The Deep Dive #011 - Implicit, Not Explicit Default

US TREASURY SECRETARY YELLEN: “WE CAN'T ALLOW ANY CHANCE OF THE GOVERNMENT DEFAULTING ON ITS DEBT.”

Consider this a signpost. This statement by Yellen, while assumed by most investors, is just another “sign of the times.”

For those who are not yet aware, we are living through the first bursting global sovereign debt bubble in 100 years and the first currency system shift in 50 years.

Sovereign debt bubble? Currency system shift? Yes, you heard right. When Janet Yellen, former chair of the Federal Reserve and incumbent Treasury Secretary states that the U.S. will not be allowed to default on its debt obligations, she is right.

The federal government will not explicitly default on its debt, instead it will implicitly default, which is in fact exactly what is happening today.

What exactly is the difference between an implicit and explicit default you ask? While the history of government defaults is quite nuanced, we will briefly examine two examples of sovereign default, both of which occurred in the United States over the last century, to provide context.

The Roaring ‘20s

The 1920s were known as “the roaring twenties,” and for good reason. Following the conclusion of World War I, U.S. productivity soared as inventions and technological advances such as the mass production of the radio and automobiles brought about the most prosperous times in all of recorded history.

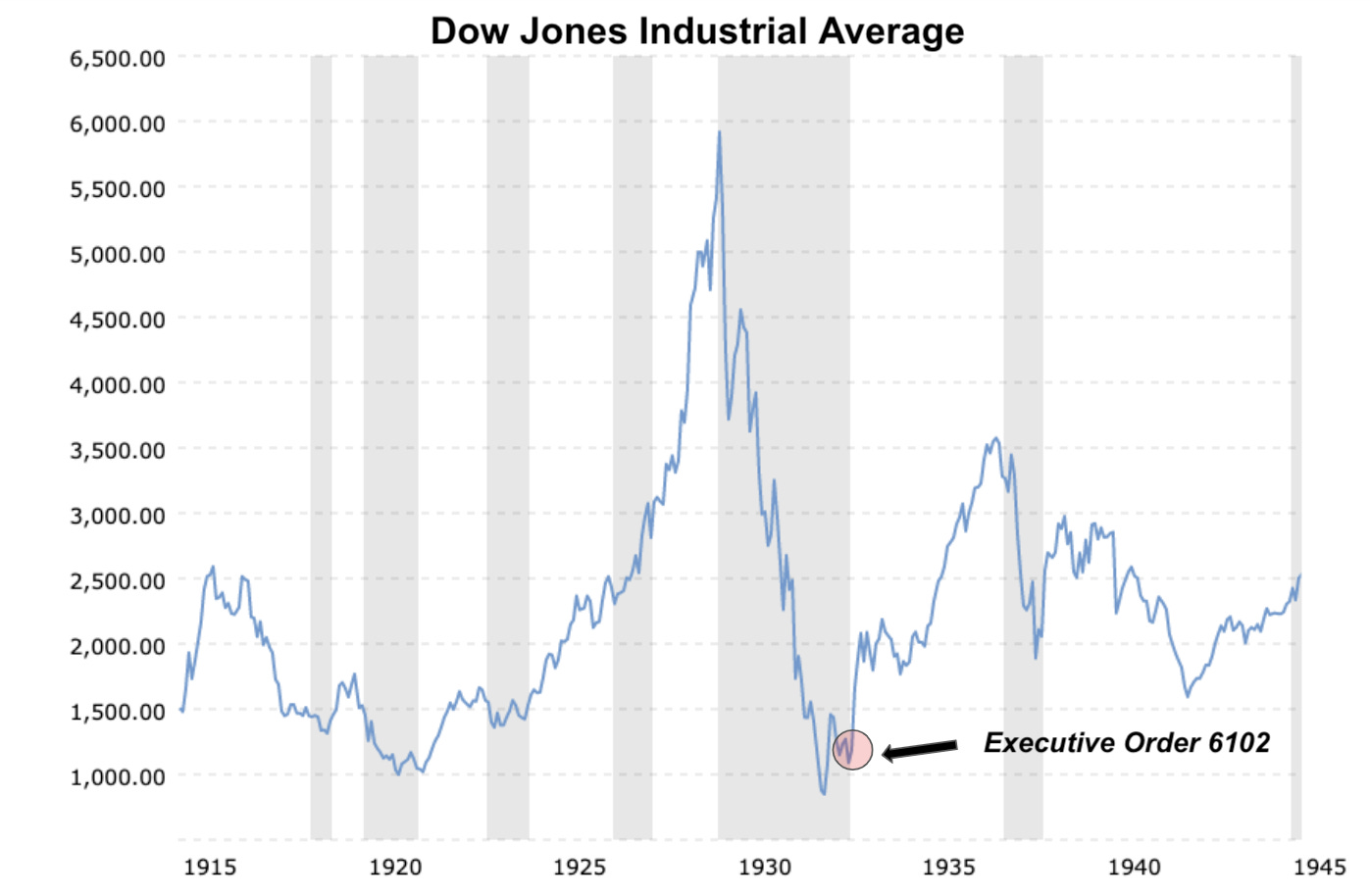

Not only was technological advancement occurring, but the stock market absolutely soared, bringing about wild enthusiasm as many average people grew wealthy seemingly overnight as the Dow Jones Industrial Average (DJIA) grew by nearly a factor of five from 1920-29.

However, the booming stock market was not a result of a “new paradigm” of productivity or financial markets like many believed at the time, but rather was mostly due to unchecked credit expansion which created a massive asset bubble.

During the later years of the 1920s, many individuals and entities would borrow solely to invest in the stock market that seemed to only go up.

Collateral values increased -> more creditworthy borrowers -> easier credit -> additional credit expansion -> higher asset prices. A virtuous cycle.

However, like all credit-fueled asset bubbles, there was eventually a bust, and what followed was among the most notorious financial market collapses ever. The DJIA collapsed by 85% in a little less than three years, as the virtuous cycle of a credit boom worked in reverse.

Collapsing asset prices -> Forced margin calls due to falling collateral value -> Lower creditworthiness - > tighter lending conditions

However, at this period in time the dollar was pegged in value to gold, which limited the Fed’s ability to further ease financial markets, as any easing of the money supply would have to be backed by additional gold reserves. Thus all of the credit extension and fractionally reserved “money” in circulation collapsed back onto the gold peg as the malinvestment attempted to liquidate itself from the system.

Here is a quote from Ray Dalio’s book, “Principles for Navigating Big Debt Crises”:

“Typically, governments with gold-, commodity-, or foreign-currency-pegged money systems are forced to have tighter monetary policies to protect the value of their currency than governments with fiat monetary systems.

But eventually the debt contractions become so painful that they relent, break the link, and print (i.e., either they abandon these systems or change the amount/pricing of the commodity that they will exchange for a unit of money).

For example, when the value of the dollar (and therefore the amount of money) was tied to gold during the Great Depression, suspending the promise to convert dollars into gold so that the currency could be devalued and more money created was key to creating the bottoms in the stock and commodity markets and the economy.

Printing money, making asset purchases, and providing guarantees were much easier to do in the 2008 financial crisis, as they didn’t require a legalized and official change in the currency regime.”

Gold has historically not only served as a hedge against monetary inflation during a credit boom, but also during the deflationary bust that follows and the accompanying counter-party risk that comes with it.

In 1933, President Roosevelt issued executive order 6102, which mandated that all privately owned gold be handed over to the government. Shortly after, in 1934, Roosevelt revalued the gold peg from $20.67/troy ounce to $35/troy ounce. The stated reason for the order was that “hard times had caused hoarding of gold, stalling economic growth and worsened the depression.”

The reality was that this was no fault of “greedy gold hoarders.” This was an explicit default. The U.S. dollar, which was pegged to a known amount of gold, was no longer redeemable at the conversion rate, and U.S. citizens were the ones burdened with the devaluation. There was not enough gold in reserves to redeem all of the claims in circulation. This was a direct result of fractional reserve banking.

Explicit Default #2

While this Daily Dive won’t go too deep into all the details, as this topic could easily be expanded upon for tens of thousands of words, the U.S. did explicitly default for a second time during the 20th century.

Following the 1944 Bretton Woods agreement, the United States, Canada, Western European countries, Australia, and Japan came together and agreed to peg their currencies to the U.S. dollar, and to have the U.S. peg the dollar to gold. This put the world on a quasi-gold standard, giving global central banks the ability to redeem dollars for gold on request.

This system worked for some time, but as the chart below shows, the banking system in the U.S. was quietly expanding the money supply despite the “gold peg”, through the manipulation of the money multiplier.

The money multiplier is the inverse of the reserve requirement for commercial banks, meaning that the higher the money multiplier goes, the more that commercial banks can fractionally lend out deposits, thus the more that the money supply can expand.

Foreign nations began to call the United States' bluff, and over the course of several decades following the Bretton Woods agreement, the U.S. gold supply gradually drew down, as nations began to redeem their U.S. dollar reserves for gold.

What followed? The Nixon Shock.

The Nixon Shock

On August 13, 1971 President Nixon announced the “temporary” suspension of the dollar’s convertibility with gold, in what was the United States’ second default in less than four decades.

Explicitly, the U.S. defaulted on its debt.

Implicit Default

How is today different? How do implicit and explicit defaults differ?

Following the 1971 “temporary” suspension of the dollar’s convertibility with gold, the U.S. and the rest of the world moved to a fully fiat monetary system. This means that the dollar is backed by “the full faith and credit of the United States Government”, whatever that is good for.

So why are Yellen’s comments so salient? Because we are in the largest debt bubble of all time. This is not just a “housing bubble” or an isolated industry or sector that has far too much debt. We are in the final crack up boom of the sovereign debt bubble, and by definition, every other asset class and debt security is a bubble as a result.

Sovereign debt is the foundation of the global fiat economy. Sovereign debt provides the “risk free” rate from which all economic calculation is conducted, and we have undoubtedly or, rather, mathematically, reached a point of no return.

Total debt-to-GDP is at 401.5%. Public debt-to-GDP is at 114% of GDP. How does this get resolved?

Ray Dalio will provide the answer with another quote from his “Principles for Navigating Big Debt Crises”:

“In the end, policy makers always print. That is because austerity causes more pain than benefit, big restructurings wipe out too much wealth too fast, and transfers of wealth from haves to have-nots don’t happen in sufficient size without revolutions.

Also, printing money is not inflationary if the size and character of the money creation offsets the size and character of the credit contraction. It is simply negating deflation. In virtually all past deleveragings, policy makers had to discover this for themselves after they first tried other paths without satisfactory results.

History has shown that those who did it quickly and well (like the US in 2008–09) have derived much better results than those who did it late (like the US in 1930–33).”

The U.S. is undergoing an implicit default. While an explicit default would entail the creditors not being paid altogether, an implicit default is when creditors are repaid in nominal terms, but in real terms the repayment is significantly diminished.

Holders of U.S. treasury securities will most likely be paid back in nominal terms. The market for sovereign credit default swaps has pinned the probability of a U.S. explicit default at 0.095% over the next 5-years. The market believes Yellen.

However, for any investor wishing to preserve or grow their wealth in real terms over the next decade, U.S. debt securities or, rather, debt securities of any kind are simply the last place you should look.

Final Word

In previous generations, gold was the monetary safe haven of choice. Gold is scarce, durable, fungible, divisible and holds no counter-party risk. This made it the go-to choice for investors during both inflationary periods and deflationary depressions, as gold would maintain its real value throughout, due to the unforgeable costliness of the asset.

After all, to acquire gold you must exchange goods or services with someone who owns some or mine it yourself. Proof of work. For millennia gold has served as humanity’s choice for transferring value across time, while fiat solved for gold’s lack of portability across space.

In the digital age, gold’s use and feasibility as a monetary asset has been greatly diminished. Gold’s bulkiness and lack of portability is partially responsible for why we are here today.

Bitcoin is superior to both.

The bursting of the sovereign debt bubble?

Bitcoin fixes this.