The Daily Dive - Markets React To Russia Ukraine Invasion

52% Drawdown In Moscow Exchange Index

Over the last 24 hours, there’s been a wave of market reactions to the Russian declaration of war and invasion against Ukraine. We will try to highlight some of these in today's Daily Dive although the markets still seem to be pricing in the magnitude and risks of the unfolding events.

As a result, the MOEX, Moscow Exchange Index, has now fallen 52% from its all-time high back in October 2021. This is significantly larger than the 34.39% drawdown from all-time high during the March 2020 pandemic crash. At the same time, Russian government debt yields have been rising over the last month with 10-year bonds now over 13%.

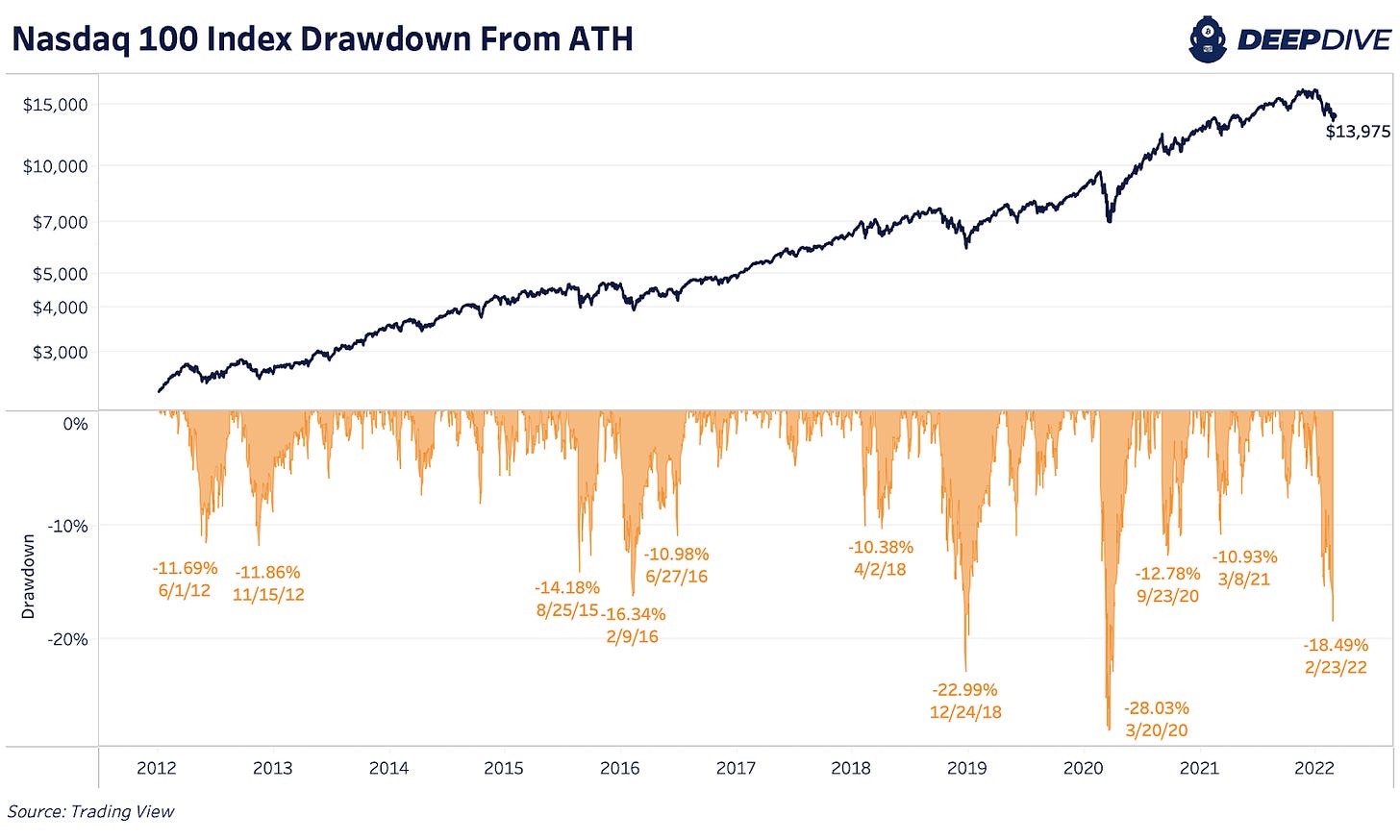

U.S. equities markets have followed the same direction but with less magnitude. The Nasdaq 100 Index was down over 18% from all-time highs yesterday and finished down 15.68% today. This is still less than the March 2020 pandemic crash but it is the third largest drawdown over the last decade.

Bitcoin continued to behave like a high beta, risk-on asset similar to most of the overvalued tech sector. As Russia’s announcement of military intervention was proliferating across financial markets, U.S. equity markets reached as far down as -3% in the night session, with bitcoin also plummeting to a low of $34,300, before bottoming and aggressively rebounding to a high of $40,000 in a large short squeeze.

At the time of writing bitcoin is down 43% from its highs from November, and 12% off the lows set late last night. At the close of the day the Nasdaq closed an outstanding 3.4% in the green in the daily session, as risk assets traded as if maximum fear and uncertainty were priced in shortly after the war declarations. Gold initially popped and hit over a one-year high, touching $1974 an ounce before dropping sharply, in an inverse pattern from U.S. equity markets and bitcoin.

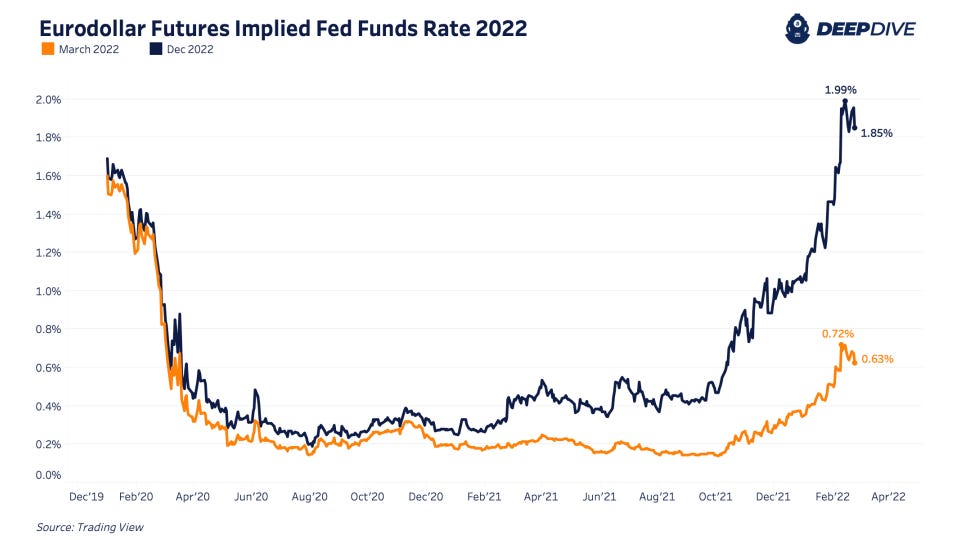

As a result of the conflict, the markets have quickly priced in lower Federal Reserve Board rate hikes for 2022. Looking at the eurodollar futures market, the implied federal funds rate has now dropped over 10 bps for March and slightly more for the rest of the year.

A development that will be important to watch is if the Fed walks back the timeline for tightening monetary policy due to the outbreak of war in Ukraine. If history is any precedent, this could very well be the case as central banks cherish the opportunity to deflect responsibility for policy error and continue to ease markets.

Great write up boys; im late on this one; are we seeing bitcoin these days act like the defensive asset the prophecies spoke of? we saw it play out: war broke out and transaction volumes rocketed in that region together with price.... out with the digital nasdaq narrative; in with the digital gold. speaking of gold, the boring kind, ive been hedging the rout in crypto with metals. Gold (gold miners/ GDX/ GDXU) and Uranium have been solid to that end ...

Deflected responsibility is error multiplied.