The Next Chapter: Successful Macro Insights and Bitcoin Adaptations

Discussing the evolving economic environment and Bitcoin’s path to global adoption through recession

Introduction and Background

In today’s post, I want to remind readers of my unique macro thesis, point out prior successful insights, and then examine the current bitcoin price to see where we go from here.

Follow me @AnselLindner and on bitcoinandmarkets.com!

Long-time readers of this newsletter will know that my take on Bitcoin and macro is different from the mainstream consensus, even within the Bitcoin space. I’ve had to stand my ground on certain calls that have proven right with the passage of time. I’m in the deflation camp and see Bitcoin adoption as the natural result of the deteriorating functionality of the credit-based dollar system.

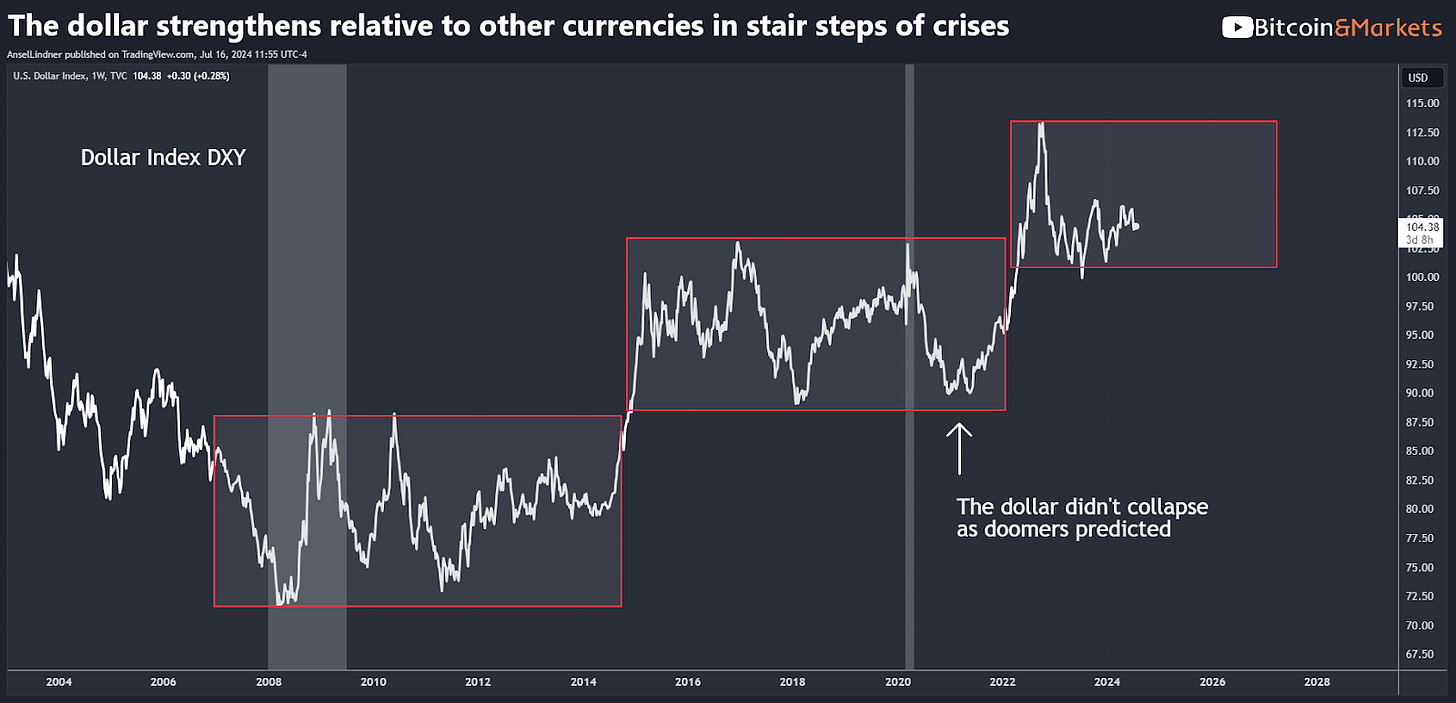

For years, I was the sole voice in Bitcoin talking about a strong dollar, before the term “dollar wrecking ball” was even coined. Of course, that was unpopular and caused me to fleshed out my theories in podcast and blog form and stuck to my guns. I predicted the dollar would climb relative to other currencies and enter a new range, waiting for the next crisis to move higher again.

As COVID and the associated stimulus hit, most people were calling for a dollar collapse. As the much anticipated “inflation” finally started to pick up after a 15-year wait, many analysts in the Bitcoin space expected very high inflation to be the new normal and Bitcoin would be globally adopted as an inflation hedge. Throughout this whole period, I was saying high CPI was going to be transitory, that the structure of the global economy would not allow for high CPI to continue for very long. You have to have a low time preference to see it like I do. Again, I stuck to my guns and have turned out to be correct. CPI is back down to 3% YoY and was negative MoM in June. It is likely to continue to fall through the end of the year.

I’ve also predicted the route to global adoption for bitcoin is through the backing of currencies, mainly the USD. I received a lot of push back from people who said the dollar is going to die, on my argument that the US dollar can change and be backed by Bitcoin. Bitcoiners weren’t ready for that back in 2020, but it’s not so farfetched now. In fact, it’s the mainstream belief with Trump’s Bitcoin endorsement, his new Vice Presidential candidate JD Vance owning Bitcoin and many others openly calling for US Bitcoin reserves.

My overarching macro thesis posits that the world is at the end of a 50-75 year long credit bubble. During this period, unanchored elasticity starting in 1971 allowed credit and the global economy to expand rapidly, pushing globalization, massive gains in the global standard of living and population growth. That success was financed with credit-based money.

However, we are now approaching the end of that credit experiment. Across the world, economies are running into declining marginal revenue product of debt, or in other words, diminishing marginal returns on debt, meaning the debt burden is exceeding any economic growth the debt produces. As seen below, we get $0.47 of GDP from each new dollar of debt, and it will decline further with the next recession.

Source: FRED, GDP/(Total Debt Securities/1000)

Additionally, global trust in institutions and international law that underlies this global credit system are failing as populism and nationalism are on the rise. Our global economic environment is changing, and the credit-based dollar is becoming maladapted. We will naturally return to commodity-backed money because it will function better in this new environment. Bitcoin is the optimally adapted new money for this, and the world will naturally, almost subconsciously, choose it.

Follow me @AnselLindner and on bitcoinandmarkets.com!

Which Way to Bitcoin Adoption?

Even Larry Fink’s base case for the economy is a looming recession. In a MSNBC interview yesterday he highlighted several key strengths of Bitcoin that align with my theory. His primary point was that Bitcoin is an uncorrelated asset to invest in times when you’re “scared.” I’ve shown in prior posts that recession odds are rising rapidly, as unemployment ticks higher and CPI cools, yet a deflationary recession likely only helps Bitcoin.

Source: MSNBC

The rest of Bitcoin’s bull market is likely going to coincide with recession, which must lead many analysts basing their views on Bitcoin be primarily an inflation hedge in these times to conclude the Bitcoin bull market is coming to an early end. However, there are no signs that Bitcoin’s bull market is different this time, even if we go into recession. Any negative impact from deflation on the price of Bitcoin will be overwhelmed by the advantages of holding bitcoin as a hedge against the deterioration in the credit-dollar system.

Next Bitcoin Bull Leg is Starting

Let's turn our attention to the current Bitcoin price charts to see if there is a negative impact from disinflation, or is the safe haven status outweighing those concerns. First up is the daily with important moving averages. I’ve been pointing out this very location on the chart to be where the price will experience some resistance and today it is dealing with that resistance. Once we breakthrough, price could rapidly move to an ATH.

This also happens to be the STH Realized Price, which might cause some temporary sell pressure as newcomers who were underwater sell as they breakeven.

The 3-month Heat Map shows the epic liquidity that is going to attract the price up to $73,000. On Binance alone there is over $12B in short liquidations that will trigger starting at $72k.

Source: Coinglass

Several indicators are also showing this as the setup we want for a very bullish move. The Puell multiple examines market cycles from a supply-side perspective, specifically miner revenue. I’ve circled the typical halving effect where the Puell multiple gets slashed. This same general idea applies to all of the cycle metrics you can find on LookIntoBitcoin. Disinflation and a looming recession has not impacted the Bitcoin cycle at all.

Source: LookIntoBitcoin

Conclusion

My macro thesis has consistently anticipated the evolving dynamics of the global financial system and Bitcoin's role within it. The convergence of rising recession odds, the diminishing returns on debt, and the loss of trust in traditional financial institutions underscores the need for a robust, commodity-backed monetary system. Bitcoin, with its unique properties, is optimally adapted to meet this need.

As we've explored, even influential voices like Larry Fink are now recognizing Bitcoin's potential as a safe haven during economic uncertainty. The current price charts and key indicators suggest that Bitcoin is well-positioned to continue its bull market, despite the broader macroeconomic challenges.

For a more in-depth analysis and ongoing insights into Bitcoin and macroeconomic trends, be sure to follow me on Twitter @AnselLindner and visit bitcoinandmarkets.com. As we navigate these transformative times, staying informed and prepared will be crucial.

Thank you for your continued support and engagement. Let’s follow the exciting developments ahead in the world of Bitcoin together.

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support!