Are the Bitcoin ETFs Priced In?

Can the ETFs be priced in or are there too many variables? Plus an update on the Chinese economic troubles.

Topics this week:

Price discussion

China update

Our Dashboards are back! One Market Dashboard and one Mining Dashboard post with summary takeaways will go out every week. Our first one was released yesterday to premium subscribers.

If you find value in our content please Like and Share! Thank you.

Is ETF Approval Priced In?

Bitcoin has not disappointed this week, up 16% since breaking out on December 1. One of our targets has been hit at $42,000, with the next being $48,000.

This move has prompted discussion of whether or not the ETFs have been priced in. This is an idea from the Efficient Market Hypothesis that all information available to the market is incorporated into the current price. If the ETF approval is priced in, the approval does not necessarily mean a rapid increase in price: It could turn out to be a sell-the-news event. We can estimate the likely inflows and multiplier as follows, but there are still many unknown variables.

In 2021, Bank of America estimated this multiplier to be as high as 107 times. James Van Straten on Twitter, did some quick math to find the multiplier for yesterday’s move, arriving at 114 times.

As for inflows, the largest ETF strict launch ever was Goldman Sachs MarketBeta US 1000 Equity ETF (GUSA) at $1.35 billion on the first day. Several ETF experts, like James Seyffart of Bloomberg Intelligence, think the Bitcoin spot ETF launch could be the largest in history. Galaxy Digital’s excellent research estimates $14 billion to flow into the ETFs in the first year. This would put a one day market cap increase as high as $100-200 billion, and the first year as high as $1.4 trillion. (Note: Galaxy Digital used an 8x multiple based on gold ETF precedent, not the 100x as evidenced by the bitcoin market, so their results are much lower.)

That being said, there are many unknown variables like, will the ETF approval prompt other large buyers. Have applicants already started buying to fulfill early demand? What will the effect of ETF inflows be when compounded by the halving and typical cycle? Will the ETFs even get approved? Rumors are flying just this morning that the current move in bitcoin is not even related to the ETF hype, but is a sovereign buying in size, namely Qatar.

Source: Twitter

We know that bitcoin is a Veblen good, meaning its demand rises with price (aka FOMO), but we don’t know the specific strength of this effect at specific price levels. Similarly, we don’t know how the multiplier will change as price rises. Simply put, there is too much uncertainty to say an event as big as approving a bunch of spot ETFs is priced-in or not.

That being said, the trend for bitcoin is undoubtedly higher, lending credence to it not being priced in. The long-term charts have been setting this up since way before the Blackrock ETF filing. On the quarterly chart, we see a new cycle beginning with rising RSI and a MACD that is about to cross bullish for the first time in bitcoin history, since that history is so short on a quarterly basis.

The monthly chart shows these same trends, except this time the MACD is already bullish and expanding.

Zooming in to the daily chart, RSI is high, but could move higher after a couple-day cool off. MACD is recrossing bullish above the center level. The last time that happened — other than the small one last month — was in early 2021, leading to multiple pushes to higher highs.

Are the Bitcoin spot ETFs priced in? No, at least not fully. The only things we can price in are the likely inflows and multipliers directly from the ETFs, but we don't know all the variables in the overall environment. The charts are telling us the totality of the information in the market is pointing to much higher prices on the monthly and quarterly scales, regardless of the ETFs.

China Slowdown Worsens

JP Morgan has a new report on global GDP for 2022. They found that in 2022, when the Chinese property bubble was just in the first innings of its demise, they showed China’s share of global GDP already falling and the US’ rising.

JPMorgan Chase & Co. economists have updated their global assessments to take account of final figures for 2022, and they show America weighing in at 28.4% of the planet’s gross domestic product. China came in at 20%.

Source: Bloomberg, JP Morgan

It was the first decline in China’s share of global GDP since 1994. In 2023, the property sector woes are still getting worse. S&P Global has a report out on the current Chinese economy, where they mention the property crisis spreading to local governments and banks.

Source: S&P Global

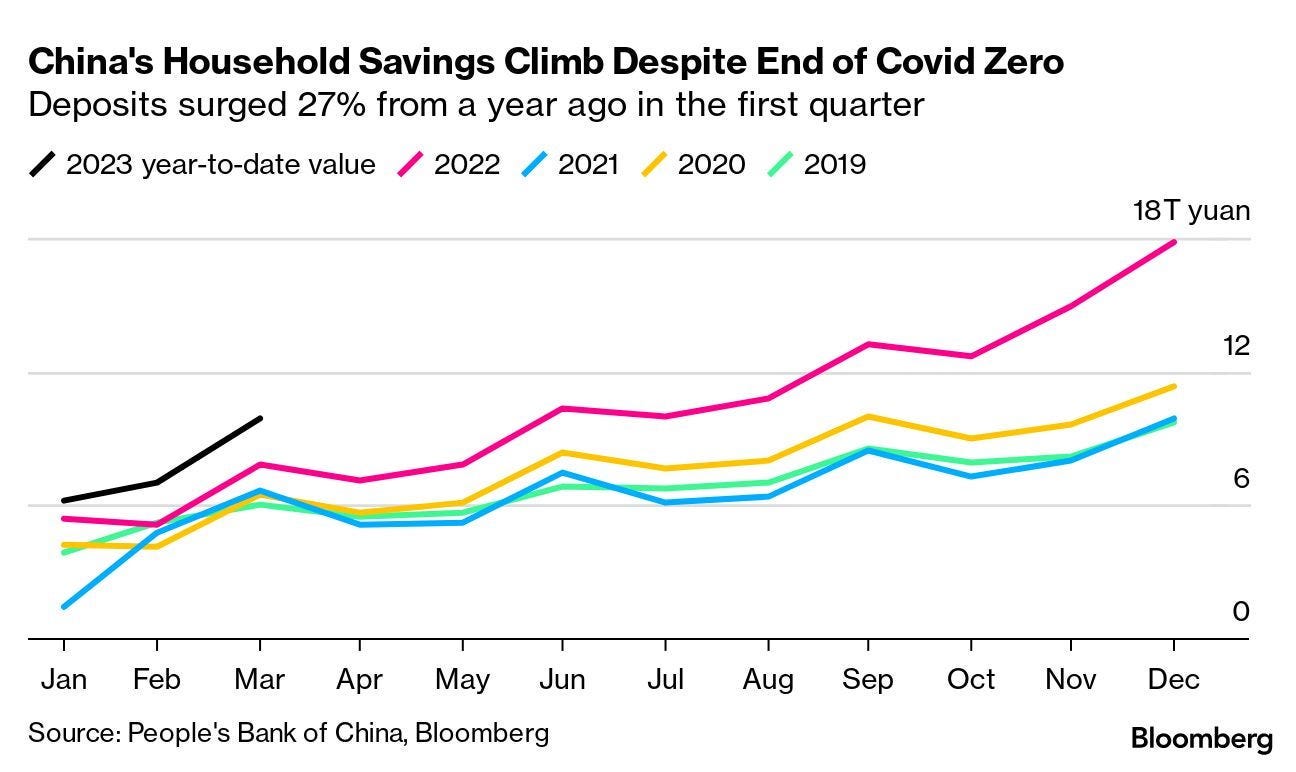

The Chinese economy is in a structural chokehold, in which a traditional high-growth model, driven by their communist 5-year dictates and a massive misallocation of credit into ever-growing excess capacity, must be turned upside-down, diverting investment to households and their private decision making on services. However, as the CCP attempts to shift investment from the manufacturing sector and into households, it translates into increased household savings, not increased spending. People intuitively understand that this shift of investment is going to crash the economy, so they self-insure through savings.

Source: Bloomberg’s Yujing Liu, PBOC

The last update I have on China is from an article this week in the Financial Times, reporting defaults by Chinese borrowers have spiked in recent years.

A total of 8.54mn people, most of them between the ages of 18 and 59, are officially blacklisted by authorities after missing payments on everything from home mortgages to business loans, according to local courts.

That figure, equivalent to about 1 percent of working-age Chinese adults, is up from 5.7mn defaulters in early 2020, as pandemic lockdowns and other restrictions hobbled economic growth and gutted household incomes.

This highlights the Chinese economy is too weak for needed reforms. They can’t keep doubling-down on their old model of investment into excess capacity and property bubbles, they must make the leap to a consumer-led economy. But in doing so they will crash their economy and bankrupt the very consumers they need.

Source: Rhodium Group

Thank you for subscribing! If you liked this content give it a like and share. Also, tell me what you’d like to hear more about in future posts in the comments.