Weekly Alpha: $100,000 Incoming?

Your essential weekly guide to Bitcoin markets, macro trends, and treasury updates. Exclusive insights and predictions await.

Today’s headlines:

Bitcoin close to breaking through $100k for the first time in 2025.

Eric Trump meets Michael Saylor at Mar-a-lago.

MARA Holdings says 16% of its BTC reserves has been loaned to 3rd parties for ‘modest’ yield.

Metaplanet targets 10,000 BTC holdings by 2025.

MARKET ANALYSIS: Bitcoin Magazine Pro 2025 Bitcoin Outlook: Insights backed by metrics data.

Bitcoin has been ranging between $90,000 and $99,000 over the Holiday season. Today marks almost a week of consecutive daily green candles.

Figure 1: $BTC attempting to break $100k again.

While $100,000 may be achieved, we do note that there is technical resistance just above that level, around $101,000 - $103,000, which may prove difficult to break through initially. That level was created by the start of the fakeout move up to $108,000, which was then heavily rejected in mid-December.

Over the past week $BTC has been steadily trending up, with a gain of +6.6%.

Figure 2: Bitcoin trending up over the past week.

The Big Story

Metaplanet seeks to accumulate 10,000 BTC

Metaplanet is one of several companies looking to increase their bitcoin treasury holdings. To do this they will continue to follow a similar playbook to the one being executed by MicroStrategy. Using share offerings and loans to generate more capital for buying bitcoin.

Currently Metaplanet holds 1,762 BTC valued at over $172M. They have plans to acquire over 8,000 more bitcoin in 2025.

If they are able to execute this, they will become one of the top corporate treasury holders of BTC. However, many other companies are also increasing their bitcoin treasury holdings as we move into 2025.

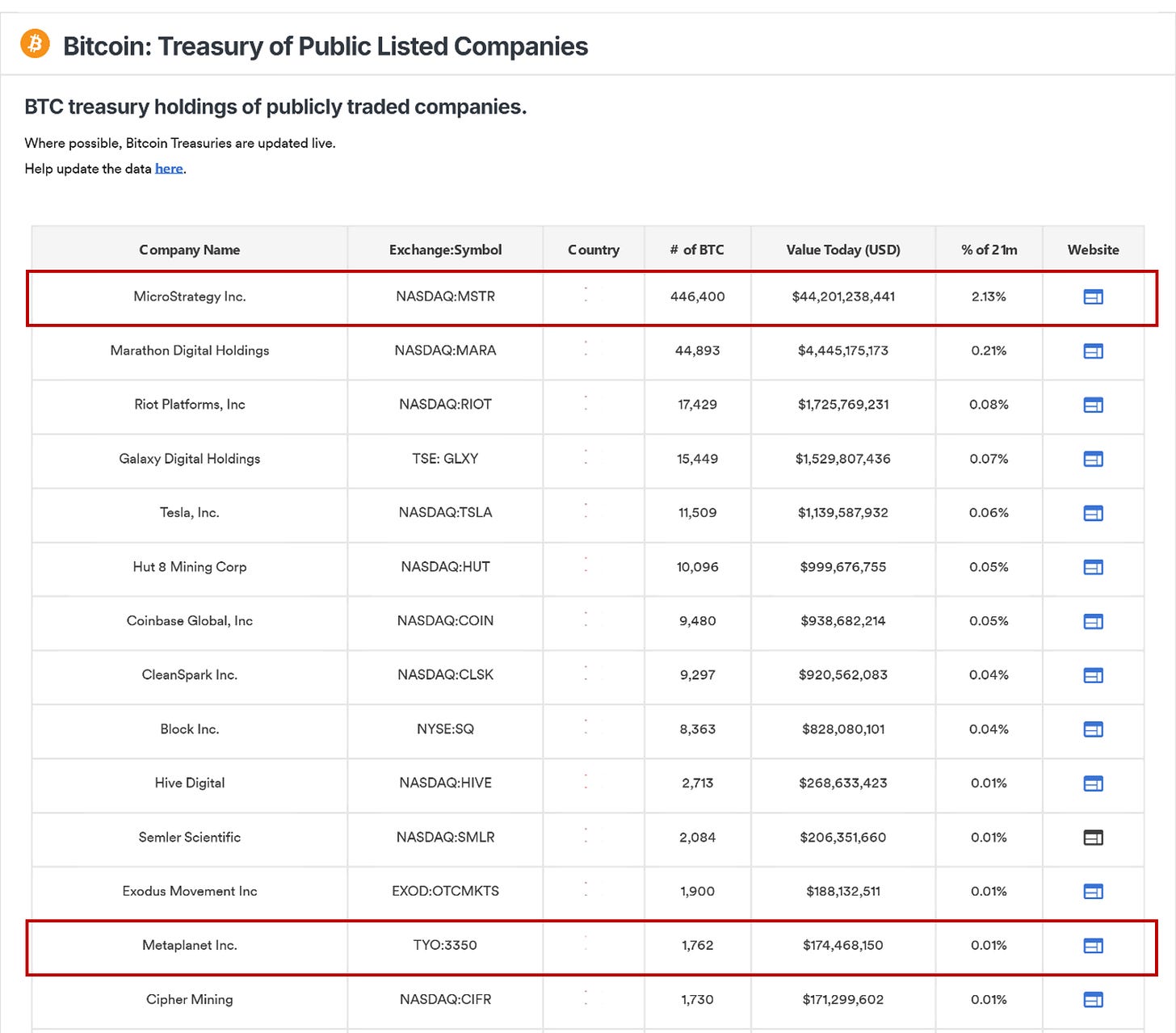

The table below shows the current top holders of bitcoin among publicly listed companies.

Figure 3: Bitcoin Treasury Holdings.

With over 2% of the total bitcoin supply, MicroStrategy remains the clear leader, holding 446,400 BTC.

Behind it is MARA Holdings who have been consistently adding to their holdings throughout 2024 at a rapid rate. They currently hold 44,893 BTC.

While Metaplanet is steadily accumulating, and have plans to accumulate significantly more in 2025, they remain some distance behind these major players with 1,762 BTC.

We expect to see many other companies accumulate bitcoin and announce their holdings in 2025.

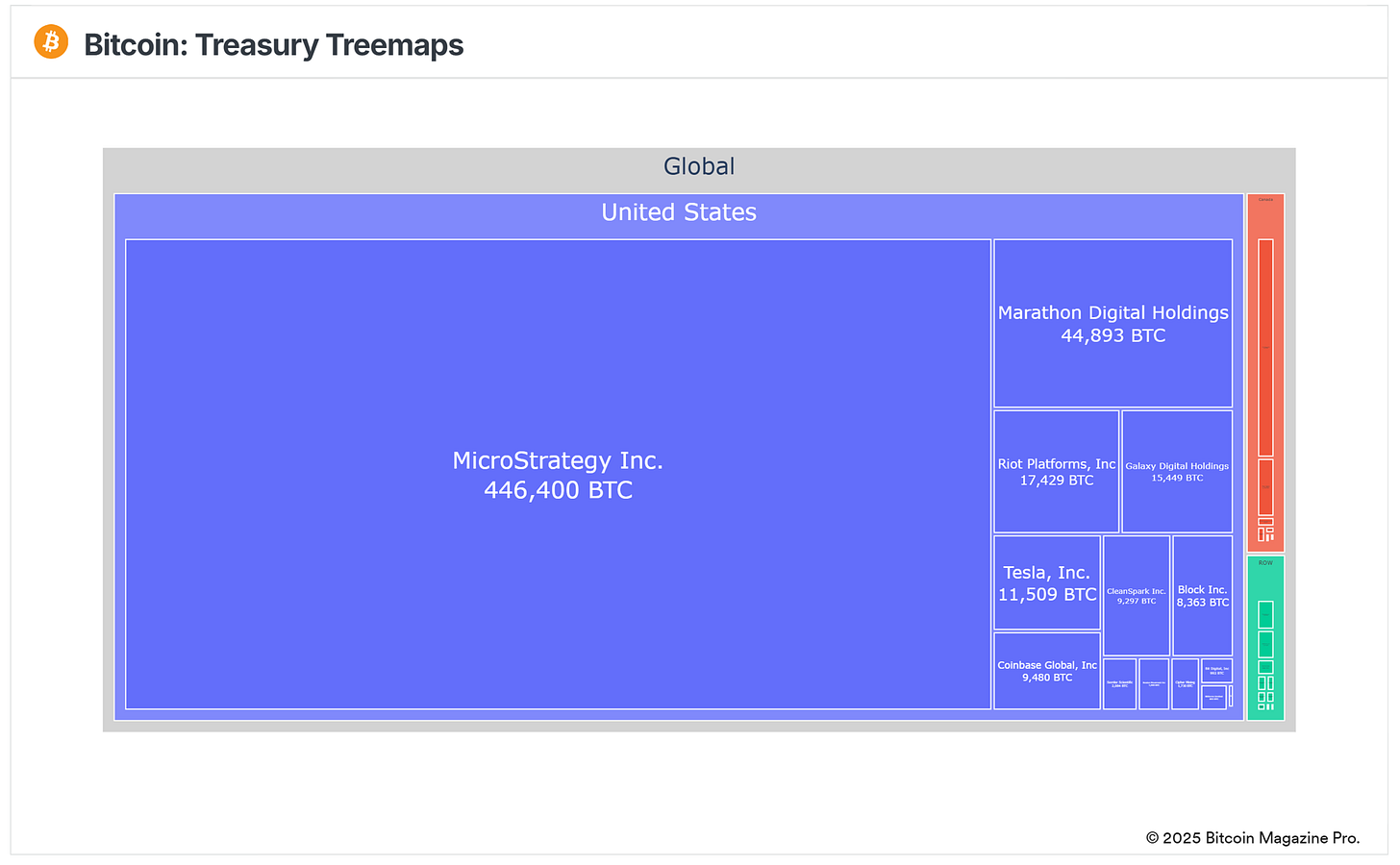

The Bitcoin Magazine Pro Treasury Treemaps are an effective way to visualize the scale of MicroStrategy holdings relative to other firms. The Treemap shows how MicroStrategy are totally dominating the landscape.

Figure 4: Bitcoin Treasury Treemap highlighting MicroStrategy dominance.

What is also clear for now is the dominance of companies listed in the U.S. Companies listed outside of the United States make up a fairly small proportion of the total bitcoin holdings. We do not expect this to fundamentally change in 2025.

Key Chart

NEW CHART - Pi Cycle Top Prediction

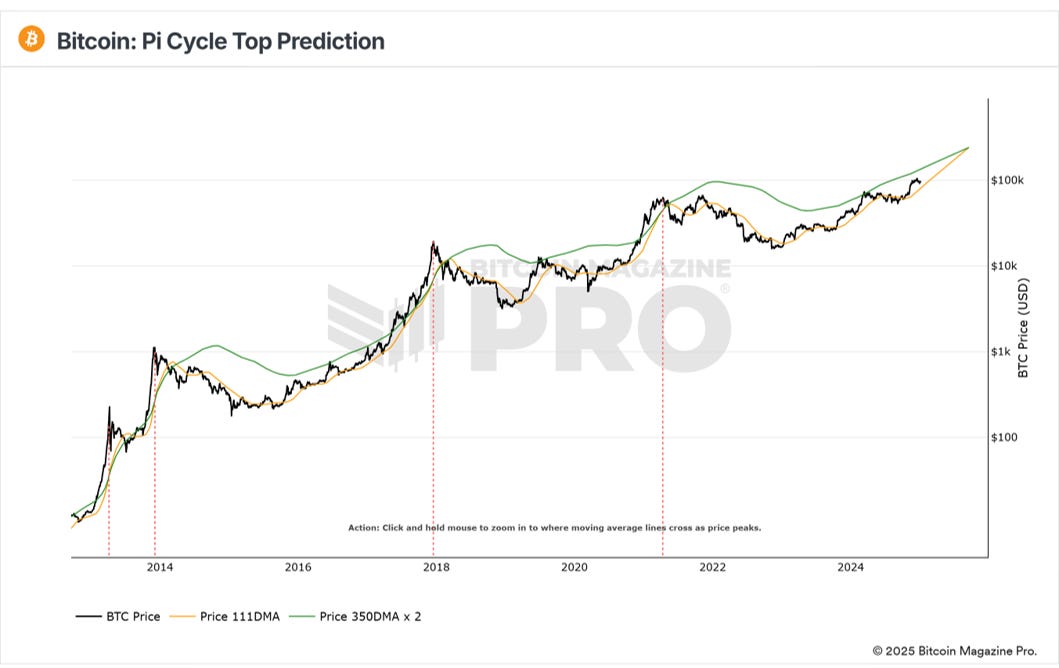

Figure 5: Pi Cycle Top Prediction chart

This week, we are sharing a new chart we have now released on the Bitcoin Magazine Pro platform - The Pi Cycle Top Prediction chart.

This chart builds on the concept of the popular Pi Cycle Top indicator, which has successfully identified Bitcoin’s cycle tops to within 3 days both before and after the indicator was created.

This new chart calculates the rate of change of the two key moving averages over the past 14 days and projects that same rate into the future. The result is an estimate of when these two moving averages will cross.

Historically, when the moving averages cross, the price of Bitcoin has often been near a cycle top, signaling a potential market reversal.

Bitcoin Price Prediction Using This Tool

The Pi Cycle Top Prediction tool helps estimate when Bitcoin’s bull market may be nearing its end. When the 111-day moving average (111DMA) approaches the 350-day moving average multiplied by two (350DMA x2), it suggests that Bitcoin’s price might be rising unsustainably.

Historically, after this crossover, Bitcoin’s price has corrected, often leading into a bear market. Therefore, this indicator can serve as a valuable risk management tool, alerting Bitcoin investors when market conditions may be overheating.

The current chart estimate is predicting that the lines will cross on the 17 September 2025. Users can see this date when hovering over the lines on the chart.

You can view the chart for free here.

The Bitcoin Magazine Pro Team.

Bitcoin Magazine Pro

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Make Smarter Decisions About Bitcoin. Join millions of investors who get clarity about Bitcoin using data analytics you can't get anywhere else.

We don't just provide data for data's sake, we provide the metrics and tools that really matter. So you get to supercharge your insights, not your workload.

Take the next step in your Bitcoin investing journey:

Follow us on X for the latest chart updates and analysis.

Subscribe to our YouTube channel for regular video updates and expert insights.

Follow our LinkedIn page for comprehensive Bitcoin data, analysis, and insights.

Explore Bitcoin Magazine Pro to access powerful tools and analytics that can help you stay ahead of the curve.

Invest wisely, stay informed, and let data drive your decisions. Thank you for reading, and here’s to your future success in the Bitcoin market!

🎁 Special Offer: Use Code: BMPRO For 10% OFF All Bitcoin Conference Tickets

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

$102,000!