Bitcoin Runes Launch Amid Controversy, As Inscription Protocols Dominate Blockchain

Runes, a New Inscription Protocol by Ordinals' Creator, Launches with the Halving: Can It Address Its Predecessor's Criticisms?

In the immediate wake of Bitcoin’s halving, a new inscription protocol has launched and taken the blockchain by storm, with Runes attracting large amounts of both support and condemnation.

The last few months in the Bitcoin scene have been marked by one long frenzy: the 2024 halving. This pre-scheduled event may have been baked into Bitcoin’s underlying blockchain, but it still caused a fair degree of chaos, with the overall market and various Bitcoin-dependent firms all scrambling to make the most of this situation. Now, however, the dust has settled somewhat, and one thing has stood out in the post-halving world: Runes, a “new and improved” inscription protocol that launched precisely at the time of the halving. What is this protocol, and how does it seek to improve on Ordinals? Can it avoid some of the intense criticism that’s accompanied inscription protocols as a whole? And what are its implications for the broader market?

The development of Runes was announced in September 2023, with Ordinals creator Casey Rodarmor declaring that he was building an improved inscription protocol. The first iteration, Ordinals, worked by “inscribing” novel data on the most minute denominations of Bitcoin, allowing users to perform unprecedented actions on the blockchain: inscribing very complicated data or even launching tokenized new assets piggybacking on it. These tokens became an overnight sensation, with individual offerings from BRC-20 alone crossing one billion in market cap. Nevertheless, they also came with intense criticism.

Ordinals inscriptions begin off the blockchain, but must go through it to be validated, and this can sometimes flood the chain with congestion that affects all Bitcoiners. A user may wish to consider a certain number of inscribed sats as a totally separate entity, but the blockchain still must process it as a series of regular (if miniscule) transactions. What’s worse, however, are the unspent transaction outputs (UTXOs), which are the fragments of Bitcoin left in someone’s wallet after making a purchase. If Bitcoins are like dollars, UTXOs are the leftover change. Normal Bitcoin transactions leave change amounts analogous to small bills and quarters, still useful in future purchases. Ordinals, however, leave infinitesimally small Bitcoin “dust"—fragments of pennies—practically useless and unspendable denominations.

Rodarmor identified UTXOs as the main problem in Ordinals that he could overcome with Runes. As he declared in his initial announcement, “Runes are harm reduction. BRC-20s create a lot of unused UTXOs. In order to spend Runes, you have to destroy UTXOs, which is good for the system as a whole…Since a UTXO can only be spent once, you can create a set of transactions and then out of those transactions, you can guarantee only one of those can be mined. BRC-20 transactions can’t do this.” In other words, Runes are fundamentally inscribed on these UTXOs and not on regular units of Bitcoin. He even went on to elaborate on his “harm reduction” analogy, acknowledging that the vast majority of tokens made with Ordinals are pure junk. They’re part of the ecosystem now, however, so wouldn’t it be better if the junk producers also swept up some Bitcoin dust? He even went so far as to compare Runes to clean needles, offering them to the “junkie” token creators.

At first glance, it may appear that Runes has occupied a possibly lucrative niche in the immediate post-halving market. The Bitcoin ecosystem is absolutely no stranger to chaotic conditions, with determined innovators forging ahead in completely different directions. A certain maxim has rang true over the years: no matter what happens, someone will end up a winner for it. As of yet, there are certainly several parties struggling, as the overall price has floundered somewhat. Bitcoin miners certainly saw a bonanza in the lead-up to the halving, but now that their mining rewards were cut in half, their actual profit margins have suffered a real squeeze. Similarly, even though the various Bitcoin ETFs saw huge profits as the halving approached, its market has also become somewhat more conservative, with even trading leader BlackRock ending its monthslong streak of cash inflows.

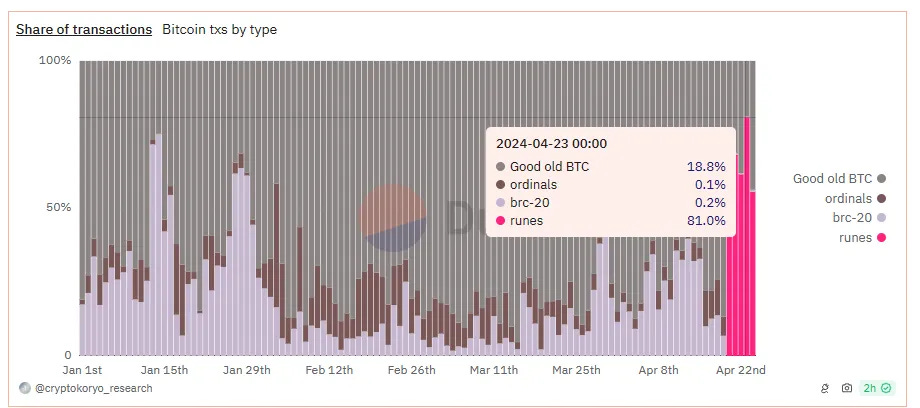

Meanwhile, inscription protocols have managed to capture a novel revenue stream that Satoshi would never have anticipated. In the middle of this conservative market, users were able to inscribe some of the first sats mined post-halving and auction them off for millions of dollars. These notorious collectibles were inscribed with the Ordinals protocol, but Runes users have also been scrambling to come up with similar commemorative tchotchkes. Could this new investment opportunity have a lasting place in Bitcoin? Additionally, Runes may have provided a lifeline for struggling miners, as it generated more than $135 million in transaction fees in its first week alone. However, these fees didn’t come out of nowhere, as Runes took up a shockingly high percentage of all Bitcoin transactions in these early days—more than 80% at one point.

Cases like this can help explain why Luke Dashjr, a prominent Bitcoin developer and Ordinals critic, only considers Runes to be the lesser of two evils. He claimed that “Ordinals are a 9-vector attack that exploit vulnerabilities in Bitcoin Core”, while “Runes are ‘only’ a 5-vector attack that actually technically follow the rules’”. Although he wouldn’t go so far as to call Runes an outright bug like Ordinals, he still proposed a method to handicap their transactions. In any event, there are a few definite points of criticism. Even if the UTXO issue is greatly improved, it’s hardly ideal that the majority of blockchain actions are currently Runes-related. Some developers have noted that Bitcoin cannot function as an electronic cash system in these conditions if the blockchain “barely processes 0.5 monetary transactions per second, and people pay $100+ for that." Additionally, the UTXO model has created a disparity between Runes transactions and transaction fees, such that these fees are unlikely to provide stable income to struggling miners.

Still, it’s not all bad. Haters of Ordinals tokens like BRC-20 will be pleased to note that Runes has completely stolen their thunder so far, with their transaction volumes withering next to this new protocol. If Runes continues to supplant Ordinals like this, cleaning up UTXOs the whole time, it may do a great deal to repair some of the bad effects of its predecessor. Additionally, it simply cannot be ignored that these inscription-based commemoratives are making money when everything from miners and ETFs to Bitcoin’s own price is feeling a bearish squeeze. Surely, the halving is not the only opportunity to open a revenue stream here, even an ephemeral one.

If nothing else, we must acknowledge that inscription protocols as a concept have a devoted base of support and aren’t likely to disappear just yet. And yet, solutions have already been proposed for handicapping Runes’ viability. If a consensus in the Bitcoin community truly gets fed up with the protocol, it may be possible to simply implement these solutions. The world of Bitcoin is full of competing strategies, and only time will tell how the best possible version will win out. Whether inscription protocols keep re-inventing themselves or find themselves locked out of the ecosystem, Bitcoin is sure to come out ahead.

Don't miss these essential reads to stay ahead in the world of Bitcoin!

Missed out on this week's Bitcoin Magazine Pro insights? Here's your opportunity to catch up:

Don't miss these essential reads to stay ahead in the world of Bitcoin!

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!