The Deep Dive Weekly Recap, 6/12/21-6/18/21

GBTC Redemptions Stealing Spot Demand

The Grayscale story is very well known at this point. An open-ended trust that found a workaround to the U.S. Securities and Exchange Commission’s (SEC’s) egregious regulations and figured out a way to deliver bitcoin exposure to institutional capital and brokerage accounts before nearly everyone else.

You have to give credit where credit is due, the GBTC product was a tremendous success for Grayscale. The trust currently holds an astounding 651,884 bitcoin, or around 3.10% of all bitcoin that will ever exist.

During the later months of 2020, shares of GBTC traded at a significant premium due to the trust’s structure (while this weekly recap won’t dive too deep into the nuance of the trust, you can read more here).

With shares trading at a steep premium, both accredited and institutional investors could acquire shares of GBTC at NAV (net asset value), but these shares had to be locked up for six months before being able to hit secondary markets.

Investors absolutely piled into the trade, as the seemingly risk-free arbitrage was too enticing to pass up.

From June 18, 2020 to February 18, 2021, Grayscale bought an incredible 284,393 bitcoin. For context, that is equivalent to 127% of the bitcoin that was mined over the same period.

On February 18th, 2021 however, shares of GBTC began to trade at a discount to NAV, and as expected, new redemptions of GBTC shares completely halted. With one of the market’s biggest buyers sidelined, bitcoin lost steam, but there is more to the story.

All of the shares of GBTC that were redeemed and locked up for six months have begun to hit the market in waves, which has created an unexpected development in the market.

While on the way up, with the premium, Grayscale was hoovering up bitcoin while retail was bidding up the price of GBTC shares on the secondary market. All of those shares that now are trading at a discount to NAV have most definitely siphoned demand for spot bitcoin for the time being.

Just over the last seven days, the equivalent of 11,512 BTC worth of GBTC shares have been unlocked, and undoubtedly some of these have been sold onto the market. As an institutional allocator, if you would like exposure to bitcoin, do you buy spot bitcoin (which still may be very challenging with many legal and regulatory hoops to jump through), or do you buy shares of GBTC that are trading at a 10-20% discount to NAV?

That is a no-brainer, and the reality is that this dynamic has taken a lot of buying pressure out of the market.

Over the next two months, the equivalent of 82,818 BTC worth of GBTC shares are being unlocked, and as long as GBTC continues to trade at a discount to NAV (which should be entirely expected), lots of bitcoin demand will go towards GBTC, which won’t be reflected in the bitcoin price.

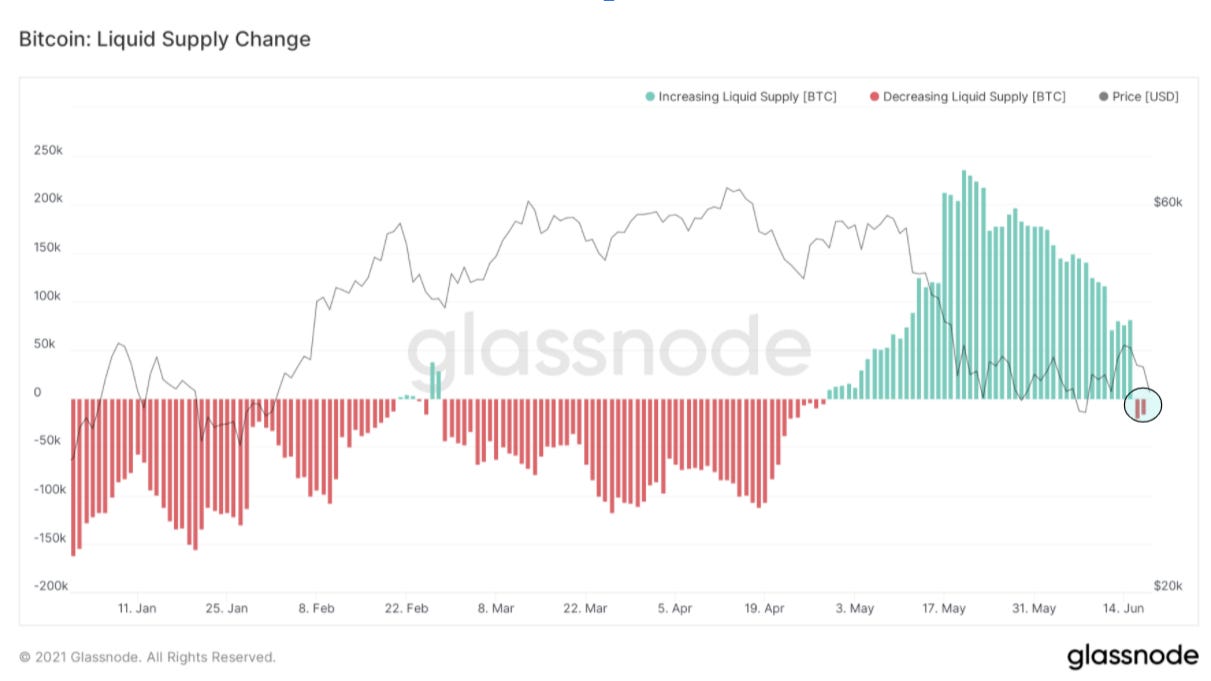

Liquid Supply Change

The May sell-off brought about a massive amount of previous illiquid supply back to the market, and thus it should be expected to take some time as buyers/hodlers reaccumulate what was sold by weak hands.

Just this week, the month over month liquid supply change flipped to the negative, with 15,365 bitcoin being moved to illiquid addresses over the past 30 days, a positive development signaling that a mid-cycle reaccumulation is underway.

Long/Short-term Profit & Loss

The breakdown of UTXOs currently in profit/loss:

Long-Term Profit: 71.4%

Long-Term Loss: 0.33%

Short-Term Profit: 10.27%

Short-Term Loss: 17.96%

This reaffirms the stance that any pain being felt in the market is being felt by short-term investors and/or leveraged traders.

Futures Perpetual Funding Rate

Similar to last week, funding in the perpetual swap market was commonly negative, an encouraging sign that on a short-term basis most traders are bearish and few are long the price of bitcoin on high amounts of leverage.

While some may argue whether this is a bullish or bearish development over the short/medium, it clearly demonstrates that much of the speculative excess and leverage in the bitcoin market is not present.

Funding regularly flipping to the negative is admittedly not a common occurrence in a bull market, so this may lead some to believe that the cycle is “over”. While we will dig far deeper into the cyclical top/bottom indicators during the monthly report, a large amount of on-chain data is pointing to a mid-cycle reaccumulation over the medium term, with a continuation of a bull market into the fall/winter.

It also has to be taken into account that the macro backdrop of this cycle is fundamentally far different than previous cycles, with central bank liquidity (or lack thereof) most likely driving the price action of all asset classes going forward.

Central Bank Indecisiveness

On Wednesday, Jerome Powell spoke for the Federal Reserve following the conclusion of the Federal Open Market Committee meeting, and reiterated the same talking points to the market.

*FOMC: Fed Will Continue Bond Buying Until Substantial Further Progress On Goals

In the days following Wednesday's meeting, the DXY (U.S. Dollar Index against a basket of foreign currencies) rose significantly, in a move that placed downward pressure on all risk assets across the board.

Over the last 18 months, bitcoin has more or less been inversely correlated with the DXY, as would be expected.

Earlier this morning, The President of the Federal Reserve Bank of St. Louis, Jim Bullard, was on CNBC and was quoted saying,

“I'm leaning a little bit toward the idea that maybe we don't need to be in mortgage-backed securities with a booming housing market and even a threatening housing bubble ... we don't want to get back in the housing bubble game...”

As Fed taper talks heats up, and with total debt to Gross Domestic Product at historic highs, the implicit short dollar position could cause a significant squeeze for dollars, otherwise known as a “liquidity crunch,” which would very likely crash risk assets, bitcoin included.

However, it is important to remember that the DXY is the value of the dollar against a basket of other fiat currencies in a world of competitive debasement. It is entirely possible (and should be expected) to see the DXY and bitcoin rising in unison at some point in the future, as the world is awash in dollar-denominated debt, and as bitcoin continues to accrue monetary premium and be adopted in every jurisdiction around the world.

Historic Asset Valuations Across The Board

A result of the Federal Reserve's (and other global central banks’) historic levels of quantitative easing, credit markets are more bloated than at any time in history.

The chart above shows real yields on U.S. corporate junk bonds, with real yields entering negative territory recently due to the rising CPI inflation reading and continued central bank easing.

In the Daily Dive #005, we detailed Michael Saylor and MicroStrategy using the manipulated cost of capital to secure nearly 100,000 bitcoin through a combination of debt raises in capital markets.

When the cost of capital is negative (in real terms), why wouldn’t you use that to your advantage to acquire the hardest money the world has ever come across, with an unforgeable costliness guaranteed with the proof of work mechanism and difficulty adjustment built into the Bitcoin Network.

Many of the world’s smartest and forward thinking capital allocators are already executing on this strategy.

Reverse Repo Mania

With the massive amount of quantitative easing being conducted in the financial system, banks are flush with liquidity, and as a result quite the conundrum has arisen.

In what is nearly the exact opposite of what occurred in September of 2019, when the overnight repo market “broke”, banks have too much liquidity in the form of reserves at the Fed, and instead of lending that money out, they have turned to the Fed’s reverse repo facility.

Today alone, the Fed accepted $747.121 billion in reverse repos.

Banks have no desire or incentive to lend when real yields are negative, and that is without taking into account default risk!

What does this mean for bitcoin today? That is hard to say, but the massive amount of cash sloshing around the banking system could mean that the Fed thinks about tapering their asset purchases sooner than expected, which would have a negative effect on asset prices across the board.

Ultimately, it is all short term noise. Whether the Fed tapers soon or doesn’t, the problem remains.

The monetary system is at the conclusion of the long term debt cycle. The ever weakening fiat monetary system will have to compete with the strengthening, decentralized, and open source challenger that is bitcoin.

Place your bets accordingly.