The Deep Dive Monthly Report, January 2022 Preview

Become a premium subscriber to The Deep Dive to get access to this monthly report and all of The Deep Dive research. We will release the full monthly report to free subscribers next Wednesday, February 9.

Sign up with the button below to get a premium subscription 30-day free trial and access to the full report.

PREPARED BY:

Dylan LeClair, Head of Market Research

Sam Rule, Lead Analyst

Summary:

Macroeconomic Correlations

Nasdaq Correlations

BTC VIX Relationship

GBTC Demand, Investor Sentiment

On-Chain Analysis

Realized Price, MVRV

Long-Term And Short-Term Holder Behavior

Cost Basis Ratio, Reserve Risk

Derivatives

Perpetual Futures Funding

Annualized Rolling Basis

Collateral Makeup, BTC-Margined Trends

Macroeconomic Outlook

The End Game

U.S. GDP Debt Relationship

Real Yields, CPI, Fed Funds Rate

Bitcoin Mining

Hash Rate, Hash Price

Mining Difficulty, Monthly Revenue

Public Miner BTC Holdings

Puell Multiple, Exchange Flows

Risk Factors

Monthly Risk Recaps

DXY Strength, Federal Reserve Policy

Macro

Since our 2021 Deep Dive end-of-year report, when bitcoin was trading at $46,000, price continued to tumble as tightening fears gripped bitcoin and equity markets alike, with bitcoin briefly breaking below $33,000 and the Nasdaq falling 20% off its all-time highs.

This report will first touch on recent macro correlations with risk-on assets before diving into on-chain metrics, relative market valuation and the state of bitcoin derivatives, and bitcoin mining. Lastly, we will zoom out and analyze the long-term global macroeconomic outlook.

Macroeconomic Correlations

Over the last month, the performance of bitcoin has been highly correlated with the performance of the Nasdaq, with the rolling four-week correlation of the two assets at 0.93, a historically high level across a four-week period.

To understand why bitcoin — which is often touted as being a “risk-off” or “uncorrelated” asset — has traded so tightly in line with equities (specifically the Nasdaq) over the last month, it helps to examine the recent adopters of the asset over the past two years.

Many of the largest allocators to bitcoin since 2020 have been macro-focused funds who were looking to ride the tide of unprecedented monetary and fiscal stimulus, and thus turned to bitcoin. Paul Tudor Jones, a legendary macro investor, laid out his thesis in May of 2020,

“I also made the case for owning bitcoin, the quintessence of scarcity premium. It is literally the

only large tradeable asset in the world that has a known fixed maximum supply.”

Along with Paul Tudor Jones, investors such as Stanley Druckenmiller and corporate adoption by the likes of MicroStrategy’s Michael Saylor as a “treasury reserve asset” sparked off a blistering bull market.

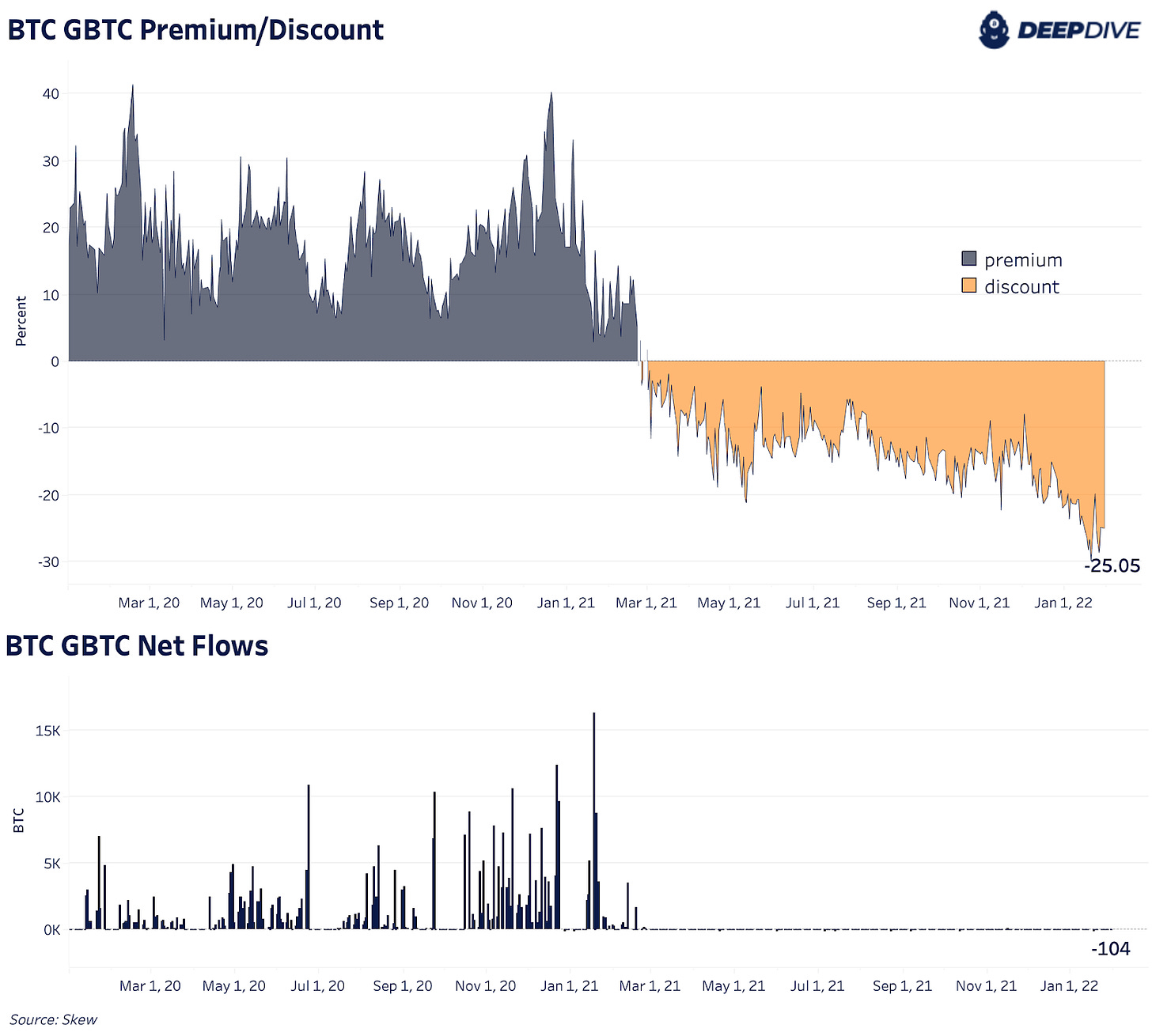

However, behind the scenes, one of the largest drivers of the bull market in late 2020 and early 2021 was none other than the Grayscale Bitcoin Trust. Grayscale purchased more than 400,000 BTC on behalf of accredited investors and institutions in return for shares of GBTC, which trades over the counter in secondary markets.

As the bull run kicked off, Wall Street and mom and pop investors alike scrambled for bitcoin exposure. GBTC was one of the only ways to gain bitcoin exposure for many market participants, which caused shares to trade at a large premium to NAV (net asset value).

With this premium present, accredited and institutional investors could go to Grayscale with dollars or bitcoin and purchase GBTC shares at net asset value while the shares were trading on secondary markets at a large premium. The only catch was that shares were locked for six months, and as the trade became increasingly crowded, shares of GBTC (which historically always traded at a premium) began trading at a discount to NAV. This enacted a lot of pain on investors and funds partaking in a seemingly “risk-free” trade.

The reason we are highlighting this dynamic nearly a year later is that the recent performance of GBTC is highly indicative of the market conditions bitcoin finds itself in today. As the discount to NAV bled from -10% in late November to as low as -30%, GBTC and its approximately 646,000 bitcoin held in the trust began to weigh heavily on the market.

We can assume with a high degree of certainty that the same macro allocators who were indiscriminately dumping tech exposure, were also market selling shares of GBTC. Although no bitcoin can be released from the trust (aside from the automated 2% fee rolloff), the greater the discount to NAV that GBTC trades with, the more spot demand the product siphons from bitcoin itself.

For the time being, shares of GBTC look to present an attractive opportunity to buy bitcoin at a large discount for institutional investors or for exposure in traditional retirement accounts. It should be noted that shares of GBTC do not have the native properties that bitcoin itself carries (i.e., sovereign ownership, censorship resistance, global liquidity, etc.).

One should expect the GBTC discount to approach closer to NAV before significant price appreciation in bitcoin (the asset itself), due to the incentive the discount places to allocate to GBTC.

During bitcoin’s maturation process as a global asset, it has increasingly become correlated to equities and risk-on assets. As a response (and as a result of how investors view the asset), bitcoin price falls with higher periods of macro volatility. Spikes in market volatility as seen through the VIX, the Chicago Board Options Exchange's CBOE Volatility Index, emphasize the relationship between S&P 500 volatility and bitcoin price short term.

The most recent VIX spike reaching over 37 on the index over the last two weeks coincided with bitcoin’s correction down to approximately $33,000.

Going forward expect bitcoin to experience temporary weakness during risk-off periods in legacy markets, which can be viewed through the VIX.