Weekly Newsletter: Bitcoin currently ranging below $60,000

Global Investments Signal Confidence: Yet Bitcoin Ranges Under $60,000

GM. Today’s headlines:

Bitcoin's price is currently ranging just below $60,000.

Coinbase states increased spot Bitcoin ETF inflows from institutions is ‘promising’.

The world's 3rd largest pension fund invests in MicroStrategy.

After briefly moving above $60,000 over the weekend, Bitcoin's price has retraced slightly to $58,457.

That is down -1.71% over the past 24 hours and flat -0.09% over the past week.

Figure 1: Bitcoin past 24-hour price performance.

However, Bitcoin price still remains up +123% over the past year.

Figure 2: Bitcoin's past 12 months' performance.

News You Need to Know

Coinbase states that increased spot Bitcoin ETF inflows from institutional investors is ‘promising’.

75% of all bitcoin has not moved on-chain for over 6 months indicating strong levels of HODL’ing.

Bitcoin Mixer founder Roman Sterlingov fights his 30-year sentence.

The world’s 3rd largest pension fund invests in MicroStrategy.

The Big Story

Firms continue to invest in MicroStrategy to gain Bitcoin exposure

The world’s third-largest pension fund has just invested in MicroStrategy.

South Korea’s National Pension Service (NPS) has invested nearly $34 million into shares of the Bitcoin-focused tech company.

A filing to the SEC shows NPS’s investment in MicroStrategy. The South Korean pension fund purchased 24,500 shares at an average price of approximately $1,377 per share.

Figure 3: NPS purchase of MicroStrategy shares.

The NPS is the country’s largest institutional investor, holding over $777B in assets. It joins the Swiss National Bank and Norway’s central bank as investors in MicroStrategy.

MicroStrategy is the biggest publicly listed company holder of Bitcoin, now holding more than 1% of Bitcoin’s total supply.

Figure 4: MicroStrategy has the largest holding of bitcoin in its treasury.

MicroStrategy holds significantly more Bitcoin than the next publicly listed company on the top holdings list, Marathon Digital Holdings. While MicroStrategy holds 226,331 bitcoin, Marathon in comparison holds 17,320.

Key Chart

Each week, our BM Pro Analysts hand-pick a must-see chart for you. This week:

Coin-Margined Funding Rates

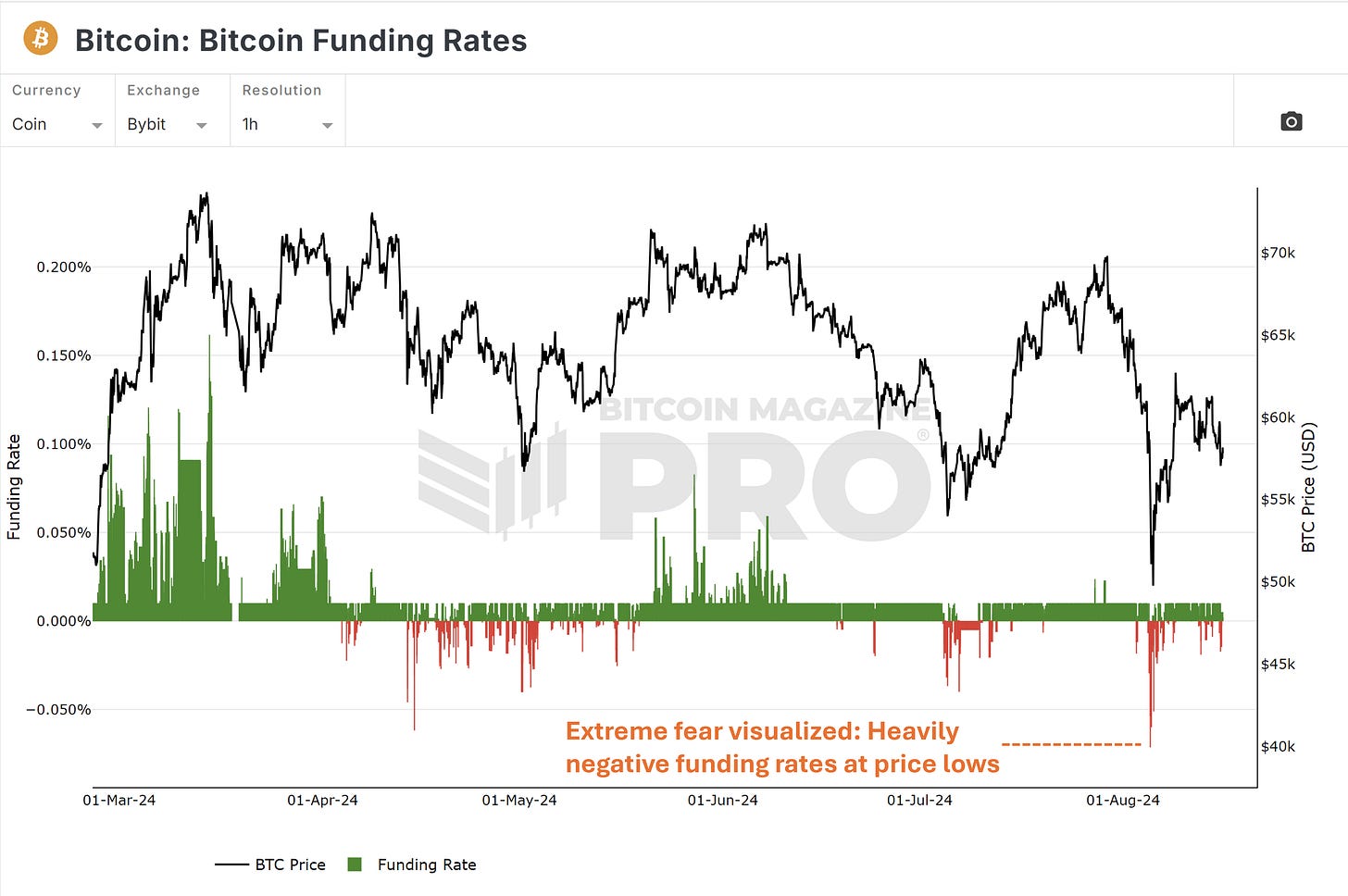

Figure 5: Bitcoin margined funding rates on Bybit.

What It Is: Funding rates are periodic payments made between traders in a specific type of futures contract called perpetual futures. These contracts don’t have an expiration date. They are the most popular trading contract for Bitcoin amongst retail traders. Traders can use their Bitcoin as collateral for these trades. This is known as ‘Coin-margined’ trading.

How Funding Rates Work:

Positive funding: If the perpetual contract price is higher than Bitcoin's market price, it indicates high demand for BUYING the perps contract. This indicates that many traders are bullish at that time. There will be positive funding rates (green bars on the chart). When this happens, buyers pay sellers a fee every 8 hours.

Negative funding: If the perpetual contract price is lower than Bitcoin's market price, it indicates high demand for SELLING the perps contract. This indicates that many traders are bearish at that time. There will be negative funding rates (red bars on the chart). When this happens, sellers pay buyers a fee every 8 hours.

Why This Matters:

It is a very useful metric to identify when traders are panicking and when there are moments of extreme fear in the market.

In a Bitcoin bull market, these brief periods of panic can often signal short-term lows in Bitcoin’s price before it reverses back upwards, as shown in the chart above.

Traders can often use coin-margined contracts to hedge their bitcoin position if they believe the price will drop further or simply use it as additional collateral if they are in a long position that is at risk of being liquidated.

What’s Happening Now:

During the sharp downturn at the start of the month to sub-$50,000 levels, Coin-margined funding rates went extremely negative across more retail-focused exchanges like Bybit.

On the chart above this is the big spike in red bars on the chart.

This indicated that many leverage-long positions were being (forced) closed, and many traders began to hedge positions or open short trades, anticipating that Bitcoin’s price would drop further.

In a Bitcoin bull market, extreme periods of negative funding rates typically mark the deepest point of a drop in $BTC before it rallies to the upside.

This is, therefore, a valuable chart to understand and track in Bitcoin bull markets for anyone looking to buy the dip (BTFD).

You can track the funding rate chart here.

The Bitcoin Magazine Pro Team.

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live chats, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else.

We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Don’t forget to like this post, share it with your network, and leave your thoughts in the comments below.

Take the next step in your investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to the YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

Thanks for reading Bitcoin Magazine Pro! Subscribe for free to receive new posts and support our work.

🎁 Special Offer: Use Code: BMPRO For 10% OFF All Bitcoin Conference Tickets

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.