Bitcoin Mining in Flux: The Effects of Market Corrections

Miners share prices are turning the corner, plus insights from hash price dynamics, and the steady state of network traffic as Bitcoin weathers a mid-cycle adjustments.

Introduction

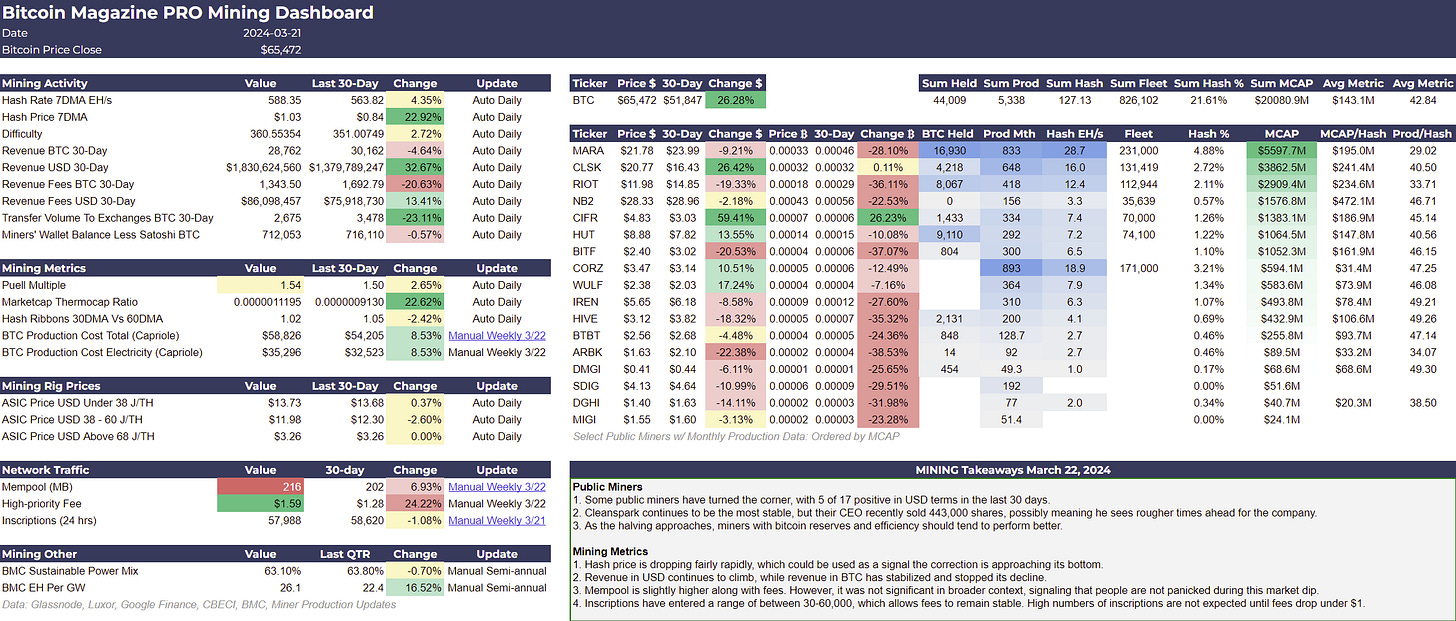

In a particularly dynamic period for Bitcoin mining and network usage, public miners have shown signs of recovery, with notable companies like CleanSpark (CLSK) outperforming others in a challenging market. Amidst a mid-cycle price correction, hash rates have shown resilience while hash prices indicate market sensitivity, reflecting nuanced behaviors in investor sentiment and mining profitability. Furthermore, network usage metrics such as mempool size and high-priority fees have seen modest increases, pointing to a stable yet active blockchain environment.

Public Bitcoin Miners Turn the Corner

Publicly traded bitcoin miners had a much better week this week than last. The week of 11 March, every single miner was negative in both dollar and bitcoin performance. This week, starting 18 March, stock prices have increased for 5 of 17 miners. In bitcoin terms, 2 posted positive results this week. CleanSpark (CLSK) continues to be the standout performer. While not the top performer this week, they have weathered this recent sell-off in bitcoin miners the best. Just a few weeks ago, its market cap surpassed Riot (RIOT), now they are 29% larger.

Other miners are turning the corner as well. While Marathon (MARA) and RIOT struggle, mid-tier miners like Cipher (CIFR), Hut8 (HUT), and TeraWulf (WULF) are starting to post gains. Interestingly, those two prior giants, MARA and RIOT have the two lowest production to hash rate at 29 and 33 respectively. Most others are in the 40’s. With Iris (IREN), HIVE and DMGI coming in virtually tied at 49 BTC/EH.

Investor Insights

Bitcoin Reserves: With each spike in Bitcoin's price, companies holding significant amounts of BTC on their balance sheets should see disproportionate stock performance, assuming other market factors remain favorable.

Market Cap Relevance: The dynamic shifts in market capitalization, as seen with CLSK surpassing RIOT and more efficient mid-tier miners posting gains, highlights the importance of efficiency and operational metrics in investor valuations. Investors should consider both market cap trends and underlying operational metrics when evaluating investment opportunities.

CleanSpark CEO Selling: “CLSK CEO and President, Zachary Bradford, has sold a significant portion of his holdings in the company, according to a recent SEC filing. Bradford offloaded 443,000 shares of common stock at an average price of $20.31 per share, bringing the total value of the transaction to approximately $8,997,330.” - Investing.com

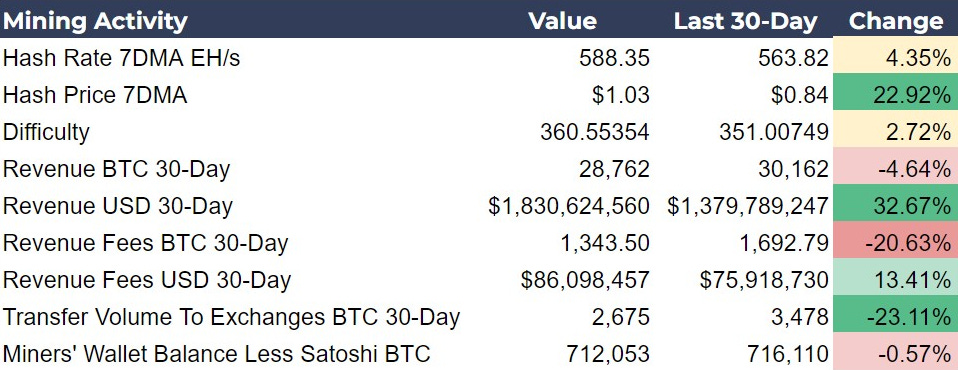

Mining Activity and Miner Revenue

While the 7DMA of hash rate has increased by 4.35% in the last 30 days, it is down week-over-week (see last week’s post). Hash price (revenue per TH) is showing the same behavior. It looks positive, up 22% in 30 days, but it is down WoW from $1.12 to $1.03. It gets even worse if you look at the current daily hash price, not part of our dashboard but part of our data collection. It stands at only $0.87. We expect these results during a mid-cycle correction that Bitcoin is currently experiencing. Hash rate tends to be less volatile than price, meaning as price spikes, hash price surges but then gets reeled back in as the correction occurs.

Revenue metrics remain mixed as they have in recent weeks, with 30-day average revenue measured in USD continues to rise while revenue in BTC continues to fall. However, WoW revenue in BTC has turned the corner as well, moving up from 28,594 on last week’s post to 28,762 this week. Most likely the reason for this is inscription volume has not rebounded significantly and fees have remained low for several weeks. The 30-day average revenue in USD climbed $90 million WoW, and $450 million MoM.

Investor Insights

Hash Price Spread and Market Timing: Since hash price typically expands during Bitcoin price spikes and declines during corrections, expanding during bitcoin price spikes and slowly declining in a correction, we might be able to use hash price returning to a previous equilibrium level to time the end of the correction. On the chart below, the previous equilibrium level is around $0.80. This would imply that the current correction will continue until the hash price reaches roughly that level. We are at $0.87 now.

Network Usage Rises

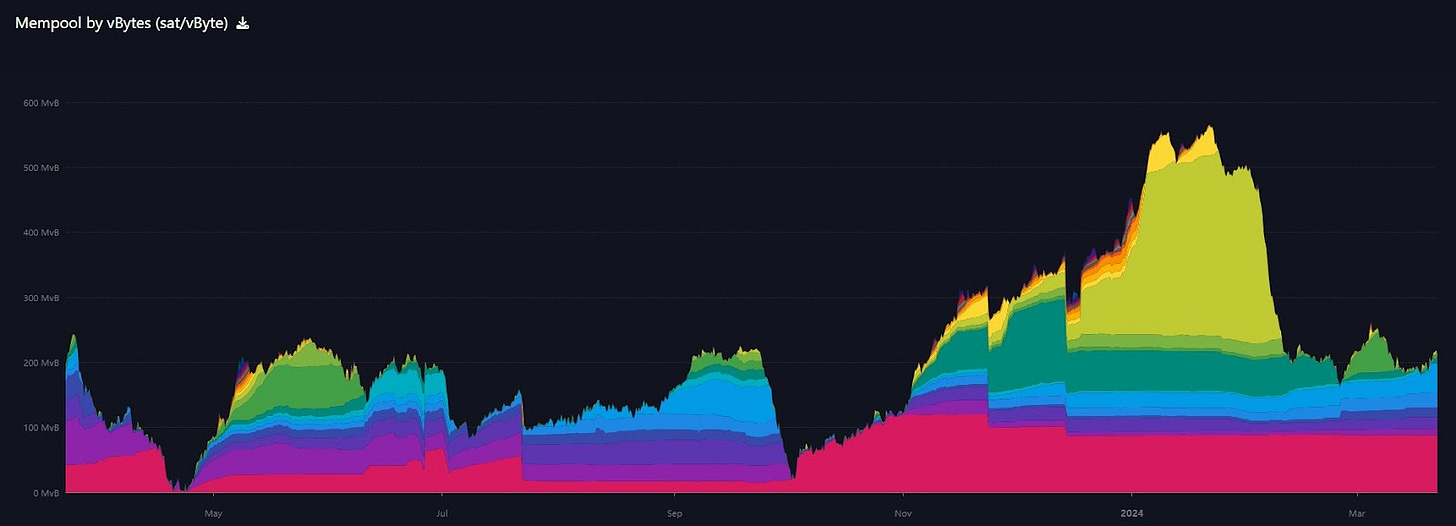

Our next section captures the important network traffic metrics. Mempool rose slightly MoM from 202 MB to 216 MB, and WoW from 191 MB. This is not a significant increase when taken in context of the mempool and fees from a couple months ago. The High-priority Fee has also increased slightly as expected, but is still <$2, which is historically normal. I don’t know when we will ever see an empty mempool in the future. If fees start going under $1 again, inscriptions will come in to take up the space.

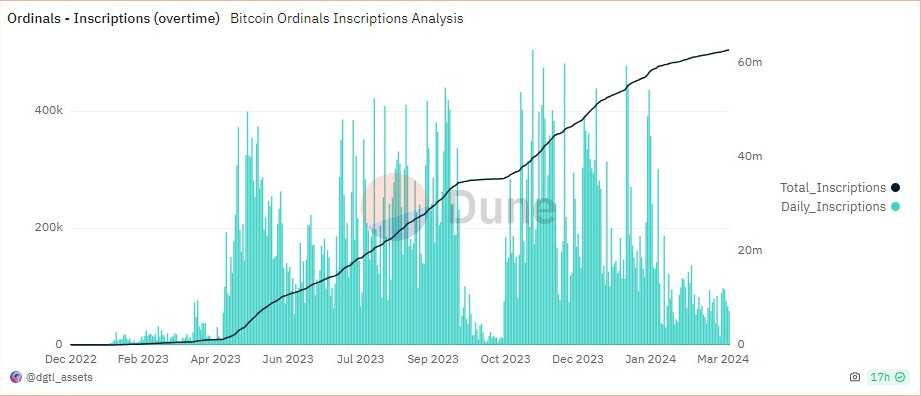

As for inscriptions, the 30-day change reflects a plateau in this sector of bitcoin. After coming down from highs of 400,000/day, the current range is between 30,000 to 60,000. For the time being a balance has been found between inscriptions and fees. People are able to inscribe up to 60,000 inscriptions/day and not balloon fees.

Investor Insights

Not a major top: The significant dip in price over the last 2 weeks has not led to a significant increase in the mempool or fees. On a major top, we’d expect more relatively fee-insensitive transactions to be sent to exchanges, causing a spike in the mempool and fees. Therefore, we can count this as evidence we have not reached a major top in price.

Speculative sentiment: Last week, I tied the number of inscriptions to the average type of investor entering the space. The more inscriptions there are, the more speculative the environment. Speculative manias often market major tops in prices as well. Inscriptions being in a plateau range is yet more evidence this is a minor pullback and not a major top.

Source: Mempool.space

Source: Dune.com

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

Missed out on this week's Bitcoin Magazine Pro insights? Here's your opportunity to catch up:

Don't miss these essential reads to stay ahead in the world of Bitcoin!

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!