Derivatives Risk Free Rates

In the legacy finance world, the market’s “risk free” rate (or cost of capital) is typically the U.S. 10-year Treasury which currently yields 2.19% nominal interest. In the Bitcoin market, the risk free rate is typically referred to as the spread captured between selling the futures market price and buying the spot market price when the market is in contango.

This is also referred to as the futures annualized rolling basis. When there is more speculation and demand building up in the Bitcoin futures market, the futures price rises relative to the spot price, creating an opportunity to arbitrage the spread between the two in a fairly risk-free way.

Bitcoin’s price followed the decline in futures market demand over the last few months and more recently, we saw a slight divergence between the spot market and the futures market. Now, we’re starting to see the annualized basis accelerate as futures demand comes back into the market following strong on-chain fundamentals. This raises Bitcoin’s risk-free rate.

*Note that the latest hourly chart annualized basis is higher than daily data we use below.

We can take Bitcoin’s risk-free rate further by comparing the futures annualized rolling basis to the traditional risk-free rate of the U.S. 10-Year Treasury bond. What this currently provides us with is a spread of 1.64% which is the daily futures annualized basis rate of 3.81% less the current 2.19% yield on the 10-year Treasury.

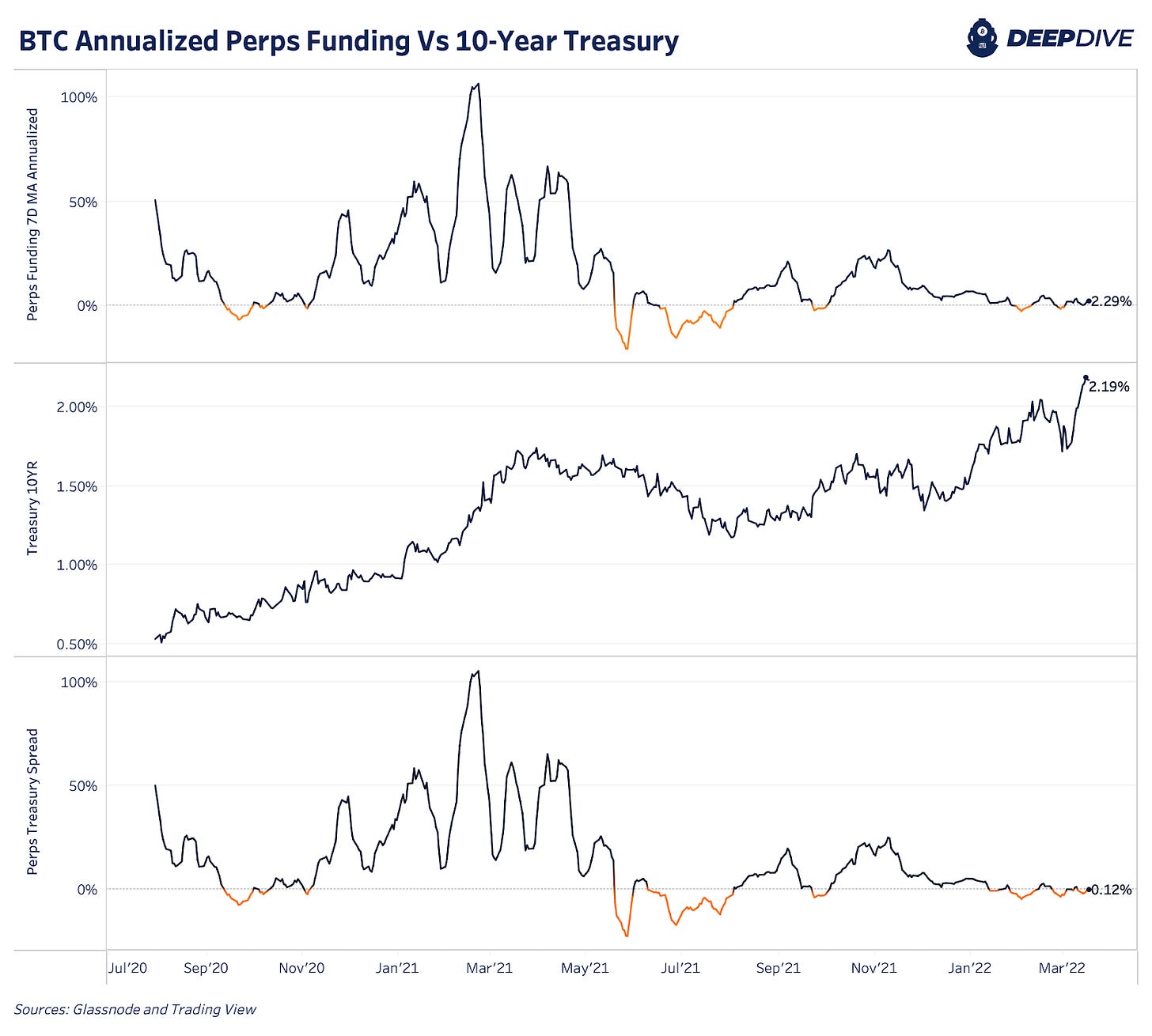

We can also leverage the implied risk-free rate that traders or investors can capture in the perpetual futures market. When funding is positive, longs pay shorts and when funding is negative, shorts pay longs. To capture these rates, one would just take the other side of the market funding rate.

Currently the 7-day average annualized rate in the perpetual futures market is around 2.29%. Using the same 2.19% 10-year Treasury yield, the implied risk-free rate for the market is 0.12%.

Below is a combined chart to show both these derivatives market rates.

We believe that comparing the “risk-free” rates existent in the bitcoin market with “risk-free” rate of the 10-year Treasury (which serves as the baseline cost of capital for the global economy) is quite insightful, in particular due to the large amount of capital that will likely be fleeing from negative real yielding bonds over the coming decade and instead enter the bitcoin market.

Thus, if we revisit the current environment in the bitcoin derivatives market, we can see that there is essentially no speculative bid existent. This is a rather bullish data point, given that excessive derivative market speculation is what has led to many of the large drawdowns in the past.

Current Outlook

Bitcoin currently looks to be in the midst of something of a relief bounce, with the potential for a short squeeze to develop given the persistent periods of neutral/negative funding rates in the perpetual swap market since the start of 2022.

With funding completely flat or even negative in recent weeks/months, the speculative bid that persisted throughout much of 2021 is completely gone, which can be partially attributed to the risk-off sentiment across global markets amidst soaring inflation, declining growth outlooks and the start of Fed policy tightening.

Given the lack of a long leverage bias present in the market, as well as the persistent selling pressure since November, it likely wouldn’t take much capital to move markets to the upside, and given the geopolitical developments as of late, the long-term bull case for bitcoin (censorship resistant, apolitical, absolutely scarce digital cash) has never been stronger.

While our outlook on credit markets is unchanged (despite the recent recovery in equities, credit and drawdown in volatility over the past week), it is entirely possible that bitcoin gets repriced higher during broader market turmoil.

One of our beliefs is that the biggest alpha is using BTC as your native risk-free rate of return and unit of account, while almost all capital allocators continue to use debasing fiat to conduct economic calculation. Exchange rate volatility in USD terms is here to stay, but those able to withstand the sharp swings (in part due to the volatility inherent to credit-based monetary regimes), will stand to gain the most.

$BTC, the hardest monetary asset humans have ever conceived.

Always a bullish ending