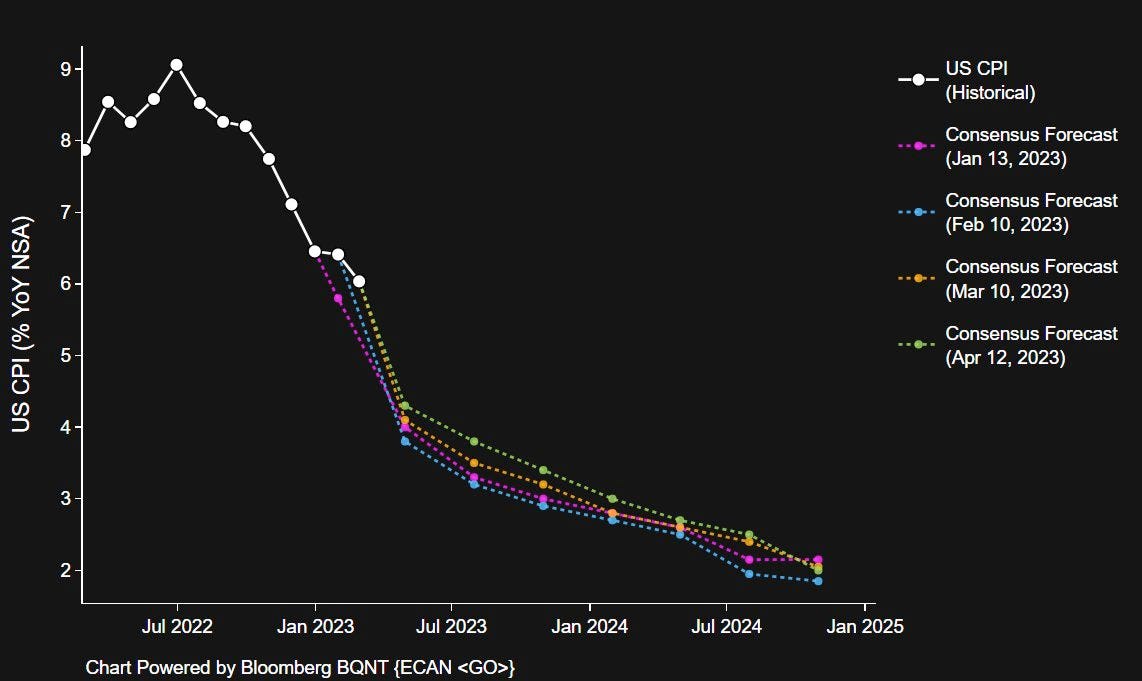

What’s the market’s consensus on CPI expectations? Consensus forecasts show the traditional decline back to 2% by mid-2024 with annual headline CPI over 3% by the end of 2023. As we’ve progressed through the first few months of 2023, consensus forecasts have revised their inflation expectations higher nearly every month.

At the time of writing and after the release, the market expectation for a 25 bps rate hike at the next FOMC meeting in May is at 70%.

Following the initial knee-jerk reaction from the STIR (short-term interest rates) market after the collapse of Silicon Valley Bank, there has been a mild but meaningful repricing of implied Fed Fund Futures higher.

Fed’s Minutes Released

The minutes from the Federal Reserve’s March 21-22 Federal Open Market Committee meeting were released today. The minutes indicate that while all officials backed the decision to hike rates by 25 basis points, there was less than full commitment to another move in May, as officials wanted to assess incoming data on how the banking crisis impacted the economy. After the recent banking crisis, policymakers have lowered their expectations for interest-rate hikes this year. Officials emphasized the importance of monitoring incoming data to determine the extent of the credit crunch's impact on the economy.

The Federal Reserve staff has projected a mild recession starting later in 2023, followed by a recovery in the following two years. Officials believe that the banking crisis is likely limited to a small number of banks with poor risk-management practices and that the banking system remains sound and resilient. The discussion also highlighted the risks to inflation, with strong labor demand potentially pushing prices higher while a credit crunch could slow inflation in the opposite direction.

The minutes were revealing as it further reiterated the reality that the Fed is attempting to financially engineer a global recession in an effort to quell inflation in its tracks. Of course, we have known that was the goal with the current tightening regime, but the rate hike consensus decision even with worries of weakening economic growth in the latter half of 2023 can tell you what's coming.

The key story here is core measures, both Core CPI and Core PCE (the Fed favors core PCE), still running far too hot. The Fed will have to crack the labor market to hit inflation, and that looks to be the course.

It's important to continue to emphasize how unique the current situation is for the Federal Reserve, who are attempting to manage their dual mandate of “stable prices” (arbitrarily defined as 2% inflation annually) and “full employment” that was first implemented in the late 1970s.

The Federal Reserve has never had to manage an inflationary cycle, that some are analogizing to the 1970s, with debt levels this bloated and this much excess liquidity in the system. With trillions of dollars of excess reserves in the banking system, the Fed knows that a decrease in the policy rate would likely unleash a nasty second inflationary impulse, which is why it is doing everything in its power to cause labor market slack first.

Shown below is the spread between the Fed’s policy rate and core PCE (which the Fed is aiming to bring below 2% y/y), displaying the Fed’s endeavor to fight inflation in an economy with Federal debt to GDP at 120%.

Final Note

As we observe the Fed grapple with the reality of sticky inflation, elevated debt levels, and looming recessionary pressures, it's crucial to stay vigilant and adaptive. Fed speak aside, there are exogenous forces and factors outside of the global central bank’s control that make this cycle much different from ones in the past. With a recession likely coming in the second half of the year, we believe the Fed’s monetary policy pendulum will have swung too far hawkish, and the deceleration of growth and economic momentum will lead to a Minsky moment of sorts.

Further balance sheet expansion is inevitable, but the path to get there is paved first, with pain. Keep the long-term outlook in mind, even if the current rally above $30,000 stalls or retraces temporarily. One of these things is severely mispriced, when the top line is all but guaranteed to go up only on a long enough time frame.

Inflation compounds, economists focused on micro decelerations amidst a broad regime shifting inflationary cycle are missing the forest for the trees.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

This is solid, thank you!