The Deep Dive: May Monthly Report

Executive Summary: Macro Landscape Remains Unchanged as May Proves Opportunity to Acquire BTC at Discount

May was a wild month for new entrants to the bitcoin market – at one point, the price was down as much as 48% from the month’s opening price and down as far as 54% from April’s all-time high.

For those who had only experienced bitcoin’s immense volatility to the upside, this meant May brought a surprising turn to the downside, one that led to the capitulation of liquidated leveraged traders as well as a slew of newer spot traders who sold holdings at a clear loss.

It’s a mistake we foresee they will come to regret not too far into the future, as for veteran HODLers the controlled chaos was nothing new.

While there was no shortage of regulatory uncertainty and energy concerns over the month of May (most notably when one of the world's richest men broadcast FUD to his 56 million followers), we observed that this had no impact on the fundamental problem that Bitcoin is solving.

Entering June, bitcoin is still decentralizing the global monetary order, taking power out of the hands of central planners and putting it into the hands of free people running open software.

In regards to the question everyone wants an answer for: Is the bitcoin bull run over?

In our view: Unequivocally, no. If anything, the pullback and consolidation around the 35k-40k level may prolong the run and break the tradition of a cycle top approximately 18 months after a halving.

In this report, we’ll highlight the macroeconomic backdrop, explore the causes of May’s sell off and show why it was unique in the history of bitcoin bull cycles, and explain why the decline should be viewed as a buying opportunity for convicted bitcoiners as well as opportunistic swing traders.

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.” - Satoshi Nakamoto

The price of bitcoin has absolutely soared over the last six months, and heading into 2021 an extremely favorable macroeconomic environment played a large part.

Investors like Paul Tudor Jones and corporations like MicroStrategy were searching for a safe haven from the “Great Monetary Inflation” following liquidity crises in March 2020, when the Federal Reserve and other major global central banks flooded the system with liquidity.

The goal of the Federal Reserve was clear – stop the deflationary spiral caused in part by the economic lockdowns, but it’s important to note that as a result the system has become flush with liquidity and remains trapped in a near-zero yield environment.

For many, bitcoin, a global monetary asset with a verifiable limit to its supply, has become an attractive alternative to this unprecedented status quo.

Entering May, global central banks remained stuck with global debt/GDP hovering around 400%, and they have responded by injecting even more liquidity into financial markets.

The motives of those in positions of power are understandable: if they take their foot off the proverbial gas pedal, the markets may self correct, and with this, there is a risk the global economy could crash into a once-in-a-century type depression.

Still, investors are left searching for a solution to “QE Infinity,” and central bank liquidity is now the entire game for asset prices. The smart money knows this.

At the time of writing, the balance sheet of the U.S. Federal Reserve is equivalent to 36% of the U.S. GDP, and the balance sheet of the ECB is equal to 77% of the GDP of the EuroZone.

Undoubtedly, we are in the everything bubble. Every investor should be asking themself what challenges this presents to them and what are the probabilities of various outcomes.

The End Game for Fixed Income

“Personally, I’d rather have Bitcoin than a bond” - Ray Dalio

When one of the greatest macro investors of all time says this statement, it serves as a wake-up call for all fixed-income investors around the globe.

The reality of the situation is that following a secular 40-year decline in interest rates around the globe, bonds no longer offer the upside appreciation they used to for investors like Dalio, who executed the notorious Risk Parity trade. (Dalio would make large allocations to fixed-income instruments that would offer protection against a protracted sell-off in equities as global central banks lowered discount rates, which would significantly raise the par value of the bond.)

With interest rates around the globe near or at 0%, and the majority of the treasury curve yielding negative when adjusting for inflation, bonds offer return free risk, which is actively forcing investors to look elsewhere for returns and a store of value. Many credit investors are beginning to discover that CPI/PCE, Wall Street’s preferred measures of inflation, are not the most accurate measures of the immense amount of monetary expansion taking place around the globe.

Bonds are without a doubt not an attractive place to be from a risk/return standpoint, both in nominal terms and more importantly, in real terms.

Volatility in the Incumbent Monetary System

Investors looking for attractive entry points to the bitcoin market should keep a very close eye on credit markets and the VIX into the future. Global financial markets are entirely dependent on central bank easing and balance sheet expansion to keep markets “functioning correctly.”

Certain securities in the treasury market, the most liquid market in the world, went no bid for a stretch during the March crash, as liquidity completely dried up across the financial sector.

Bitcoin wicked to $3,800, and was declared a “failing” safe haven asset.

Yet, there remains a real difference in how an asset performs during a liquidity crisis and how it might perform as a safe haven from monetary expansion.

Bitcoin, at this point, is the latter, and as it continues to gain market share and liquidity in global financial markets, it will likely act as a pure price signal for the credit expansion or contraction occurring in the legacy system.

While it cannot be known when the next liquidity crises will arise, the problems that arose during the Great Financial Crisis in 2008 and in March 2020 have only been made worse. We expect another large deleveraging event to occur as the everything bubble fueled by QE infinity and Modern Monetary Theory continues to increase debt levels and inflate asset prices.

There will be another liquidity crisis, and volatility will absolutely explode. A certain class of bitcoiners will embrace this event and happily continue to accumulate and HODL.

For those that are worried about sharp drawdowns into the future, consider longing VOL with a small allocation of your portfolio. This could help limit some upside during the parabolic uptrends as liquidity from quantitative easing programs flow into bitcoin.

The asymmetry of a long volatility position will limit downside risk and allow hedged investors to buy the dip with a larger proportion of their portfolio.

Looking over the past few months of data, we can reasonably conclude a few major catalysts for the bitcoin selloff, and it all boils down to one thing – leverage.

Exchange Inflows/Outflows & Seller Breakdown

The month of May saw the first major spike in bitcoin exchange inflows since the COVID crash in March 2020.

While there was not a major liquidity crisis like there was 14 months ago, leverage dynamics native to the bitcoin market provide an explanation for the sharp increase in exchange deposits.

At the beginning of the month, there were 2,457,207 BTC on exchanges and the price was hovering at around $57,000. Total exchange balance rose to as high as 2,553,537 BTC on May 19th, an increase of 96,330 BTC as opportunistic whales relentlessly sold.

Following leverage liquidations all the way down to $30,000, exchanges saw large net bitcoin outflows, as dip buyers (most likely being largely the same whales who were driving the spot price down in the first place) had their limit orders filled for over a 50% discount to where the price was trading just a month prior.

The month of May saw the trend of coins moving off exchanges reverse for the first time since March 2020, as BTC balances on exchanges jumped from 2,457,201 BTC to 2,526,900 BTC at the time of writing.

This trend reversal is quite telling, as a look at the spent output age bands gives us a glimpse of who was selling during the recent dip.

Specifically, a majority of sell pressure during the recent selloff came in the form of UTXOs spent in the previous 1-6 months. This indicates sellers were recent entrants (who bought in after the prior all-time high was breached) and have since trimmed their positions.

Typically around 60-70% of spent outputs are UTXOs transacted within one month of being acquired, but the spike in UTXOs spent in the 1-6 month age band was sharp.

Said another way, the parties responsible for May’s price decline were mostly new investors.

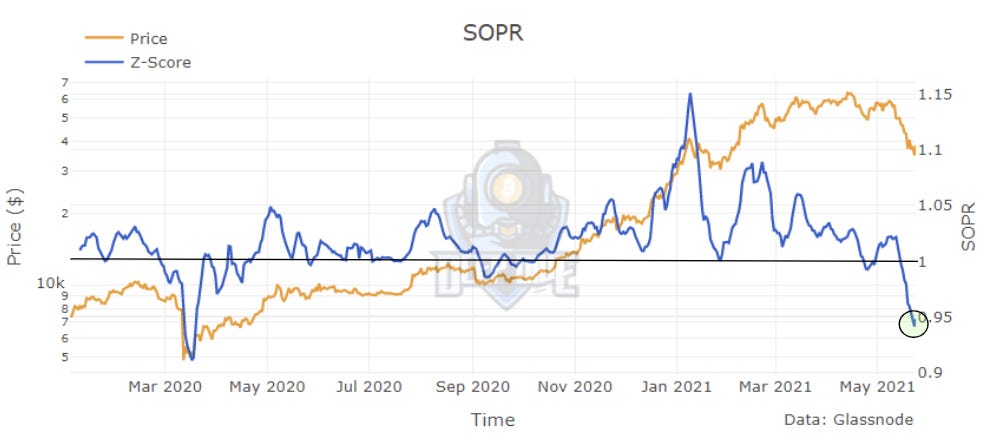

SOPR, the spent output profit ratio, charts on average if UTXOs are being moved at a profit or loss. During the recent sell off, the SOPR 7-day moved well below 1, a sign that coins are being moved/sold on average for a loss.

This strengthens the case that a large amount of sell pressure came from low-conviction investors and traders who entered the bitcoin market for the gains without truly understanding the value proposition or thesis around acquiring and holding bitcoin for the long term.

Futures & Options Markets

As previously mentioned, the futures and derivatives market played a dominant role in the May drawdown. Leveraged long positions were mercilessly liquidated as open interest plunged not only in U.S. dollar terms, but more significantly, in bitcoin terms, as futures open interest collapsed by 28.5% in BTC terms, by 120,000 BTC, on May 19th alone.

This sell-off proved once again that derivatives have a very meaningful impact on the bitcoin market over the short term, but that spot demand (signifying global adoption) truly sets price, short-term derivative whipsaws aside.

Simply put, out-of-position traders both long and short leave the BTC/USD price susceptible to massive volatility as opportunistic traders seek to take advantage of swings.

Leveraged long BTC exposure is especially susceptible to drawdowns when BTC is used as collateral, as during a price decline, the underlying collateral is depreciating alongside the P&L of the trade. With BTC margined longs, liquidation price increases as price falls, which can lead to cascading liquidation events, which is what occurred on May 19th.

Implied volatility during this month's sell-off exploded to levels not even seen during the COVID crash, touching as high as 157% on the 19th. The VOL explosion was due to a massive dislocation in the derivative markets as long liquidations cascaded down and leverage was purged, with over $3 billion in long liquidations occurring as the price plummeted to $30,000.

For those dollar cost averaging into bitcoin, this event provided the chance to accumulate at a discount, and for more sophisticated traders, the spike in VOL and liquidation of long positions provided a lucrative opportunity to enter a long position with funding deep in the negative for a brief period of time following the crash (touching as low as -0.1%, short pay long 0.1% of position size per day).

It needs to be repeated again, this steep pullback was a derivatives-driven event, one that saw opportunistic spot sellers take profit on the move to the downside.

As a look into the funding rates shows, following each pullback after the April 15th all-time high, traders quickly relevered as broader market sentiment remained bullish, but spot demand just wasn’t enough to keep the rally alive.

This means the relief rally looks to have been derivative driven, as funding rates and aggregate BTC futures open interest spiked in BTC terms following every pullback; a flush, both in terms of sentiment and leverage, was long overdue.

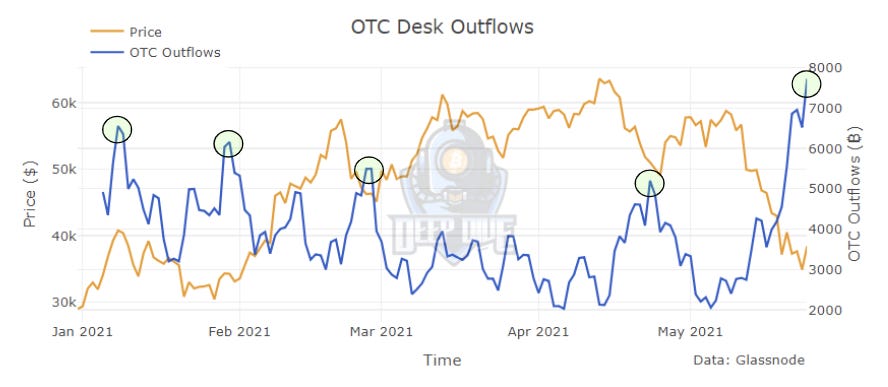

OTC Desks & Convicted HODLers Buying The Dip

Following the large sell-off, OTC Desks aggressively bought the dip, as institutional investors and high net-worth individuals capitalized on an opportunity to secure a pristine monetary asset at a large discount (as they have during every pullback of 2021). OTC desks witnessed 54,010.32 BTC flow out to clients wallets from the May 18th to May 25th, a 7 day high during 2021.

Long-term holders are buying as well, and there were signs that investors who took chips off the table in late October began to accumulate again after the 50%+ pullback. Over the last 30 days, long term hodlers have accumulated 199,492 BTC more than they have sold, demonstrating that the conviction of veterans in the notoriously volatile market were by no means shaken.

While the backdrop is different compared to last March (this was leverage native to the crypto markets), we expect similar market conditions ahead – a steady grind upwards as convicted accumulators who know the thesis remain confident and long.

Central banks continue to inject liquidity into the system at a feverish pace, and the value proposition of a global digital monetary asset with no counter-party or dilution risk is worth orders of magnitude more than it is valued at today.

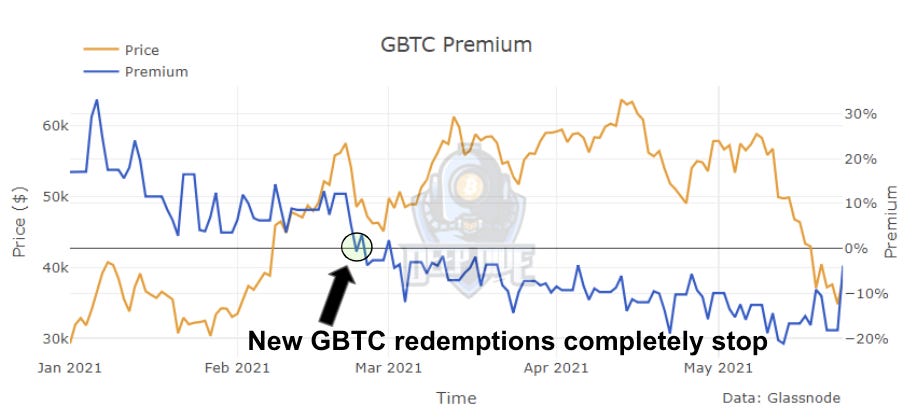

Grayscale Purchases Nonexistent As GBTC Continues Trading at Steep Discount

Along with the other catalysts for the sell off over the last month, we have Grayscale, or rather, the lack of Grayscale. One of the largest drivers of bitcoin demand from July 2020 until this February has completely halted new share redemption, as the trust began to trade at a steep discount to NAV.

New shares of Grayscale’s Bitcoin Trust (GBTC), are minted by exchanging either dollars or bitcoin to Grayscale for GBTC shares at NAV. Prior to February 2021, shares of GBTC had always traded at a premium to NAV, which placed a direct incentive to arbitrage the difference for accredited investors and institutions. However, the caveat is that newly redeemed shares must be locked up for 6 months before they can be traded on secondary markets, locking into an illiquid derivative of the price of bitcoin. The GBTC premium to NAV encouraged investors to redeem new shares of GBTC and short futures or a BTC equivalent to remain market neutral and capture a large “risk free” yield.

This arbitrage opportunity was an absolutely massive driver of bitcoin demand, with Grayscale increasing their bitcoin holdings from 371,072 BTC on June 18th 2020 to 655,465.2 BTC on February 18th 2021.

Over the course of 8 months (245 days), 284,393.2 additional BTC were purchased by Grayscale, or 1160.78 BTC per day, approximately 129% of the new issuance of bitcoin over the same time period.

After shares of GBTC began to trade at a discount to NAV, the incentive for investors to redeem shares of GBTC in exchange for bitcoin or dollars at a discount is nonsensical, and subsequently, redemptions of new GBTC shares have not occurred since February 18th when shares first began trading at a discount.

Since February 18th, Grayscale’s bitcoin holdings have actually decreased by 2,942.4 BTC, as the product’s built-in 2% annualized has turned Grayscale into net sellers to the tune of approximately 29 BTC per day.

While it was the mainstream interest in getting bitcoin exposure through traditional market rails that led to the large GBTC premium in the first place, it can be assumed that much of the demand that came from Grayscale during the run up from prices around 9k to 56k in just 8 months was to arbitrage the price of GBTC relative to the trust’s NAV and capture the extremely large yields offered in a still nascent and developing market that is gradually building out institutional grade rails.

On April 5th, in a blog post posted by Grayscale, the company announced its intentions to convert GBTC to an ETF, which would allow the security to track NAV and without the 6-month lockup period, which would be an extremely positive development for the asset class and institutional adoption going forward. It remains to be seen whether the SEC will approve any of numerous Bitcoin ETF proposals that have been put forward in 2021.

One area that should be watched closely ahead is the development and growth of the bitcoin futures market and the “yields” present in these markets.

As bitcoin grows in market capitalization and liquidity, the derivative market grows alongside it as evidenced by the recent ranging in futures open interest from ~300,000-420,000 BTC.

Over the course of 2021, the bitcoin futures contango continued to grow in size, as more leveraged bets in the futures market and an overall bullish sentiment pushed futures prices above the spot price. This presented investors an extremely attractive opportunity to capture 20-30%, and as high as 48% annualized return, while remaining delta neutral.

With the steep contango, investors can long spot, short the futures contract, and collect the spread.

This arbitrage opportunity arose as bitcoin investors (who are nearly always extremely bullish on the asset) have access to synthetic leverage to long bitcoin. This leverage is something that is not available with the legacy financial rails.

Contango yields peaked at the $64,000 all-time high in April, but as leveraged long liquidations tumbled, the price ground annualized yields down to near 0% as leverage was purged, and the bid across the futures curve seemingly disappeared.

As contango yields hit 48%, the total bitcoin futures open interest across derivatives exchanges hit an all-time high of $27 billion. While this number is no doubt significant, this figure remains small in terms of the liquidity available in the traditional financial system.

What investors both in the bitcoin market as well as the legacy financial system need to watch for is this – what happens to global debt markets when a digital bearer asset with a futures curve that is entirely a free market phenomenon comes up against the estimated $280 trillion of debt with real yields near 0%?

While the volatility of bitcoin and the volatility of the contango yields themselves need to be noted and acknowledged, it cannot be understated how big of a deal a developed derivatives market in bitcoin will be.

The time value of money, aka the market's expectation for the price of bitcoin on a certain date, is once again a free market phenomenon, and central planners cannot step in to manipulate discount rates or the futures curve of bitcoin like they can in global credit markets.

June FOMC Meeting

An important thing to watch out for over the coming month/s is what materializes out of the Federal Open Market Committee’s meetings on June 15th to 16th, as talks of inflation become more and more rampant on both Wall Street and “Main Street”. On May 28th, U.S. Core PCE rose 3.1% year over year, compared to estimates of 2.9%, the highest year over year reading since the early ‘90s.

The impending inflationary pressures are troublesome for the Fed in a couple different ways, as their mandate of “stable prices and maximum employment” are obviously met in the face of sustained inflation. With the looming probability of inflation “running hot”, bond yields would rise as fixed income investors react to lower real yields, which in turn would raise discount rates across the economy.

Powell and the Fed are left to choose between (reluctantly) announcing the Fed’s intention to taper QE programs in an effort to dampen inflationary pressures, or to monetize debt at an even faster rate to suppress yields and to keep elevated asset prices sustained. Heads I win, tails you lose.

While any talk of tapering may at this point very well be jawboning by Central Bank governors, who seemingly have been hitting the airwaves daily to dismiss inflation concerns, the eventual attempt by the Fed to wean the market off of quantitative easing programs and/or raise the Fed Funds Rate would very likely end up exactly like the last, an utter failure, as a rise in bond yields tightens financial conditions as liquidity to dries up, causing volatility to explode and all risk assets sell off in tandem.

Central Bank liquidity injections cannot fix a solvency problem, and the very same central bank put that has eased markets for over 3 decades will one day work to no avail. Bitcoin is protection against both… but for the time being, it is still treated as a risk asset in a de-risking/illiquidity event, and allocators should plan accordingly.

It is important to remember that bitcoin at this stage in its adoption phase is not a hedge against PCE/CPI (consumer price) inflation, but rather the dual threat faced by every capital allocator on the planet; perpetual credit expansion (dilution risk) that inevitably ends with a credit contraction leading to a deflationary bust (counter-party & political risk).

Cycle Long Market Indicators

Below are three separate market top/bottom indicators that gauge the risk to reward ratio of buying bitcoin based on various metrics. While these indicators may or may not prove to be useful into the future, it is valuable to measure just how relatively overheated or not the market may be based on historical trends and data.

Reserve Risk at time of writing: 0.00403

2021 Reserve Risk High: 0.00829

Previous Cyclical/Local Tops: 0.033184 - 2013, 0.03685- 2013, 0.027901- 2017

Reserve risk is a cyclical indicator that quantifies that risk/reward of buying bitcoin relative to the conviction of long term hodlers. While this monthly report won't delve into the specifics of the indicator, you can read more about the calculations and concept here.

Puell Multiple at time of writing: 1.14

2021 Puell Multiple High: 3.43

Previous Cyclical/Local Tops: 10.46 - 2013, 9.41 - 2013, 6.72 - 2017

The Puell Multiple is a calculation that takes the daily issuance value of new bitcoin issued in dollars and divides that by the 365 day moving average of the same calculation. Looking at previous cycles, the Puell Multiple reached much higher peaks in previous cycles, and both the price action of bitcoin and the multiple itself had a blow off top.

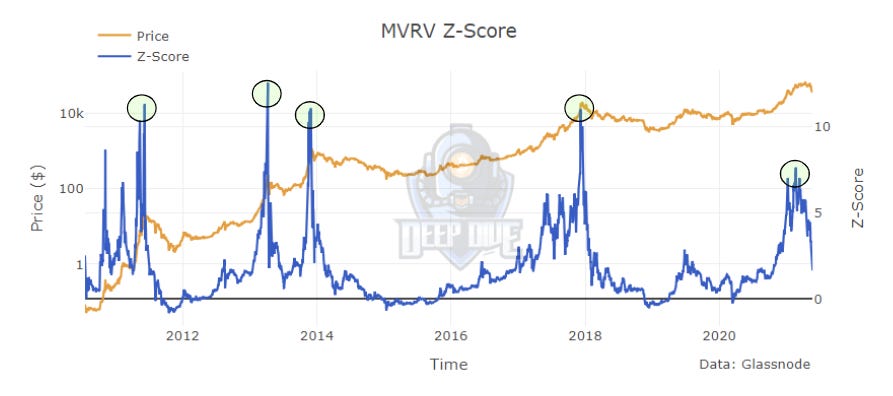

MVRV Z-Score at time of writing: 1.75

2021 MVRV Z-Score High: 7.63

Previous Cyclical/Local Tops: 12.54 - 2013, 11.05 - 2013, 11.01 - 2017

MVRV is a measure of market capitalization relative to realized capitalization. Realized cap values each UTXO at the price it was last spent, compared to market cap which is the total circulating supply of bitcoin multiplied by the market price. The metric can provide insight as to the market price of bitcoin relative to what may be closer to fair market value. While the MVRV did start to increase in parabolic fashion with the price action throughout the early months of 2021, during the consolidation around 50k realized cap appreciated significantly as price was flat, a solid signal for the market that a price floor was indeed rising.

While history is not guaranteed to repeat, the 3-month consolation around the $50,000 to $60,000 price level is not indicative of the end of a bitcoin bull cycle in our view.

Rather, we see this as a temporary pullback and consolidation as weak hands were purged and the convicted remained, constantly accumulating over the period.

It also has to be noted that the very notion of a 4-year bitcoin cycle may be invalidated over the coming years, as bitcoin as an asset has entered a reach and penetration with both institutional capital allocators and the mainstream audience that it has not reached prior.

This could well set off a larger trend of adoption, similar to the last decade but at a much larger scale, especially with instability and fragility in the incumbent system at all-time highs.

Looking ahead to June, a sustained period of price activity around $30,000 to $40,000 could even prove positive for the market, provoking capital on the sideline to allocate during a reflexive uptrend where it’s possible to secure large positions.

Put simply, bitcoin adoption at an institutional level is just getting started, and unlike retail adoption, these institutions can be slow with their actions.

Should more capital allocators continue to enter the space, they are likely to lead with “toe dip” allocations, but as bitcoin continues to show signs of emerging as a dominant digital store of value, this could well accelerate on levels unseen yet in the market’s history.

Potential Catalysts For Next Leg Up:

Approval of Bitcoin ETF in the United States

Quarterly Corporate Earnings Reports in July, potential announcements of bitcoin purchases

Integration of bitcoin into hundreds of commercial banks across the United States

Additional fiscal bill announced/passed by congress.

Announcement of nation state or small central bank holding bitcoin on balance sheet or in a sovereign wealth fund.

An abbreviated list of the month’s most significant events regarding bitcoin.

May 1st - Bitcoin Taproot activation starts

May 4th - S&P Dow Jones Indices launches bitcoin index

May 5th - NYDIG partners with FIS Global to bring bitcoin services to U.S. commercial banks, 300,000,000 potential bank accounts

May 5th - Largest Latin American e-commerce company, MercadoLibre, adds Bitcoin to its balance sheet

May 6th - Metromile becomes first insurance company to accept premiums and pay claims in bitcoin, adds $10 million worth of Bitcoin to balance sheet

May 6th - Cash App bitcoin sales come in at $3.5 billion in Q1 2021, +100% Q/Q, +1000% Y/Y

May 6th - Jack Dorsey on Square's earning call, "We see Bitcoin as the internet’s potential to have a native currency and we want to further that as much as we can."

May 7th - Bridgewater CFO John Dalby departs to join NYDIG

May 7th - Goldman Sachs launches cryptocurrency trading team under their Global Currencies division

May 7th - Gary Gensler, SEC Chair: “Bitcoin is a scarce store of value”

May 11th - Hungary plans to reduce taxes on Bitcoin earnings from 30% to 15%

May 11th - Druckenmiller: “Dollar will lose reserve currency status within 15 years… 5 years ago I say crypto was a solution in search of a problem, well know the problem has been identified. It’s Jerome Powell and the rest of the world's central bankers. There's a lack of trust.’

May 11th - Palantir Technologies, “Adding Bitcoin to our balance sheet is on the table. On the other side of that, we do accept it as payment.”

May 12th - An estimated 46 million Americans own Bitcoin

May 12th - Central Bank of Norway’s Deputy Governor: “If money such as Bitcoin becomes more dominant here at home, we will be moving towards a new financial system.”

May 13th - Tesla announces it has stopped accepting payments in bitcoin citing energy use concerns, still holding bitcoin as a reserve asset

May 13th - BlackRock CIO: “Bitcoin is durable and it will be part of the investment arena for years to come”

May 17th - Iranian government institutes a new ban on Bitcoin Mining in households

May 18th - Chinese Regulators: “Cryptocurrency trading is disrupting the normal economic and financial order.”

May 19th - Indian government reconsiders attempt to ban bitcoin first proposed in 2019

May 19th - Bitcoin falls as much as 30% intraday, touches $30,000 price level, 54% below ATH

May 21st - China announces attempt to ban Bitcoin Mining

May 24th - Governor of Wyoming Mark Gordon discloses Bitcoin holdings

May 24th - Dalio: “I would rather own Bitcoin than bonds… I own some Bitcoin.”