PRO Market Keys Of The Week: Altcoins Are Securities, Bitcoin In The Clear

The SEC advised Coinbase to halt trading in all cryptocurrencies except bitcoin. Bank of Japan raises its bond yield target, impacting global markets. Bitcoin spot market volume hits multi-year lows.

SEC To Coinbase: All But Bitcoin Are Securities

In a newly released Financial Times article, it was revealed that the U.S. Securities and Exchange Commission (SEC) had advised Coinbase to halt trading in all cryptocurrencies except bitcoin, a clear indicator of the SEC's intent to extend regulatory authority over the broader crypto market. This suggestion was made prior to the agency’s legal action against Coinbase for failing to register as a broker. Coinbase CEO Brian Armstrong stated, "They said … we believe every asset other than bitcoin is a security,” and that compliance with this directive would have risked positioning most American crypto businesses outside the law unless they registered with the SEC. While Armstrong’s stance to protect not only his own business interests but also the legal precedent in the crypto industry is certainly an admirable one, it looks as if the legal battle between the SEC and crypto businesses/service providers is far from over.

Surging Interest Rates Propel US Treasury to Boost Bond Issuance

As we noted in our previous BM Pro Market Dashboard thread for paid subscribers, central bank decisions from the U.S. and Japan have been stirring the global liquidity pool. Following this, news comes of the U.S. Treasury’s plans to start a ramp-up in the issuance of longer-dated securities that will likely continue into the next year, as it grapples with a deteriorating budget deficit and surging short-term interest rates. An increase in the quarterly refunding of long-term Treasuries to the tune of $102 billion is expected, marking a significant hike from pre-pandemic levels. The Federal Reserve’s rate hikes, leading to a 22-year high policy benchmark, and rising government debt yields are driving up public borrowing costs, incentivizing Treasury officials to utilize the long end of the curve due to the lower rates currently offered.

A Stealthy Shift In BOJ's Yield Peg Policy

The Bank of Japan (BOJ) Governor Kazuo Ueda has initiated a discreet shift away from the longstanding pegging of 10-year yields near zero, a process which began in December when his predecessor, Haruhiko Kuroda, doubled the tolerance range for yields from 0.25% to 0.5%. To ensure markets have an anchor, Ueda mentioned that daily bond purchases would be conducted at a fixed rate of 1%, but also emphasized there’s been no move toward normalization of policy. On Monday, in an unexpected move, the BOJ announced an unscheduled bond-purchase operation to manage rates, which pushed the yield on Japan’s benchmark debt from a fresh nine-year high of 0.605% and weakened the yen against the dollar.

As the BOJ allows yields on Japanese Government Bonds (JGBs) to increase, these bonds become more appealing in global markets, driving investment back into the yen and out of other dollar-denominated securities. The fluctuation underlines the fungibility of sovereign debt — once adjusted for exchange rates and risk, bonds from different countries essentially substitute each other. The BOJ’s adjustment in yield policy, therefore, subtly alters global capital distribution and could place additional pressure on long-dated yields globally. As the world’s largest net creditor, Japan’s monetary policy is important to monitor, given their large impact on global debt markets and long-duration interest rates.

Oil Prices Rally: Record Demand & OPEC+ Cutbacks Fueling Surge

Oil prices are surging towards their largest monthly increase in over a year due to tightening market conditions. This shift is attributed to record-breaking demand for crude and strategic supply reductions by OPEC+. Factors such as cutbacks from Saudi Arabia and Russia, in addition to speculation that the Fed is nearing the end of its monetary tightening cycle have fostered an optimistic market sentiment. Meanwhile, declining inventories at the largest storage hub in the U.S. supports this bullish trend. Despite contracting manufacturing in China, the market appears to shrug off growth pessimism, fueled by a robust demand and calculated supply reductions. Continued bullish momentum in the oil market could throw some gasoline on the inflation fire that the global central banks have been keen on dampening over the past year.

Bitcoin Spot Market Apathy: A Signal Of The Bear Market Aftermath?

Bitcoin’s spot trading volume 7-day average has plunged to its lowest in multiple years, using aggregate spot volume from Coinbase BTCUSD, Binance BTCUSDT and Kraken BTCUSD. Similarly, according to CryptoQuant, the spot versus derivatives volume ratio dropped from 35% to 6% since January 11, revealing that a mere 6% of total bitcoin trading volume is occurring in the spot market. This downturn suggests a minimal eagerness among sellers to divest their bitcoin holdings after the harsh bear market of 2022, coupled with limited new cash inflow. This pause in activity may be attributed to traditional finance investors awaiting approval of bitcoin spot ETFs, with current market volatility primarily driven by crypto-native participants trading derivatives in a zero-sum game.

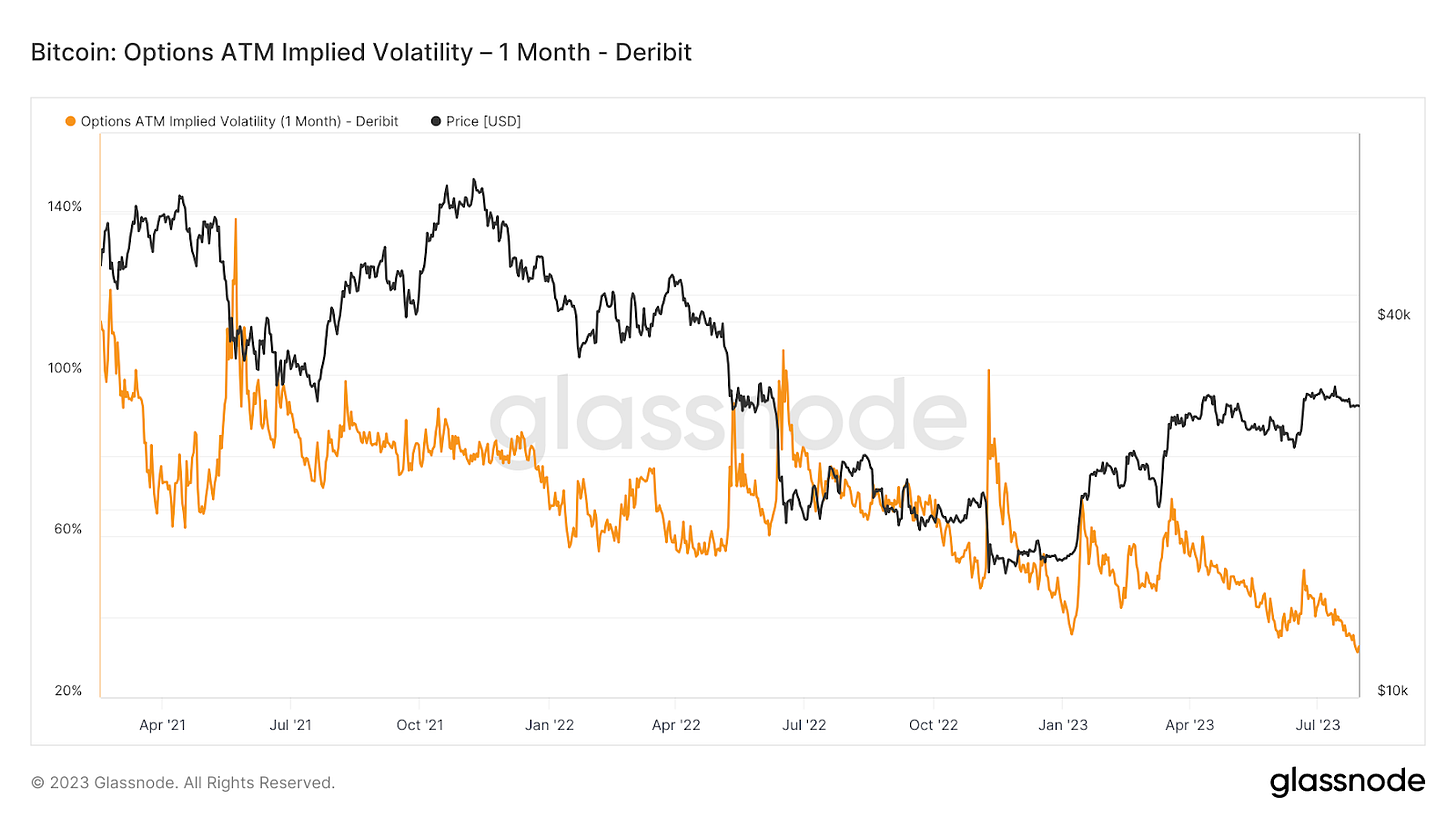

This comes at a time where 1-month implied volatility, derived from the bitcoin options market, is at its lowest level ever recorded (starting from February 2021), yet another sign of the market’s expectations of additional chop and muted volatility going forward.

With bitcoin spot market volumes at multi-year lows, our view is that bitcoin is in the pre-bull market consolidation phase, which can span for quarters on end as fundamentals improve and supply continues to be constrained due to HODLer accumulation trends. With TradFi flows being the obvious future catalyst, we remain aware and alert of a Fed tightening cycle that has yet to play out in full, as evidenced by no rate cuts materializing yet. Our 2023 outlook hasn’t changed. Expect choppy exchange rate consolidation and muted volatility to remain while the regulatory and macroeconomic environment gets sorted out.

A tentative roadmap for the bitcoin bull cycle has our sights set on the second half of the 2024 calendar year, where we fully expect a spot bitcoin ETF approval to have manifested in tandem with a global economic cycle trough to have been found.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!