New Realities in Bitcoin Post-Halving

Public miners stabilize after the halving, while the network deals with lower issuance but spiking fees, and what can we learn from watching the layered protocol wars.

Introduction

As the Bitcoin mining industry navigates this critical post-halving period, recent data reveal both challenges and strategic responses that underline the sector's resilience and forward-thinking approach. This analysis delves into how public miners are adjusting to new market realities with revised strategies and how the entire Bitcoin network is responding to the layer 2 protocol wars reshaping transaction dynamics and fee structures. By examining changes in mining activity and network traffic, we aim to provide a comprehensive view of the current Bitcoin mining industry.

Public Bitcoin Miners: Bullish or Bearish?

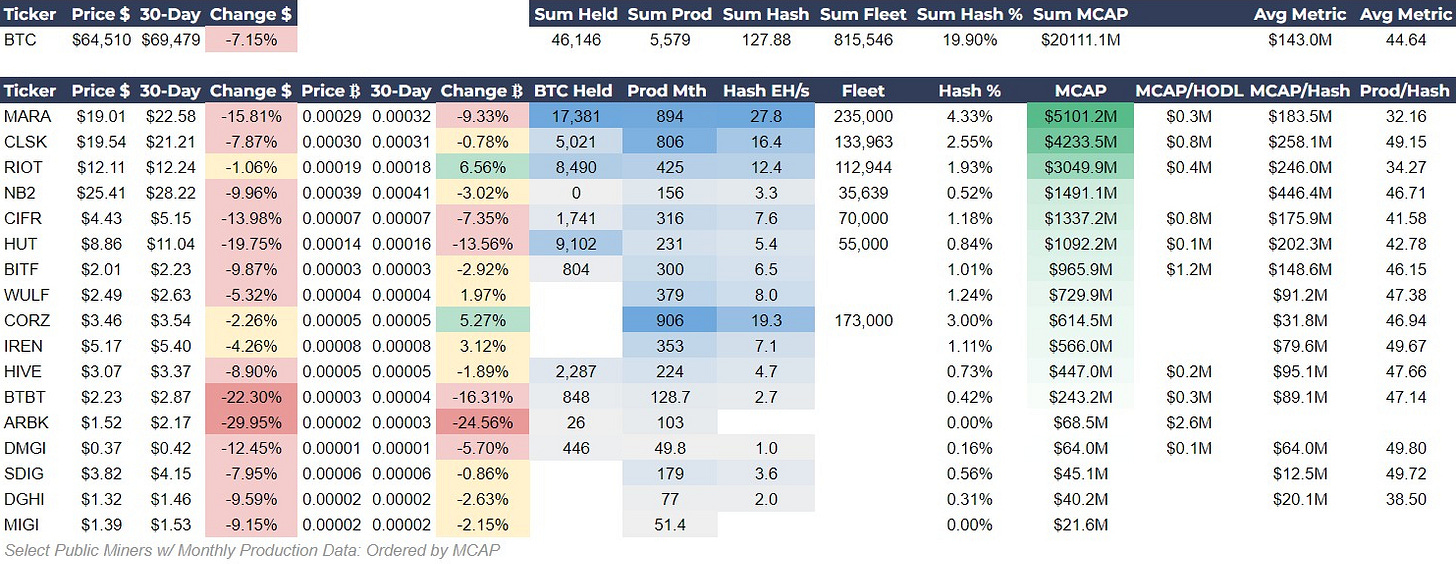

As we take a closer look at the stock performance of publicly traded bitcoin mining companies, the data shows a sector navigating through a period of consolidation we’ve been talking about for two months. The general trend across these companies shows a decline in both USD and Bitcoin terms over the last 30 days, coinciding with a 7.15% decrease in Bitcoin's price. This behavior is to be expected during a consolidation and through the uncertainty of the halving.

All share prices tracked declined week-over-week (WoW) but at a significantly slower rate than last week. Where the top 5 miners by market cap averaged a 26.39% 30-day decline last week, this week they averaged a 9.74% decline. This is evidence that the consolidation in the sector is slowing and a potential reversal is possible.

Detailed Analysis:

Marathon (MARA): Marathon Digital has significantly escalated its ambitions in the Bitcoin mining sector with a revised 2024 hash rate target of 50 EH/s, up from the previous range of 35-37 EH/s. experienced a significant drop of 15.81% in USD value and a 9.33% decline in Bitcoin value, holding approximately 17,381 Bitcoins.

Riot Blockchain (RIOT): Despite a minor decrease in share price in USD terms (-1.06%) and an increase in Bitcoin terms (+6.56%), Riot's strategic investments seem to be paying off. Their market cap stands at $3.1 billion, with an MCAP to HODL ratio of $0.4 million, reflecting a balanced valuation relative to their Bitcoin holdings.

Hut 8 Mining (HUT): Hut 8 Mining's recent strategic move to energize one-third of its new 63 MW site at Salt Creek, Texas, marks a significant step in optimizing its mining operations. Despite this HUT saw the most notable decrease, with its stock price plummeting by 19.75% in USD terms and 13.56% in Bitcoin terms.

Smaller miners like Argo (ARBK) and Digihost (DGHI) appear to be severely affected by the halving. ARBK, in particular, faced a stock price decrease of 29.95%.

Investor Insights

Short-term Volatility, Long-term Potential: Investors should expect continued volatility in the short term as the market further adjusts to the post-halving environment. However, companies that have maintained or increased their Bitcoin-denominated stock values, like RIOT, may offer promising long-term growth potential as they appear to navigate market dynamics effectively.

Strategic Positioning is Key: Companies actively expanding their operations and maintaining healthy Bitcoin reserves, like MARA and RIOT, are better positioned to capitalize on the eventual market recovery. Investors should focus on miners who are not only surviving the current downturn but also preparing for scalability and efficiency improvements.

General Mining Activity: Post-Halving Recovery

The data demonstrates that miners were not only anticipating the halving but were also actively preparing for it, evidenced by the increased hash rate and difficulty leading up to the event. While the hash rate did dip slightly post-halving, it’s a smaller change than one might expect from such a significant reduction in block rewards, reflecting the overall health and optimism in the mining sector. The surge in transaction fee revenue suggests that the network is adjusting to the new dynamics introduced by the halving, with fees becoming a more crucial part of miners' income.

Detailed Analysis

Hash Rate & Difficulty: There's a minor decline in hash rate from the past week, but a significant 30-day increase, reflecting robust network growth pre-halving and only a slight effect after. Difficulty has risen, indicating sustained competition and network security. It also represents a sustained optimism by the miners for future post-halving price gains.

Revenue & Fees: Revenues in BTC and USD modestly climbed over 30 days, displaying resilience against the halving's block reward cut, mainly thanks to drama surrounding fees. Fees temporarily spiked due to people messing around with Runes in the blocks immediately after the halving. That spike will take a while to work its way through the 30-day data, but we have already seen a return to normal fees today. Perhaps, the network will feel the halving’s full effect in the coming week.

Transfers & Balance: The sharp drop in Bitcoin transfers to exchanges over the last 30 days signals a HODL strategy from miners pre-halving. That number should continue to decline due simply to fewer bitcoins being mined. Miner wallet balances show little change, suggesting a wait-and-see approach in the new reward era. That is an important metric to watch over the coming months.

Investor Insights

Hash Rate Stability and Price: The minimal post-halving decline in hash rate coupled with increased difficulty pre-halving suggests that miners remain committed to their operations, despite the reduced supply from block rewards. If this miner confidence translates into holding behavior, it will become a self-fulfilling prophecy for price.

Transaction Fee Normalization and Spot Price: Typically, high transaction fees are indicative of coins moving to exchanges and precede price drops. However, the context of the halving paints a different picture. Elevated fees in this scenario instead point to robust demand. When paired with reduced block rewards, a deflationary environment is likely to follow.

Network Traffic: Drama and Lessons

In the wake of the halving, the Bitcoin network is adjusting to the extreme spike in transaction fees caused by the Runes protocol. The rapid development and launch of so many different layer 2 protocols on Bitcoin are going to cause interesting transaction fee dynamics over the next few years. The new protocols will not stop, this is the area of experimentation right now, and transaction fees are the referee.

The contrast between inscriptions and runes lies in technical execution — inscriptions occupy SegWit space for richer data, while runes use OP_RETURN for simpler, token-based data. This technical distinction is shaping network traffic and influencing transaction costs.

Detailed Analysis

Mempool Expansion: The mempool’s relatively small increase compared to the size of the spike in fees reflects very temporary demand by layer 2 protocols to get in the first blocks after the halving. The experimentation on the new protocols will like cause the mempool to be more full than we have been accustomed to in the past. 200 MB might be the new 20 MB, in other words.

High-Priority Fee Dynamics: Fees are now back to normal after the drama this week. At the time of writing the high-priority fee was $2.78. In the new era of layer 2 experimentation, we should expect to enter the next phase of the transaction fee regime. It is commonly understood that as each halving cuts the block reward, transaction fees will become a larger percentage of miners’ revenue. Fees in the lower single digits, will become more and more rare over this halving epoch.

Shift in Inscription Activity: The notable decline in the use of traditional inscriptions in favor of Runes highlights a market shift towards more block space-efficient protocols. We will have to update our metrics to include the different protocols, because the small number of inscriptions is not representative of the activity across the different protocols.

Investor Insights

Innovation From Layer 2 Experimentation: The current experimentation on bitcoin will likely not amount to much sustained economic value, but the amount of innovation is compelling. I expect this space to rapidly iterate, due to bitcoin’s fees point out weaknesses faster than experiments on altcoins. Watch for innovation coming out of this space. Not in the tokens themselves, but companies and protocols.

Adoption of New Protocols: The shift towards Runes and similar protocols suggests a trend towards efficiency and utility on the Bitcoin blockchain. As adoption grows, this could influence Bitcoin's utility, demand, and ultimately, its market price.

Chart of the Day

Today’s chart of the day compares the major public miners stock performance to bitcoin since the halving. As you can see, RIOT is out front, climbing 31% this week. Then there is a group of miners including the miner ETF (WGMI) all around 10-20%. Bitcoin has been the big loser since the halving, which is very interesting. I expect miners to be leading indicators for the price, so this might imply the bitcoin price is set to catch up to the miners.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!

Splendid breakdown.

Don't focus on L2 tokens but focus on mining stocks?