The Daily Dive - Lightning Network Growth

Lightning Network Analysis

“Bitcoin itself cannot scale to have every single financial transaction in the world be broadcast to everyone and included in the block chain. There needs to be a secondary level of payment systems which is lighter weight and more efficient.” - Hal Finney

In today’s Daily Dive we examine the growth of the Bitcoin Lightning Network. The Lightning Network is a decentralized second-layer scaling solution built on top of the Bitcoin network that allows for cheap payments between counterparties. The Lightning Network can essentially be thought of as a bar tab between counterparties, with the opening and closing of the tab serving as the equivalent of an on-chain bitcoin transaction. The proverbial “bar tab” is constructed using a 2-of-2 multisig wallet, which allows for users to take control of their funds in case of a hostile counterparty.

While today’s Daily Dive won’t go much further into the technical mechanics of the Lightning Network, you can find additional information here.

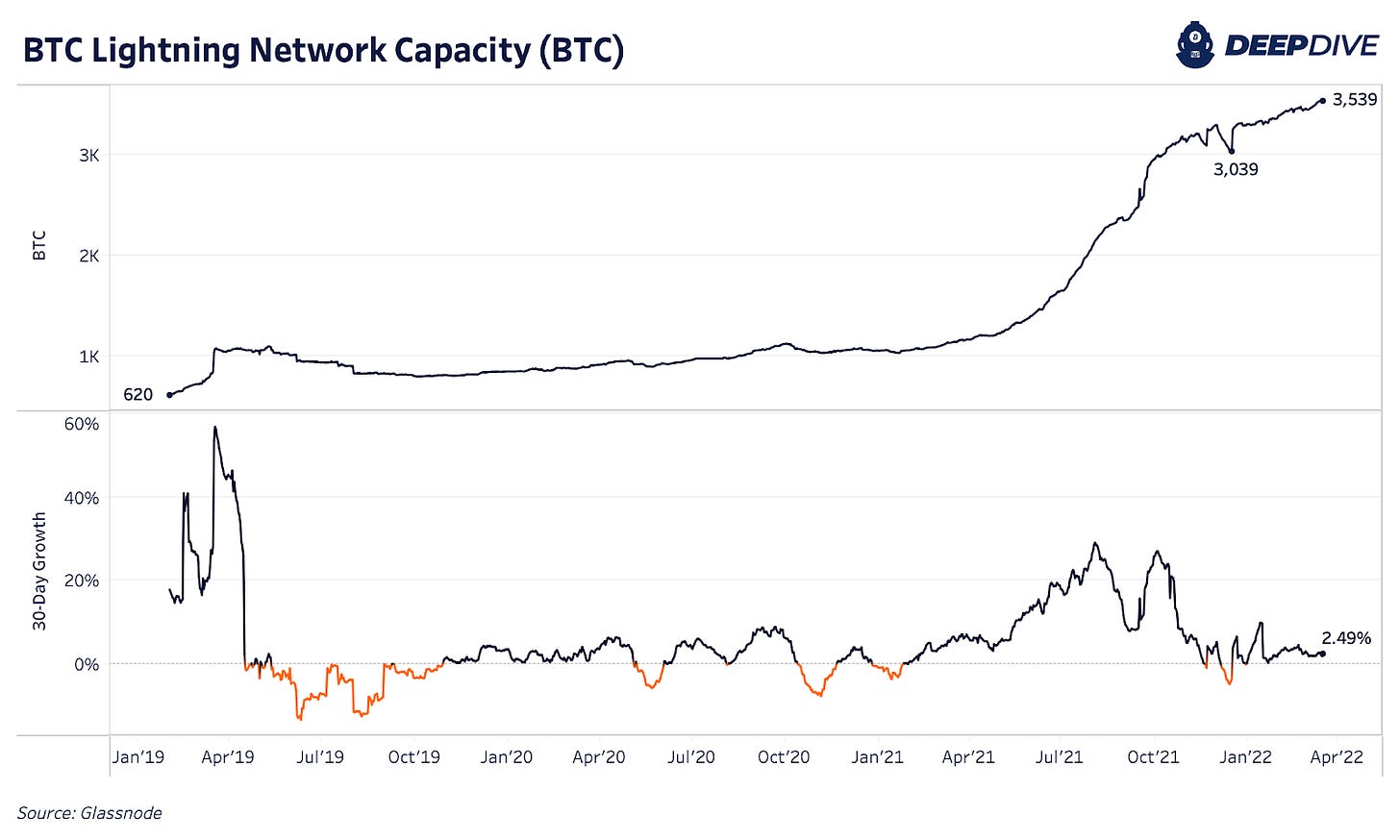

While the Lighting Network does enable private channels between counterparties, the total balance locked in these channels is not public, which is self-explanatory. Thus, in our analysis we will focus on public channel capacity, but it is important to remember that this is not counting the potentially large channels set up between counterparties that are private.

At the time of writing, current public channel capacity is 3,539 BTC. The pane below shows the 30-day growth rate, which displays the Lightning Network’s relentless growth over the previous three years.

Growth was highest in 2021 over the last two years, with the 30-day growth reaching a peak annualized growth rate of nearly 348% in August last year. Since then, growth in public channel capacity has slowed but is still growing over 30% annualized when averaging the growth over the last 30 days.

When pricing public channel capacity in USD terms, the explosive growth of the network becomes even more impressive, because after all, LN is a protocol to transfer value between peers. Thus, as bitcoin the asset becomes more valuable, liquidity between users in BTC terms goes further. It is also important to distinguish that the chart below is in logarithmic scale.

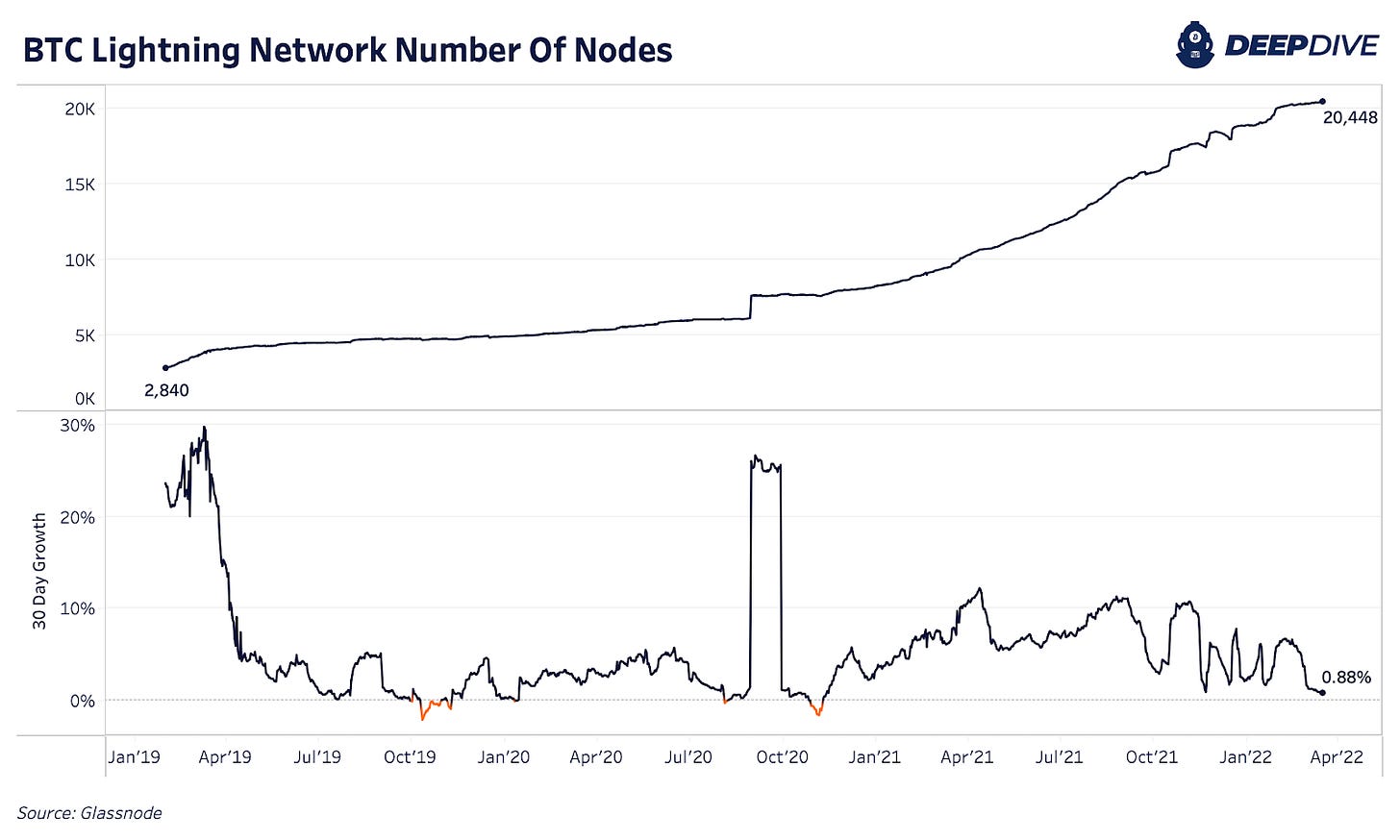

The total number of nodes on the network has surpassed 20,000 with many of these nodes being individual users, while many others are operated by companies like Block (CashApp), Strike and River, who offer their users the ability to send and receive funds via the Lightning Network.

The Lightning Network is among the most bullish yet least talked-about aspects of Bitcoin, as many discuss the superior monetary properties of bitcoin the asset; very few seem to understand the implications of an open and programmable monetary standard that is far more cost-effective than traditional payment processors (centralized networks) like Visa or Mastercard.

The recent growth in public channel capacity is especially impressive when taking into account the fee market environment in Bitcoin, which has been extremely low since the fall of 2021 (in BTC terms).

During periods like 2017/2018 when the network faces an influx of activity and new users, the Lightning Network will drastically help to reduce strain and on-chain congestion, which will keep settlement costs much lower, improving the overall efficiency of the network.

Closing Note

The Lightning Network is a near lock to continue growing in exponential fashion over the coming months and years, and most don’t understand the potential disruption that a cheap settlement network for a digital bearer asset is to the internet protocol stack.

Bitcoin is far more than just an asset.

keep up the great write ups 👍👍