Venezuela Cracks Down on Bitcoin Mining, Cites Power Grid Security

Months after the Petro's collapse, Venezuela has apparently banned all crypto mining. Massive raids are occurring as the government plans to remove every miner from the power grid.

The Bolivarian Republic of Venezuela, once the first country to officially launch a state-backed cryptoasset, has seen its Bitcoin acceptance levels hit a new low with an apparent mining ban.

Venezuela has had a somewhat rocky relationship with the entire concept of cryptocurrency. In late 2017, President Nicolas Maduro announced the development of the Petro, a state-run digital asset whose valuation would be tied to the country’s oil production. Ostensibly, the Petro was launched for reasons very similar to El Salvador’s arguments for making Bitcoin legal tender: in an economic system rigged by the most powerful countries, why not turn to a new decentralized horizon to gain some economic independence? The Petro was launched in 2018, making it a true trendsetter in the world of state-backed digital currencies, a world that is now occupied by some of the largest economies in the world. However, although it was a radically new idea at the time, Petro was no match for Bitcoin.

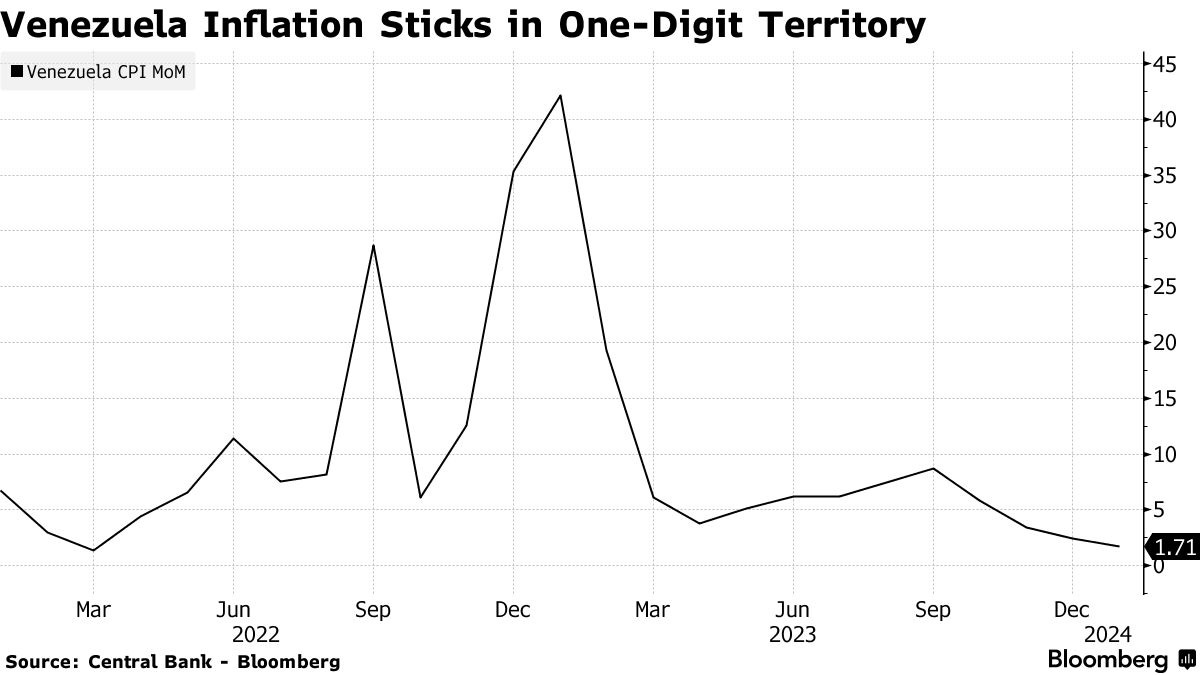

This oil-backed cryptocurrency had a consistently rocky timeline after a promising launch. Rocked by major corruption scandals and failed support plans, the government formally liquidated Petro in January 2024. In the years of Petro’s existence, it was not formally able to stand up to the waves of sanctions and lopsided trade deals that have plagued the Venezuelan economy. By 2024, the economy will have actually seen the lowest inflation rates in several years, but that feat must be kept in its proper context: the current rate is shy of 200%, but it was the world record-holder of hyperinflation with several thousand percent just two years prior. Clearly, this recovery has a long way to go.

Since the Petro’s downfall, it doesn’t appear that the Venezuelan government has any remaining desire to try and adopt Bitcoin in any fashion. In fact, the government has even started its fair share of crackdowns on Bitcoin mining while the Petro was still alive. Bitcoin is a world-class store of value and hedge against inflation, but Venezuelans have had to endure this hyperinflation period without Bitcoin’s help. These early crackdowns, however, are small in scale compared to the apparent total ban initiated by the Ministry of Electrical Energy. It announced in late May that a seizure of 2,000 mining rigs from the state of Aragua was only the beginning, and that the Ministry would be taking steps to starve the entire electricity industry.

The stated reason for the Ministry’s sweeping decision has been the instability of its power grid, calling miners an active hindrance to the country’s infrastructure. In the Ministry’s announcement, it claimed that its “purpose is to disconnect all cryptocurrency mining farms in the country from the SEN (National Electric System), avoiding the high impact on demand, which allows us to continue offering an efficient and reliable service to all the Venezuelan people." The announcement included a request from a local state governor asking concerned citizens to either report suspected Bitcoin mines or otherwise convince their proprietors to cease operations.

How did Venezuela get to this point as an early crypto pioneer? Local pro-Bitcoin NGOs have proclaimed a de facto complete ban, mere months after Venezuela’s radical project was finally killed. A key answer to this question involves their decision to try and launch a state-controlled asset rather than trusting in the decentralized economic vision of Bitcoin. As mentioned, El Salvador had an extremely similar motivation to adopt Bitcoin as Venezuela did for Petro, but the state of mining in El Salvador has proven wildly more profitable. Of course, it must not be discounted that El Salvador merely wished to have more leverage over domineering trade partners, while Venezuela has been more actively combative with these same countries. Nevertheless, there are a variety of different models for a harmonious Bitcoin policy.

Take, for example, the nation of Paraguay. Its government, too, is urging legislators to pass a new bill aimed at cracking down on illegal mining operations. Paraguay cites the same concerns about electrical infrastructure as Venezuela and has even accompanied this legislative campaign with massive raids against illegal Bitcoin miners. However, at the exact same time that the government has targeted these illegal miners, it has also welcomed foreign investment in legal operations. Bitfarms announced a major expansion of hydroelectric energy generation along the Iguazu River, giving the firm’s mining efforts a reliable source of cheap, green power while also improving overall power generation. It is true that totally renegade miners can cause damage to both national power grids and the environment, as off-the-books operations are far more likely to use fossil fuels. However, a deliberate plan can lead to everyone winning.

Paraguay’s actions here can actually serve as a sort of mirror to similar actions taken in Venezuela, which had far less successful results. After China’s prominent Bitcoin mining ban in 2021, Venezuelans jumped at the chance to purchase sophisticated mining equipment for pennies on the dollar. These sales were conducted more by private businesses and individuals, however, without an apparent connection to the government’s “Petro maximalism” of the day. By 2024, however, it seems that all those investments will have turned into a total loss. A total ban has punished these miners, fully throwing away whatever advantage they might have gained.

This is especially ironic because China has actually become a major investor in overseas hydroelectric Bitcoin mining, substantially funding a massive dam in Ethiopia. China is an extremely important trading partner for sanctioned Venezuela, with China dominating both imports and exports to the country. Surely, China could invest in its partner the same way it did in Ethiopia? Paraguay can accept hydroelectric Bitcoin investments while cracking down on illegal miners, after all. Unfortunately for Venezuelans, the government seems totally uninterested in pursuing a Bitcoin-friendly plan like this, and this revenue stream may be permanently affected.

There are several lessons in these proceedings, especially when considering Venezuela’s economic woes next to several success stories from other countries. At one point, it must have seemed like Venezuela had every opportunity: a government willing to try out cryptocurrency, a people eager to escape an oppressive financial establishment, and a trading partner willing to conduct long-term infrastructure investment. Yet, Venezuela tried to focus on a new asset it could control rather than taking a chance on the radically trustless horizon of Bitcoin. From very early on, it was clear that none of its trading partners had an interest in a choice like that. The Petro floundered for several years, and its collapse has apparently turned the government into an anti-Bitcoin hardliner. Things could have been so much different.

As we look back on the whole event, it seems that we can clearly point to several key differences that separate success from failure. Venezuela changed its tune several times: it tried to entice citizens to use the Petro, and shut them down afterwards. It tried to force state officials to adopt the Petro, and ended up arresting them over Petro-related scandals. Above all else, it tried to improve on Bitcoin, both loved and hated around the world, with an alternate cryptoasset that interested nobody. Venezuela is on the long, slow road to economic recovery after its periods of hyperinflation, and its citizens are cut off from the best asset for inflation protection. To see meteoric returns like the world’s foremost digital asset, there really is no substitute.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!