The Deep Dive Weekly Recap, 6/5/21-6/11/21

What an incredible week for bitcoin. In what was one of the most significant developments surrounding bitcoin ever, a country has officially adopted bitcoin as legal tender, creating a global tax haven in the process.

While this weekly report could be dedicated almost solely to the news out of El Salvador, Tuesday’s and Wednesday’s issue of “The Daily Dive” covered the significance and market reaction in more detail here.

Price Consolidation

The price action of bitcoin ranged from a high of $39,500 on the third all the way down to $31,000 on the eighth before recovering, now trading at $37,260 at the time of writing.

MicroStrategy’s $500 Million Debt Issuance

This past Monday, Michael Saylor, CEO of MicroStrategy, announced that the company was proposing a $400 million private offering of senior secured notes, with the funds being used to acquire additional bitcoin for the company's balance sheet.

MicroStrategy also announced that the company was moving the 92,079 bitcoin on its balance sheet into a new subsidiary, MacroStrategy, LLC. The purpose of the move was to separate the bitcoin that will be acquired from the pending debt raise from the bitcoin already on MicroStrategy's balance sheet, as the senior secured notes entitle the bond investors to equity stake in the case of a default.

The following day, the company announced that due to robust investor demand, it had raised its bond offering to $500 million total, at a coupon of 6.125%, with principal due in 2028.

Saylor and MicroStrategy continue to conduct a masterclass in economic calculation by conducting speculative attacks on the dollar, borrowing billions of dollars at very low yield due years into the future to acquire bitcoin.

The $500 million is set to clear this coming Monday, and it is expected that the purchases will be executed using dollar-cost averaging by the second over multiple days like previous bulk purchases were.

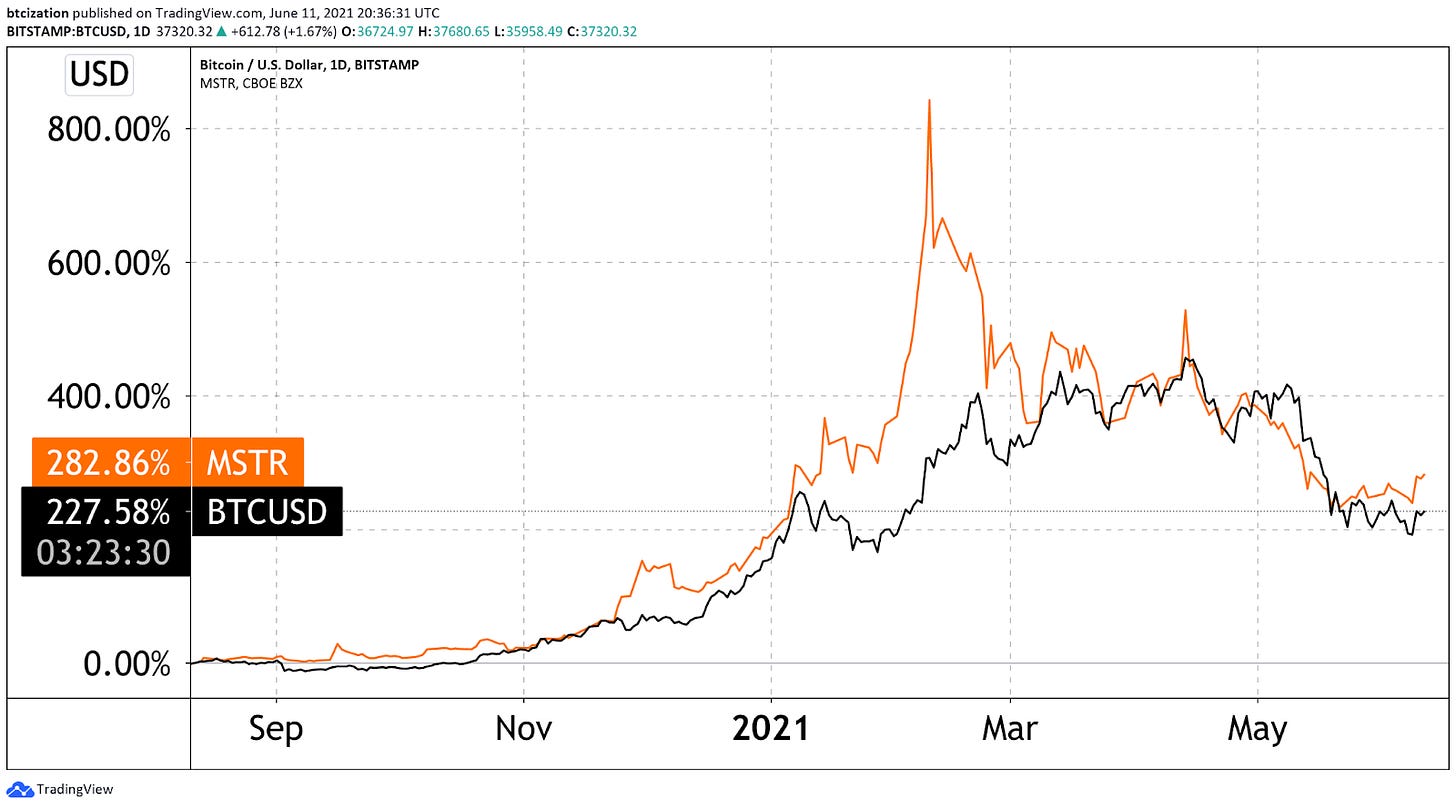

Since adopting a bitcoin standard, shares of $MSTR have outpaced BTC, gaining 282.86% and 227.58%, respectively.

SOPR Reset

SOPR is a metric computed by dividing the realized value (in USD) divided by the value at creation (USD) of a spent output. Or simply: price sold / price paid. Adjusted SOPR, or aSOPR, is the same, but ignores all outputs with a lifespan of less than one hour to cut out noise.

On average, bitcoin was being spent at a loss during the drops to $30,000 and $31,000. The previous time aSOPR was this low for more than one day was during the March 2020 crash to $4,000.

Historically, during bull markets, aSOPR touching zero or even going below zero marks local bottoms and we do not expect this time to be any different.

Hash Rate Drop And Miner Capitulation

Over the past few months, hash rate growth has hit a bit of a roadblock. At the time of writing, hash rate has declined about 25% from the all-time high as a confluence of a China mining ban causing a relocation of miners to different jurisdictions, as well as the past months’ near 50% decline from all-time high putting pressure on margins, causing miners to shut down their operations temporarily.

The hash ribbons metric shows inefficient miners on the network turning off their machines, and signals miner capitulation. Historically, when the 30-day moving average crosses back over the 60-day moving average, it indicates that miner capitulation is likely over and the price uptrend will continue.

However, due to the decline in hash rate and downward price pressure over the last month, this buy signal may not flash for at least two more weeks.

The steep drop in hash rate demonstrates the squeeze that miner profit margins have undergone over the last month. Miner net position change, a measure of miners’ net accumulation and selling over the past 30 days, further supports this, with the data showing that miners have seen a 5,148 bitcoin decrease in their total holdings over the last month.

Stock-To-Flow Model Update

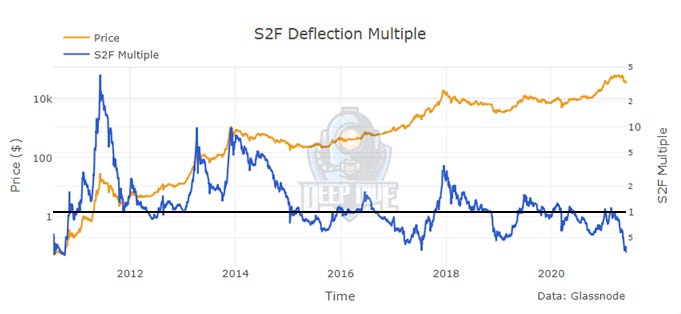

It is close to make or break time with the notorious stock-to-flow (S2F) model.

While it is obviously just a model meant to quantify the relationship between the scarcity of bitcoin versus its market value, the fact that bitcoin has oscillated around one standard deviation above and below the model since its release is notable, and if the model is to hold, a big rebound is coming.

The price of bitcoin is currently trading at one of the lowest multiples (compared to the model price) in its history. Today, the multiple is at 0.36. In July 2017, when the price of bitcoin hit a low of $1,900, the S2F multiple was at 0.35.

Historically, when this multiple hits lows like we’ve seen, the price soon begins to get squeezed higher, like pushing a beach ball underwater.

As Pierre Rochard said, “Bitcoin's price doesn't go up based on good news, it goes up when the marginal sellers have been exhausted.”

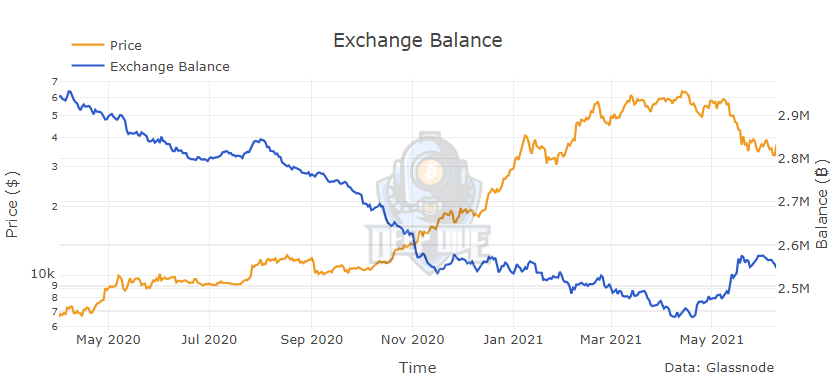

Exchange Balance

Over the previous week, 10,728 bitcoin were withdrawn from exchanges, with a notable uptick of withdrawals occurring after the announcement that El Salvador was adopting bitcoin as legal tender.

As the year goes on, exchange balance will be something to keep an eye on, especially if the trend of bitcoin being relentlessly withdrawn from exchanges continues the trend that was developed throughout the course of 2020.

Futures Backwardation

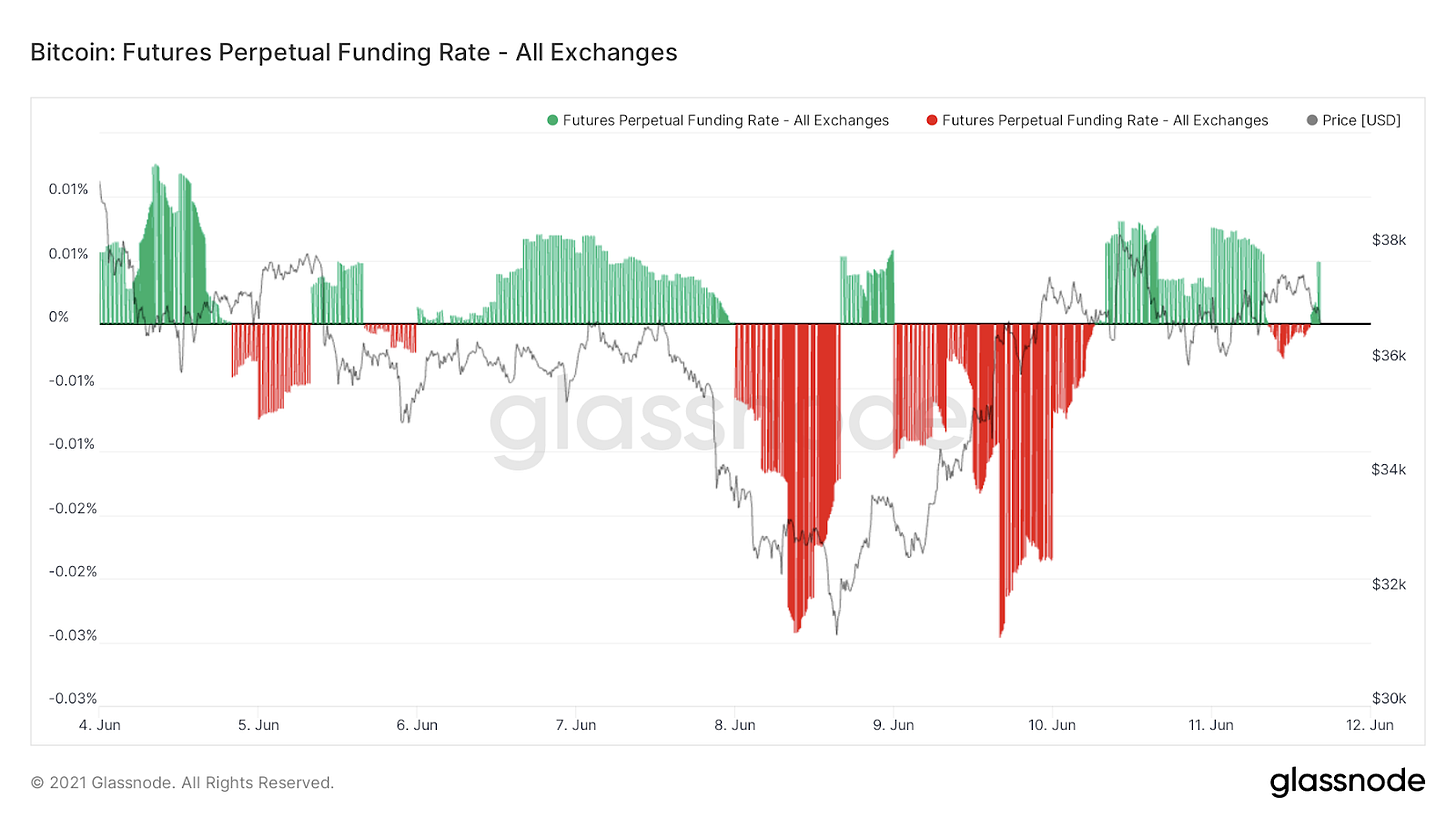

Bitcoin one-month futures contracts briefly traded in backwardation on Kraken, OKEx and Deribit this past Tuesday, a sign that traders had turned bearish over the medium term.

As it turns out, this is quite the bullish contradiction, as when perpetually bullish traders turn bearish on the best performing asset in history, it's time to go long. This also presented a (albeit very small) risk-free opportunity to buy bitcoin for cheaper than the spot price, a deal that is not often presented to the market.

Throughout much of the week, funding in the derivatives market was negative, an encouraging sign that leveraged long speculation had all but disappeared from the market, and also presenting an opportunity for traders or arbitrageurs who were paid to open long positions in the derivatives market.

Negative funding is rare in bitcoin derivatives as most large holders of the asset are long-term bullish, thus the bias skews market position to net long rather than net short.

It was very encouraging to see bitcoin catch a strong bid from the $31,000 level as funding was negative and futures were trading in backwardation.

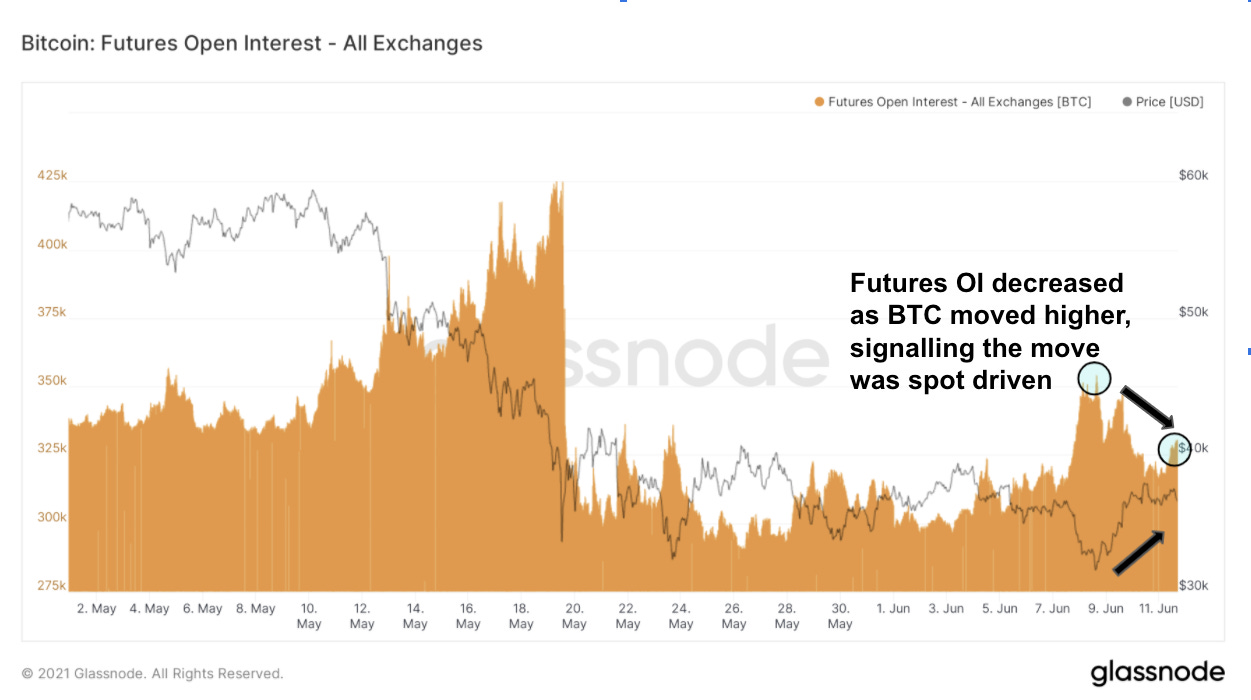

Similarly, the divergence between open interest and price with OI declining with price pumping is generally very bullish, as it gives a sign that the recent rally was spot driven, and not derivative based.

The Weeks Ahead

Expect more chop, with the price bouncing from $32,000 to $40,000, as bitcoin builds the biggest base of on-chain volume in the range. Demand at 30k is extremely strong, and it would take a volatility explosion/liquidity crises in the legacy financial system to be breached in all likelihood, but it is possible.

When a breakout comes, it will be explosive, as sidelined cash from around the world watches an entire nation (with potentially many more coming) onboard onto the bitcoin network.

The most likely scenario is that bitcoin consolidates for some time, before explosively breaking to the upside on the back of ever more central bank liquidity, with millions of individuals & entities adopting bitcoin for the first time.

Thank you for the reading The Deep Dive Weekly Recap,

The weekend is here, Cheers.