Testing The Short-Term Holder Cost Basis

Bitcoin, along with broader risk assets, is on the move with equites rallying and equity volatility falling since late February. Bitcoin in particular is in an interesting spot, having been range bound for much of 2022, with price beginning to approach the pivotal level of $46,000, which is the short-term holder realized price (cost basis). Price reclaiming above the short-term holder realized price and sustaining there has been a useful short/medium-term indicator of bull/bear market in bitcoin, due to the dynamics at play when newer entrants are “in the money” on their investment.

When short-term holders (new money) are in the green on their investment, they are often less likely to capitulate and sell their coins, which works in a reflexive manner causing new money to have to bid a small amount of free-float supply to acquire a position.

While this is obviously an oversimplified explanation, a look at the all-time history of short-term holder cost basis relative to the market price displays quite the story. Displayed below is the ratio of short-term holder cost basis against price (STH market-value-to-realized-value ratio):

Along with the short-term holder realized price, the long-term holder realized price sits around $16,000 with a total market realized price around $24,000.

Derivative Market Update

Since the start of the new year, the bitcoin derivatives market has been almost entirely risk off, which has sustained periods of flat or outright negative funding. This is a sharp contrast to the market conditions of 2021, where rampant speculation dominated and elevated the market to new highs.

With price grinding to the mid $40,000s, it is a positive development to see that derivative market positioning has not taken a sharp turn with it, showing that spot market demand has been the driving force as of late. This is in no doubt partially fueled by the Luna Foundation buying hundreds of millions of bitcoin to back its stablecoin over recent days.

Lastly, we can look at the quarterly futures basis to display the lack of speculative money currently in the market, with the three-month forward futures basis yield at 4.5%.

When compared to the Treasury market, which serves as the “risk-free rate” for global capital markets, the futures basis is the lowest it has been since September of 2020 and July of 2021.

The Present And Future Of Reserve Assets

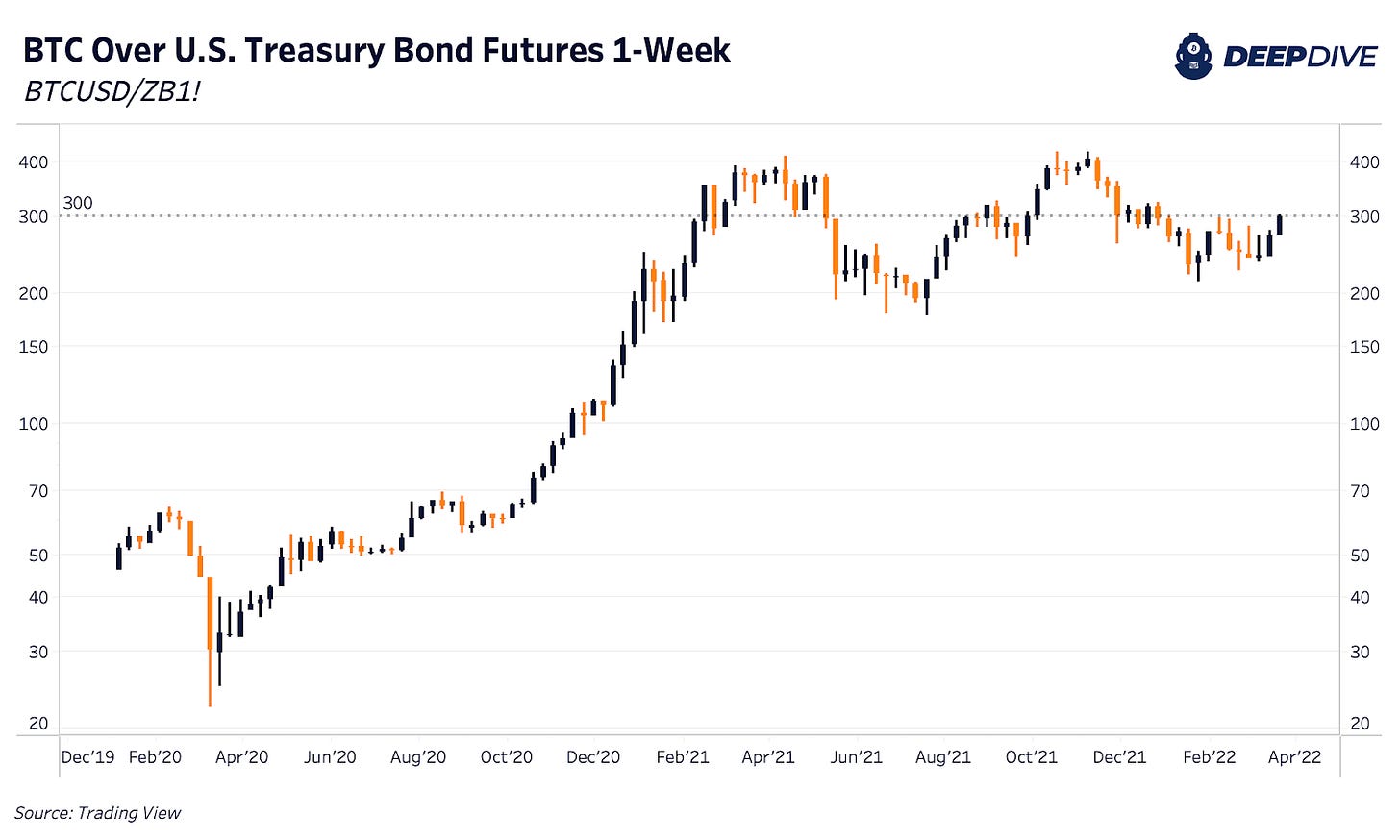

Lastly, if we chart bitcoin denominated in Treasury Bonds, we see quite the stellar-looking chart.

As we have been covering extensively in the Deep Dive as of late, the inflationary environment we are currently experiencing is awful for fixed-income securities, especially with long duration. As yields have soared, the principal value of treasury bonds has fallen substantially.

Thus it begs the trillion dollar question:

What if the world’s future reserve asset isn’t the liability of an over-indebted sovereign nation that increasingly relies on printed money to fund its deficits, but a non-sovereign absolutely scarce bearer asset with a programmatically increasing marginal production cost …?

Something to ponder for all of the bond holders currently.

excellent article. great info, great charts