Why Michael Saylor’s Strategy Missed the S&P 500

Michael Saylor’s Strategy misses S&P 500 spot despite strong metrics

What’s Happening

Price Action

Over the past week, BTC has been slowly climbing within a range. It is up just +1.45%.

Figure 1: Past week’s price action for BTC.

To many, this may simply look like ranging price action, but at Bitcoin Magazine Pro, we think the price action of the past week is actually bullish.

Why? BTC has managed to reclaim the 128-day moving average after briefly dropping below it last week. We have discussed in recent weeks how this moving average could be a key support level. So far, that is playing out.

Figure 2: BTC reclaiming the 128-day moving average.

As long as BTC stays above that moving average, then we expect BTC to start trending up towards the previous highs of +$120k in the coming weeks.

Note: If you’re wondering why that moving average is so important, in previous bull markets, it has typically acted as a key support level for BTC.

Additional Support Area

We also note that BTC has now come back, and is currently resting just above the Short Term Holder Realized Price - another chart we have been monitoring in these newsletters over the past few weeks.

The STH Realized Price represents the average cost basis of newer market participants (coins held <155 days). In bull markets, price dipping into this level often highlights a buy-the-dip opportunity, as short-term holders may be capitulating as BTC price drops below their average buy-in price.

Figure 3: STH Realized Price.

BTC has dipped to this level again and seems to be holding just above it. Could this be a value buy area before price trends back up, as we’ve seen many times before in this cycle?

The Big Story: Why Michael Saylor’s Strategy Missed the S&P 500

Despite ticking every technical box, including a market cap well above the S&P 500’s $22.7 billion threshold, robust liquidity, and GAAP profitability, Michael Saylor’s Strategy (MSTR) was notably passed over in the latest S&P 500 rebalancing.

The S&P 500 index committee retains full discretion over additions, and many suspect Strategy’s heavy skew toward Bitcoin and earnings volatility played against it.

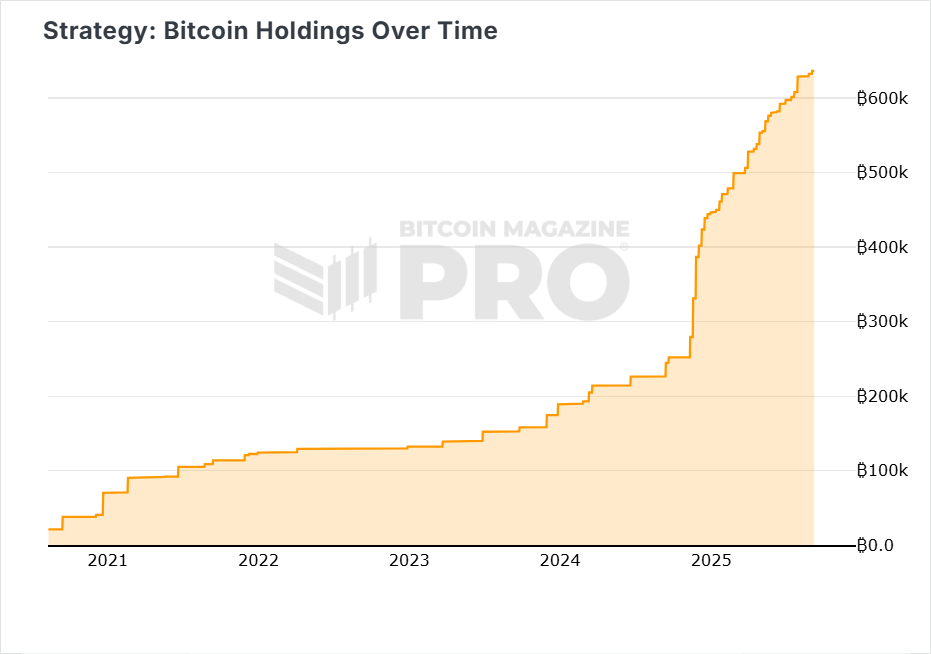

For many, the amount of bitcoin held by Strategy is seen as a huge plus, rather than a negative, with its Bitcoin holdings now well over 600k at 636,505.

Figure 3: Strategy currently holds 636,505 bitcoin.

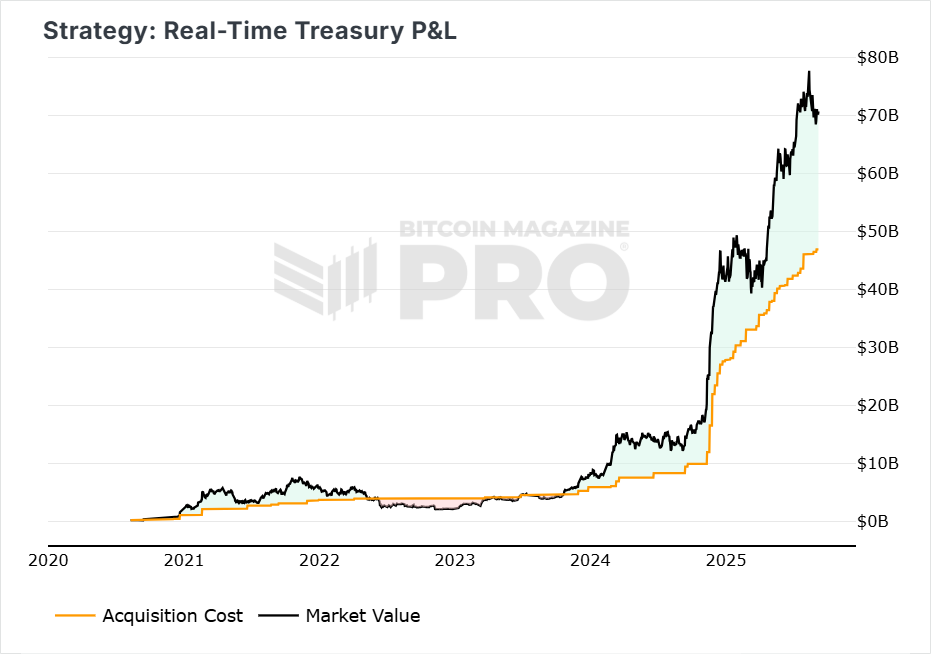

Not only that, but the profit held in that Bitcoin treasury is over $20B.

Figure 4: Strategy treasury value is +20B above their acquisition cost.

In contrast, Robinhood (HOOD) secured entry, and will officially join the S&P 500 on September 22, 2025.

Following the announcement, Strategy’s stock dropped nearly 3% in after-hours trading, wiping out the day’s gains, while Robinhood’s stock jumped roughly 7% amid expectations of increased demand from index-tracking funds.

Currently trading near US $336, Strategy remains under pressure. It has now dropped below its 50-day, 100-day, and 200-day moving averages for the first time in this bull market, which appears to be spooking investors.

Figure 5: $MSTR is currently trading below its key moving averages.

However, with the upcoming December S&P500 rebalance on the horizon, some analysts believe Strategy may still earn a spot then, which would likely draw back enthusiasm from many investors for the stock. If Bitcoin is also trending up around that time, which we believe it may well be, that would add further excitement towards the narrative of Saylor’s Strategy.

Speak again soon!

Bitcoin Magazine Pro Team.

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else.

We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Time to retest the Weekly 50MA for Bitcoin