The Growing Disconnect In Financial Markets

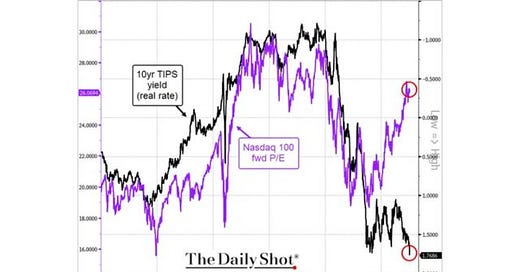

There is a divergence in the performance of equities and real yields in bonds. The lag effects of history’s swiftest tightening cycle are only beginning to be felt, but the market has yet to react.

Disinflation And Monetary Policy

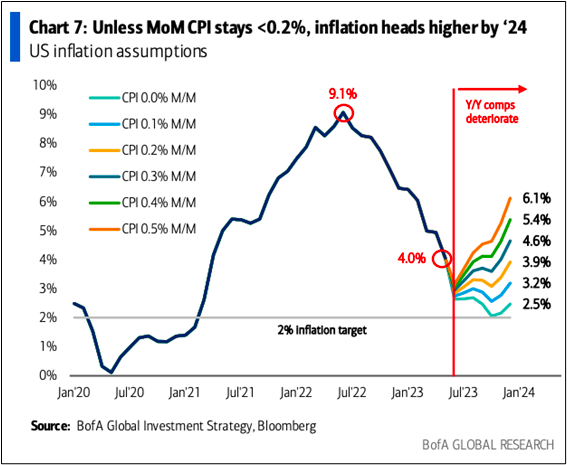

As we delve deeper into 2023, the U.S. economy finds itself at a crossroads. Disinflation seems to be setting in as a direct result of the Federal Reserve’s tightening monetary policies. This policy shift has led to a notable slowdown in the annualized sticky Consumer Price Index (CPI) over recent months. With this in view, the conversation among market participants has gradually shifted away from inflationary concerns and toward trying to understand the impact of the tightest monetary policy in a decade and a half.

The high inflation we’ve experienced, particularly in the core basket (excluding food and energy), concealed the effects of the swiftest tightening cycle in history. Inflation was partially fueled by a tight labor market leading to increased wages, and has thus far resulted in a sustained second-half inflationary impulse driven more by wages than by energy costs.

It’s worth noting that the base effects for year-over-year inflation readings are peaking this month. This could lead to a reacceleration of inflationary readings on a year-over-year basis if wage inflation remains sticky or if energy prices resurge.

Interestingly, real yields — calculated with both trailing 12-month inflation and forward expectations — are at their highest in decades. The contemporary economic landscape is notably different from the 1980s, and current debt levels cannot sustain positive real yields for extended periods without leading to deterioration and potential default.

Historically, major shifts in the market occur during Fed tightening and cutting cycles. These shifts often lead to distress in equity markets after the Fed initiates rate cuts. This isn’t intentional, but rather the side effects from tight monetary policy. Analyzing historical trends can provide valuable insights into potential market movements, especially the two-year yields as a proxy for the average of the next two years of Fed Funds.

LESS THAN TWO WEEKS REMAIN TO APPLY! Bitcoin Magazine PRO has teamed up with Samara Alpha Management to allocate $1 million in seed capital for a fund manager with a proven track record. Accepting applications until July 31. Apply today!

Bonds And Equities: The Growing Disconnect

Currently, there’s a sizable and growing disconnect between bond and equity markets. It’s not unusual for equity earnings to outperform bonds during an inflationary regime due to equities’ superior pricing power. However, with disinflation in motion, the growing divergence between equity multiples and real yields becomes a critical concern. This divergence can also be observed through the equity risk premium — equity yields minus bond yields.

Research from Goldman Sachs shows systematic investment strategies, namely Commodity Trading Advisors (CTA), volatility control and risk-parity strategies, have been increasingly using leverage to amplify their investment exposure. This ramp-up in leveraging has come in tandem with a positive performance in equity indices, which would be forced to unwind during any moves to the downside and/or spikes in volatility.

Research from JPMorgan Chase shows their consolidated equity positioning indicator is in the 68th percentile, meaning equities are overheated, but continuation higher is possible compared to historical standards.

The fate of equity markets in the short-to-medium term will be determined by earnings, with 80% of S&P 500 companies set to complete their reporting by August 7.

Any disappointment during earnings season could lead to a reversion in equity valuations relative to the bond market.

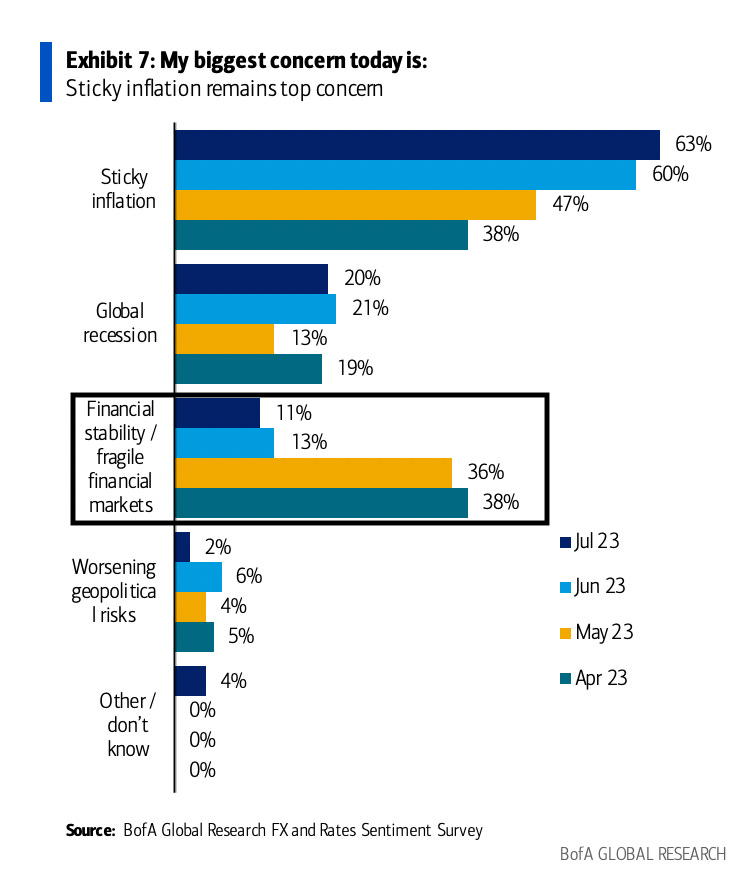

Another interesting note is from a recent Bank of America survey, where client concern around the health of financial markets has risen in recent months at the same time as equity markets continue their uptrend.

Headwinds Ahead For The U.S. Consumer?

The robust earnings surprises and the U.S. consumer market’s resilience are being underpinned in part by excess savings from the COVID-era fiscal stimulus. However, it’s worth noting that these savings are not uniformly distributed. A recent BNP Paribas report estimates that the top income quintile holds just over 80% of the excess savings. The savings of the lower-income quintiles are already spent, with the middle quintile likely following suit soon. With factors like the resumption of student debt obligations and emerging weaknesses in the labor market, we should brace ourselves for potential stress in consumer markets.

Despite potential consumer market stressors, the performance of the U.S. economy in 2023 has surpassed expectations. Equity markets have put on a stellar show, with the bull market appearing unrelenting. Amidst these market celebrations, we must maintain a balanced perspective, understanding that the path forward may not be as clear cut or straightforward as it appears.

Final Note

We highlight developments in equity and interest rate conditions as we find it crucial to recognize the growing liquidity interplay between bitcoin and traditional asset markets. To put it plainly:

It signals substantial demand when the world’s largest asset managers are competing to launch a financial product that offers their clients exposure to bitcoin. These future inflows into bitcoin, predominantly from those currently invested in non-bitcoin assets, will inevitably intertwine bitcoin more closely with the risk-on/risk-off flows of global markets. This isn’t a detrimental development; on the contrary, it’s a progression to be embraced. We expect bitcoin’s correlation to risk-on assets in the traditional financial markets to increase, while outperforming to the upside and in a risk-adjusted manner over a longer time frame.

With that being said, turning back to the main content of the article, the historical precedent of significant lag in monetary policy, combined with the current conditions in the interest rate and equity markets does warrant some caution. Conventionally, equity markets decline and technical recessions occur in the United States after the Fed begins to cut interest rates from the terminal level of the tightening cycle. We haven’t reached this condition yet. Therefore, even though we’re extremely optimistic about the native supply-side conditions for bitcoin today, we remain alert to all possibilities. For this reason, we remain open to the idea of potential downward pressure from legacy markets between now and mid-2024, a period marked by key events such as the Bitcoin halving and possible approval of a spot bitcoin ETF.

Thank you for reading Bitcoin Magazine Pro, we sincerely appreciate your support! Please consider leaving a like and letting us know your thoughts in the comments section. As well, sharing goes a long way toward helping us reach a wider audience!

Thank you, Dylan, for extracting valuable takeaways from the industry top players’ reports and so also for your own ‘connecting the dots’ job. It is highly appreciated 👏