The Daily Dive #148 - State of the CME Futures Market

CME Futures

Today, we’ll be taking a look at the evolving role that the Chicago Mercantile Exchange (CME) has played in the bitcoin futures market. In particular, we will examine some of the trends since the ProShares Bitcoin Strategy Futures ETF (BITO) began trading in October 2021.

We covered the potential impact of a bitcoin futures ETF in The Daily Dive #080 - Bitcoin Futures ETF Impact.

There is currently $14.7 billion of bitcoin futures open interest contracts across various exchanges and contract types, a figure equivalent to 348,000 bitcoin.

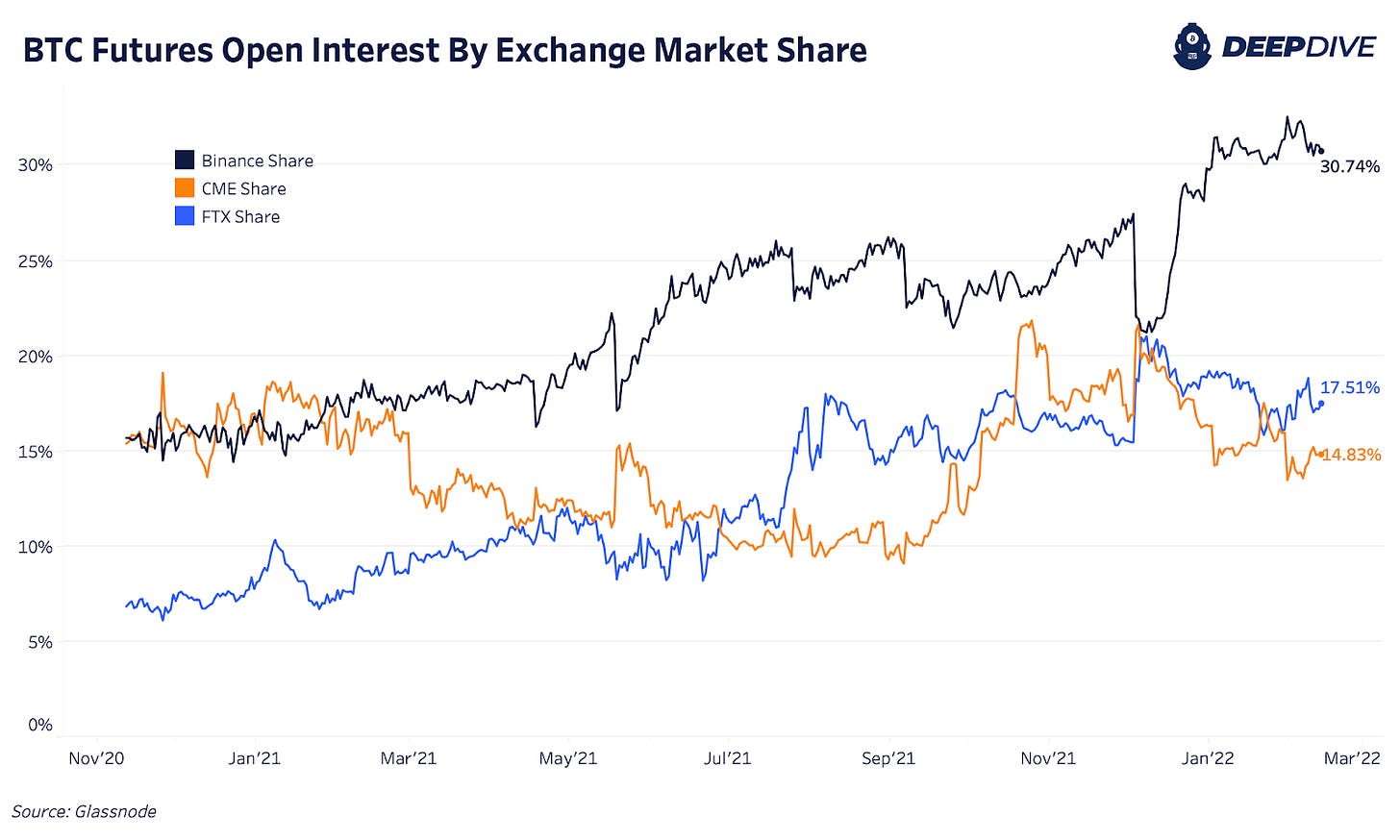

An analysis of open interest by exchange shows Binance ($4.44 billion) as the market leader with FTX ($2.53 billion) and CME ($2.14 billion) following behind. These three exchanges make up the majority of open interest contracts accounting for over 60% of the market.

In terms of the percentage of aggregate open interest by exchange, 30.74% is currently held on Binance while FTX and CME hold 17.51% and 14.83% of open interest each, respectively.

Among the most interesting dynamics, in regards to analyzing the open interest of specific exchanges in the futures market, is the rise of open interest in the CME leading up to the approval of the bitcoin futures ETF.

In early October, rumors began to circulate that a futures ETF was imminent and bitcoin futures open interest on the CME (where the prospective futures ETF would trade its holdings) more than doubled to a peak of $5.5 billion in less than a month, briefly becoming the market leader in open interest.

During the period, CME’s futures market share increased from 9.10% to 21.85% at its peak.

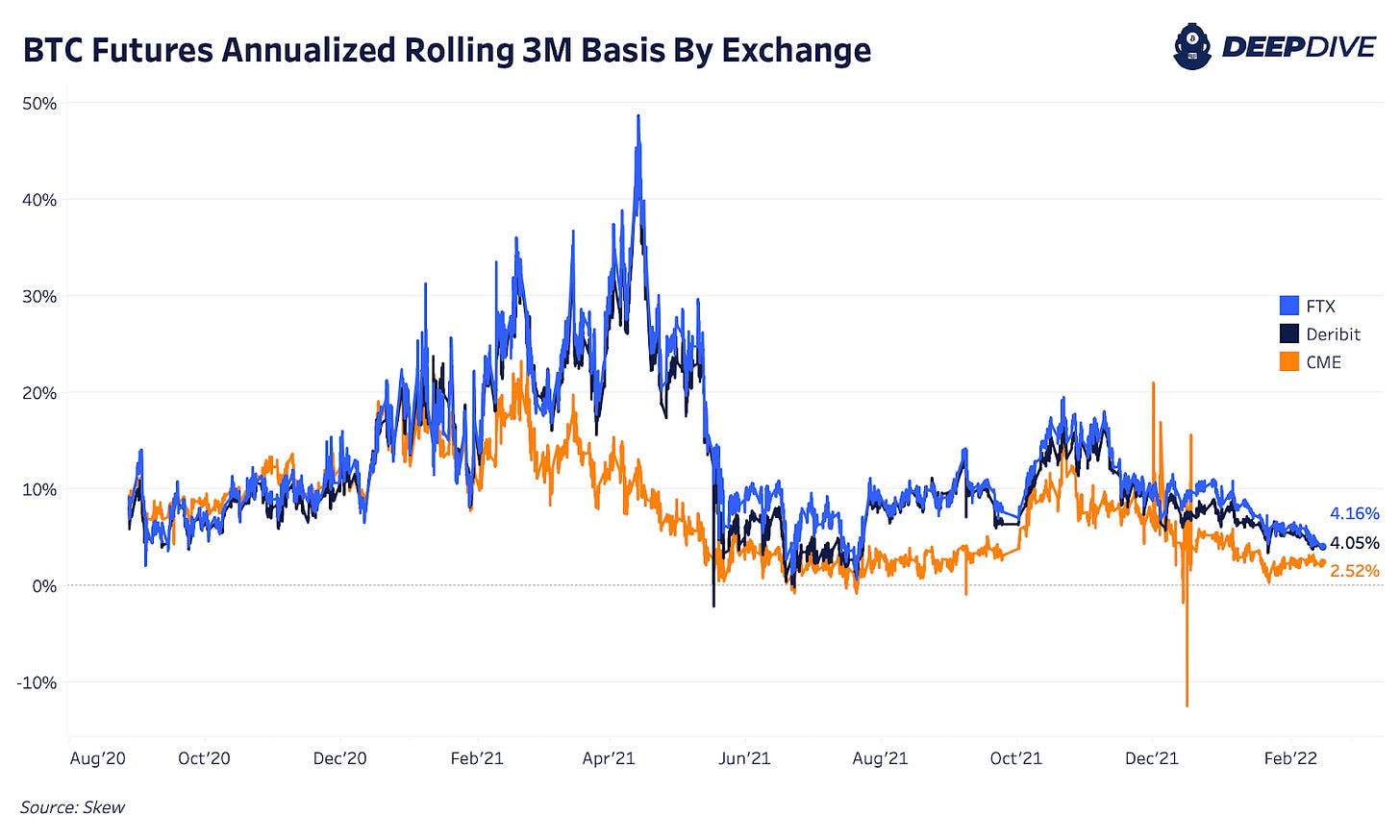

But what was the market impact on the price of bitcoin, if any at all? We can look at a few metrics, but the futures basis (the spread between the forward futures contract and current spot price) is especially telling, as it signals the markets forward (yet sufficiently speculative) expectations.

Since this summer, the annualized basis (the spread between the three-month forward futures contract and the spot market, annualized) were tightly correlated, showing us that derivative speculation was a primary driver in the market. The figure below shows the average annualized basis across exchanges.

Going into October, the basis on the CME began to rise with fervor alongside open interest, a signal that certain market participants might have known a bullish catalyst was on the horizon (and front-run billions of dollars of capital inflows in the process).

Zooming in further, we can see the sharp move from 3% to over 15% in the CME futures basis, from early October to the passing of the futures ETF on October 19.

*Note the term “boomer” in the following tweet is satirical and meant to refer to the types of institutions who trade on the Chicago Mercantile Exchange.*

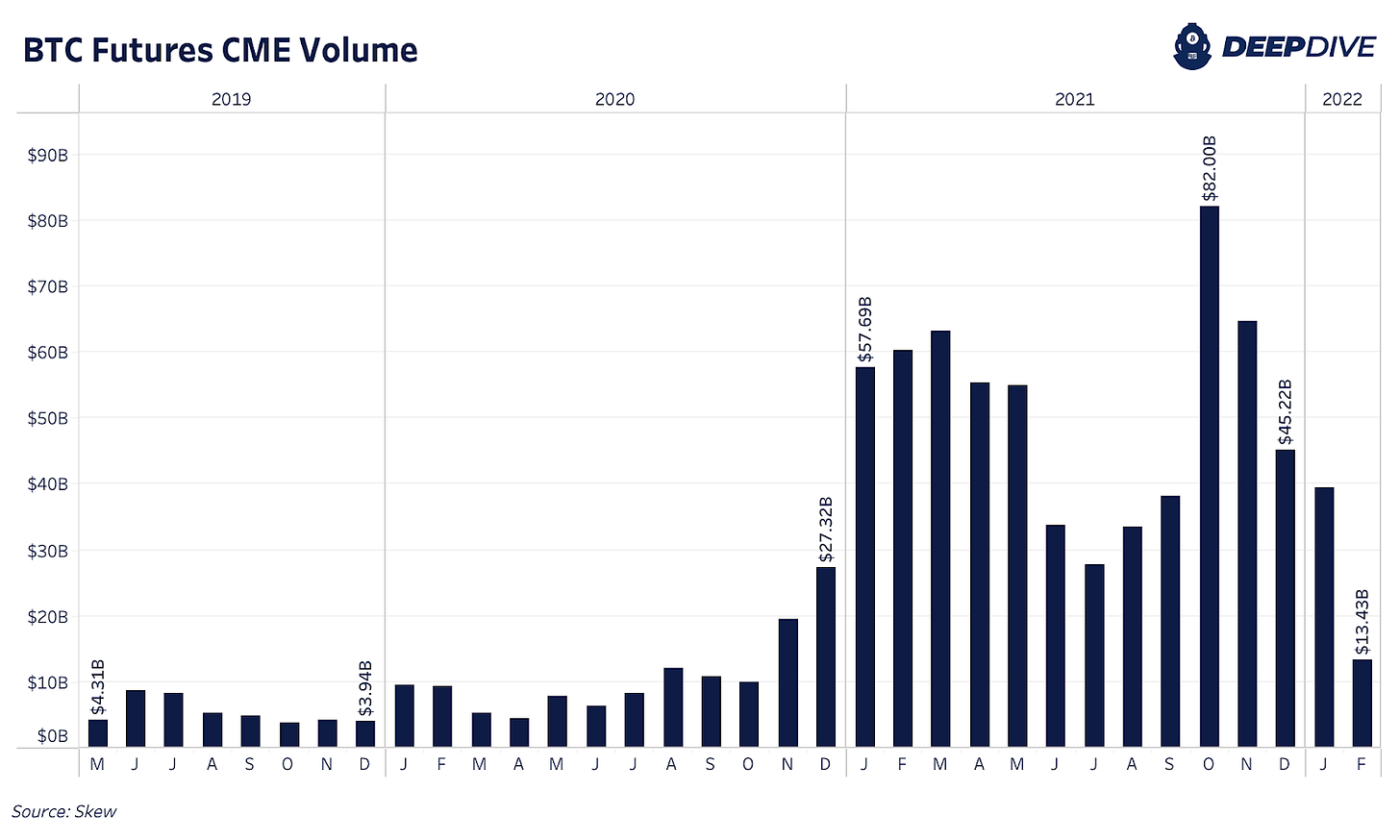

Over the last few months, CME monthly trading volume has fallen to near 2021 lows on the platform, with open interest down 61% off its October peak.

While we are not inferring that “insider trading” occurred in the approval process of the CME-based bitcoin futures ETF, what we are attempting to highlight is the speculative impact that the bitcoin futures ETF narrative and ensuing speculative market inflows had on the bitcoin market.

A spot market bitcoin ETF is on everyone’s watchlist for 2022, but it has yet to be seen when Gary Gensler and the Securities Exchange Commission will allow for a product to hit the market.

In the meantime, it's a great opportunity to learn how to self-custody the world’s only absolute scarce digital monetary asset.