U.S. Recession Territory And FTX Accumulation

Atlanta Fed forecasts negative GDP growth for Q2. FTX buys BlockFi but passes on Celsius.

Atlanta Fed Forecasts Negative Q2 Growth

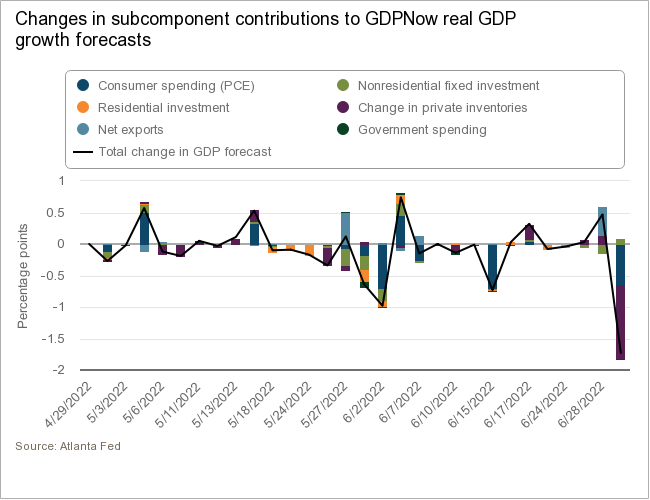

If you needed any more confirmation that the United States economy is likely in a recession, then today we have the latest Atlanta Federal Reserve GDPNow official forecast showing another contraction in the second quarter of -1.0% down from 0.3%. The GDPNow forecast updates as new data comes in and the latest decline is due to a deterioration in private inventories and consumer spending data.

To be fair, the technical recession definition from National Bureau of Economic Research (NBER) is nuanced and is not just two quarters of real GDP contraction. A valuable breakdown on this topic from EFB Macro Research is here. Although real growth is turning negative, employment growth is not yet at recessionary levels but is likely to follow.

Although many blue chip consensus forecasts have shown a pickup in GDP throughout the second quarter, the Atlanta Fed’s projections have declined from 1.9% to -1% over the last two months. The rapid deterioration in growth expectations to come in 2022 has been a key point we’ve highlighted in previous macroeconomic updates. All of the “the economy is strong” calls are now disappearing quickly.

With the pending recession data surfacing, the Eurodollar futures market has also moved to pricing in a Federal Reserve rate cut of 58 bps throughout 2023, showing another sign that quantitative tightening measures can’t and won’t be sustained even through 2022.

This would mean that the Federal Reserve will have to stop tightening measures although the median FOMC member projection for inflation has actually risen to 5.2% for 2022 and is expected to be above the 2% target through 2024. Even if we were to see a deflationary bust with inflation rolling over in the next 6 months, we’re not going back to 2% inflation anytime soon.

We expect that for the broader legacy and bitcoin markets, the worst is yet to come. Second quarter earnings reports will start to surface mid-July, where we will see a much clearer picture on how fast the business cycle is turning over along with new earnings expectations for the second half of 2022. Businesses are facing rising input and labor costs across the board while consumer sentiment hits all-time lows and spending slows down in the face of persistent inflation. Earnings and profits look to be the next to fall.

What does that mean for bitcoin? As we’ve highlighted previously, bitcoin is not immune to the liquidity tides turning and economic cycles turning over, especially at this magnitude. It’s uncharted territory during a period where risk assets look to be untouchable. Even in the scenario that the latest forced selling, unsecured debt wash and broader crypto contagion has played out, we would want to see the recent bottom retested at least. The long July 4th holiday weekend with legacy markets closed and low liquidity may be one of those tests.

FTX Buys The Dip

In a massive announcement today, it was reported that FTX is closing a deal this week to buy BlockFi for a major discount below their previous estimated $5 billion valuation at peak. Although news initially mentioned the deal was for only $25 million, it’s likely more around $275 million including the previous FTX revolving line of credit of $250 million. This comes right after CEO Zac Prince announced BlockFi faced 10% of asset withdrawals in a “massive stress test” just last week.

Either way, FTX is in accumulation mode with the market near rock bottom and BlockFi down roughly 95%. They even looked at acquiring Celsius but the state of its finances with a $2 billion hole in the balance sheet was too much. Although it’s a fire sale in the market right now, some institutions are well past saving. Celsius will likely continue down the most probable path: bankruptcy, years of legal proceedings with customers and a possible buyer getting distressed assets for cheap.

Knowing FTX is both working to expand their retail customer base and their FTX Earn product, acquisitions at these discounts make strategic sense. The move likely wipes out all BlockFi equity holders but saves customers’ deposits. It’s also in FTX’s interest to keep the contagion contained for the sake of the entire industry’s reputation. Either way, they look to be the industry’s lender of last resort and the show continues on.

For now it’s not clear what’s going to happen with the Celsius assets or even if the market has priced in potential future liquidations. A rough 40% of assets under management that may be bitcoin calculation, assuming a similar mix to Coinbase, would put Celisus around 50,000 BTC with the rest of the assets in alternative cryptocurrencies (alts). Celsius’ known wrapped bitcoin on Ethereum is estimated to be 23,962 with a $13,600 liquidation price.

Alts and DeFi bets have been falling in BTC terms throughout the year, despite recent rallies, and it doesn’t look like the total damage is over yet.