The Geopolitical Significance of Bitcoin

Bitcoin's Role in Geopolitical Crises with Safe Haven Status, Academic Insights, and Inflation Hedging Capabilities, plus a Bonus Chart of the Halving.

Introduction

In a world where geopolitical tensions frequently jar the markets, investors seek refuge in assets that can weather the storm. The question of Bitcoin’s ability to perform during periods of heightened geopolitical tensions has come up with increasing regularity. I wrote about this topic here several months ago on my website, in response to bitcoin’s performance around the Oct. 7th attacks (it is a highly detailed post that I recommend you checkout for tons of charts). The topic is once again coming up as the Israel conflict looks likely to expand into a regional conflict against Iran.

The question of whether or not Bitcoin can perform well in a crisis is the one big bearish criticism of Bitcoin in a period where its bullish fundamentals are off the charts. In this post, I’ll attack this from several different angles. First, a simplistic backtest of bitcoin’s price performance during periods of increased geopolitical or monetary risk. Second, we take a look at an academic study using highly sophisticated statistical methods to measure bitcoin’s behavior under geopolitical tensions. Third, Bitcoin’s dual advantage under monetary responses to expanding military conflict.

Bitcoin’s Strong History as a Safe Haven

Traditionally, safe haven assets are investments that retain or increase in value during times of market uncertainty, with gold long considered the definitive example due to its intrinsic value and historical stability. However, Bitcoin has begun to challenge this status since its inception in 2009, presenting itself as a viable alternative during geopolitical crises. This is noteworthy given Bitcoin's digital and decentralized nature, which contrasts sharply with more traditional assets.

Despite the loud voices of the naysayers out there, Bitcoin has performed very well in periods of increased geopolitical risk. Bitcoin's claim as a safe haven has been supported by its performance during specific crises, such as the financial unrest in Cyprus in 2013, where Bitcoin's value surged as investors sought alternatives to conventional financial systems and unstable government situations.

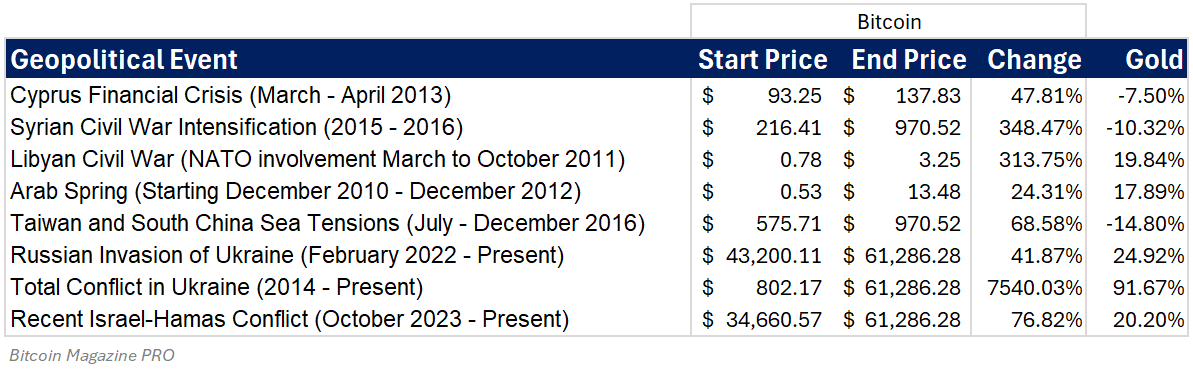

I took a simple price history of bitcoin and evaluated it during, what I picked as, recent periods of elevated geopolitical crisis. I then compared it to the price of gold during the same periods. As you can see, bitcoin has outperformed gold in every single period of increased geopolitical tensions!

This simple analysis here might not go far enough to assuage investor concerns, but there is also more research being done on this very topic with positive results, such as the following study.

Academic Study of Bitcoin as Geopolitical Hedge

Bitcoin’s safe haven status has been studied in a few academic works, but there is still much to be done on this front. Not just for bitcoin but also for gold and other assets. In a study titled, “Digital Gold” and geopolitics by Refk Selmi, Jamal Bouoiyour, and Mark E. Wohar, the researchers investigated Bitcoin’s and gold’s role as safe havens amid geopolitical risks. They constructed a comprehensive geopolitical risk indicator, capturing various global tensions, to examine asset price reactions. A novel dynamic Markov-switching copula model revealed that in high-risk environments, both Bitcoin and gold exhibit positive responses, affirming their potential as safe havens. However, this role is nuanced, varying with different risk types and levels.

The study validated Bitcoin's emergent safe haven status, which gained traction following the 2008 financial crisis and events like the 2013 Cyprus bailout, underscoring its resilience in uncertain times. Comparatively, gold maintains its traditional role as a hedge, though Bitcoin and gold's effectiveness as safe havens is influenced by the specific nature of geopolitical unrest.

For investors, this implies that the hedging efficacy of these assets is context-dependent, offering protection in times of heightened geopolitical tensions. The research paves the way for further investigation into asset behavior in response to diverse forms of risk, suggesting that a strategic combination of Bitcoin and gold might diversify risk during geopolitical upheavals.

Source: “Digital Gold” and geopolitics

Bitcoin exhibits a stronger and more consistently significant positive response to geopolitical risks in high-risk periods, suggesting it may have performed better as a safe haven across most of the risk categories evaluated in the study. However, it's important to note that a higher dependence doesn't necessarily mean "better performance" as a safe haven; it reflects a stronger relationship with geopolitical risk within the context of this study's methodology. Gold's responses are also significant but tend to be less pronounced compared to Bitcoin's across the categories.

Bitcoin's Dual Advantage as Inflation Hedge

Given that if we do have an escalation of the Iran-Israel tensions, we should anticipate a global uptick in deficit spending and a downward adjustment in central bank policy rates to mitigate the economic consequences of the conflict. Such fiscal and monetary policy reactions are historically common as nations strive to bolster their economies amid rising uncertainties. This expected shift in economic strategy could play to Bitcoin's other important strength, particularly as an inflation hedge.

Geopolitical crises often trigger economic downturns that ripple through global markets, reducing consumer and investor confidence while disrupting international trade. This in turn leads governments to increase deficit spending and central banks to lower interest rates in an attempt to stabilize the economy. In that scenario, inflation as measured in CPI should rise increasing the demand for inflation hedges. In such an environment, Bitcoin, with its capped supply of 21 million coins, becomes increasingly attractive. Its inherent scarcity coupled with its detachment from any government's financial system positions it as a buffer against inflation—a digital safe haven that stands apart from the traditional monetary policy tools that may exacerbate inflation during crises.

For Bitcoin, then, the dual impact of geopolitical unrest and the accompanying inflationary policies serves as a tailwind, likely boosting its appeal and demand. For investors, the blend of Bitcoin's attributes could mean that it not only serves as a safe harbor during turbulent geopolitical events but also as a hedge against the inflation that might follow, providing a compelling case for its inclusion in a diversified investment portfolio tailored for such times.

Conclusion For Geopolitical Risk

With its proven track record as a resilient safe haven and its inherent qualities as an inflation hedge, Bitcoin presents a compelling option for diversifying investment portfolios. As global tensions potentially escalate, understanding Bitcoin's role not just in the context of electronic cash but as a strategic financial asset becomes crucial. By leveraging Bitcoin's unique properties, investors can protect their assets from both immediate geopolitical risks and the longer-term economic impacts of these crises.

Bonus: Chart of the Day

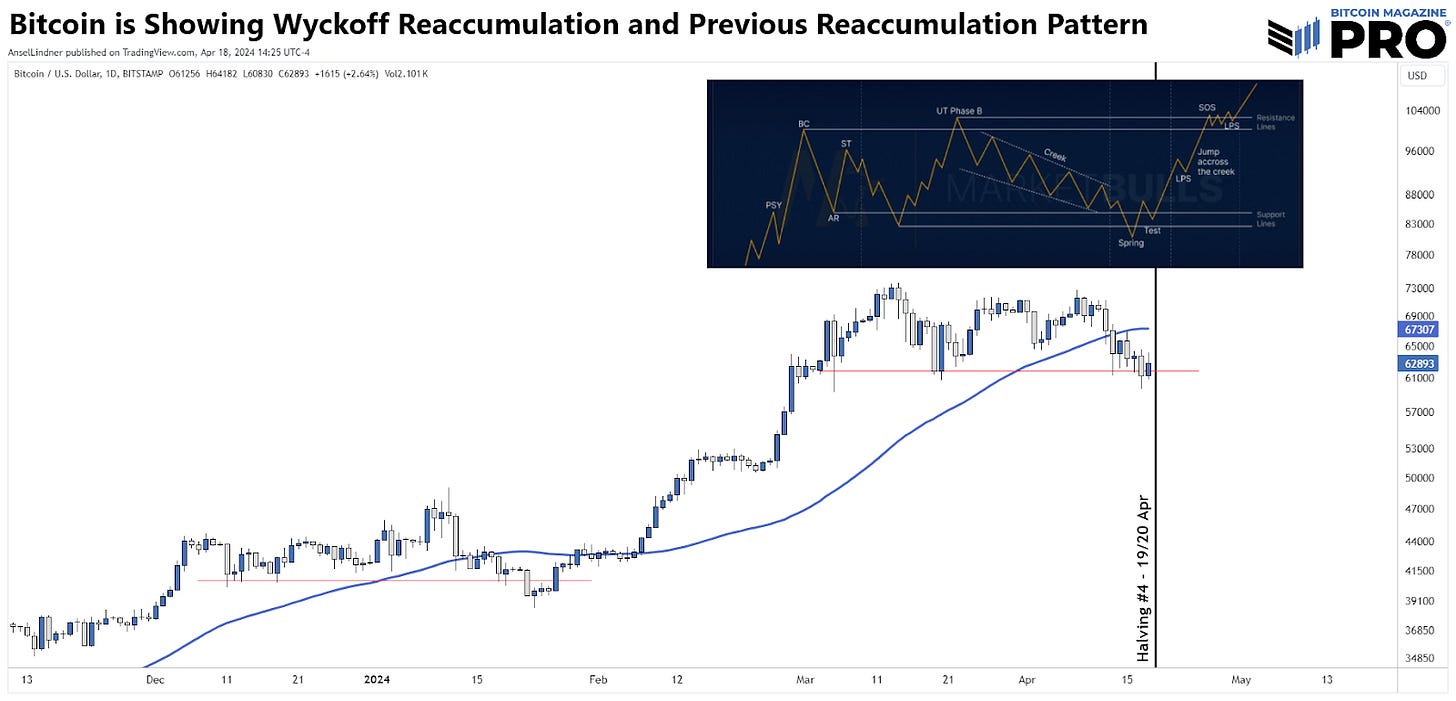

The Bitcoin halving is a nerve-racking time. Proponents of Bitcoin take victory laps in the pre-halving pump, while skeptics amplify any tiny dip. We are only one day from the halving, and the price is currently dipping. In this situation, I anticipate selling after the halving itself to be muted, meaning we could be looking at a ‘buy the news’ event. This shift is expected as the uncertainties held by uneducated investors dissipate once the halving occurs without incident.

The daily chart also shows striking similarities to a Wyckoff reaccumulation pattern, suggesting an intriguing possibility. This pattern would align the current price dip with the last fake-out of the Wyckoff pattern along with the halving event itself, potentially creating a powerful combination. There is also a high similarity with the Nov ‘23 - Jan ‘24 consolidation period, as you can see price dipped below the 50-day MA (blue), faked out to a new low, before rallying nearly 80% from $41,000 to $72,000.

THE BIGGEST CELEBRATION IN BITCOIN

THE BITCOIN HALVING LIVESTREAM BEGINS AT BLOCK HEIGHT 839,979 ⤵️

If you liked this content please give a like and share! Comment below with your reactions to this post and any recommendations for future topics.

Thank you for reading Bitcoin Magazine Pro™, we sincerely appreciate your support!

"Bonus: Chart of the Day" was fire!