Bitcoin Mining Weekly Analysis - Feb 16 2024

In the ever-evolving realm of Bitcoin, mining remains a bellwether (leading indicator of trends) worth watching. Let’s unpack this week's mining data and unearth the insights that matter to investors.

💼 Executive Summary:

In the realm of Bitcoin mining, this week marks a period of stabilization and recovery from previous bearish trends. The mining difficulty has seen a marked increase, suggesting a rise in the hash rate as more miners ramp up operations. There's a glimmer of positive momentum with a slight week-over-week uptick in 30-day revenue, hinting at stabilization within the month-long review period. However, the sector faces a significant drop in fees, with a $21.5 million decrease from the previous week and a stark 65% fall over the past month. Network efficiency appears to be improving, evidenced by the shrinking mempool, now at 212 MB compared to 551 MB a month ago, and high-priority transaction fees remaining below $2. The daily number of inscriptions is finding a new equilibrium, with figures consistently between 30,000 and 40,000.

Turning to public mining companies, Cleanspark (CLSK) has emerged as a strong player, surpassing RIOT in market capitalization to become the second-largest public miner. The broader landscape for public miners is looking up, with most reporting positive returns over the last 30 days. Mawson (MIGI) stands as an exception, with a quarterly decline in Bitcoin production, dropping from an average of 68 BTC per month in Q3 to 48 BTC per month in Q4. Despite this downturn in production, Mawson's monthly revenue has increased, bolstered by strategic co-location services and hosting for other miners.

📈 Chart of the Week:

🎯 The Bitcoin Miner ETF (WGMI) has bounced on the 50 DMA and is trying to break above the golden pocket retracement fib formed after its launch in February 2022.

Mining Metrics: 📊

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

Key Takeaways from the ⛏️ Mining Dashboard:

1. Hash Rate and Difficulty on the Rise:

Hash Rate 7DMA EH/s: ↑ 11.36%

Difficulty: ↑ 11.65%

🕵️ Why It Matters: A stronger, more competitive network is emerging, albeit at the cost of higher operational expenses for miners.

⚠️ Potential Market Impact: A more secure Bitcoin network is a boon for investor confidence, but increased difficulty might tighten miners' profit margins.

2. Bitcoin's Price Stability vs. Revenue Declines:

Bitcoin Price Close: $51,933

Revenue BTC 30-Day: ↓ 6.90%

Revenue USD 30-Day: ↓ 6.42%

🕵️ Why It Matters: Miners may be holding their coins, hinting at a bullish outlook for Bitcoin's price.

⚠️ Potential Market Impact: If miners withhold supply, this could play a role in driving Bitcoin prices up, provided demand stays constant.

3. Dip in Transaction Revenue:

Revenue Fees BTC 30-Day: ↓ 64.65%

Revenue Fees USD 30-Day: ↓ 64.69%

🕵️ Why It Matters: This points to a possible decrease in network transaction volume.

⚠️ Potential Market Impact: Miners under financial stress could lead to industry consolidation.

4. Mining Economics - Earnings and Costs:

Puell Multiple: ↑ 49.35%

BTC Production Cost Total (Capriole): ↓ 3.41%

🕵️ Why It Matters: Miners are seeing increased earnings, which may influence their decisions to sell.

⚠️ Potential Market Impact: An increase in Bitcoin selling by miners could pressure the price.

5. Steady Mining Rig Prices:

ASIC Price USD Under 38 J/TH: ↑ 0.50%

🕵️ Why It Matters: A stable market for mining rigs allows for predictable planning.

⚠️ Potential Market Impact: Predictable costs benefit long-term operational stability for miners.

6. Network Traffic Eases Up:

Mempool Size (MB): ↓ 61.52%

High-priority Fee: ↓ 68.64%

🕵️ Why It Matters: Fewer unconfirmed transactions suggest decreased network congestion.

⚠️ Potential Market Impact: Bitcoin may become more appealing for transactions due to lower fees.

7. Focus on Green Mining:

BMC Sustainable Power Mix: ↓ 1.10%

🕵️ Why It Matters: Sustainable mining practices are critical for future-proofing investments.

⚠️ Potential Market Impact: Companies prioritizing green mining could be favored in the long term.

💡 Actionable Insights:

Focus on Efficiency: With hash rates soaring, efficiency is key. Look for companies optimizing operations to maintain profitability.

Monitor Holding Patterns: Pay attention to miners' Bitcoin reserves for indications of market sentiment.

Stable Hardware Spending: Consider ASIC price stability as an indicator of sound capital management in mining operations.

Green is the Future: Factor in the sustainability of mining operations into investment decisions.

In conclusion, the Bitcoin mining sector offers a complex, nuanced picture. Investors should weigh these insights with macroeconomic conditions and continue to stay informed.

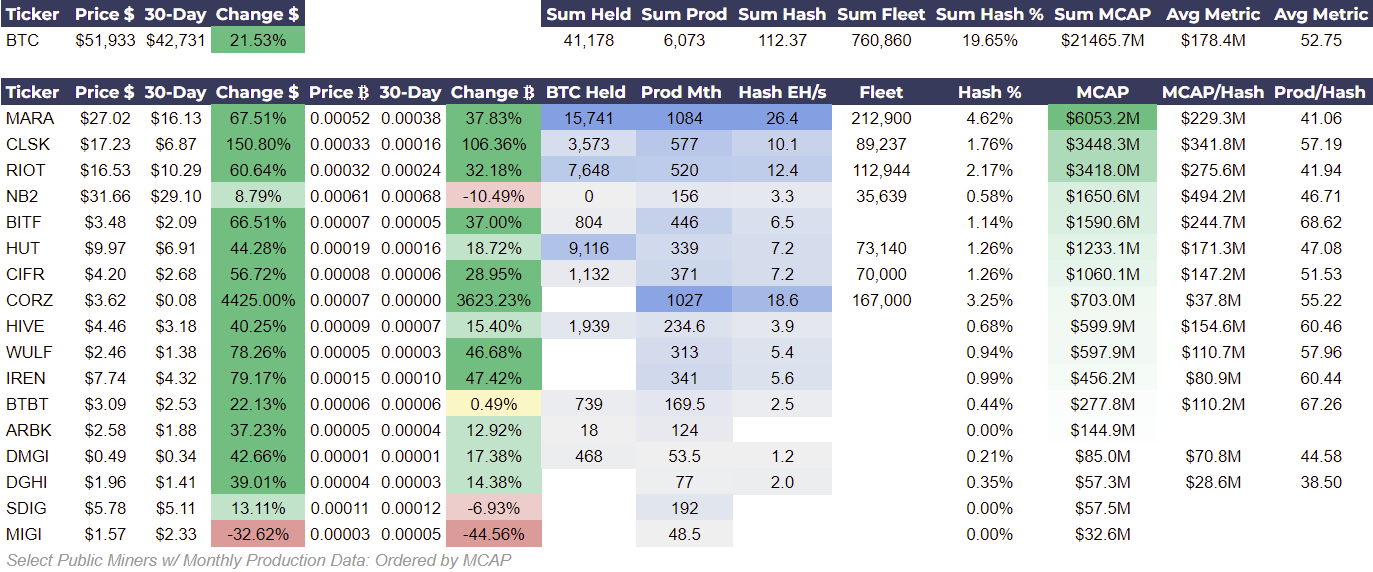

Public Miners Metrics: 📊

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

Key Takeaways from the ⛏️ Public Miners Dashboard:

1. Stellar Performance in Stock Prices:

MARA: ↑ 67.51%

CLSK: ↑ 150.80%

RIOT: ↑ 60.64%

🕵️ Why It Matters: This significant increase in stock prices indicates robust investor confidence and a bullish outlook on the mining sector.

⚠️ Potential Market Impact: The rise in stock prices could attract more investors to the mining sector, potentially increasing capital inflow and driving further growth.

2. CLSK Overtakes RIOT:

CLSK Market Cap: $3478.0M

RIOT Market Cap: $3426.1M

🕵️ Why It Matters: Cleanspark's surge to become the second-largest public miner by market cap reflects its growing influence and operational success.

⚠️ Potential Market Impact: CLSK's ascent could lead to a reevaluation of market positions and encourage other miners to ramp up their competitiveness.

3. Bitcoin Holding and Production:

MARA BTC Held: 15,741

CORZ Monthly Production: 1027 BTC

🕵️ Why It Matters: The Bitcoin holdings and monthly production rates are critical indicators of a miner's potential future revenue and operational health.

⚠️ Potential Market Impact: High reserves and production rates may signal to investors that these companies are well-positioned to capitalize on Bitcoin's market movements.

4. Negative Turn for MIGI:

MIGI Price: ↓ 32.62%

MIGI 30-Day BTC Change: -44.56%

🕵️ Why It Matters: MIGI's decline in both stock price and BTC price change could indicate operational challenges or market skepticism.

⚠️ Potential Market Impact: This downturn may affect investor sentiment towards smaller miners and highlight the importance of operational efficiency and scalability.

5. Bitcoin's Strong Market Performance:

BTC Price: $51,933

30-Day BTC Price Change: ↑ 21.53%

🕵️ Why It Matters: Bitcoin's strong performance sets a positive backdrop for mining stocks, as higher BTC prices can lead to increased mining revenues.

⚠️ Potential Market Impact: Continued appreciation of BTC price could enhance the profitability and market valuation of mining companies.

💡 Actionable Insights:

Diversify with Leaders: Consider investing in mining companies that have shown strong stock performance and robust operational metrics.

Keep an Eye on Market Shifts: Monitor changes in market capitalization among mining companies for potential investment opportunities or risks.

Evaluate Reserves and Production: Assess companies based on their BTC holdings and production rates for long-term revenue potential.

Watch for Turnaround Stories: Be cautious with companies like MIGI that are experiencing downturns but stay open to the possibility of a turnaround with the right operational adjustments.

In conclusion, this week has provided a positive outlook for leading Bitcoin mining stocks, signaling a strong period for the industry. As Bitcoin continues to show strength, mining stocks may follow suit, offering compelling opportunities for informed investors.

Full Bitcoin Magazine Pro Mining Dashboard: 📊

The following is a screenshot of the Bitcoin Magazine Pro Mining Dashboard. Click the image below ⤵️ to zoom in. 🔍

🔗 Download this week's Bitcoin Magazine Pro Mining Dashboard in PDF format. ⤵️

Request for Reader Feedback? 🙏

We experimented with an alternative format for this week's report with the objective of providing our paid readers with more context and insightful information. The information presented aims to assist you in understanding of market dynamics, regardless of whether you own Bitcoin, mine Bitcoin, or own shares in publicly traded Bitcoin mining companies. Please let us know in in the comments ⌨️ area if you enjoyed the new format or would rather stick with the old one. Thank you.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like if you enjoyed this piece. As well, sharing goes a long way toward helping us reach a wider audience!

I'd like to continue seeing this format for a while. It's new and different but it's informative.

Great, concise format!