The Deep Dive Monthly Report, September 2021

This report is a free public release of The Deep Dive's September Monthly Report. The Deep Dive is a Bitcoin Magazine premium market newsletter that delivers content directly to your inbox 20 times a month on bitcoin on-chain analytics, derivative markets, and global macroeconomics.

To become a subscriber to The Deep Dive, use discount code: BULLMARKET for 80% off the first 6 months, for a limited time only.

PREPARED BY:

Dylan LeClair, Head of Market Research

Sam Rule, Lead Analyst

Summary:

On-Chain Analysis

Liquid Supply Change

HODLer Behavior

Balance on Exchanges

Derivatives

Annualized Rolling Basis

Funding Rate

Estimated Leverage Ratio

Bitcoin Mining

Hash Rate Recovery

Difficulty Adjustment

Miner Daily Revenue

Macro Environment

Evergrande, China Debt/GDP

CPI Climbs Higher, Inflation

United States Must Print, Debt/GDP

Bonds, Negative Yields

On-Chain Analysis

“It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self fulfilling prophecy.” - Satoshi Nakamoto

As many know, bitcoin is the most transparent monetary technology the world has ever seen. With a completely transparent ledger, everyone has access to view and analyze the capital flows occurring, and unsurprisingly this data can offer great insight as to what is happening in the bitcoin market. Currently, what can be seen is the rise of the world's first perfected monetary network, gradually then suddenly entrenching itself around the world.

Let's dive in.

Starting with liquid supply, the trend is clear: the bitcoin market changed in March 2020. As a measure of an entity's liquidity, L is the ratio of the cumulative outflows and cumulative inflows over the entity's lifespan. Liquid and highly-liquid supply, which are defined as entities with L greater than or equal to 0.25 but less than 0.75, and L greater than or equal to 0.75 respectively, sharply reversed trend 18 months ago. Since then, the supply of liquid/highly-liquid bitcoin has decreased by 640,449 BTC, even with overall circulating supply increasing by 559,056 BTC during the same time period. For more information about quantifying bitcoin’s liquidity click here.

Simply, the last 18 months has seen the largest accumulation period in the history of bitcoin.

Another visualization of this trend is liquid supply change, which shows the net 30-day change in liquid supply. Although we saw a large reversal in May, with 276,106 BTC moving from illiquid to liquid entities, what followed has been a massive reaccumulation, with the current month-over-month figure at minus 104,707 BTC. Despite price consolidation, the smart money is accumulating hand over fist.

Many traditional investors or mainstream media financial reporters love to ask or commentate why the bitcoin price is rising or falling on a certain day, and the funny thing is it often has precisely zero to do with whatever narrative is being parroted. But why?

The bitcoin market is globally liquid, and not only is there a robust spot market, but also a derivatives market with products offered on many exchanges that offer up to 100x leverage; which is to say that oftentimes the “news driven events” have exactly nothing to do with the news of the day.

In reality, the long term price is set by the stackers and hodlers, and nothing else. Oftentimes “news events” result in a short bump in price but fizzle out quickly because the underlying supply has already been absorbed by the participant/s announcing the news (i.e., the news is already “priced in”).

For the last six years especially, what truly has driven bitcoin market cycles have been long-term holders, and we can see this explicitly in the data below.

Before every parabolic advance since 2015, the amount of bitcoin held by short-term holders touched a low of 20% of circulating supply, as coins traded hands between short-term speculators and long-term, convicted investors. This can be observed by looking at the transparent purple accumulation zones.

It is simple: HODLers and stackers set the floor, and it would look as if the new “floor” is actively being set at $40,000. Some perspective is needed when $40,000 is 300% higher than where the price was trading just a year ago!

Yet another metric showing the historic bitcoin supply squeeze underway is the under-three month HODL waves, as 84.87% of bitcoin have not moved in over three months, which is the highest reading in the history of the bitcoin network. The theme of this report in regards to on-chain metrics is quite clear, but we will continue to bang the point home.

Supply Squeeze: The next wave of large capital allocators (Wall Street, corporate treasurers, sovereign wealth funds, insurance asset managers, etc.) to enter the market will be unpleasantly surprised to realize that they cannot secure an adequate position without moving the market immensely to the upside.

Further, when taking a look at the total bitcoin balance on exchanges as of September 29, 2021, there is the least amount of bitcoin available on exchanges in over three years, dating all the way back to August 25, 2018, with 2,457,418 BTC available.

While still quite a significant figure, accounting for 13.05% of the circulating supply, the bitcoin balance on exchanges is yet another supply-side metric that made a sharp trend reversal in March 2020, and all signs point to this downtrend continuing into the future.

Additionally, when analyzing the non-exchange and illiquid supply percentages since March 2020, we see quite the striking correlation. While this relationship was not strong before March 2020, the trend reversals in both liquid supply and balance on exchanges was a result of the unprecedented monetary and fiscal easing that occurred on a global scale and changed the global macroeconomic landscape for good; this has served as absolute rocket fuel for bitcoin, and thus the correlation between the percentages and price hold great significance. We covered the correlation between non-exchange bitcoin supply and the bitcoin price over the last 18 months in The Daily Dive #046 - Bitcoin Poised For Next Leg Up.

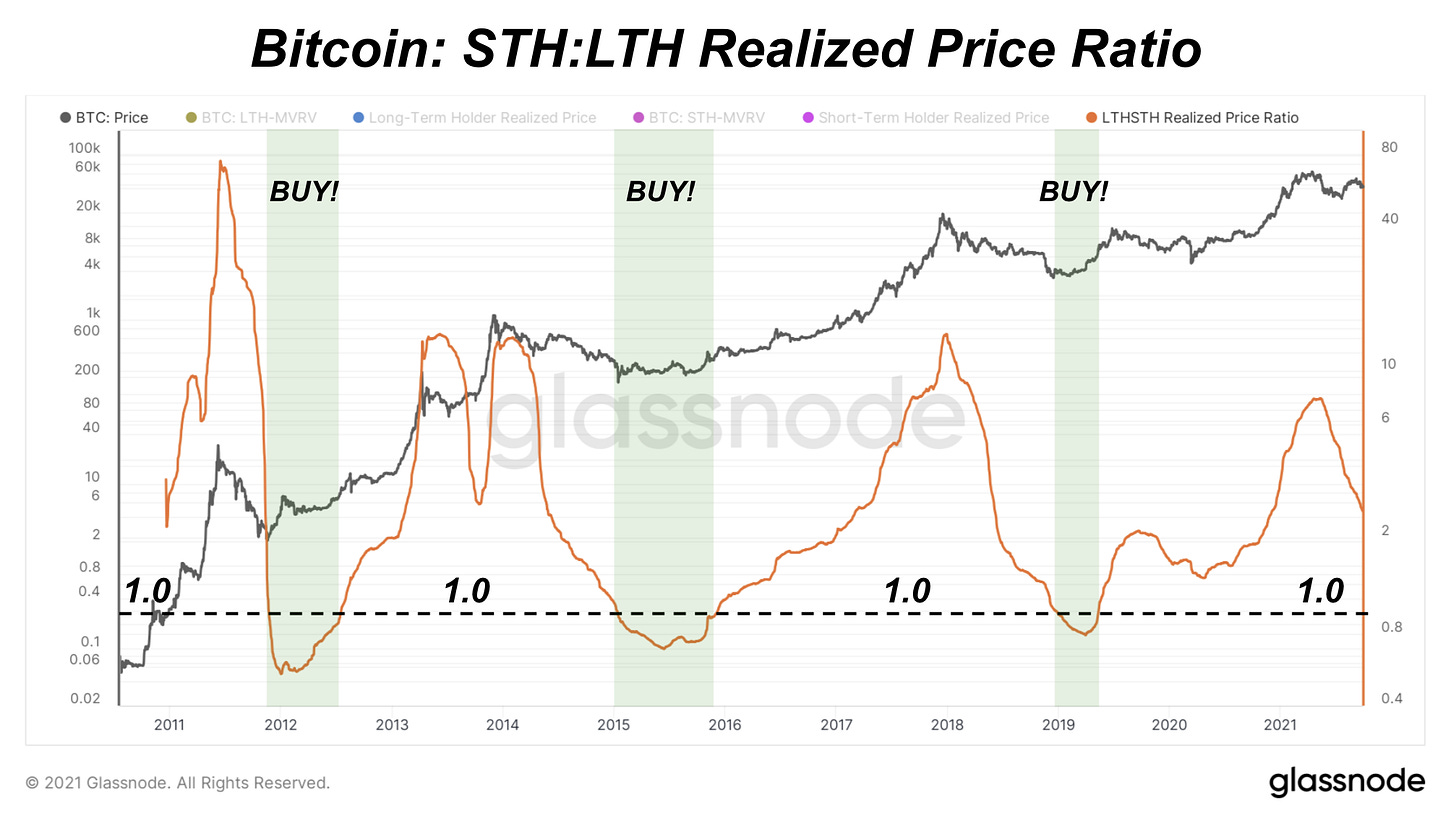

Lastly, we have the short-term:long-term holder realized price ratio, which gives a ratio of the average cost basis of two classes of bitcoin investors. The higher the STH:LTH realized price ratio goes, the more overheated the bitcoin market becomes, which makes the developments occurring in the market today extremely encouraging. With long-term holder cost basis rising steadily while short-term holder cost basis has begun to fall, the bitcoin price has a long way to run in 2022. For a more in depth analysis of the STH:LTH realized price ratio, make sure to read The Daily Dive #070 - Short-Term:Long-Term Cost Basis Ratio.

Bitcoin Derivatives Market

The bitcoin derivatives market is one of the least understood aspects of the market, especially for those stuck in legacy financial markets. Bitcoin derivatives are a way of directional betting, or rather speculating as to where the price will go in the future. There are various types of bitcoin derivatives, such as quarterly futures, monthly futures, perpetual futures, and options to name a few. What all of these have in common is that the value of the contracts are derived from the underlying spot bitcoin market.

Oftentimes, when you look at the bitcoin chart and see a vertical line in one direction or another, it is a result of a dislocation in the derivatives market that is correcting. As an example of what is possible with bitcoin derivatives, if you have 1 BTC and wish to enter a position with 10 BTC of buying power, you can employ 10x leverage, but with a 10% move in the wrong direction you are completely wiped out - or formally, liquidated.

Among the most popular types of bitcoin derivatives is the “futures perpetual swap.” The futures perpetual swap is a derivative contract native to the bitcoin/crypto markets, which took the legacy commodity futures contract, but simply extended it into perpetuity.

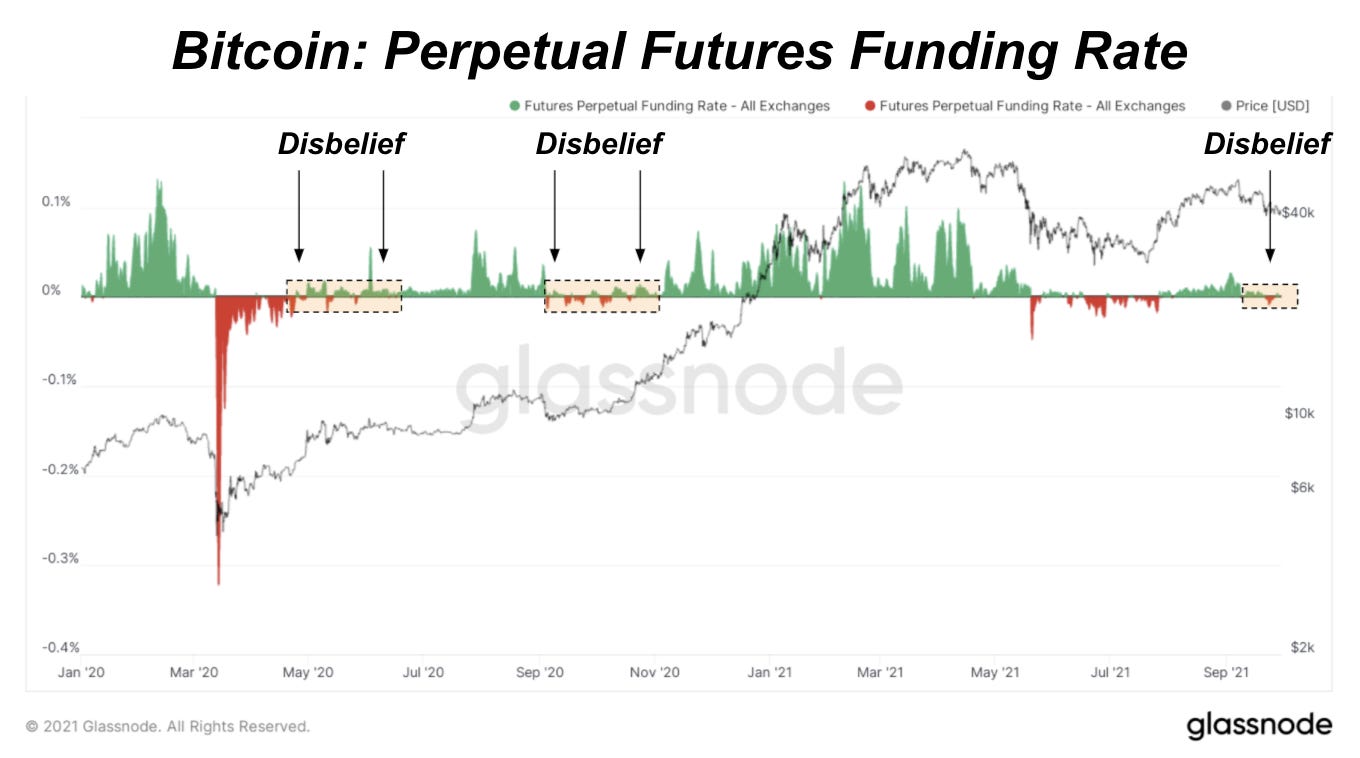

But the catch with the perpetual futures contract is that to ensure that the value stayed close to the value of the spot market, a funding rate was introduced, which resets every eight hours on most derivatives exchanges. If the perpetual swap contract is trading higher than the spot market index, then the funding rate will be positive, which means that traders who want to long (i.e., because they are bullish) have to pay traders on the short side (who are bearish) a percentage of their notional position size. Thus, if we look at funding rates over time, we can see what the derivative market bias is at the time.

It is important to note that with all else being equal, funding is usually slightly positive, as traders generally hold a bullish bias on the best-performing asset in human history.

When looking at the market today, it can be seen that funding is flipping back-and-forth between slightly positive and negative, which is a far different story than the first time bitcoin was trading at today’s levels. This lines up with our belief that the bitcoin price is being supported by large spot market demand, which is far more ideal than excessive leverage driving price action, which can leave the market exposed to large drawdowns and liquidations, similar to what occurred in May.

We can also look at the futures-annualized rolling basis which measures the annualized yield that can be acquired by buying spot bitcoin and simultaneously selling a futures contract. In this case, it uses a three-month interval. Early in 2021, bitcoin’s “contango” was the talk of the market, and many in the legacy financial system began to take major notice, including J.P. Morgan, who released an in-depth report covering the dynamic in April.

As it turns out, the report and the flurry of Wall Street interest came right at the exact top, and the leverage-fueled futures curve bid collapsed shortly thereafter. Paradoxically, the futures basis did not collapse due to Wall Street arbitrage like many predicted, but collapsed due to the lack of spot bid to support the immensely leveraged bulls betting on further advance.

Many would have expected Wall Street to effectively “squash the curve” by arbitraging the delta-neutral (risk-free) trade away by selling futures and buying spot until the yield no longer existed if the street had a reliable spot instrument to allocate or a bitcoin-settled derivatives exchange, but the reality was U.S. public capital markets had, and still have, neither.

What unfolded instead was that essentially the crypto markets “ran out” of new money on the spot side of the bid to support such high leverage on the long side of the derivatives market, and the basis trade collapsed. Now, with the annualized basis for the three-month contract at a mere 6.9%, the mania seems to have all but disappeared, with price reflecting strong spot bitcoin demand.

Using the futures-estimated leverage ratio, which aggregates the total open interest in futures contracts on derivatives exchanges and the corresponding balance of bitcoin on said exchanges into a simple ratio, one can visualize the liquidations that occur on both the long and short side.

With leverage in the bitcoin market, it is almost always stairs on the way up, and elevator on the way down, not in terms of price but rather the leverage ratio. The highlighted zones are the liquidations that occur in the derivatives market when the spot market doesn’t agree with the leveraged-directional bets. This is almost always what is happening under the surface whenever you look at the price of bitcoin trading around 10% (or any significant volatility spike) in a very short period of time. This is natural and healthy, and in the interim, volatility is the function of natural price discovery.

In The Daily Dive #028 - Structural Changes To BTC Derivatives Market, we extensively covered the change in the derivatives market since the local top in April. In short, the increasing amount of stablecoin-collateralized futures contracts instead of bitcoin-collateralized left the market far less susceptible to large liquidation on the long side, due the negative convexity associated with being leveraged long bitcoin, collateralized with bitcoin.

It should be warned that for 99% of people with exposure to bitcoin, simple recurring accumulation of the asset and HODLing is sufficient, and holds the highest expected value. Speculating with leverage and in volatility through options is a losing game when the expected value of holding the bearer asset itself during the initial monetization process of the asset is still so lucrative.

With that being said, with the futures basis at such muted levels, and leverage as a whole relatively low in the bitcoin market, it could be an attractive option for many to borrow at laughably low rates in the legacy financial markets for duration to buy and hold bitcoin.

The smartest and most prudent capital allocators have already been executing this strategy for some time now, as we have covered numerous times, such as in The Daily Dive #005 - Writing The Corporate Bitcoin Accumulation Playbook. It must be reiterated that you should NEVER be put in a position where you could lose everything due to a volatility spike.

You can never be liquidated while holding your own keys with your sats in cold storage.

Bitcoin Mining

Network Resilience

This year, with the Chinese mining exodus, we’ve witnessed the largest global stress test to the bitcoin mining network in history. Accompanied with the network's biggest downward difficulty adjustment of 28%, everyone was watching this historical moment to see how resilient the network really was. If bitcoin is to compete as a global monetary network, it must be able to absorb market shocks of this magnitude, while sustaining hash rate long term. That’s exactly what the network proved it can do.

As a response to this test, the hash rate of the network continues to climb at an exceptional recovery rate hitting over 140 TH/S in less than three months from the July 2021 lows. The network experienced zero downtime as significant hash power reallocated around the world.

As a response to the hash recovery, we saw five increased difficulty adjustments in a row totalling 38.94% with a single 13.24% upwards move this month, one of the steepest increases in bitcoin’s history. Even amidst semiconductor chip shortages and lack of hosted mining capacity available, this was (and continues to be) a robust response showcasing the innovative, decentralized engineering solutions and incentive mechanisms of the protocol.

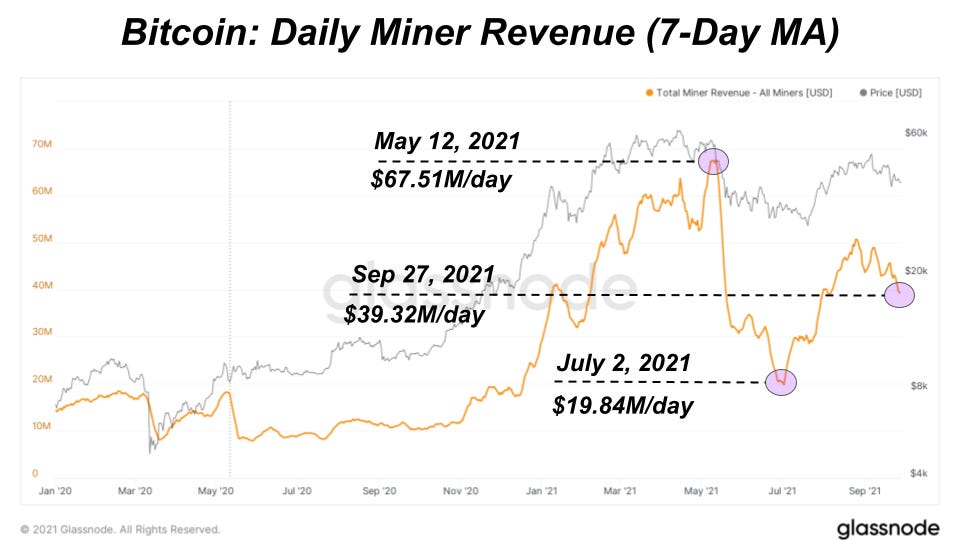

Miners are now generating $39.32M per day which puts bitcoin mining at a $14 billion-plus-per-year industry. Previously covered (and mentioned below), we’ve seen exceptional 140% average year-to-date growth across North American publicly-traded miners signalling positive, growing investor demand for an industry in its nascent stages.

At the same time, we’ve seen bitcoin miners continue their plans for rapidly scaling up production through 2022 with deeper commitments to HODLing more bitcoin signaling that more healthy hash rate growth is just getting started. The massive 3.4x swings in mining revenue-per-day opportunity seems to have little effect on the market. If anything, the events that played out this summer strengthened the network significantly, with weak operations liquidating, in a process that can be thought of similar to derivative market liquidations. Only the strongest and most well-run operations will remain in the most competitive market in the world.

In The Daily Dive #061 - Mining Industry Overview, we covered the massive increase in miner revenue on a per hash basis since the summer of 2020, and how this was serving as additional upwards momentum for price due to the lack of sell pressure that comes with increased miner profitability. We still believe that this is the case, and we encourage readers to head back to the industry overview for further context and analysis.

Macro Environment

Evergrande

The macro conversation of the month has been on the topic of China Evergrande Group’s collapse and whether it’s another Lehman Brothers-style moment in history. As for global market impacts, we haven’t seen that level of impact yet. We covered the immediate, short-term global market impact in The Daily Dive #063 - Evergrande Sparks Sell-Off.

Structurally, Evergrande is a state-run enterprise borrowing from state-owned banks for building real estate specifically in China so this looks to limit the impact to the Chinese economy and property sector for now. If the entire property sector and construction industry slows for a prolonged period, that would be a major concern.

To deal with the crisis and increased demand for liquidity, People’s Bank of China injected 460 billion yuan ($71 billion) of short-term cash into the banking system.

At the same time, we’ve seen the Chinese government ask state-backed firms to buy Evergrande assets so they can pay off debts. Just this week, we’ve seen a Chinese state-owned enterprise step in to take on Evergrande’s $1.5 billion stake in another bank while Guangzhou City Construction Investment Group is close to acquiring Evergrande's Guangzhou FC Soccer stadium for $1.9 billion. All this points to a state-influenced rescue of Evergrande rather than a direct bailout.

The Chinese Communist Party has made it increasingly clear that their renewed goal of “common prosperity” will not allow wealth and capitalist influencers to have a larger impact on the population. Directly bailing out the second-largest property developer in the country during a red-hot housing market with runaway prices, already under government scrutiny, would be sending the wrong message.

On top of Evergrande, China is now rationing electricity to domestic and industrial users caused by coal shortages. This will likely have a more short-term direct global impact as manufacturing hubs face outages and capacity constraints slowing down supply chains even further.

Regardless of the potential impact that we will see play out in the coming months, what Evergrande reflects is a symptom of a larger issue, an overindebted sovereign nation economic model chasing high growth at all costs through increased debt issuance in the face of declining future gross domestic product growth. China’s total debt-to-GDP ratio has risen from 172% since 2008 to over 300%.

“Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.” - Satoshi Nakamoto

CPI Climbs Higher

In the latest September Federal Open Market Committee meeting, Jerome Powell and the Federal Reserve announced a likely taper and tightening of monetary policy to start in November. This comes directly after the biggest yearly percentage change in the Consumer Price Index in the last two months that we’ve seen since 2008. They went to turn up their inflation dial a little bit, but may have hit the “on” switch instead.

The narrative told to the market remains “transitory,” highlighting pandemic supply-chain bottlenecks as the main cause which do have merit. But with supply-chain bottlenecks, Evergrande risks popping up, and an energy crisis unfolding with surging prices, there are external factors out of the Fed’s control when it comes to controlling inflation in a globally-connected market.

We also can’t forget that we are in uncharted territory when it comes to the inflation tactics being deployed. What we saw over the last two years for the first time is helicopter-money-through-fiscal-policy stimulus checks, while interest rates were purposefully being held at their lowest levels through monetary policy.

This is directly out of the playbook from a published 2019 Blackrock Institute paper, Dealing With The Next Downturn: From Unconventional Monetary Policy To Unprecedented Policy Coordination.

The paper was authored by Stanley Fischer and others. Fischer is a former Vice Chair of the Federal Reserve, former Governor of the Bank of Israel and Ben Bernanke’s mentor.

The paper outlines an economic framework for dealing with the next downturn in unprecedented ways. It articulates the challenges of trying to produce just enough inflation without overdoing it:

“That highlights the main drawback of helicopter money: how to get the inflation genie back in the bottle once it has been released. As noted above, history is littered with examples of how central bank money printing leads to runaway inflation or hyperinflation. Yet there is little experience in using helicopter money to generate just-enough inflation to achieve price stability. History as well as theory suggests large-scale injections of money are simply not a tool that can be fine-tuned for a modest increase in inflation.”

The assumption that we can still manage inflation at reasonable levels in the current market conditions with this specific prescription of coordinated monetary and fiscal policy, without risking runaway inflation, is not one we would make.

United States Must Print

When we zoom out, we know that the bigger goal is still to try and inflate away the United States’ 130% debt-to-GDP problem through implicit default. Without a miracle enhancement to economic productivity, we don’t have the means to pay off this level of debt.

We’ve hammered the point home many times that the United States can only solve its sovereign debt crisis by printing more money. Cutting back spending is an option but politically, it will be near impossible for Congress to cut back spending on our largest federal obligations across Social Security, Medicare, Medicaid and U.S. military spending.

These obligations and debt interest payments together already make up 106% of estimated 2020 annual federal tax revenues. In fact, we only expect them to further exceed tax revenues with a 6.2% Social Security cost-of-living adjustment expected to come in 2022, a Department of Defense budget increased by 1.6% this year and Medicare spending that is expected to grow 65% by the end of the decade. It’s likely the exact reason that Janet Yellen has identified $7 trillion in uncollected taxes.

At the same time, the government has signaled many times to the market that it will do whatever is necessary to avoid explicitly defaulting on the debt that finances the spending.

Now knowing what’s in store for us when it comes to projected government spending, let’s revisit what having a 130% government debt-to-GDP ratio means for the future.

We can do that by looking at the examples of the past. Using Ray Dalio’s long-term debt cycle framework covered in the Deep Dive July Monthly Report as a base foundation, we can supplement that with a historic study of government default by Hirschman Capital.

“A study by Hirschman Capital shows that out of 51 cases of government debt breaking above 130% of GDP since 1800, 50 governments have defaulted. The only exception, so far, is Japan.”

This study shows that 98.07% of the time, that sovereign default is inevitable mostly through high inflation or hyperinflation. This study was published prior to the United States reaching the 130% level.

Bonds With Negative Yield

Levels of over 5% monthly prints of CPI inflation only puts more pressure on real yields in the bond market where any investor that buys 10-year Treasurys today is expected to lose 3.5%.

We’re now in a phase where the Federal Reserve will constantly have to play a game between switching inflation on and off with dual goals of inflating away the debt to support the economy or cater to the bond market. 10-year Treasurys are no longer a viable investment option but rather act as highly-regulated, pristine collateral to leverage in a growing market.

As a result of suppressed interest rates and rising inflation, 85% of the U.S. high-yield bond market is now producing negative real yields with the yield on high-yield corporate bands below 5%.

With inflation persisting, the increasing level of bonds under negative-yielding waters may be the catalyst for a more significant rotation out of fixed-income assets into bitcoin exposure. The global market size for all debt is estimated to be around $128.3T which makes the bitcoin market size 0.6% of all bond investments. Even relatively small capital reallocations will have major impacts on bitcoin’s market size.

We’ve already seen a major move from debt investors this month showing increased mainstream demand with an oversubscribed $7 billion trying to chase Coinbase’s $1.5 billion initial debt offering.

If we just look at the market value for United States Treasury debt, it’s $23 trillion. The Federal Reserve owns close to 24% of that debt with $5.41 trillion of United States Treasury securities on their balance sheet. As of Q2 2021, federal debt held by the Federal Reserve as a percentage of GDP was 24.82% increasing from 3.22% at 2008 lows. The bond market is no longer the same.

The sentiment around holding traditional bonds continues to change the longer negative real yields last. We are starting to see more big-time investors make the case publicly for owning bitcoin over bonds advocating for smaller portfolio percentage positions, but the real capital rotations haven’t even started.

And many may not until bitcoin hits a more meaningful market cap like gold’s $10.7 trillion, which can all be accelerated with longer periods of rising inflation resulting in real negative yields. After all, this is a global game of maintaining or increasing your purchasing power and the returns speak for themselves:

“Since before COVID began, long-term treasury bonds (TLTs) are down by 1%, whereas bitcoin is up by more than 677%.”

Looking at the on-chain supply dynamics, the trends in the derivatives market, and the increasingly uncertain, inflationary macroeconomic environment, we remain materially bullish on the adoption of the world's only credibly absolutely-scarce monetary asset, and fully expect all-time highs to be surpassed during Q4.

This report is a free public release of The Deep Dive's September Monthly Report. The Deep Dive is a Bitcoin Magazine premium market newsletter that delivers content directly to your inbox 20 times a month on bitcoin on-chain analytics, derivative markets, and global macroeconomics.

To become a subscriber to The Deep Dive, use discount code: BULLMARKET for 80% off the first 6 months, for a limited time only.