By the Numbers: Bitcoin Gets Bumpy

Exploring if the numbers are as bearish as sentiment has turned, perhaps the most important point for price this year.

Introduction

Despite bearish technicals and declining sentiment, bullish fundamentals are basically intact. The macro environment adds to the uncertainty felt by most Bitcoin market participants right now. Hodling isn’t easy. This week, we explore on-chain metrics that are telling us risk-reward is improving along with holding behavior picking up. Additionally, price is running into the most important level we’ve seen since perhaps August 2023, and we get insights from the derivatives markets.

Get value from this content? Subscribe for free over on bitcoinandmarkets.com and follow me @AnselLindner.

On-chain Remain Bullish

Despite the recent dip in the bitcoin price, on-chain metrics remain bullish. This is why we consider both fundamentals and technicals in our analysis. The technicals might look atrocious, but the deeper fundamentals tell a different story.

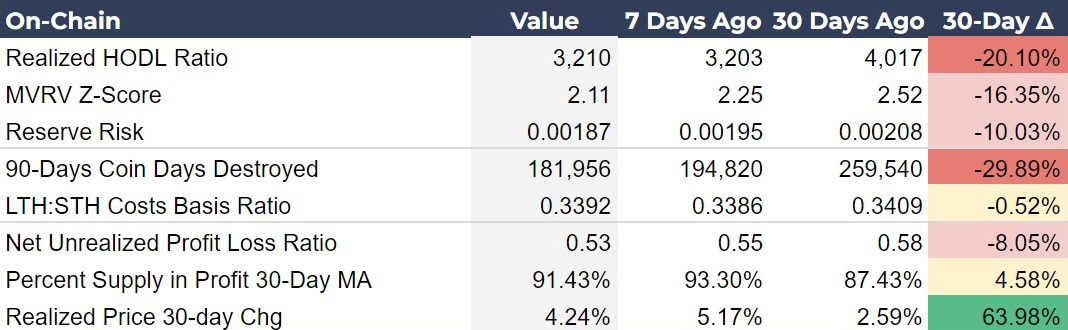

The move bullish on-chain metrics this week are the Reserve Risk, 90-days Coin Days Destroyed and Realized Price 30-day change. I wrote about Reserve Risk in depth in yesterday's post, and as we can see here, it has dropped significantly, increasing the attractiveness of the risk/reward ratio. The 90-Days CDD has plunged 30%, meaning an increase in holding behavior, as fewer LTH coins are moved. Additionally, the Realized Price 30-day change is slightly less than last week, but remains high, signifying an increase in the general inflow into the asset.

Developments in the Realized HODL Ratio and MVRV Z-score are not on the scale of changing our reading of the cycle. They are mid-range, the longer they stay there, one could speculate the stronger the eventual breakout will be. For instance, below I show that in the last two cycles, when price was breaking the previous cycle’s ATH, the Realized HODL Ratio was also in this mid-range area.

Source: LookIntoBitcoin

Investor Insight

Capitalize on Attractive Risk/Reward Scenario: The significant decrease in the Reserve Risk metric to 0.00187 indicates a highly favorable risk/reward environment for Bitcoin investment. Investors should consider this an optimal entry point to increase their Bitcoin holdings, leveraging the attractive conditions highlighted by reduced risk and strong capital inflows reflected in the Realized Price 30-day Change.

Price Metrics Straining Under Pressure

Bitcoin’s technicals are deteriorating. Remember the saying, it gets darkest before dawn. In trade speak, it is most bearish before the reversal.

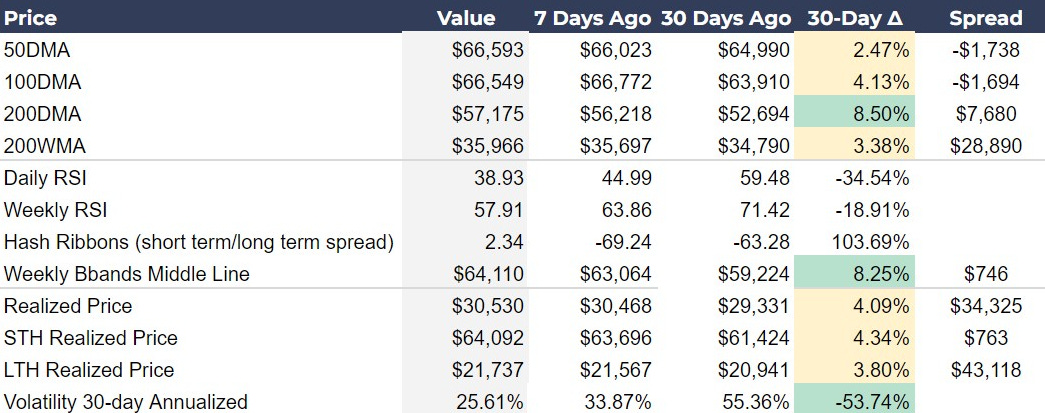

These price metrics in the table are based on Thursday’s close or the most recent weekly close. At the time of writing, price has continued to dip further. Price is threatening the STH Realized Price and the Weekly Bbands mid-line (20-week MA), while also being under the 50-day and 100-day MAs, in a bearish short-term trend.

This is the most important level we’ve experienced since August of last year. Back then we dipped below the 200-day and battled back over the following 60 days. I think bullish momentum is better at our current spot, with the 200-week far below price and the 200-day a safe distance away. There is a significant chance that daily RSI does hit oversold, requiring a few more days of weak price performance, but the battle back should not be as lengthy as last August.

Investor Insights

Derivatives Data

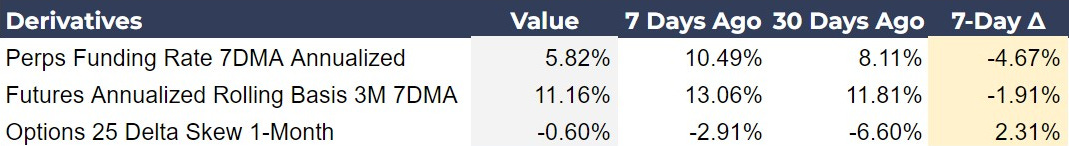

Bitcoin’s derivatives markets are slowing but remain decidedly bullish. The Perps Funding Rate 7DMA Annualized has decreased significantly from 10.49% to 5.82%. This decline suggests a reduced leverage among long positions, risk of volatility to the downside is reduced. Similarly, the Futures Annualized Rolling Basis 3M 7DMA has dropped from 13.06% to 11.16%, a much smaller drop, indicating futures are still quite bullish over the quarterly time frame.

The Options 25 Delta Skew 1-Month has improved from -2.91% to -0.60%. This positive shift in skew to roughly neutral indicates traders are less pessimistic about downside risks. The neutral skew reflects market conditions where options traders might be considering the downward trend has run its course, and the market is preparing for a reversal.

Investor Insights

No need to get the exact bottom: Uncertainty is market sentiment and where the price will go in the near-term is rising. This is the most bearish the bitcoin market has been all year. There is no need to time a trade to the pico bottom. When sentiment is this far from your general bullishness on bitcoin, it is best to trade breakouts and not dips. However, if not buying on leverage, this period provides a great opportunity to cost-dollar-average over the coming week or two.

Macro Environment

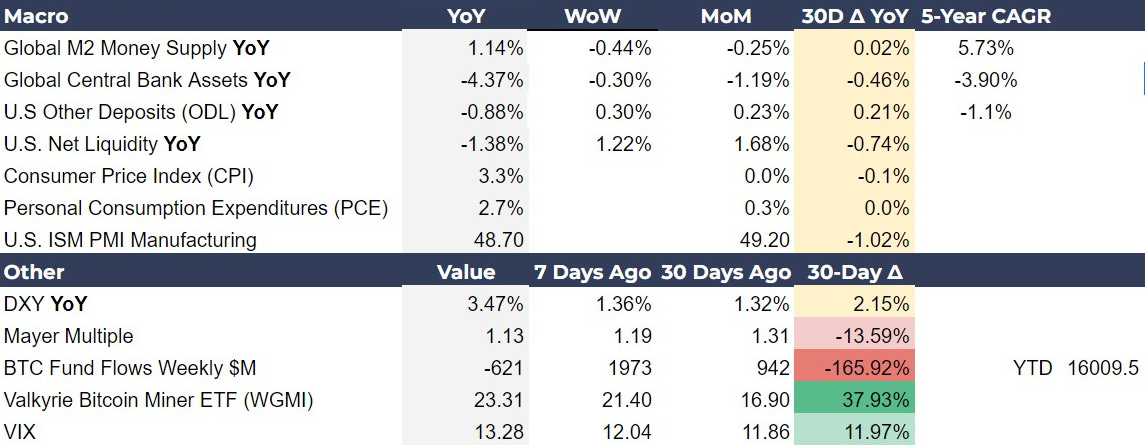

Overall, these macroeconomic indicators highlight a tightening liquidity environment and persistent recessionary pressures amidst a backdrop of lingering inflation effects. M2 Money supply is positive YoY, but significantly negative WoW and MoM. Shrinking M2 should translate into slowing economic activity. Other Deposits and Liabilities (ODL), which is a more narrowly tailored M2, is still shrinking YoY. Net Liquidity is also negative YoY, but it shows some positive movement WoW and MoM.

It is still my base case that we are moving closer to a recession, but this call is being challenged by the potential reversal in liquidity. While there are some signs of improvement, it is too early to say that the US and the globe have dodged recession and are now on the upswing. The economy could experience a few months this summer with improving conditions, only to roll back over into recessionary territory by the end of Q3.

Bitcoin, with its potential as a safe haven asset, stands to benefit from this environment as investors seek to protect their capital from the effects of deflation and inflation alike. Investors should remain cautious, monitoring these indicators closely to navigate the complexities of the current macro environment.

Conclusion

In summary, Bitcoin's market shows a mix of bearish technical signals and bullish on-chain fundamentals. Key metrics like the Reserve Risk and increased holding behavior present a favorable risk/reward scenario, despite the current price and derivatives market uncertainty. Macro indicators point to tightening liquidity and recessionary pressures, highlighting Bitcoin's potential as a safe haven asset. Investors should monitor these metrics and market shifts closely to navigate the complexities and capitalize on Bitcoin's long-term resilience.

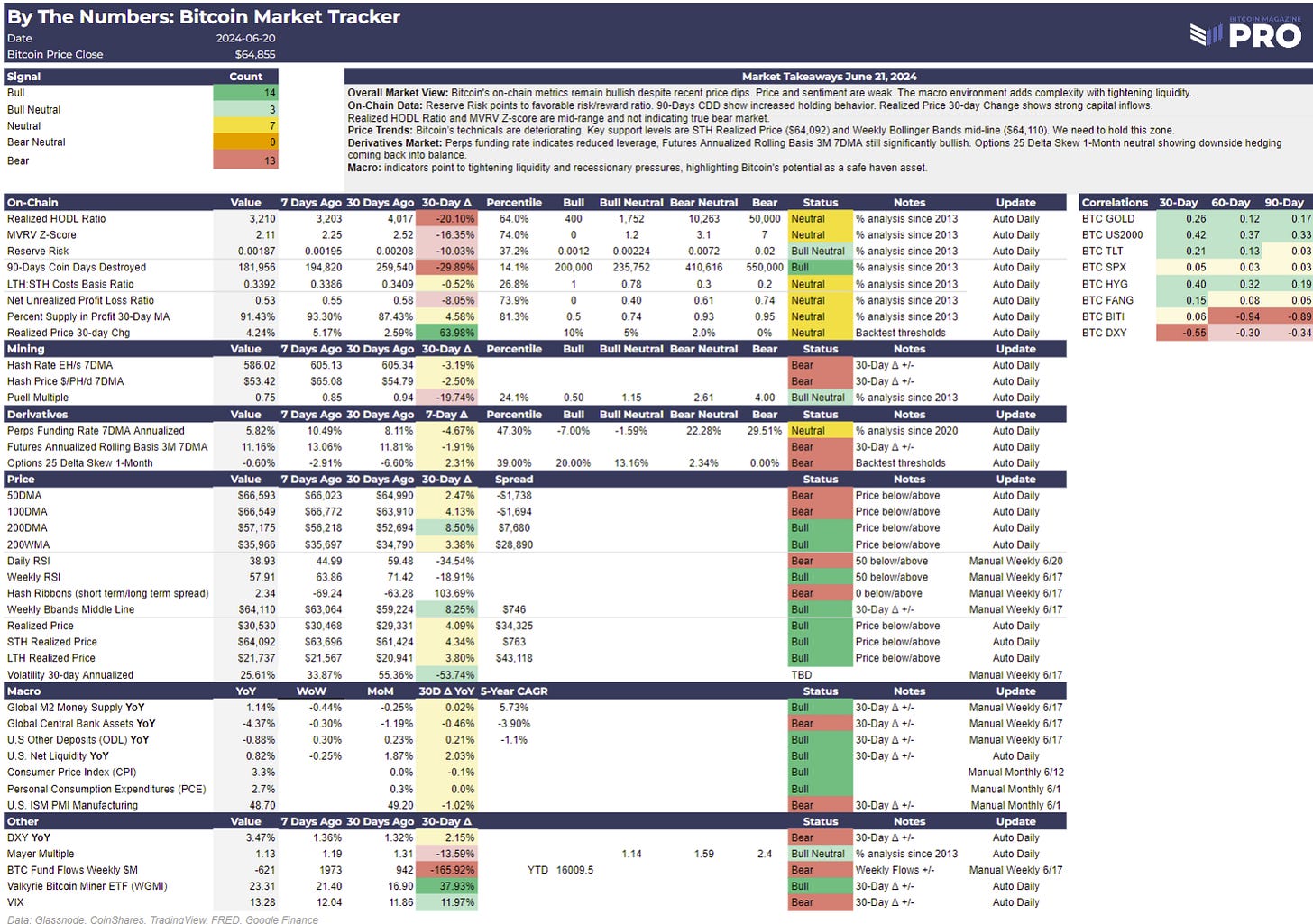

Bitcoin Magazine Pro Market Dashboard

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!