Will Bitcoin’s Market Malaise End Anytime Soon?

Exploring the Convergence of On-Chain Metrics, Price Dynamics, and Macroeconomic Trends as Bitcoin Consolidates, Offering Investor Insights Amidst Global Economic Uncertainties.

Introduction

In this week's detailed analysis of bitcoin’s market metrics, we dive into the dynamics of Bitcoin's market, examining a range of on-chain metrics and price indicators that suggest a consolidation phase with potential for an upcoming bullish reversal. Our detailed exploration extends into derivatives and macroeconomic indicators, where shifts in global liquidity and economic activity provide a backdrop to Bitcoin's increasing appeal as a safe haven asset. As we navigate through complex technical signals and economic data, we uncover strategic insights for investors looking to optimize their positions in a rapidly evolving cryptocurrency landscape.

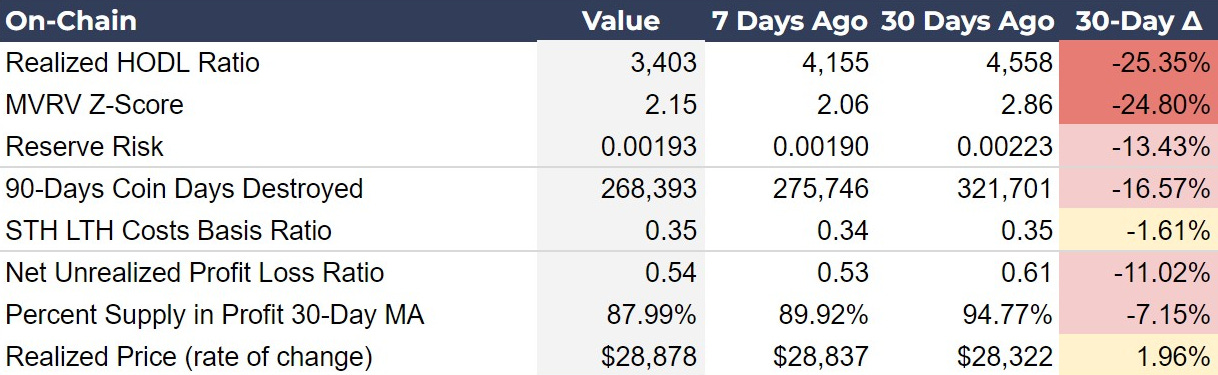

On-Chain Bitcoin Metrics Analysis

The latest on-chain metrics for Bitcoin illustrate a bull market consolidation in a bottoming behavior, which is similar to the last couple of weeks. The MVRV Z-score, Reserve Risk, STH LTH Cost Basis Ratio and Net Unrealized Profit Loss Ratio are showing a possible bottom this week with reversals in trend from the 7-day versus the 30-day. Meanwhile, the Realized HODL Ratio and Coin Days Destroyed are still noticeably still showing bull market consolidation.

Detailed Analysis

Realized HODL Ratio: This metric has decreased significantly over the last 30 days from 4,558 to 3,403, a 25.35% decline. This reduction indicates a significant cooling period or profit taking after a bullish phase. This is the one metric that shows an intensification of the recent downward consolidation, with 65% of the total decline coming in the last week. This could be seen as the last rapid redistribution before a reversal.

MVRV Z-Score: The decrease from 2.86 to 2.15 over the last 30 days (-24.80%) indicates that Bitcoin is moving away from overvalued conditions towards a more fairly valued state according to this metric. However, it has increased over the last week, suggesting the market is deeming the current level as fair value, and selling pressure will reduce.

Reserve Risk: The flat performance of this metric suggests that the market perceived risk/reward has remained the same. It also happens to be on the bullish side of the historical norms, meaning there is plenty of upside for new investors looking to ride the bull market higher.

90-Days Coin Days Destroyed: Still marching lower but at a slower pace over the last week, indicating that the oldest coins are being moved less frequently, typically a bullish sign.

STH LTH Cost Basis Ratio: This metric has remained relatively stable over the last 30 days, with only a slight decrease (-1.61%), suggesting a balance between short-term and long-term holder cost basis. In other words, as measured by this metric, LTH distribution is waning slightly, reducing selling pressure from profit-taking.

Net Unrealized Profit/Loss Ratio: This is yet another metric showing a decrease over 30 days, but bottoming-type behavior in the last 7 days. A flat value here suggests the market is experiencing less overall profit, aligning with a cooling or consolidation phase. The slight increase in the last week could be an early indicator of returning optimism.

Investor Insights

Stabilizing Sentiment and Value Entry Points: With many key on-chain metrics showing signs of stabilization after a period of decline, investors should consider this an opportunity to identify potential entry points. On-chain metrics are just one part of a holistic view of this market. Once on-chain metrics start to show a fundamental return of bullish momentum, attention can go to technical analysis to identify support and resistance levels, to help identify entry points.

Long-Term Strategy Amidst Market Reset: The significant declines in MVRV Z-Score and Percent Supply in Profit suggest that Bitcoin has undergone a substantial market reset, clearing out much of the speculative froth driven by the first leg of ETF inflows. For long-term focused investors, this could be an opportune time to accumulate positions at a perceived fair value.

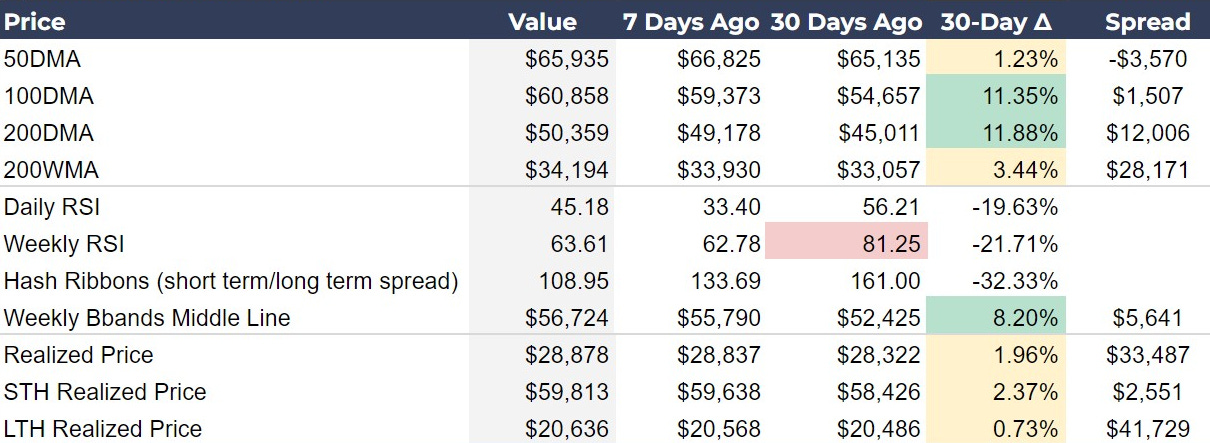

Bitcoin Price and Technical Dynamics Analysis

This week's price analysis shows a bullish trend still intact, but with the potential to tip bearish. The 50 DMA is declining, but the rate of that decline has slowed in recent days. The 100-Day and 200-Day Moving Averages, along with the Weekly Bollinger Bands remain positively sloped and bullish.

Significant declines in both Daily and Weekly RSI represent the consolidation we’ve been talking about since early March. The Hash Ribbons indicate miner stress, typically preceding a bullish recovery. Realized prices for both short-term and long-term holders have modestly increased, supporting higher valuations. Overall, the market, despite short-term cooling, shows strong potential for sustained growth in the technicals.

Hash Ribbons Bollinger Bands Explained

These are new indicators for us, so here are some quick definitions of what information we can glean from them.

The Hash Ribbon is a market indicator that assumes that Bitcoin tends to reach a bottom when miners capitulate, i.e. when Bitcoin becomes too expensive to mine relative to the cost of mining. The Hash Ribbon indicates that the worst of the miner capitulation is over when the 30d MA of the hash rate crosses above the 60d MA (switch from light red to dark red areas). Times when this occurs and the price momentum switches from negative to positive have shown to be good buying opportunities. - Glassnode

Bollinger Bands consist of three lines on a trading chart. The middle line of the indicator is the simple moving average (SMA) of the instrument's price, which is the average of the price over a certain length of time. This is generally set to a 20-day period. The upper band is the SMA plus two standard deviations. The lower band is the SMA minus two standard deviations. - CMC Markets

One use is for trend analysis. The direction of the middle band can indicate a trend's strength: when the middle band is heading upward, this suggests an uptrend, and the converse when heading downward. - Investopedia

Detailed Analysis

The 50 DMA is downward sloping, but is slowing. Last week I mentioned that the 50 DMA shifting to a negative slope could be seen as bearish, but we’ve witnessed this pattern several times recently and it always happens before continued upward price movement. The 50-day also has provided resistance over the last couple of weeks, making it an important first level to break to confirm renewed bullishness. Other MAs are showing intact bullishness.

The Relative Strength Indicators (RSI) are mixed on the daily and weekly. The daily is on the bearish side of the range, and was close to going oversold last week, which it did not. There is potential that the daily RSI can make another attempt at oversold conditions in the near term. The Weekly RSI on the other hand is on the bullish side of the range, and is now cooled off enough to make a monster rally by historical comparison.

Hash Ribbons have narrowed significantly in the last 30 days. The most bullish phase in a hash ribbon cycle is crossing from negative to positive. Being that this spread is still positive means the halving has yet to cause a capitulation period for miners. If that comes, this ratio will turn negative.

Investor Insights

Support and Indecision: The last few weeks have been a period of indecision in the bitcoin price. Some important levels of support and resistance have been identified. Below the price, acting as support in the near term are the STH Realized Price of $59,813 and the weekly Bollinger bands middle line at $56,724. The 50 DMA and ATH are the resistance levels above price. As we proceed through May those levels will squeeze the price requiring a decision.

Divergences with On-chain Metrics: The last two weeks the price consolidation has taken a noticeable bearish bias, as it is squeezed between support and resistance. At the same time, on-chain fundamentals are starting to shift back in the bullish direction, along with long-term technical indicators continuing to show significant bullishness. This could be considered a bullish divergence, which we will have to watch to confirm.

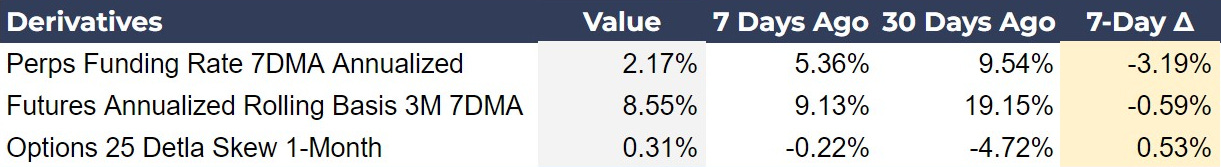

Analysis of Bitcoin Derivatives Market Dynamics

These derivative market indicators offer a snapshot of the broader market sentiment and provide clues on the prevailing financial dynamics in Bitcoin trading. They suggest a market that is slightly more bullish than bearish, but more importantly fully reset from overheated conditions. According to the data, the risk of a significant sell off is very low, and traders are ready to lever-up as soon as bitcoin breaks out.

Detailed Analysis

Perps Funding Rate 7DMA Annualized: This week's annualized funding rate for perps stands at 2.17%, a massive decrease from 5.36% last week and 9.54% a month ago. This decline indicates a significant decrease of bullish leverage within the market. This could be interpreted as a shift towards more neutral or bearish sentiment, or simply an indication of how long this consolidation has lasted since 4 March. Holding a long position open with a positive funding rate eats away at your margin, and if held for a long period of time will drastically increase your risk.

Futures Annualized Rolling Basis 3M 7DMA: The three-month futures rolling basis has also decreased slightly to 8.55% from 9.13% last week, and significantly down from 19.15% 30 days ago. This drop of 0.59% over the past week is essentially flat, but the change over the last 30 days tells us the market has already consolidated in this respect.

Options 25 Delta Skew 1-Month: The one-month options skew flipped slightly positive technically indicating a reversal from bearish to mildly bullish sentiment, however it is not anything significant.

Investor Insight

Primed for a Big Move: The derivatives market is boring right now other than the fact that it is set to powerfully reinforce the next upward move in price. At this time, derivatives have plenty of room to expand to the bullish side, once the market picks a direction. Watch for these metrics to make a significant move and you’ll have identified your next trend.

Macro Indicators Impacting Bitcoin

This week's macroeconomic indicators highlight a complex global financial landscape with implications for Bitcoin. A modest year-over-year increase in global M2 money supply and a contraction in global central bank assets suggest a cautious approach to liquidity, potentially impacting Bitcoin's role as an inflation hedge. U.S. economic data reveals tightening liquidity and a contraction in manufacturing activity, enhancing Bitcoin's appeal as a non-correlated safe haven asset. With persistent inflationary pressures evidenced by the CPI and PCE indexes, Bitcoin may serve strategically as both a hedge against inflation and a diversification tool in uncertain economic times.

Other Deposits, CPI and PCE Added

This week I’ve added CPI and PCE numbers, as well as the Other Deposits and Liabilities (ODL) data from the Federal Reserve's H.8 data. Some legendary economists, like Lacy Hunt of Hoisington Investments, prefer this measure of the money supply to M2.

The main difference between ODL and M2 is that ODL does not include currency or retail money market funds. Currency is accepted at an increasingly fewer number of business establishments and simply cannot be used for very large sized transactions. Retail money market funds never became an important medium of exchange. Both are becoming a far less used medium of exchange. ODL has the additional advantage that it is the main source of funding for bank loans and investments, making ODL both a monetary and credit aggregate. Friedman would not be surprised that the need to change the best definition of what constitutes money would change over the years. - Lacy Hunt

Detailed Analysis

Global M2 Money Supply and Other Deposits: In general, both these monetary aggregates agree that the money supply has changed little over the last year, which doesn’t support the reacceleration of inflation narrative that is common in the market. ODL is in agreement with Central Bank Assets and US Liquidity measures. This is not the picture of a booming economy, but one that is slowing.

US Net Liquidity YoY: The negative year-over-year change in US net liquidity by 0.70%, and a more stark MoM decrease of 4.21%, suggests tightening financial conditions in the US, which could lead to increased demand for more liquid and possibly safer assets, including Bitcoin. Many analysts are convinced that bitcoin performance is 100% dictated by market liquidity like this, which suggests a major sell off in bitcoin is imminent. I’m not convinced and so far, bitcoin has held up very nicely.

Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE): Included for the first time this week, these are important metrics to follow and gives us the ability to chart more metrics in future posts. April CPI is released next week and is estimated at another 0.4%, or 4.8% annualized. PCE is released later in the month.

Bitcoin is a unique asset that is a win-win against deflation in recession or inflation in a reacceleration scenario.

U.S. ISM PMI Manufacturing: The ISM PMI Manufacturing index came in this month for April at 49.2 indicating a contraction in manufacturing activity. Last month was the first expansionary reading at 50.3 since November 2022. That means the US has experienced contraction in manufacturing in 17 of the last 18 months. This development supports the recessionary not inflationary outcome to this period.

Investor Insights

Risk Management and Safe Haven Appeal: Given the tightening of global liquidity and the potential economic slowdown indicated by ISM PMI data, investors might consider increasing their exposure to Bitcoin as a non-correlated asset that could offer protection against a deflationary or inflation and economic outcome.

Overarching Recessionary Numbers: While elevated price measures of inflation imply economic expansion, all other metrics are pointing toward a looming recessionary slowdown. When the recession will begin is the trillion dollar question, but be aware of seasonal crunch points. The next major seasonal crunch point is the end of Q3. Watching these metrics proceed through the summer should give us a clue on if a recession will start before the end of the year.

US Election Season: We are almost guaranteed to see increased deficit spending and releases from the Strategic Petroleum Reserve later this summer and into the November election. Those two things have offsetting effects on CPI and PCE, but should temporarily increase money supply measures and could potentially push recession into 2025.

As we assess the complex interplay between Bitcoin's technical signals and broader economic indicators, it becomes clear that strategic opportunities are emerging for astute investors. Navigating this landscape requires a nuanced understanding of market dynamics, positioning Bitcoin as a pivotal asset in the face of global economic shifts.

Bitcoin Magazine Pro™ Market Dashboard

The following is a screenshot of the Bitcoin Magazine Pro™ Market Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Market Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!

This weekly update is of high value in the amount of time saved perusing data. Thankyou. Hope to see these during my time here.