Four Bitcoin Indicators, One Comprehensive Conclusion

An Examination of STH Realized Price, Reserve Risk, Pi Cycle Top, and Terminal Price to Predict Bitcoin’s Market Dynamics and Potential Path Forward

Introduction

Today, we will be exploring some of the plethora of indicators from LookIntoBitcoin.com. We will delve into two indicators for valuing Bitcoin right now and two for predicting Bitcoin's market cycles. By examining these metrics, we aim to provide a comprehensive understanding of Bitcoin's current market dynamics and future potential.

Understanding STH Realized Price Indicator

Source: LookIntoBitcoin

A critical metric we’ve written about several times in the last couple of months is the Bitcoin Short Term Holder (STH) Realized Price. This indicator is particularly insightful for understanding the behavior and sentiment of investors who have acquired Bitcoin relatively recently.

What is the STH Realized Price?

The STH Realized Price represents the average acquisition price of Bitcoin for short-term holders, people who have held their coins for less than 155 days. The STH Realized Price offers a snapshot of the cost basis for more recent entrants into the market.

Why is the STH Realized Price Important?

The STH Realized Price is crucial because it reflects the financial commitment and behavior of short-term holders, who play a significant role as a marginal buyer or seller. Short-term holders typically have been seen as more sensitive to price changes than long-term holders. For instance, they are often more likely to sell their holdings during periods of price volatility or decline.

However, this cycle has not been dominated, like previous cycles, by weak-handed retail investors. The average STH profile has changed and the STH Realized Price might now indicate very strong support, as the institutional investors are less likely to sell at a loss.

Overall, the STH Realized Price might be a great level to go long, enabling relatively tight stop-losses just below support, limiting risk/reward. Speaking of risk/reward, next we look at this directly through the lens of Reserve Risk.

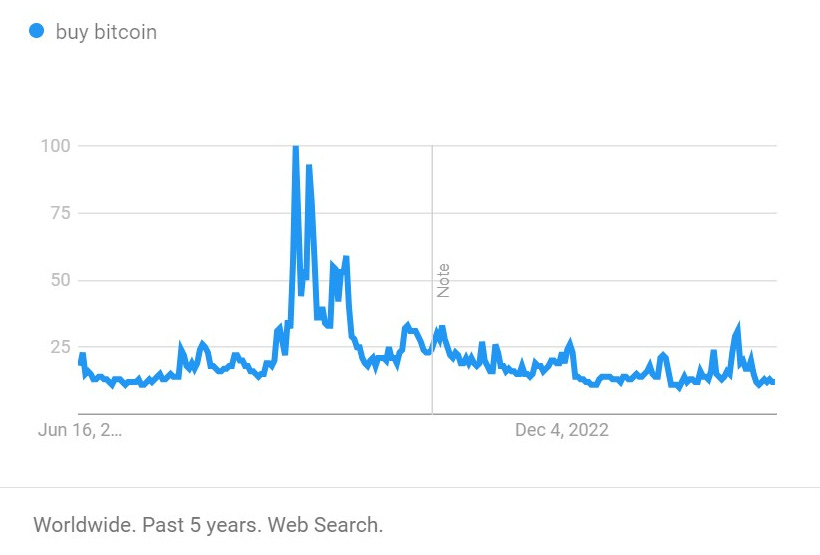

Source: Google Trends

Reserve Risk Indicator

Source: LookIntoBitcoin

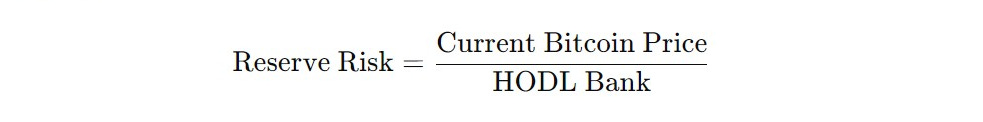

Reserve Risk is a common indicator we mention in our By the Numbers posts. It helps us visualize the confidence of long-term Bitcoin holders in relation to the current Bitcoin price. This indicator offers insights into the risk/reward ratio of investing in Bitcoin at any given moment, based on the behavior of these experienced investors.

When confidence is high and the price is low, the risk/reward ratio is attractive, indicating a good buying opportunity (green zone). Conversely, when confidence is low and the price is high, the risk/reward ratio is unattractive, suggesting caution (red zone). Historically, investing in Bitcoin when Reserve Risk is in the green zone has led to significant returns.

Calculating Reserve Risk

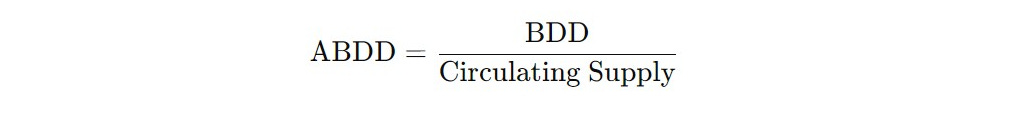

To calculate Reserve Risk, we need to understand and determine the HODL Bank. The HODL Bank is a measure of the confidence of long-term Bitcoin holders and is calculated by summing up the opportunity cost of holding Bitcoin instead of selling it over time. First, we have to adjust the Bitcoin Days Destroyed by the circulating supply to get the Adjusted BDD.

The Hodl Bank is the cumulative opportunity cost of holding Bitcoin over time.

Finally, once that is complete, Reserve Risk can be calculated by dividing the current Bitcoin price by the HODL Bank.

Why Reserve Risk Matters

The Reserve Risk indicator provides a comprehensive view of the confidence of long-term Bitcoin holders and the current market price. By using this metric, investors can better assess the risk/reward ratio of their investments. Integrating Reserve Risk with other indicators like the STH Realized Price above, and the Pi Cycle Top and Terminal Price below, offers a holistic approach to understanding Bitcoin's market dynamics, aiding in strategic investment decisions.

Pi Cycle Top

Source: LookIntoBitcoin

The Pi Cycle Top Indicator has earned a reputation for its precision in identifying market cycle highs within a narrow window of three days. This indicator relies on the interplay between two moving averages: the 111-day moving average (111DMA) and a modified version of the 350-day moving average (350DMA x 2). It's important to note that the multiple here refers to the price values of the 350DMA, not the number of days.

Historically, when the 111DMA crosses above the 350DMA x 2, it has aligned with cycle peaks. This correlation has been observed across the past three market cycles. Interestingly, the ratio of 350 to 111 is approximately 3.153, which closely approximates Pi (3.142), highlighting a mathematical harmony in Bitcoin's price behavior.

Source: LookIntoBitcoin

Peaks happen above the 350DMA x2 line in green, which is currently at $91,000 and rising. The last two cycles also had this period of consolidation at the previous ATH after touching the green line. I highlighted where this happened last cycle on the chart above.

In the chart below, you can see the 2013 ATH and how price tapped it and the green line at the same time, then consolidated and tested the orange line 111-day multiple times before breaking out. This behavior from 2017 is more similar to the price action today.

Source: LookIntoBitcoin

Terminal Price Indicator

Source: LookIntoBitcoin

The Terminal Price Indicator for Bitcoin is a complex indicator for timing cycle tops. To this value you must start with Coin Days Destroyed and adjust that by the existing supply multiplied by the time since Bitcoin’s inception to get the Transfer Price. This Transfer Price is then multiplied by 21 to get the Terminal Price for each cycle.

The Terminal Price provides a normalized value that adjusts for the entire potential supply of Bitcoin. This approach offers a reverse supply adjustment, giving equal weight to historical behavior as it does to current behavior. By doing so, it eliminates the heavy bias towards later market actions and creates a comprehensive view of Bitcoin's valuation.

The current Terminal Price is $150,419, however, its slope tends to increase significantly prior to cycle tops, a process that is just beginning. You can see in the previous bull markets the Terminal Price ramps up significantly before the price ultimately meets it. The one exception is 2020, but that cycle’s metrics were heavily influenced by the COVID flash crash and leveraged reserve schemes.

Conclusion

The near-term price indicators we examined today, the STH Realized Price and the Reserve Risk, both suggest that the current Bitcoin price offers a relatively favorable risk/reward ratio for investors. The STH Realized Price is expected to act as a support level, reflecting the building confidence among long-term holders.

On the other hand, the full cycle indicators, the Pi Cycle Top and Terminal Price, offer distinct but complementary insights into Bitcoin's market cycles. They arrive at the same general conclusion using two significantly different formulas. Both indicators show that we are approaching the explosive phase of the current cycle, suggesting significant upward potential in the near future.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!