Weekly Newsletter: Bitcoin recovering from low $50k’s

Volatility Strikes Again: Bitcoin Rebounds After Slumping to $52,000

GM. Today’s headlines:

Bitcoin bounces to $55,000 after last week's price slump.

Fear remains in the market due to sustained sluggish prices.

Venezuelan opposition leader proposes Bitcoin as a National Reserve.

Bitcoin has bounced over the weekend after last week's lows of $52,000.

However, over the past month, the price of Bitcoin is down 9.88%.

Figure 1: Bitcoin past month price performance.

Over the past 3 months, Bitcoin's price has gone down by 18.5%. It has been a volatile period with price bouncing between current levels and $68,000.

Figure 2: Bitcoin's past 3-month performance.

News You Need to Know

Bitcoin bounces to $55,000 after last week's slump.

Fear moves through the market due to sustained sluggish prices.

Venezuelan opposition leader proposes Bitcoin as National Reserve.

Tether addresses $102M agriculture investment.

Japanese power giant TEPCO explores ‘green’ Bitcoin mining.

The Big Story

Fear Moves Through the Market

Traders remain fearful as Bitcoin’s price drops into the low $50k’s. This choppy price action contributing to the fear has continued since the ETF euphoria in March earlier this year.

Right now, the Fear & Greed Index is showing a score of 29, well into the Fear zone, reflecting the poor sentiment in the market.

Figure 3: Fear & Greed Index.

We note that fear often emerges around major price lows as traders and investors panic, seeing the dollar value of their investments drop. Historically, Bitcoin often bounces hard after such periods.

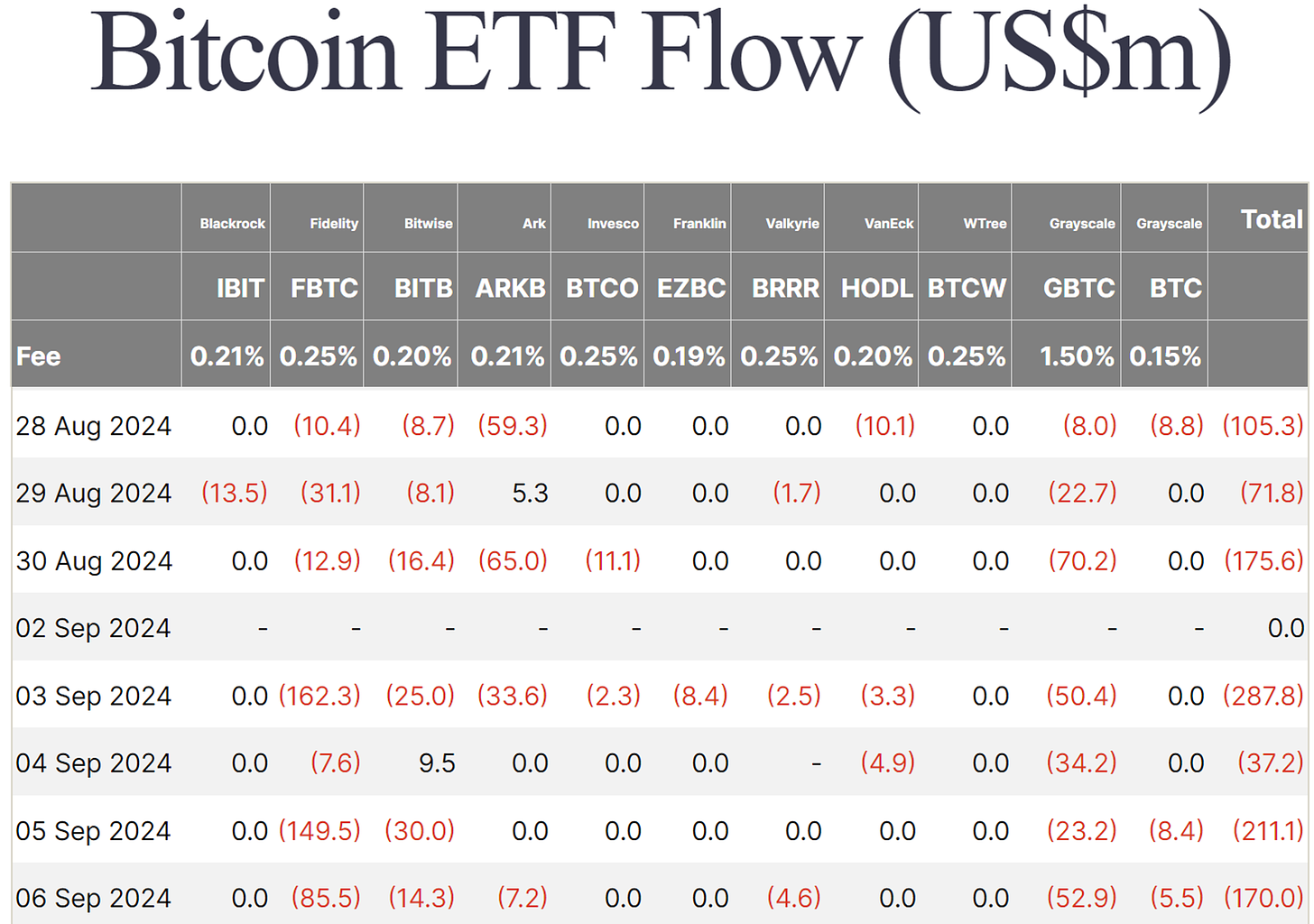

Concerns around weak global markets are being cited as reasons for the weak Bitcoin price action. There are also concerns about recent negative Bitcoin ETF flows, which have been poor over the past 10 days.

Figure 4: Bitcoin ETF Flows.

Despite the doom and gloom sentiment in the market, Bitcoin’s price remains above its 1-year moving average. The 1-year moving average is a key line in the sand for Bitcoin bull markets throughout it’s history. With the exception of the black swan event of Covid in March 2020, where price briefly dropped below the 1-year moving average, $BTC has always remained above its 1-year moving average in bull markets.

Right now, $BTC price remains above that key level…just.

Figure 4: Bitcoin’s 1-year moving average.

As long as Bitcoin can remain above that key level the bull run will likely continue. Sustained periods below it may question the bull market thesis for many.

Key Chart

Each week, our BM Pro Analysts hand-pick a must-see chart for you. This week:

Profitable Days

Figure 6: Bitcoin Profitable Days.

What it is

This chart shows the number of days where holding Bitcoin has been profitable relative to today’s price.

It highlights the aggressive growth of Bitcoin's adoption curve over time, reflected in its price. Because supply is limited, as demand grows, the price moves up.

Why this matters

This chart acts as a helpful reminder to Bitcoin investors to zoom out.

Particularly during periods when Bitcoin’s price action is sluggish and has retraced from recent highs…as we are seeing right now.

It shows how the patient investor can benefit from Bitcoin’s adoption process over time.

What's happening now

Currently, 94.1% of Bitcoin days are profitable relative to today’s price.

That is 4,831 days out of a total of 5,135.

The red lines on the chart show the days when it would not have been profitable to have bought bitcoin relative to today’s price. The green lines show when it would have been profitable.

You can track this metric here.

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live chats, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else.

We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Don’t forget to like this post, share it with your network, and leave your thoughts in the comments below.

Take the next step in your investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to the YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

🎁 Special Offer: Use Code: BMPRO For 10% OFF All Bitcoin Conference Tickets

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.