The Daily Dive - Dollar-Cost Averaging Bitcoin

Bitcoin Dollar-Cost Averaging Results

For those looking to acquire more bitcoin, a strategy of dollar-cost averaging (DCA) is likely the best option for the vast majority of market participants. Although we look for unique opportunities in the market when it’s more favorable to acquire more bitcoin and when it’s relatively cheap based on a mix of macro, on-chain and derivative market indicators, timing bottoms, tops and momentum is a difficult game.

In today’s Deep Dive, we will look through a few dollar-cost averaging scenarios sharing the percent returns, accumulated bitcoin and total costs.

For starters, having a long-term preference of bitcoin during its monetization and adoption cycle has proven the best way to view the asset. As we’re still incredibly early in this stage with meaningful global adoption estimated below 5%, we expect dollar-cost averaging with a long time horizon of bitcoin to still be the most effective acquisition strategy.

Over Bitcoin’s history, thinking in four-year cycles was significant to realizing returns and seeing one’s purchasing power increase versus other assets. Thinking in multi-year periods (or even decades) is still the most valuable approach to frame an investment in bitcoin while the typical four-year market cycle seems to be behind us.

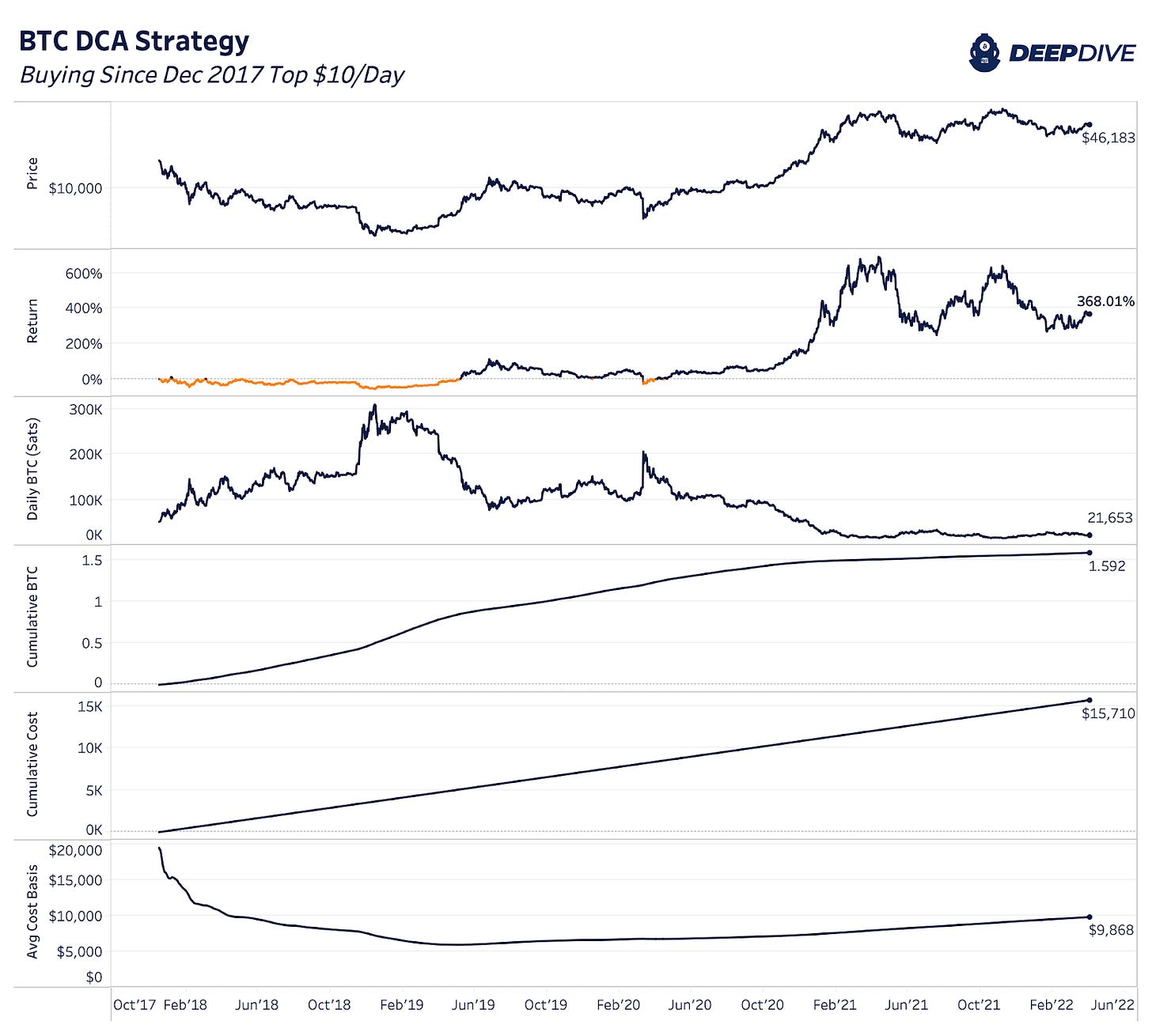

If one was to start allocating $10 a day since the 2017 bitcoin cycle peak, they would have a 368% gain on their investment today. By doing so, you would have acquired 1.592 BTC at a $15,710 total cost. That’s an impressive return for buying at the cycle top, but it takes time to see these returns appreciate. One would have been “underwater” for the first 16 months in this scenario and would have a negative ROI during the March 2020 COVID-19 crash. It’s not until 2021 where the ROI would really start to take off.

A similar exercise for the most recent November 2021 top would show a $10 per day DCA scenario that just recently turned positive ROI since its buying start date. The average cost basis of this strategy is $44,973, just shy of current price levels. With a probable chance that price drops even further in 2022, it’s likely that this strategy and entry point could be underwater for most of the year just like our 2017 example above. But to reiterate, it’s about framing bitcoin through a long-term lens rather than just the initial one to two years of the investment.

Lastly, rather than show buying at exact tops, we can think of scenarios from specific dates. The two scenarios below show buying beginning on the first day of 2020 and 2021.

In the 2020 year-to-date scenario, the strategy yields 163% return netting 0.4706 BTC at a $17,530 cost basis. For 2021, the strategy is slightly better than buying at the November 2021 top with the current ROI of 3.92% peaking at 53% return at the top while reaching -30% at the price bottom.

Final Thoughts

If you have a long-term view and high level of conviction on where bitcoin is going, then you’re likely trying to accumulate as much bitcoin as possible at the lowest price you can find in the market. Yet, timing exact market tops and bottoms and trading them well is almost an impossible feat, a fool’s errand, unless you have an edge.

If you’re waiting for lower bitcoin prices then you have to be prepared to risk the potential upside if the market moves against your favor. And bitcoin has proven to explode to the upside in a short amount of time throughout its history leaving many FOMOing into tops. For most, that’s why a dollar-cost averaging strategy is the ideal strategy. It’s simple, effective and a sure way to consistently secure more sats as Bitcoin adoption continues on.

Thank you for keeping it real Dylan. (I'm doing a very similar discipline as you preach in this column) Sorry I can't be at BTC 2022 even though I'm holding 2 GA tix. My day job is causing me to miss the fun. Maybe next year my young friend.