This month, we’re releasing the monthly report across both PDF and Substack options. Click the “Read Now” button below to access the full report PDF.

If you have any issues viewing this report through e-mail or mobile, you can view the full report on Substack here.

PREPARED BY:

Dylan LeClair, Head of Market Research

Sam Rule, Lead Analyst

Summary:

Macroeconomic Backdrop

Equity Market Correlation

Treasury Market Yields

Eurodollar Futures and Rate Hike Probability

Military Escalation in Ukraine

Trade Wars, Currency Wars and Kinetic War

The Exorbitant Privilege

Eroding Trust Between Sovereigns

A Bifurcating Global Monetary Order

Bitcoin: Risk-On or Risk-Off Asset?

Bitcoin as a Monetary Commodity

On-Chain Market Dynamics

Supply Held, Last Active Supply

Reserve Risk

Bitcoin Derivatives

Perpetual Swaps Market

Quarterly Futures

Concluding Thoughts

Long-Term View

Reserve Currency

Macroeconomic Backdrop

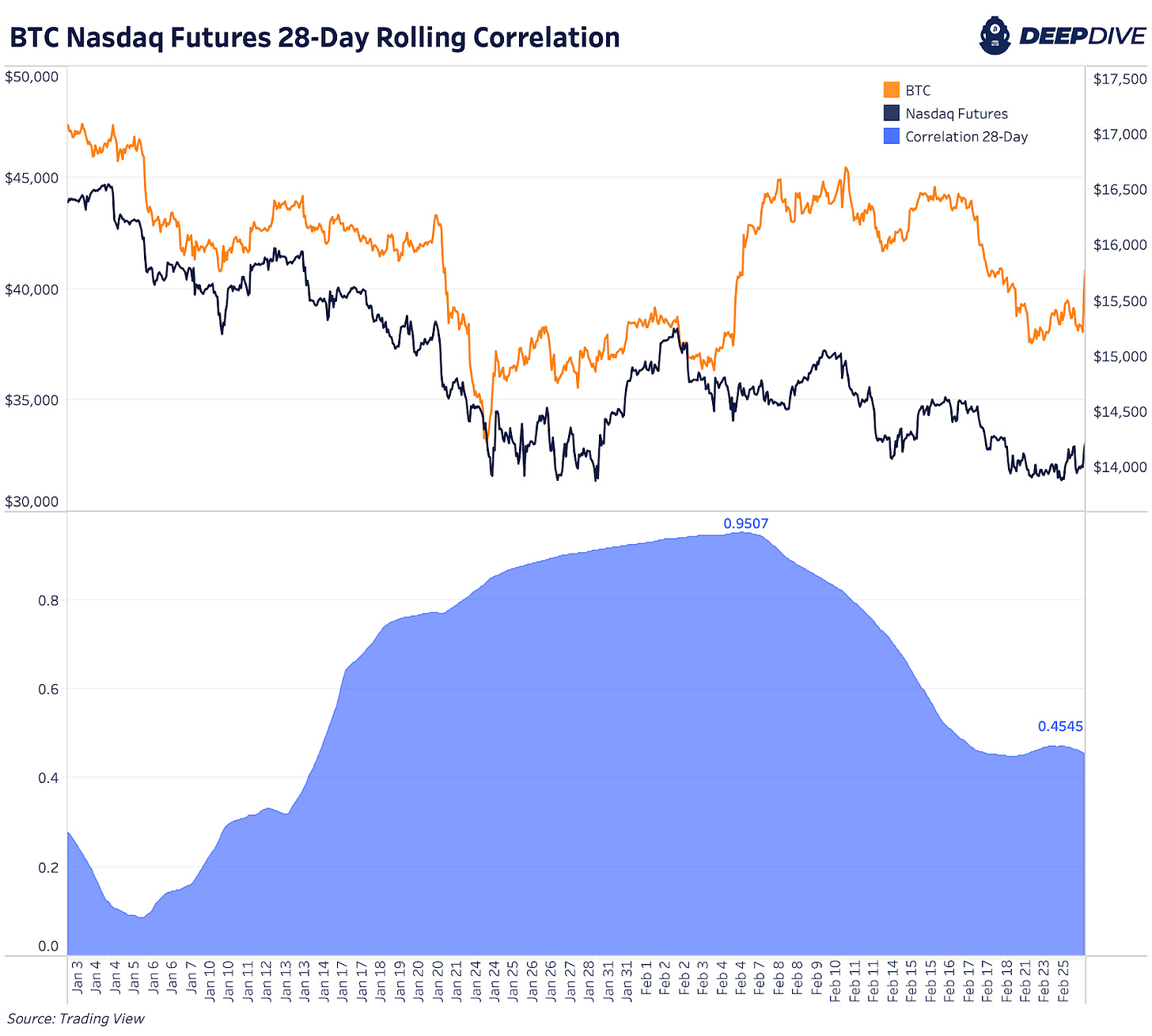

In our January 2022 Monthly Report, we covered bitcoin’s near 1:1 correlation with the Nasdaq over the previous four-week period, finishing the month with a correlation coefficient of 0.931. The relationship between the two asset classes reached a rolling four-week high of 0.95, before beginning to decouple as February progressed.

Bitcoin had been in a broad downtrend since November when Federal Reserve Chairman Jerome Powell announced the Fed’s policy shift toward taming inflation, due to the consumer price index hitting all-time highs. It wasn’t exactly the 40-year high in consumer price inflation that was the bearish catalyst for risk assets, but rather the reaction by the Federal Reserve Board and Chairman Powell that followed.

As the Fed merely signals that future hikes were in the cards, credit markets react swiftly and succinctly, with the short end of the treasury curve selling off leading to higher bond yields and flattening yield curve.

Eurodollar Futures, a futures market for the Fed Funds Rate, shows the steep advance in the market’s expectation for Fed rate hikes in 2022, leading into February, before sharply reversing course as markets teetered. The predicted Fed Funds rate for December 2022 reached as high as 2.11% on February 11 before the implicit Fed Put began to get priced into markets, with this figure now at 1.56% at the time of writing, nearly two full 25bp hikes.

The market now assigns the probability of two, full rate hikes in the upcoming March Federal Open Market Committee (FOMC) meeting at 0%, with a 3.13% chance that the Fed doesn’t even hike at all.

Military Escalation In Ukraine

The purpose of this section is not to predict the outcome of the escalating conflicts between Russian and Ukraine, and more broadly the measures taken by the North Atlantic Treaty Organization (NATO) countries against Russia as a result, but rather to probabilistically examine the potential scenarios and how one should look to position themselves financially. It also should be noted that this next section on geopolitical conflicts is not meant to serve as an in-depth history lesson, but rather to provide some context to the driving geopolitical forces impacting financial markets. While many analysts and financial market speculators are watching hour-by-hour updates of the escalation unfold, we prefer a wider view when assessing the current events.

A summarized form of the situation is as follows: Russia, the world’s third-largest oil producer and second-strongest military force invaded Kyiv, Ukraine, as Putin declared that Russia could not feel "safe” because of what he claimed was a constant threat from modern Ukraine due to the country’s increasing involvement with NATO.

Tensions between the two nations have been high since Ukraine declared itself independent of the Soviet Union in 1991 and moved to a market economy. In 2014, in what later became known as the Revolution of Dignity, the Ukrainian president and government was overthrown following a series of violent riots and protests, which led to the Russian invasion and Annexation of Crimea.

This is all to say that the current conflict between Russia and Ukraine is not something that developed seemingly overnight but that has been in the cards for decades. But why would Putin strike now, and what are the second order effects of the conflict?

It’s important to evaluate the specific battlefields in which this war is unfolding, of which the kinetic warfare occuring in Kyiv might be the least impactful.

Trade Wars, Currency Wars And Kinetic Wars

While all of the focus of the current military escalation occuring in Ukraine, the real war being fought by Putin is one of monetary and economic proportions. Over the last decade, Putin has made a deliberate decision to divest U.S. dollar holdings into alternatives like gold, the yuan and the euro. During the same period, he has verbally stated his disdain for the U.S. dollar and its role as the world reserve currency on multiple occasions.

In the summer of 2021, Putin said this of the dollar, “The US will regret using the dollar as a sanctions weapon … Russia's oil companies could stop using the currency which will harm the US dollar's global currency position.”

Putin also had this to say about the dollar and America’s exorbitant privilege as the issuer of the world reserve currency, “They are living beyond their means and shifting a part of the weight of their problems to the world economy.”

“They are living like parasites off the global economy and their monopoly of the dollar.”

What does Putin exactly mean when he is referring to the U.S. as “parasites off the global economy and their monopoly of the dollar”? What Putin is referring to is the United States’ twin deficit status, as a nation with both a current account deficit and a budget deficit.

A country with a current account deficit is an economy that imports more than it exports while also spending more than it generates in revenue (tax receipts). In theory, a country's trade balance and relative currency values work to find a natural equilibrium as countries that run a current account surplus (export more than it imports) find that their currency appreciates as money flows into their economy. Value is then stored in the strength and stability of the currency. But this dynamic decreases global competitiveness as labor and manufacturing seek to migrate to cheaper jurisdictions with weaker currencies, and hence lower production and labor costs.

Conversely, countries that run current account deficits in tandem with budget deficits will accrue debts to foreigners, leading to an increasing amount of foreign asset ownership and investment in the country. Ultimately, this leads to a far weaker currency, meaning diminished purchasing power in foreign markets but an increasing level of attractiveness in its labor and manufacturing markets.

This is, in theory, the self-correcting mechanism of trade balances and capital flows between nations, but the world doesn’t work based on theory.

Due to the Triffin dilemma, this self-correcting mechanism does not take place. The Triffin dilemma was a problem first identified by Belgian-American economist Robert Triffin, who pointed out that the country with the global reserve currency must be willing to supply the world with an extra supply of its currency to fulfill world demand for foreign exchange reserves, leading to a trade deficit.

However, unlike other economies, due to the reserve status nature of the currency (meaning international demand outside of the domestic economy), the currency (in this case the U.S. dollar) remains relatively strong, translating to poor competitiveness in global labor and manufacturing markets.

The Exorbitant Privilege

This exorbitant privilege is a term for a country that holds reserve currency status, in which it doesn’t face a balance of payment crises due to its imports being denominated in its own currency. This position held by the U.S. seemingly enabled the U.S. to “print” its dollars in exchange for other countries' physical commodities, like oil, and this was a great deal for all parties while foreign nations could receive a real return on their dollars in the form of U.S. Treasuries.

However, it is our belief that we have reached the end of the 40-year bull market in bonds for numerous reasons, with an expectation that creditors (bond holders) are in for a sustained period of negative real returns going forward. Displayed below is the yield on the 10-year U.S. Treasury subtracted by the year-over-year change in the consumer price index.

This makes it largely unattractive for foreign countries running a current account surplus (like Russia) to hold large amounts of dollars or Treasuries.

So why is Putin moving in now? In all likelihood, it’s because the global monetary order has never been more fragile. In our January Monthly Report, we covered our thesis on the state of the global economic environment and our view on a somewhat binary long-term outcome.

Following 40 years of lower years’ highs in interest rates in the dollar, which serves as the world reserve currency in a previously unprecedented global fiat experiment, the economic endgame is rather binary.

Either:

Deflationary Collapse, as an entire global economic system built upon credit unwinds and the fractionally reserved financial system becomes completely insolvent.

Perpetual Monetary Expansion, as the ever-growing pool of liabilities that are contractually obligated to be fulfilled meets a political system that can create money with a pen stroke, i.e., if the proverbial can can be kicked, it will be.

Taking a look at today’s financial landscape, inflation is at four-decade highs, the Fed Funds Rate is still at the zero lower bound, equity and credit market volatility have picked up in a major way, a broad basket of commodities are ripping to new highs daily and the Atlanta Fed is now forecasting 0% real GDP growth in Q1 of 2022.

Shown below is the S&P 500 (SPX) and its corresponding market volatility index (VIX), with the market making it very clear that we are in a new regime of higher market volatility.

Central banks are trapped.

A key input in the inflation equation in the global economy is the price of energy, which is going parabolic into a weakening domestic and global economy. This also is one of the key points of leverage for Putin and Russia, who produce approximately 11% of the world’s oil supply.

Rising energy costs yield higher input costs for producers, lower consumption and slower economic growth. Putin’s Russia also produces approximately 40% of Europe’s natural gas supply, which accounts for about 25% of Europe’s energy supply in total. This gives Putin and Russia a massive amount of economic leverage.

So, it is obvious Putin has tremendous leverage over the West due to Russia’s energy exports alone. If Russia decides to cut the West off of its energy exports, or merely slows the flow, inflation explodes. This is a horrible development for trapped bond markets, nevermind the millions of Europeans that would face an energy shortage as a result.

A potential for a huge spike in inflation to rise above current levels leaves few good options for Western policy makers:

Nominally default on sovereign debt as parabolic energy costs spirals western economies into recession, lowering tax receipts for historically over-indebted sovereigns.

Increasing central bank debt monetization and balance sheet expansion during an inflationary environment in a slowing economy.

For a Central bank, both are poison pills.

Eroding Trust Between Sovereigns

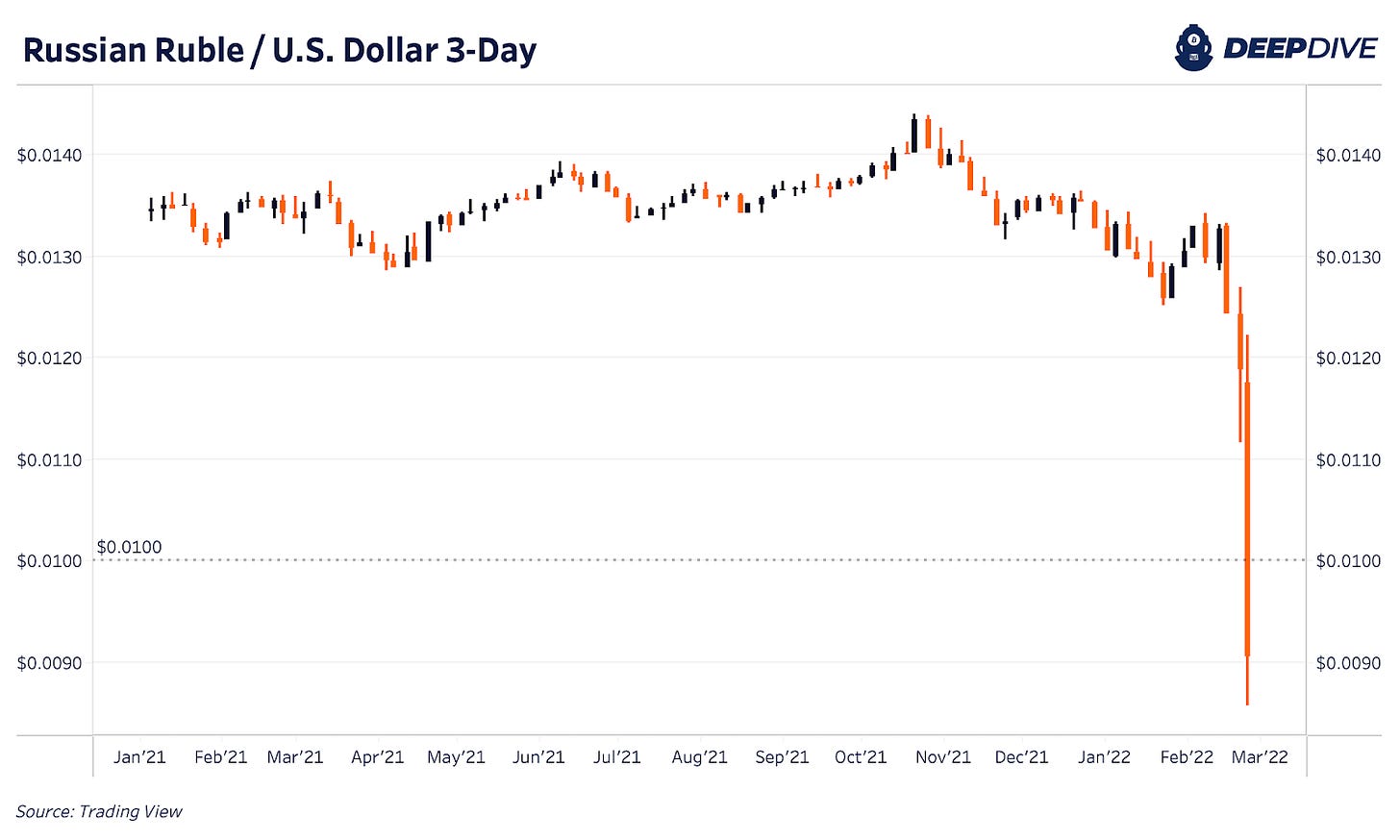

Following Russia’s invasion of Ukraine, G7 nations quickly moved to freeze Russia’s foreign reserve assets. In response to the sanctions by G7 nations, the Russian ruble and Russian equity markets plunged in value.

While this move wasn’t entirely unexpected, it was yet another sign of rapidly eroding trust and a fractured monetary world order, sending a bold message to the world, and China in particular.

The move essentially told all sovereign nations, but especially China, “Your foreign exchange reserves might not be yours if you make a wrong step.”

The reality of having their foreign exchange reserves sanctioned, although not realized until this past week, no doubt played a large role in Russia’s strategy of stockpiling thousands of tons of gold at the expense of Treasuries during the 2010s.

A Bifurcating Global Monetary Order

The largest takeaway from this geopolitical strife, regardless of the outcome of the war, is that the unilateral global monetary order that has been in place for the last five decades has begun to fracture in a major way. The biggest flex of power that has taken place over the last week has not been the weaponization of tanks or fighter jets in Eastern Europe, but rather the weaponization of ones and zeros that has taken place in regards to sovereign foreign exchange reserves.

Not your ledger, not your money.

“The root problem with conventional currency is all the trust that's required to make it work … but the history of fiat currencies is full of breaches of that trust.” — Satoshi Nakamoto

Foreign exchange reserves are the liability of someone else, and in the event that your counterparty is your adversary, cooperation quickly breaks down. This makes the calculation of holding dollar debt even more complex if you are China, as debt is not only presenting return free risk in real terms, but the counterparty risk that arises from geopolitical power games makes the calculus even less attractive.

Fewer buyers of U.S. debt leaves the Fed increasingly on the hook for monetizing a greater percentage of U.S. debt, a trend that has been developing since the Great Financial Crisis.

While Russia nor any sovereign nation besides El Salvador has embraced bitcoin as a reserve asset, the case for an absolutely scarce digital bearer asset with no counterparty risk has never been stronger. While the geopolitical chess match is being played between Russia and NATO countries, it would be wise to observe the following trends from a long-term perspective:

Sovereign debt has become a liability in terms of its claims on real purchasing power into the future at the same time that international trust has quickly eroded.

Fiat debt instruments are the liability of the creditor; scarce monetary bearer assets fix this.

This observation is not from an anti-American perspective (actually far from it), but rather an objective one on where the international monetary order stands. The game theory no longer points to cooperation between sovereigns, and thus dollar global hegemony looks to be on the decline.

In terms of scarce monetary bearer assets, there are really only two choices: bitcoin and gold.

We believe the performance of the two assets since the start of COVID-19 speak for themselves. One asset runs on open-source software, perpetually growing more useful and liquid as the network entrenches itself across global jurisdictions and in the hearts and minds of individuals everywhere.

The other is a shiny rock that has become demonetized gradually over the last century in favor of fiat debt instruments, equities, real estate and now bitcoin as stores of monetary value.

Even if one made the claim that bitcoin was “far too volatile” to be adopted as a currency or reserve asset, in volatility-adjusted terms, it has outperformed all three of the Nasdaq (IXIC), gold (GLD), and long-dated treasuries (TLT) over the past four-year period.

Bitcoin: Risk-On Or Risk-Off Asset?

We believe that bitcoin has mainly two types of capital market allocators.

The first type of allocator treats bitcoin purely as a “risk-on” asset, using it’s absolutely scarce properties to ride the high tides of central bank liquidity flows and monetary debasement. However, this class of investors is among the first to sell during the first sign of monetary easing or even decelerating easing by central banks.

The second type of allocator is buying bitcoin because it is a superior monetary asset altogether. This type of allocator often completely disregards the quoted exchange rate of their respective local fiat currency and focuses on increasing their share of the ultimate 21,000,000 supply cap.

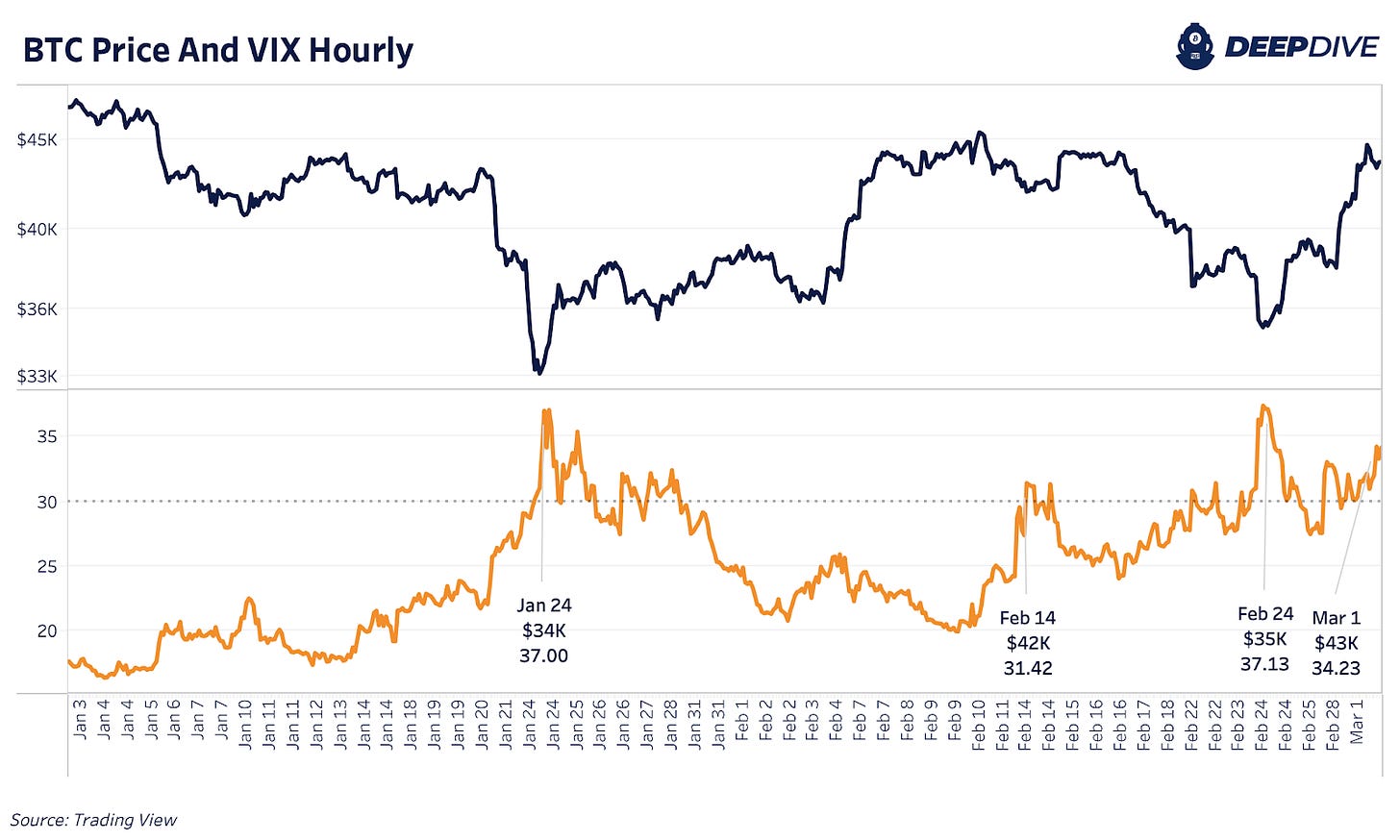

During periods of elevated volatility and risk-off sentiment in capital markets, our view is capital flows from the first type of allocator to the second, eventually leading to an ultimate recovery where bitcoin emerges stronger than ever.

March 2020 and February 2022 are two key moments where this occurred in our view.

Bitcoin As A Monetary Commodity

As we have dedicated much of this monthly report to the discussion of energy and commodities production, we would be doing a disservice to not highlight the commodity-like nature of bitcoin.

Bitcoin, like gold or oil, has a production cost, with units able to be brought to market through the expenditure of energy through purpose-built hashing devices called miners. Due to the asymptotic supply issuance of bitcoin combined with the difficulty adjustment, it has become exponentially harder to marginally produce a unit of bitcoin for over a decade. The chart below shows the hash price (miner revenue divided by hash rate) of bitcoin in both dollars and bitcoin since 2011 in logarithmic scale.

Bitcoin’s difficulty adjustment is the equivalent of a world where oil becomes incrementally harder to produce with every new source of production that comes online. The chart below shows hash price since the start of 2020 in linear scale.

What does this all mean? It has become exponentially harder to produce bitcoin with a marginal unit of hashing (computational power), which obviously requires energy to execute. Lastly, unlike gold, which can be thought of as the monetary predecessor of bitcoin, bitcoin has its own settlement network directly built into the system.

Total change-adjusted transfer volume across the Bitcoin network over the last month was an impressive $963 billion.

As the dollar (and other currency rails) become increasingly weaponized, the need has arisen for an immutable settlement network of value across the internet. Bitcoin, comparable to the advent of the internet or electricity, is neither explicitly good nor bad, but rather a neutral tool for humans to use to scale trade and the transfer of value. This is similar to how the internet scaled the transfer of information and electricity scaled the transfer of energy.

“In this paper, we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions. The system is secure as long as honest nodes collectively control more CPU proof-of-worker than any cooperating group of attacker nodes.” — Satoshi Nakamoto

On-Chain Market Dynamics

Our view over the last quarter has been that the on-chain dynamics supply side dynamics were looking strong, but it was the lack of marginal buyers in the market that kept bitcoin from performing in a strong manner. In our January Monthly Report, we highlighted the various risk-off indicators that were flashing in legacy markets, and how bitcoin was likely to face headwinds during periods of declining liquidity and increasing market volatility.

However, the beauty of the bitcoin market and the asset’s absolutely scarce supply profile makes for interesting periods of outperformance. To quote from our previous monthly report, “It is important to understand that the price of bitcoin rises when the marginal seller is exhausted … and we can see the supply side of the equation with complete transparency in bitcoin.”

While investors in the credit and equities market indiscriminately risked off with fears of monetary tightening, convicted Bitcoiners stepped in to catch a falling knife with bitcoin more than 50% off its all-time highs.

The reality is with just 15.5% of circulating supply having moved over the last three months, the free float of coins on the market is quite slim. Once indiscriminate selling by quant funds and correlation traders had eased up, bitcoin was in the hands of players who better understood the asset they’re holding.

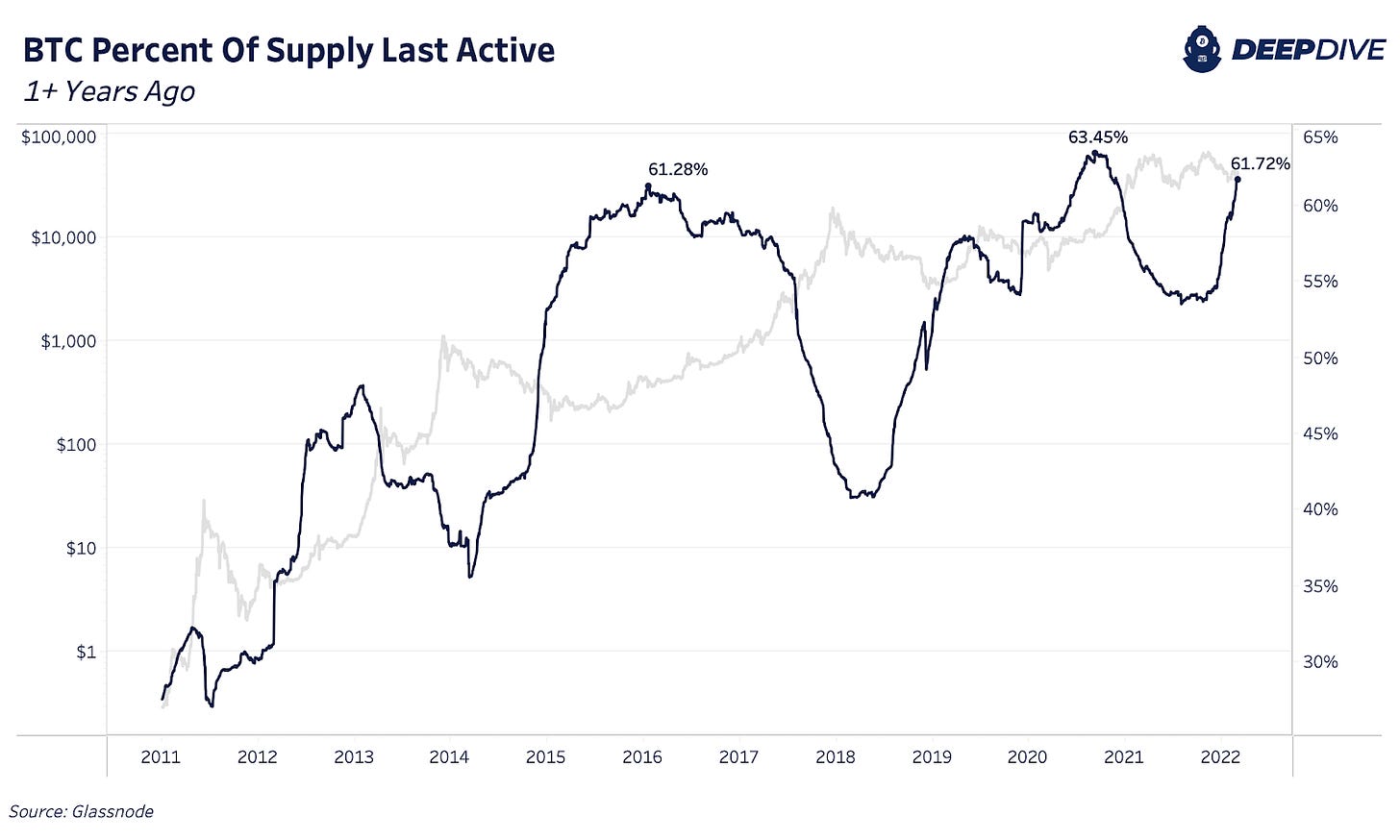

Similarly, the percentage of the bitcoin circulating supply that hasn’t moved in over one year is close to all-time highs at 61.7%. Remember, this is during a period where bitcoin experienced a 50% drawdown followed by a rally over 100% and then another subsequent drawdown.

Most holders of bitcoin have extreme conviction in the asset. They are unable to be shaken out of their position.

A metric that we love to evaluate in terms or asymmetric risk/reward opportunity is reserve risk. Reserve risk is a cyclical market indicator which aims to quantify the risk/reward of allocating to bitcoin based on the conviction of long-term holders. Simply, reserve risk is a ratio between the current price of bitcoin and the conviction of long-term holders. The current price can be thought of as the incentive to sell and the conviction of long-term holders/investors can be quantified as the opportunity cost of not selling.

For an in-depth review of reserve risk, read more here.

Currently, reserve risk is in our max opportunity threshold, as the quantification of conviction by the holder as a visualized on-chain trend is extremely strong at the same time that price is well below its all-time highs

We view this as an asymmetric opportunity for buyers, nevermind the recent developments in the macroeconomic landscape.

Bitcoin Derivatives

With our outlook on the geopolitical and macroeconomics shown above, let’s dive into the state of the bitcoin derivatives market and see what’s occurring under the surface. The following explanation below is directly from January's monthly report, but we found it useful to carry the explanation over to this issue for explanations and simplicity's sake.

The bitcoin futures and derivatives market are important to understand on a short- to medium-term time frame. Dislocations in these markets naturally clear over the long term often through excessive volatility (to the upside or downside).

In bitcoin futures markets, there can never be more shorts than longs, it is always a 1:1 relationship, but the positioning of these contracts can tell us a lot about the state of the market.

The two distinct types of futures contracts are perpetual swaps and quarterly futures. We will first examine the perpetual swap futures market, as it is the largest and most liquid segment of the bitcoin futures market.

Perpetual Swaps Market

The story since November 2021 has been the relative unwind in long-biased leverage due to the risk-off environment in legacy markets. The funding rate for perpetual swaps, which is used as an economic incentive to keep prices close to that of the underlying spot market went negative for sustained periods of time during the month of February. This means that investors were becoming overly protective to the downside in the derivatives market.

This type of bearish positioning can lead to short squeezes if the price moves right. Derivative markets often exacerbate price moves to the upside and downside to the forces of sentiment and greed within investors, and the market often takes the path of most pain in regards to these speculators.

Below is the funding rate in the perpetual swaps market since 2020 overlaid on price.

Quarterly Futures

There are also the monthly and quarterly futures contracts, which operate similarly to how traditional futures markets operate. We can look at the basis between the spot market and front month futures to evaluate the level of speculative activity in the market.

Since the summer of 2021, there was a very strong correlation between the annualized basis present in the futures market and the bitcoin price, showing that a large amount of the price action was driven by speculation and long-biased leverage, which was in part driven by the narrative of a bitcoin futures ETF being approved in October.

Shown below is the weekly average of funding rates in the perpetual swap market and the three-month forward futures basis annualized to give readers a visual of the relative levels of speculation.

A main takeaway is that, although bitcoin has traded at and above the current price level before (currently $44,000 at the time of writing), it has never looked this strong in terms of relative levels of long-biased derivative positioning being this low.

This is a spot market led rally.

Concluding Thoughts

Our view remains completely unchanged in regards to the long-term prospects of bitcoin. Bitcoin is the world’s first absolutely scarce monetary asset, and due to its immutable properties coupled with immaculate conception, we view the ongoing monetization process of the asset as a game theoretic inevitability.

The recent geopolitical tensions and macroeconomic weakness only strengthen our conviction in this belief.

Sidenote: As we were concluding this monthly report, Chairman of the Federal Reserve Jerome Powell was quoted as saying it is “possible to have more than one reserve currency.”

We agree.

Maybe Powell was orange-pilled by some witty Bitcoiner in his family, and he was thinking about bitcoin when he said that.