Bitcoin Mining Pro Analysis - March 16 2024

Unpacking the effects of the Bitcoin halving on mining companies, network traffic, and investment strategies in the evolving landscape.

Introduction

As we approach a significant Bitcoin halving event, understanding the current landscape of Bitcoin mining, network traffic, and market sentiment is crucial for investors. This analysis covers the key performance indicators of mining companies, the state of the Bitcoin network, and the trends in speculative investment, offering insights into the complexities and opportunities in the cryptocurrency market. With a focus on practical implications, the insights here aim to guide investors through the changing dynamics as the halving nears.

Analyzing Bitcoin Mining Stocks Ahead of the Halving Event

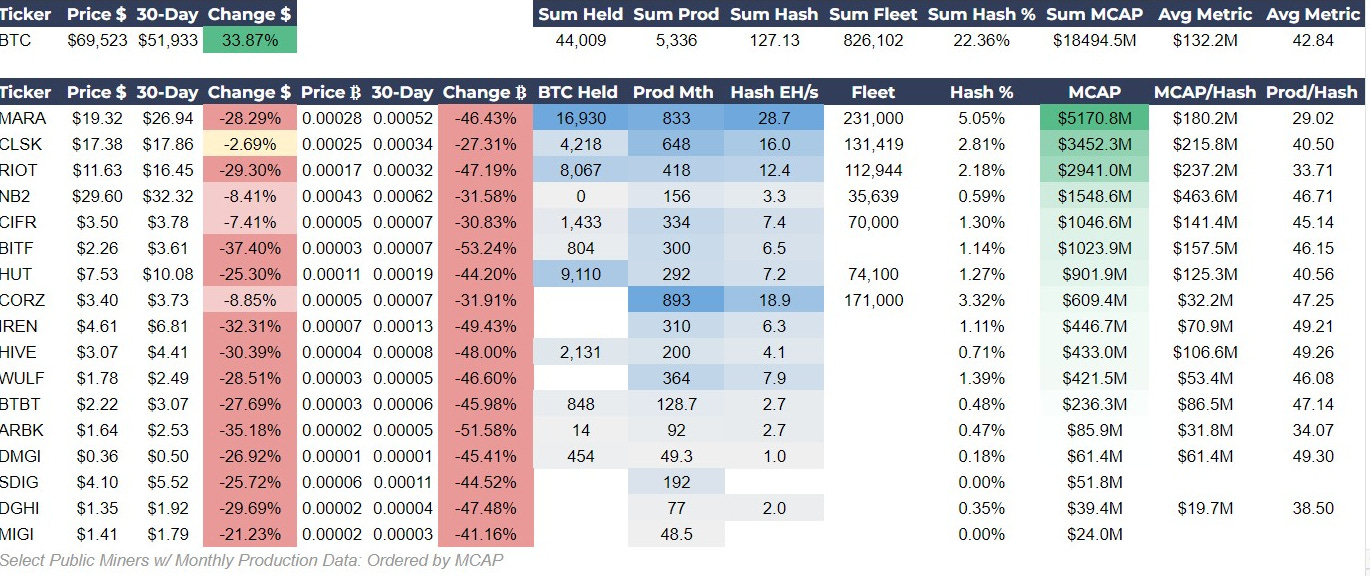

The data on publicly traded Bitcoin mining companies illustrates a notably challenging environment. Stock performance in Bitcoin terms has been significantly negative across the board, which contrasts slightly less severe, yet still negative, trends in dollar terms. For instance, MARA has seen a 28.29% decline in dollar value and a more pronounced 46.43% drop in Bitcoin terms over the past 30 days. This pattern is consistent across other companies like CLSK, RIOT, and BITF, indicating a sector-wide struggle. The decline in stock values against Bitcoin underscores the miners' underperformance compared to simply holding Bitcoin, especially in a context where Bitcoin's price surged by 33.8% in the last month. Despite the bearish trends, these companies maintain substantial Bitcoin reserves and continue to produce, with MARA leading in monthly production and BTC holdings.

The valuation metrics like market cap (MCAP) to hash rate and production of bitcoins per hash rate provide insights into the operational efficiency and market valuation of these firms. While the MCAP per hash rate varies significantly among companies, indicating differing market expectations, the production per hash rate figures highlight operational productivity. For example, CLSK's higher production per hash rate compared to MARA suggests better operational efficiency despite a smaller scale.

Investor Insights

Impending Halving Impact: Investors must monitor how mining companies adapt to the upcoming halving. Given MARA's CEO projecting a $43,000 break-even post-halving, the focus should be on firms with operational efficiencies that can sustain profitability in this new environment.

Strategic Investment Decisions: Key metrics like MCAP/hash rate and bitcoins produced per hash rate are vital for assessing which mining firms are well-equipped for the halving's challenges. Companies with higher bitcoin reserves will likely outperform competition who do not. This reserve buffer should be considered alongside their operational efficiency, specifically production by hash rate.

Bitcoin Mining Activity

Mining data reveals an increase in the Hash Rate 7-Day Moving Average (DMA) by 4.3%, and the Hash Price 7DMA shows a promising increase of 30%, indicating a rise in revenue per hash rate unit, which is a positive signal for mining profitability. The mining difficulty's ascent by 2.72% reflects a tightening competitive environment, pushing miners to enhance efficiency to sustain profitability.

Adding a layer of complexity to this scenario is the notable 26% drop in Bitcoin transfer volume to exchanges, a metric critical for understanding market liquidity and investor sentiment. This decline could signal a reduced selling pressure or a shift in investor strategy towards holding. This is doubly important in the context of the great sucking sound from the Bitcoin spot ETFs. They are still averaging $250M per day in buying pressure, and when mixed with a decrease in miner outflow, this could dramatically affect the price.

Revenue metrics offer a mixed perspective again this week: while the Bitcoin revenue over the last 30 days decreased by 6.63%, the USD revenue surged by 29.85%, reflecting Bitcoin's price appreciation. This divergence is particularly interesting in regards to the upcoming halving. For miners to not face major economic disruption. Revenue measured in BTC terms will be slashed in half, but the purchasing power revenue, or USD revenue, will have to remain stable. This can be accomplished by bitcoin price appreciation in USD.

Investor Insights

Market Sentiment Indicator: The drop in Bitcoin transfer volume to exchanges is a pivotal market sentiment indicator. A decrease in miner outflows suggests a bullish sentiment for price from miners specifically heading into the halving, contrary to what many TradFi pundits are saying is a possible doom loop for the industry.

Feedback Loop Effect: A decrease in Bitcoin transfer volume to exchanges suggests a constrained supply, which can drive up Bitcoin prices. Elevated prices, in turn, enhance the future revenue potential for miners, positively affecting their stock performance. This feedback loop between supply restriction, price increase, and improved company valuation is crucial for investors to understand when assessing opportunities in the mining sector.

Bitcoin Network Activity: Understanding Current Flows

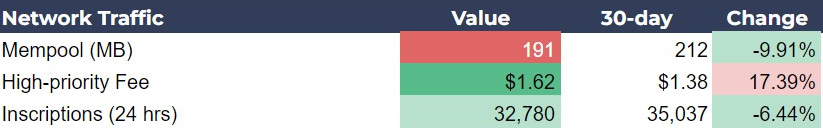

The Bitcoin mempool size, currently at 191 MB, while historically high, is a big decrease from recent months where figures have soared up to 500 MB+. The high-priority fee stands at $1.62, which is economical given that the median transaction value on the network in the last month is roughly $320, making the current fee about 0.5%. The reduced mempool size alongside low fees could be a result of fewer high-value transactions entering the queue, or fewer speculative inscription transactions.

Inscriptions, currently sitting at 32,780, have decreased by 6.44%, providing a lens into the market's speculative health. With the fees remaining under the $2 mark, it is evident that the lower cost of transaction confirmations has not spurred an increase in speculative transactions, as one might expect. I consider inscriptions to be a gauge of this speculation level in the space. More inscriptions mean the average new investor is more of a speculator or retail investor. The fewer inscriptions the more professional the new investors.

If we take it as granted that this current bull market will end in a speculative blow-off top, the number of inscriptions can be used to gauge the stage of the market. Since inscriptions have been decreasing along with fees, we can safely say that the retail FOMO is not here yet, and the average new investor into bitcoin, up to this point in the cycle, is a more professional investor.

Investor Insights

Mempool Size and Market Activity: Investors should note that the mempool size, while high by historical standards, indicates a slowdown from peak levels. This context is critical when forecasting network demand and potential fee increases, as well as price. Major volatility tends to be accompanied by an uptick in network traffic. The lack of rising traffic currently, is evidence against major negative volatility in price.

Speculation and Inscriptions: The current low inscription numbers in tandem with affordable fees point to a tempered speculative market within Bitcoin. This could suggest a period of consolidation or caution among investors. Also, a less speculative average investor is entering the market, again more evidence of less risk of a major sell-off at this point.

Chart of the Day

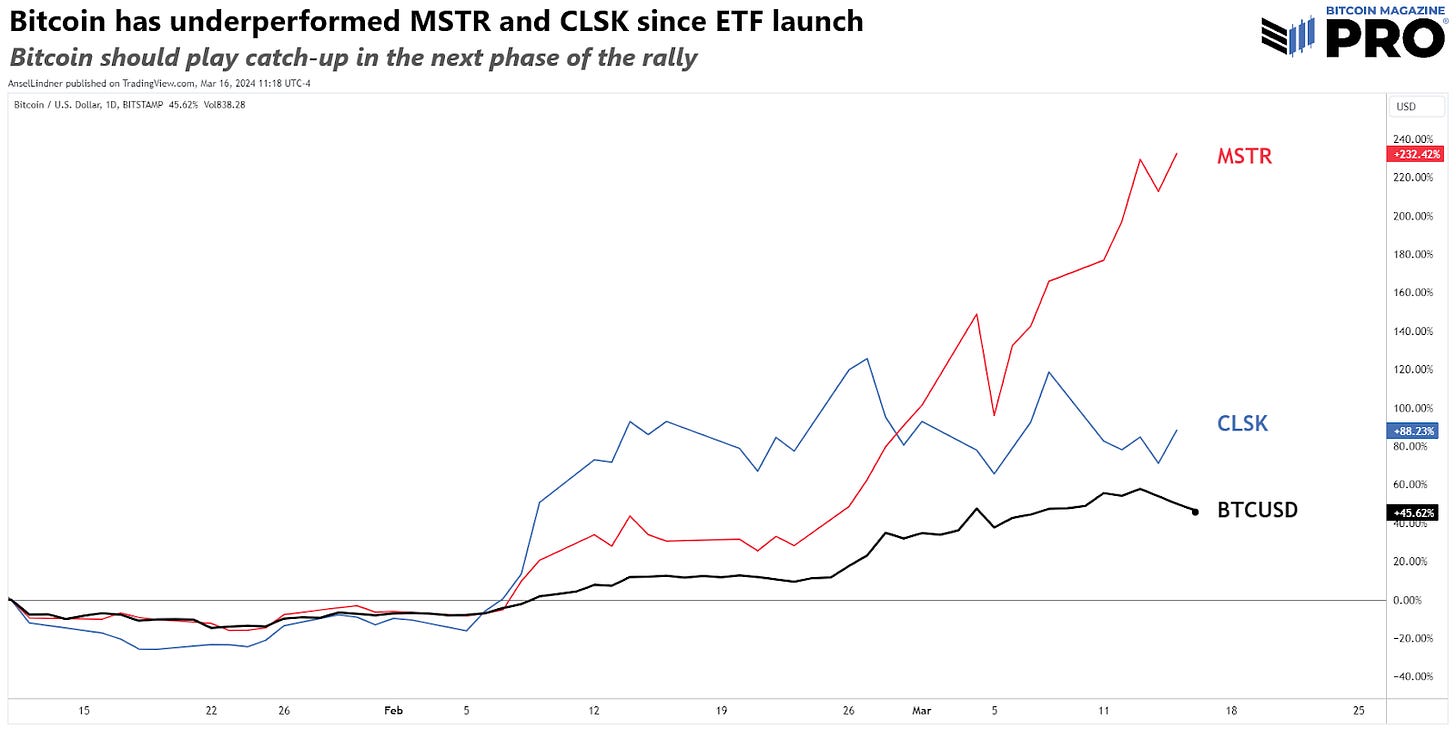

On 8 March 2024, MicroStrategy (MSTR) announced the completion of a $800 million debt offering to purchase bitcoin. Then on 15 March they announced the pricing of another $525 million debt offer. These offerings leverage the profitable underlying MicroStrategy software business to buy more bitcoin. From the share performance we can see that it has behaved effectively as a leveraged bitcoin product.

Investors should be aware of the higher volatility that MSTR offers than bitcoin. If bitcoin has a mid-cycle correction of the historical 30%, MSTR could crash by 50%. This increased volatility will have different psychological effects on the investor and also, create different trading opportunities, like different options strategies. Spot bitcoin promises to outperform all other bitcoin related equities this year except MSTR.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!