What’s Working for Bitcoin Miners: Industry Summary

Analyzing public bitcoin miners performance and strategies, overall network mining activity and revenues, and low network traffic numbers.

As the Bitcoin ecosystem continues to evolve, recent data sheds light on significant trends and shifts within the mining sector and network activity. This week, we delve into the performance of publicly traded Bitcoin miners, uncovering the impacts of their expansion plans versus Bitcoin reserves during periods of price consolidation. We also explore the latest mining activity data, highlighting the critical adjustments miners are making in response to the post-halving environment and market volatility. Finally, we examine the dynamics of network traffic, focusing on the transition from Inscriptions to Runes and its implications for speculative interest and transaction costs. These insights provide valuable context for understanding the current state of the Bitcoin network and inform strategic decisions for investors navigating this rapidly changing landscape.

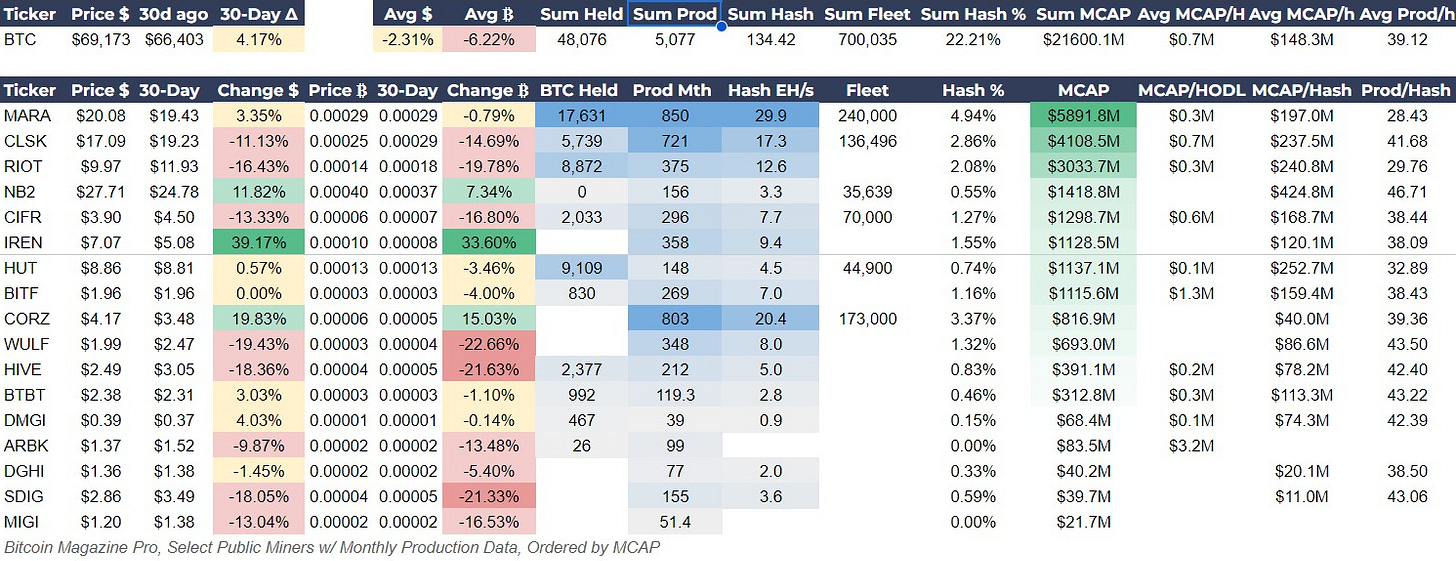

Public Bitcoin Miner Performance

The average 30-day performance for bitcoin miner stocks is -2.3%, down from +6% last week, with spot bitcoin significantly out performing. There are several surprises in the data for this week with miners with large bitcoin reserves performing quite badly. For miners with more than 1,000 BTC held, they averaged -9% returns over the last 30 days. The top three gainers were all miners that don’t hold bitcoin.

Iris Energy (IREN) has surged in recent weeks, up 39% in the last 30 days. This is likely due to their quarterly investor update, where they showed their revenue beating forecasts by 5% and earnings per share by 10%. IREN also announced it achieved its hashrate goal of 10 EH/s ahead of schedule, and its 2024 expansion plans have increased from 20 EH/s to 30 EH/s.

Cleanspark (CLSK), RIOT, Cipher (CIFR) and HIVE all have significant bitcoin holdings and all were down by double digits over the last 30 days. This also shows no correlation to their operational efficiency either.

Investor Insight

Valuing Expansion Over Reserves During Consolidation: In periods of price consolidation, investors are increasingly valuing miners' expansion plans and the execution of those plans over their bitcoin reserves. As the market dynamics shift again, it will be crucial to monitor whether the importance of bitcoin reserves increases during price breakouts, potentially reversing this trend and favoring companies with larger holdings.

Mining Activity

The latest data on mining activity highlights several critical trends that underscore the current challenges and adjustments within the Bitcoin mining ecosystem. Over the past 30 days, the hash rate and hash price have evolved, initially declining before experiencing a modest increase over the last 1-2 weeks. Below, you can see the dramatic turnaround in just the last week.

Source: Mempool.space

Despite this recent uptick, mining revenue has continued to decline, reflecting the ongoing impacts of the recent halving and market volatility. Revenue in USD for the last 30 days for the industry as a whole dropped below $1 billion. Fee revenue has also fallen sharply, with on-chain activity drying up. However, this can be seen as positive if we focus on holding behavior. Increased holding activity suggests optimism among holders, as we would expect higher velocity if people were pessimistic and attempting to dump their coins.

The transfer volume of Bitcoin to exchanges has decreased by 47.21%, which is expected given the reduced block subsidy post-halving. However, this does not necessarily indicate increased holding behavior, as the miners' wallet balance has decreased slightly over the past 30 days. Specifically, miners’ wallet balances have declined by 731 BTC during this period. While significant, this decrease does not fully account for the reduction in new Bitcoin production due to the halving, which results in 13,500 fewer Bitcoins being produced in a 30-day window.

These metrics highlight the significant deflationary pressures and adjustments within the mining sector as it navigates the post-halving landscape and broader market dynamics.

Investor Insight

Public miners secured $2 billion in financing prior to the halving: In a recent article related to how public miners are handling the reduction in revenue, it was revealed that “according to BlocksBridge Consulting’s analysis of financial earnings from 12 public miners, ten of them raised a combined $2 billion in gross proceeds from equity financing activities, anticipating a post-halving slump in profitability.” - Cointelegraph

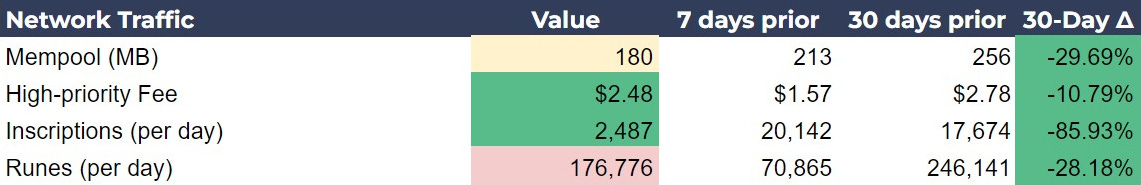

Transaction Activity

The mempool, which represents the pool of unconfirmed transactions, has decreased by 29.69% over the past 30 days, from 256 MB to 180 MB. This reduction is primarily due to the near-total abandonment of Inscriptions, a more wasteful form of token protocol. As Inscriptions have waned, the more efficient Runes protocol has started to dominate transaction volume. Yesterday alone, there were 176,776 Runes transactions, and today the number has already exceeded 250,000. This shift indicates a preference for more efficient transaction methods and reflects broader trends in network usage.

I have called token protocols a proxy for speculative interest in Bitcoin, and the recent rise in the number of Runes transactions could be a sign that Bitcoin is about to experience a surge of new speculators. This increase in activity suggests renewed interest and optimism among users, potentially foreshadowing a period of heightened market engagement and price movements.

Investor Insight

Interpreting fees: Low fees are not bullish for the reason most people believe, namely that low fees will attract more use as payments. Instead, low fees represent increased holding behavior, which in turn causes price to rise by restricting supply relative to demand.

Bitcoin Magazine Pro Mining Dashboard

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!