The Deep Dive Monthly Report, June 2021

El Salvador, The First Domino

On June 5th, 2021, arguably one of the biggest moments in the history of Bitcoin occurred. In a presentation made by Jack Mallers, CEO of Zap, titled “One Small Step for Bitcoin, One Giant Leap for Mankind,” and with the help of President Nayib Bukele of El Salvador, it was announced that a bill would be introduced in El Salvador to officially make bitcoin legal tender in the country.

In terms of immediate price action, the event was less significant than a rogue tweet from Elon Musk, but over the medium/long term the significance of the announcement cannot be understated. While El Salvador is a very small country in terms of both total population and gross domestic product (GDP), with 6 million people and a GDP of $27 billion in 2019, it was the fact that the step was taken at all which mattered.

On June 9th, 2021, the bill was passed by a majority vote of 62 of 84 votes approving the bill. With the approval of the bill, bitcoin will no longer be subject to a capital gains tax, and any entity that has the technological means will be mandated to not only accept U.S. dollars (which was the nation’s sole official currency before the passing of the bill), but also bitcoin.

This move also significantly undercuts the narrative that bitcoin “cannot be used as a currency or medium of exchange” due to the asset’s means of final settlement on the blockchain. This notion is evidently very false, as the blockchain is a settlement layer akin to the SWIFT settlement network, with Layer 2 solutions like the Lightning Network being developed for instantaneous settlement.

At the time of writing, there are 1,650 bitcoin (approximately $59,000,000) in public Lightning channels - an increase of 70% in bitcoin terms, and a 460% increase in dollar terms, year over year.

The Lightning Network scales not only with the adoption of new users, but also, as the price of bitcoin rises. As demand continues to increase on bitcoin’s base layer, the Lightning Network will be a vital part of the ecosystem.

Many skeptics have the belief that their credit card instantly transfers money from their account to a merchant’s, which is false. Rather, numbers are merely being changed digitally on bank computers temporarily, on the second layer. However, base layer settlement takes much longer and must be agreed upon by multiple counter-parties.

This is why the “argument” that bitcoin cannot be used as a currency because of “slow transactions” has always been wrong in theory. Now, with the rapid development of the Lightning Network, and the recent passage of the Bitcoin bill in El Salvador, it is no longer theory, but reality.

For the long term adoption of bitcoin as a global monetary asset, the ongoing development and adoption of the Lightning Network is crucial, and the news out of El Salvador at the beginning of the month officially accelerated the timeline in a major way. During the 2017 bull run, the Lightning Network was in beta, and had zero meaningful adoption or use cases. Now, in 2021, entire countries have begun to onboard onto Lightning, which can theoretically scale to an infinite amount of transactions.

As it turns out, bitcoin is much more than just “digital gold”.

China Bitcoin Crackdown

The month of June was truly historic for the Bitcoin mining industry. Following a flurry of bans and crackdowns across various provinces in China, hash rate on the Bitcoin network experienced its most severe sustained drop-off ever.

Here is a brief timeline of the events regarding the crackdown across China:

May 21st, Chinese Financial Oversight Committee (FSDC) announces the intention to crack down on Bitcoin mining and trading

May 25th, Inner Mongolia announces measures to restrict Bitcoin mining

May 27th, Sichuan province, home to a vast amount of hydroelectric powered miners, announces public meeting to assess impact of mining ban

June 5th, Social media platform Weibo suspends accounts of Chinese crypto “influencers”

June 9th, Certain Xinjiang miners ordered to shut down

June 9th, Miners in Qinghai province ordered to shut down

June 11th, Yunnan province, a leader in hydroelectric energy, announces Bitcoin mining operations will be inspected around the end of June

June 18th, Sichuan province orders state-owned energy suppliers to cut power to mining farms

The takeaway from this event, both now and into the future, is that bitcoin is not able to be banned. People in the mainland of China will continue to use the Bitcoin Network without asking for permission, and the ASICs that were located in China will be distributed around the world to wherever they are demanded most.

Governments cannot ban bitcoin; they could only (attempt to) ban their nation's citizens from accessing the asset and network. But regardless, blocks will continue to be mined and the Bitcoin network will continue to operate as the most resilient computing network in the world.

While the actions taken by China are short-term bearish for the price of bitcoin (covered below), these actions are also long-term extremely bullish for the resiliency and decentralization of the network. The end result also completely dismantles the often cited (yet completely incorrect and misguided) claim that bitcoin is “controlled by Chinese miners” due to the geographical concentration of mining operations that formerly resided in mainland China.

As the notorious “fork wars” in 2017 demonstrated, users running full nodes actually have greater “control” of the network, and they are not beholden to miners or any of their apparent demands, especially regarding changes to the consensus mechanism of the protocol.

Another very interesting angle on China’s crackdown of Bitcoin is the game theory involving competing nation states and bitcoin adoption.

On June 30th, U.S. Congressman Warren Davidson was quoted in a congressional subcommittee saying,

"China is building the creepiest surveillance tool in history...that's why we should be embracing decentralized ledger technology."

American citizens and politicians alike will increasingly begin to wake up to the fact that in the digital age there are only two paths: centralized, top down, Orwellian control of the monetary system and the populace, or, decentralized, apolitical, and nonnegotiable monetary sovereignty.

The message will become increasingly clear and evident; America must choose the path of rules, not rulers.

Miner Revenues

As a result of the declining price of bitcoin and the historic miner exodus out of China, miner revenues were absolutely decimated over the later weeks of June.

Daily miner revenue (seven-day moving average) peaked on June 6 at 941.19 bitcoin, and at $34,743,000, also on June 6. However, as miners in China continued to be hit with a wave of crackdowns and regulatory pressure, hash rate dropped significantly, and with it, so did miner revenue.

Miner revenue hit a monthly low on June 30 (seven-day moving average) in both bitcoin and dollar terms, with 605.80 bitcoin, worth $20,506,000 being mined. With an expected -27.5% difficulty adjustment coming on July 2, miner revenue and profitability should see a meaningful uptick, with North American miners seeing a significant increase in market share.

While Glassnode data does not show significant miner outflows, it should be noted that Bitcoin miners, unlike any other commodity producer, attempt to keep as much of their reserves as possible in the underlying “commodity,” which of course is bitcoin.

This is significant because if an expected event arose - such as the forced relocation of around half of the mining industry on short notice - this would result in a significant amount of bitcoin needing to be sold to cover costs.

This dynamic in our view has definitely served as a massive tailwind over the last month on the price of bitcoin over the course of June.

Exchange Balance Super Cycle?

Something to watch closely is exchange bitcoin balances. As the ecosystem around bitcoin continues to grow and become more intertwined with the legacy system, traditional crypto exchanges will likely play a less important role, but for the time being they are still the dominant players for bitcoin liquidity and market making.

Exchange balances peaked near the beginning of 2020, before falling 20.1% by April, 2021. In comparison to the 2017 bull run, exchange balances also peaked around July, 2016, before falling 12.3% by December, 2016.

Both of these peaks in exchange balances coincided with the 2016 and 2020 bitcoin halvings. The following declines (12.3% and 20%) could be evidence of the supply shocks that took place after the block reward was cut in half.

@Croesus_BTC posted a thread explaining how this decline in new supply combined with the same (or increasing) new demand leads to a decrease in the amount of bitcoin “available for sale,” and ultimately leads to an increase in price. A potential gage of the amount of bitcoin currently “available for sale” is exchange balances.

This reduction in bitcoin available for sale leads to the price of bitcoin being bid up to induce HODLers to add to the supply available for sale.

However, as price begins to increase so does demand for bitcoin. Bitcoin as a monetary asset becomes more attractive as its global liquidity grows. For a monetary medium or a money, this is referred to as its “saleability.” Unlike consumer goods or services, as the price of bitcoin rises it becomes less risky to acquire and becomes more attractive to hold. However, this global adoption does not occur in a linear manner, but rather in exponential waves, which is the reason that price increases in parabolic fashion seemingly every four years.

As the price begins to go up during the supply reduction phase (post-halving), long-term HODLers eventually are incentivized to sell small amounts of their holdings for large gains. This second phase of the cycle may actually begin to see an increase in exchange balances as the amount of coins available for sale actually increases.

Throughout the months of May and June we have seen increases in exchange balances, and no significant declines. It’s possible that this could continue over the next six or more months and still be bullish for bitcoin.

What is interesting is how deep exchange balances dropped during this current bull run. In the previous bull cycle, exchange balances hit their low at roughly $1,000 per bitcoin. This cycle, exchange balances hit their low around $50,000 per BTC.

While exchange balances are not a perfect measure of “available supply” as visualized by @Croesus_BTC, it could indicate that we are in the early stages of a potential super cycle. As you likely know, bitcoin went on to go almost 20x higher than $1,000 per bitcoin, and its bear-cycle low was roughly $3,000 (3x).

If we do see a rough repeat of the last cycle, that would lead to a peak of $1 million per BTC (20x) and a bear-cycle low of $150,000 per bitcoin (3x). It should be noted however, that with each subsequent cycle, the multiple from the previous cycle top has decreased.

Liquid Supply Change

Similar to exchange balances, we have liquid supply change. It is possible that the exchange balances do not increase like the previous cycle, and instead, the steady outflow of bitcoin off of exchanges continues, as investors move funds to cold storage for the long haul.

Near the local top in late April and early May, we began to see decreasing liquid supply turn into increasingly-liquid supply, with 240,000 bitcoin that were previously illiquid moved over the trailing month on May 21st. This trend has begun to reverse, with net 79,560 bitcoin moving to addresses defined as illiquid over the course of the month.

This further supports our view that a re-accumulation period is underway, but it will take some time for strong hands to clean up all of the excess supply that hit the market over the month of May.

Click here for additional information on the classification of liquid & illiquid supply.

It will be interesting to see over the following months how this metric compares to exchange balances as a gauge of “available supply.”

Puell Multiple

The Puell Multiple is calculated by dividing the daily issuance value of bitcoin (in U.S. dollars) by the 365-day moving average of daily issuance value. This has been passed around on Twitter as a sign that bitcoin has printed a rare bottom signal.

The daily issuance value of bitcoin (in USD) has varied greatly over the last few months. As we approach the largest Bitcoin difficulty adjustment in history, it should be noted on the Puell Multiple that the dip down to what is traditionally known as a “bottom” zone, was caused partially by extremely slow production of blocks. Since the hash rate is declining, it has taken blocks significantly longer to come in. This has temporarily caused a decrease in the daily issuance value of bitcoin, because less bitcoin are being mined during this epoch.

Thus, the Puell Multiple is unlikely to stay suppressed for very long, it is nonetheless another signal of a market in distress, which should be fantastic news for bulls.

Market Value To Realized Value Ratio

Bitcoin, like all assets, has its price set by the marginal buyer and seller. But unlike most assets, due to the transparent nature of the asset’s ownership (the UTXO set), you can quantify a realized price for each UTXO.

Realized price takes the price of when each bitcoin was spent into account, rather than just multiplying the circulating supply by the market price.

Thus, with the realized price and the market price you can find a ratio of the two, called the MVRV ratio.

The MVRV peaked at 3.95 in April at the all-time high, and has since fallen to 1.65, as bitcoin pulled back to the $40,000-$30,000 range. The realized price of bitcoin has been consolidating around the $19,000 level since April, demonstrating that much of the buying and selling is coming from recent investors, who are sitting on positions without significant gains.

The trough of previous bear markets has been around an MVRV of 0.75, which at this current level of realized price would be around $14,250. While this is not at all likely in our view, any buyer today should realize that the possibility of this occurring is not zero, and should prepare accordingly. After all, the asymmetry of potential 100x upside over the coming decade means that downside volatility is also possible.

It should be mentioned that any potential break of an MVRV level of 1 (market price trading under realized price) would likely be the result of a temporary leverage unwind in the traditional system.

Derivatives Market

May and June were particularly interesting times to be monitoring the bitcoin futures market. Since the sharp drop to $30,000 on May 19, where we saw futures open interest drop nearly 100,000 BTC (-25%), we’ve watched open interest climb from its low of 300,000 BTC back to 350,000 BTC and back down to 324,000 BTC.

As the price of bitcoin has stabilized around $30,000 to $40,000 during the month of June, we’ve yet to see a resurgence in high demand for leverage long positions. For nearly the entire second half of June, the perpetual swap market funding rate was consistently negative. This means that in order to short bitcoin you are paying an additional funding rate every eight hours to be short. The leverage longs are receiving this additional funding for going long.

This level of bearishness in the perpetual swap market hasn’t occurred since post-March, 2020.

Bitcoin Futures Contango

Similar to the perpetual swap market, the three-month rolling futures contract has not regained the large contango we saw throughout most of 2021.

The annualized return for buying bitcoin while shorting the three-month rolling futures contract never went back above 10% during the entire month of June. On top of that we even saw the curve trade in backwardation for short periods of time during the sharp dips throughout the month. This type of price action across the futures and derivatives market would traditionally be viewed by traders as a bear market signal, and over the short term, this may be true.

However, in our view, a sustained multi-year bear market is not to be expected, but rather an accumulation period over the course of the summer and possibly into the fall, with bitcoin ranging as supply is transferred to strong hands, similar to what occurred post March, 2020.

Once the re-accumulation phase has passed and bitcoin begins its ascent towards the previous all time highs, it is probable that with the return of bullish price action and positive sentiment fueled by new market entrants and overall lack of sell pressure brings back bitcoin’s contango, which in turns incentivizes more capital to flood into the market to capture the market neutral trade of shorting futures and buying spot.

This reflexivity was a large driver of bullish price action during the early months of 2021, and is probable to return following the re-accumulation phase.

Bitcoin Liveliness

Bitcoin liveliness is a ratio of coin days destroyed and the sum of all coin days created. Liveliness gives insight as to the behavior of investors/holders on the network. Liveliness increases as long-term holders spend/move their positions, and decreases while hodlers accumulate.

In theory (if it were possible), if every bitcoin was moved at once, liveliness would temporarily reach 1, and conversely, on a blockchain that has not had any transactions other than the initial issuance, liveliness would be 0.

Starting in the middle of October, liveliness reversed from its steady downtrend from the summer of 2019. As the bull run kicked off, long-term holders began to exit long held positions, and coins began to be distributed to new hodlers. Historically, periods of significant price appreciation in the price of bitcoin have been coupled with increases in bitcoin liveliness, and vice versa.

Thus, with the slope of liveliness recently reversing its direction from an uptrend over the last month, the data is pointing to net accumulation once again starting to occur. Whether this is a short-term trend or one that will be sustained remains to be seen, but overall it is bullish to see re-accumulation begin, pointing to further price appreciation in the later months of 2021 and heading into 2022.

For a review of Bitcoin liveliness, read this article by the creator Tamas Blummer.

Long Term Holder SOPR

When observing the spent output profit ratio (SOPR), you can quantify the average profit/loss of UTXOs being moved on the blockchain.

When looking at long-term SOPR (bitcoin that has not moved in 155 days or more), over the last week of June the average acquisition price of bitcoin being spent is $14,500 at an average profit of 130%.

Despite all of the volatility and the substantial correction in the market, long-term bitcoin holders are still deep in the money.

Macroeconomic Backdrop

Liquidity, liquidity, liquidity. You’ve heard it before, but this is the reality in financial markets right now. The rising tide of ever-more liquidity lifts all boats. Notably, rising inflationary factors across the global economic system have pushed real yields to record lows. Relatedly, the S&P 500 and the Nasdaq continued to break record highs each and every trading day to close the month, reflecting the phenomenon that markets are merely a reflection of additional liquidity injections.

The most recent Consumer Price Index print came in at 5.0% year over year, putting real yields across the bond market near or at record lows.

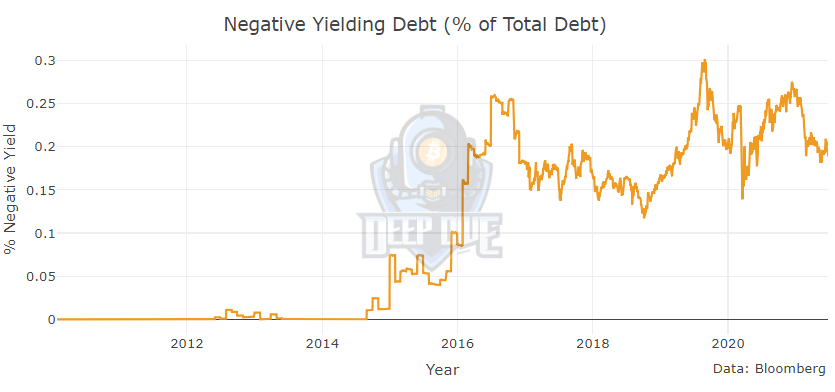

Negative-yielding debt as a percentage of global debt continues its gradual ascent, as central banks have ramped up quantitative easing programs to keep yields suppressed, as the world remains engorged in debt.

The combined balance sheets continue to climb as a percentage of GDP in G4 nations, recently passing 50%. Central banks now find themselves as the dominant player in the sovereign debt markets, as investors.

This past month, real yields on “high yield bonds” turned negative in an historic move, in another move that will be remembered as a sign post during the final crack up boom of the central bank fueled everything bubble.

Final Word

Over the months ahead, a re-accumulation period should be expected as convicted accumulators clean up the supply held by those 2021 investors continuing to exit positions underwater, or at breakeven price.

The prolonged negative funding on perpetual swap contracts and low-rolling yields in the futures market signal that sentiment is very bearish. This is quite similar to how the market reacted following the crash of March, 2020, where derivatives funding stayed negative for a prolonged period of time during a sustained accumulation period for months on end. In our view, a very similar outcome is probable.

In the event of a crash in the legacy markets, bitcoin would likely see further downside momentum due to the implicit dollar squeeze that brings about a market sell-off. While this scenario is certainly possible, any such scenario would likely be met with increasing amounts of fiscal stimulus and central bank easing, due to the dynamics covered above.

At the end of the day, Bitcoin is far and away the most antifragile network in the world, and is humanity’s best shot for freedom and liberty in the digital age.

The road to usurping the global monopoly over monetary policy was never going to occur without hiccups, or in linear fashion. This should be expected. The market cap was cut in half from $1.2 trillion to $600 billion in two months, nearly half the hash rate was unexpectedly upended and forced to relocate, and yet, the Bitcoin Network continues to function exactly as designed. Tick tock, next block. Bitcoin does not care.

There is a cohort of individuals and entities that are buyers at any price. Read that again if you have, and internalize it, because this is the reality. There is a growing fanatical cult of bitcoin proponents around the world that are buyers at any price.

At. Any. Price

This is a feature, not a bug, and as a result, due to the dynamics of currency competition coupled with the winner take all dynamics of networks in the digital age, bitcoin will emerge victorious, with price serving as the scoreboard.