Treasury Sanctions Open Source Software

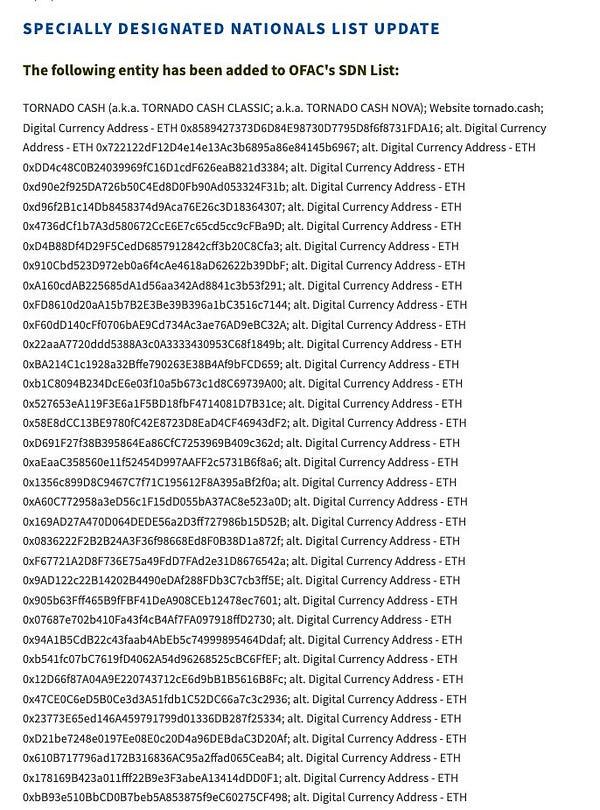

Early this morning, it was announced by the U.S. Treasury that Tornado Cash was added to the U.S. OFAC (Office of Foreign Assets Control) SDN list.

Early this morning, it was announced by the U.S. Treasury that Tornado Cash was added to the U.S. OFAC (Office of Foreign Assets Control) SDN list (the list of specially designated nationals with whom Americans and American businesses are not allowed to transact). Tornado Cash, a non-custodial open source software project built on Ethereum, allowed users to mix their coins through the use of the Tornado Cash smart contract, obfuscating the previous trail of the coins (which are of course being transacted across a transparent ledger).

The sanctions placed were particularly notable because they were placed not on an individual person or particular digital wallet address, but rather the use of a smart contract protocol, which in the most basic form is just information. The precedent set by these actions are not ideal for open source software development.

To quote CoinCenter,

“How is adding Tornado.cash to the SDN list different from past OFAC actions? A smart contract is a robot, not a person. It is software that resides on the Ethereum blockchain. If a contract is credibly decentralized then the original authors of that contract could be hit by a bus and the service would continue to work. As such, today’s action does not seem so much a sanction against a person or entity with agency. It appears, instead, to be the sanctioning of a tool that is neutral in character and that can be put to good or bad uses like any other technology. It is not any specific bad actor who is being sanctioned, but instead it is all Americans who may wish to use this automated tool in order to protect their own privacy while transacting online who are having their liberty curtailed without the benefit of any due process.”

Tornado Cash has seen a large amount of volume across the history of its protocol, with over $7.6 billion of all-time deposits and over $40 million of withdrawals and deposits occurring over the last week.

All-time Tornado Cash statistics - Source: Dune Analytics

Following the announcement, it could be seen that Circle, the centralized issuer of stablecoin USDC, blacklisted every sanctioned address from using USDC.

USDC, unlike a blockchain-native asset like bitcoin or ether, is the liability of a centralized issuer, Circle. A user’s ownership of USDC, although supposedly operating across decentralized rails, is entirely centralized and at the discretion of Circle.

At the time of writing, there is currently $54.27 billion of USDC in circulation, with $21.11 billion of that currently being held in various smart contracts.

Today’s actions have led many to question the safety of holding centralized digital assets, even for non-criminals who just prefer to use privacy-enhancing tools.

The total number of USDC addresses that are blacklisted now stands at a current total of 81. Readers can track the banned address list here.

Source: Dune Analytics

On a similarly scary note for active bitcoin/crypto developers, the co-creator of Tornado Cash Roman Semenov had his GitHub (open source development repository) account suspended. This should worry freedom-loving bitcoin/crypto enthusiasts, given the nature of the sanctions placed on Tornado Cash — which, as stated earlier in the piece, is simply non-custodial software.

Today’s actions also beg the question as to what is the future of many tools in the so-called DeFi space, that depend on centralized stablecoins and that may have centralized development choke points.

As brutal as it may be, the organic and decentralized nature of bitcoin’s rise is the only reason it is still standing today. Open source software will continue to operate as designed, but given the increasing pressure that will likely be placed on software/wallet/protocol developers, only the strongest and most truly decentralized networks will not be co-opted.

Lastly, it should be reiterated that stablecoins themselves, while useful to escape the short-term volatility of bitcoin/other crypto assets and help many around the world access U.S. dollars, are centralized. Not only that, but they also implicitly centralize networks that become overly reliant on them.

This can be seen for instance, on protocols such as Ethereum or Solana, with assets like USDC or wBTC.

Zooming out further, when looking at the long-term case for bitcoin, among its strongest value propositions is the fact that it’s an asset that has no counterparty risk nor dilution (devaluation) risk. Yet, more importantly in light of many government regulations that are taking shape and are likely to come, Bitcoin’s true decentralized properties and censorship resistance will be just as important.

Bitcoin will still need to prove itself as a need for many around the world. To competitively increase its adoption, it will face off against centralized regulated stablecoins alongside Central Bank Digital Currencies, which may be the next major catalyst to showcase Bitcoin’s true value and opportunity.

Bitcoin doesn't have borders, neither do we. Take 10% off your tickets for Bitcoin Amsterdam with code “BMPRO”: http://b.tc/conference/amsterdam