The Daily Dive - February Miner Performance

Miners Increase Hash And BTC Holdings

Although our focus has largely been on the current macro picture, bitcoin miners continue to operate like normal, producing blocks every 10 minutes. Over February 2022, the top public miners increased their hash rate and bitcoin holdings but produced less bitcoin compared to January.

Almost all of the miners with available public data increased their hash rate last month with aggregate hash rate reaching 28.41 EH/s. If we include previous reporting numbers for Bit Digital, hash rate reached 31.01 EH/s across the below group of 11 public bitcoin miners. We’ve added CleanSpark, Northern Data and Iris Energy since our last miner update, The Daily Dive #145 - Public Miners January Update.

Core Scientific still makes up the lion’s share of hash rate with over 26% at 8.2 EH/s. That figure only includes their self-mining hash rate and doesn’t count their 7.7 EH/s in hosted hash rate capacity offered as a service to other miners. Across both their self-mining and hosting hash rate, they plan to reach 40–42 EH/s by the end of the year with Mike Levitt, CEO saying,

“We believe that we are well positioned to achieve 40 to 42 EH/s of total hashrate by year end 2022, distributed approximately evenly between our self-mining and hosting segments. Demand for our hosting capacity remains strong and continues to exceed our available supply. Our construction and power team is on pace to achieve 1.2 to 1.3 GW of operating infrastructure by year end to continue expanding our hosting and self-mining capacity.”

In this scenario, Core Scientific is implying their hash rate will grow another 164% this year.

Bitcoin holdings increased nearly 10% in February to 39,429 BTC just shy of 40,000. Marathon still holds the most bitcoin in their treasury across top miners. With Core Scientific, both miners have 16,291 BTC (roughly $635 million equivalent) and make up approximately 41% of all public miner bitcoin holdings.

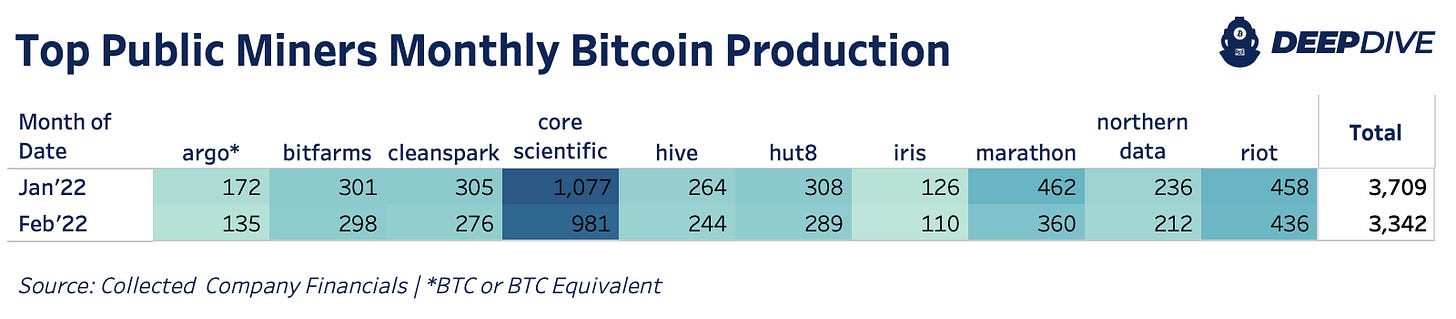

Monthly produced bitcoin fell nearly 10% in aggregate. Production was affected by rising difficulty over the last month, less February days in the month and curtailed operations in response to harsh winter storms across North America. Out of all the bitcoin produced in February, these public miners made up 12.89%.

After upward difficulty adjustments of 9.32% and 4.78%, Bitcoin had its largest negative difficulty adjustment since July 2021 of 1.49%. As of now, the next difficulty adjustment (over the next few days) is estimated at negative 1% which will be a positive sign for miners increasing their March bitcoin production.

With higher difficulty adjustments over the last month, hash rate fell from all-time highs of 214.75 EH/s down to 200.33 EH/s. Even with the decline, hash rate is still up 15.92% YTD and 11.33% over the last 30 days. Annualizing the YTD growth would produce roughly 80% growth for the year yielding over 300 EH/s at the end of 2022.

This is still in line with our initial 2022 hash rate projections, but we expect rising energy costs and commodities prices to be a significant headwind for miner expansion plans. Continued global supply chain constraints for high-performing chips are also a concern as Intel looks to enter the industry, building its second-generation chip, and fulfill increased demand. We plan to update more analysis on this in our next miner release as these dynamics take shape.

As for financial performance YTD, bitcoin is down 15.94% while most miners are down much worse. The only two miners that have outperformed bitcoin this year are CleanSpark and Iris Energy, although both in negative territory. As miners can outperform bitcoin in bullish periods, they can also vastly underperform in risk-off bearish markets.