PRO Market Keys Of The Week: Bitcoin Price Breakdown Or Fake Out?

After a sustained and steadily consolidating trading range for the bitcoin price, the asset sees a breakout to the downside. The GBTC discount is at the lowest level year-to-date with spot ETF news.

Bitcoin Price Historical Trading Range Compression

Bitcoin has been steadily consolidating within a confined trading range of around $29,500-$31,500 for over a month. This stability, although perfect for scalpers, has induced a sense of boredom for many investors and HODLers accustomed to bitcoin’s inherent volatility.

In financial markets, extended periods of consolidation are often succeeded by vigorous breakouts in either direction, reflecting the local exhaustion of either buyers or sellers. One effective way of quantifying the compression of a trading range is by using Bollinger Bands.

To put it simply, Bollinger Bands are a technical analysis tool that uses a rolling mean and standard deviation calculations to determine trading ranges. These bands consist of a middle band (the rolling mean), an upper band (+2 standard deviations), and a lower band (-2 standard deviations). On a weekly timeframe, the width of the Bollinger Bands, which is typically calculated as the difference between the upper and lower bands, has reached historical lows. This highlights the exceptional compactness of the current trading range.

Delving into specifics, the present weekly Bollinger Bands stand at $31.3k and $25.6k.

Examining the daily timeframe, with today’s dip below the local range, bitcoin has breached the lower Bollinger Band. The question remains whether this movement is a deceptive dip or a definitive breakdown following extensive consolidation. The price action over the past month suggests that any upward surge beyond the range was swiftly and decisively rejected.

Launched last fall as a Bitcoin equivalent to the VIX, the Volmex Bitcoin 1-month implied volatility index (BVIV) is currently hovering near all-time lows. This is yet another testament to the current lack of volatility in the market.

ONE WEEK LEFT TO APPLY! Bitcoin Magazine PRO has teamed up with Samara Alpha Management to allocate $1 million in seed capital for a fund manager with a proven track record. We are currently accepting applications until July 31. Apply today!

GBTC: An ETF Approval Play

In 2023, one beacon of optimism in the bitcoin market was the performance of shares for the Grayscale Bitcoin Trust (GBTC). After a daunting 2022, GBTC shares have significantly outperformed bitcoin, driven largely by the shrinking of the discount to the net asset value (NAV) from a staggering -45% at the start of the year to approximately -27.5% at the time of writing. Consequently, GBTC has seen year-to-date gains of 124%, compared to bitcoin's rise of 72.6%.

The relative illiquidity of GBTC compared to bitcoin itself has contributed to the narrowing discount. However, shares have also reaped substantial benefits from the slew of ETF applications and amendments ensuing from BlackRock's application. This trend has instilled optimism in the market regarding the potential future approval of a spot ETF that aligns with the SEC's guidelines.

Currently, GBTC shares are trading at a bitcoin cost equivalent of around $22,000.

It's worth reiterating that while GBTC carries annual management fees which bitcoin does not, speculating on ETF approval through GBTC has become a popular trade in 2023.

July FOMC Meeting

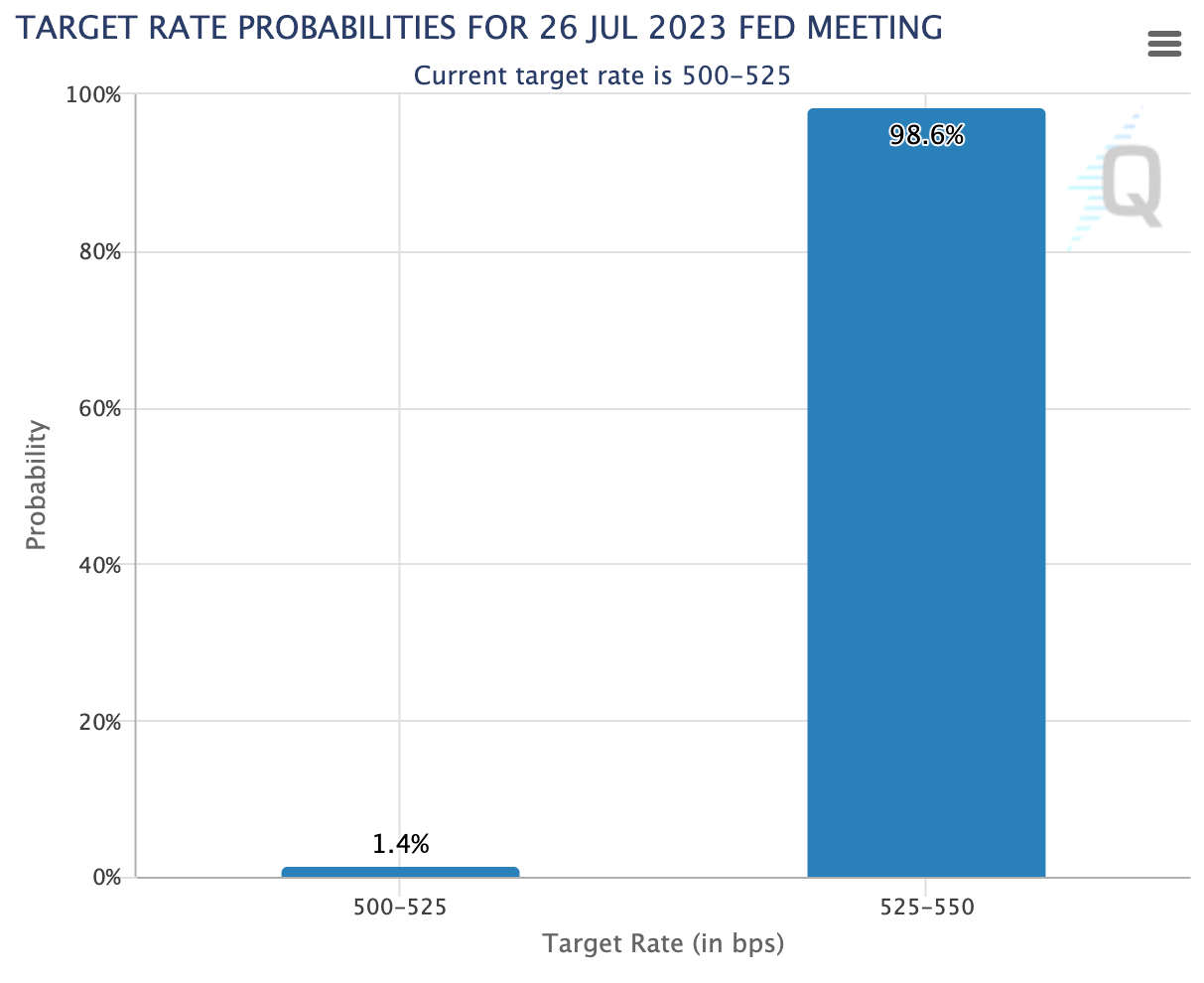

Lastly, an important event to watch this week is the Federal Open Market Committee (FOMC) meeting scheduled for Wednesday. According to the FOMC tracker from CME, there's a near-certain chance (98.6% probability) of another 25-basis-point rate hike, with only a minuscule 1.4% chance of a pause.

The upcoming week will see critical inflation data, particularly the monthly core Personal Consumption Expenditures (PCE) index from the U.S., which is highly anticipated by the market. The Federal Reserve's decision to hike rates by 25 basis points is also of significant interest, especially if there are changes in the Fed's messaging due to recent softer inflation data. Elsewhere, the European Central Bank and the Bank of Japan are also expected to make decisions that could influence market dynamics. It is hoped that this data will provide further clarity on inflation trends and central bank policies, which are key drivers of the global market sentiment. The data will allow market participants to reassess their expectations about the pace of rate hikes and other potential policy adjustments.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!