The Daily Dive #147 - Stablecoin Supply Ratio At Historic Low

Rising Stablecoin Supply

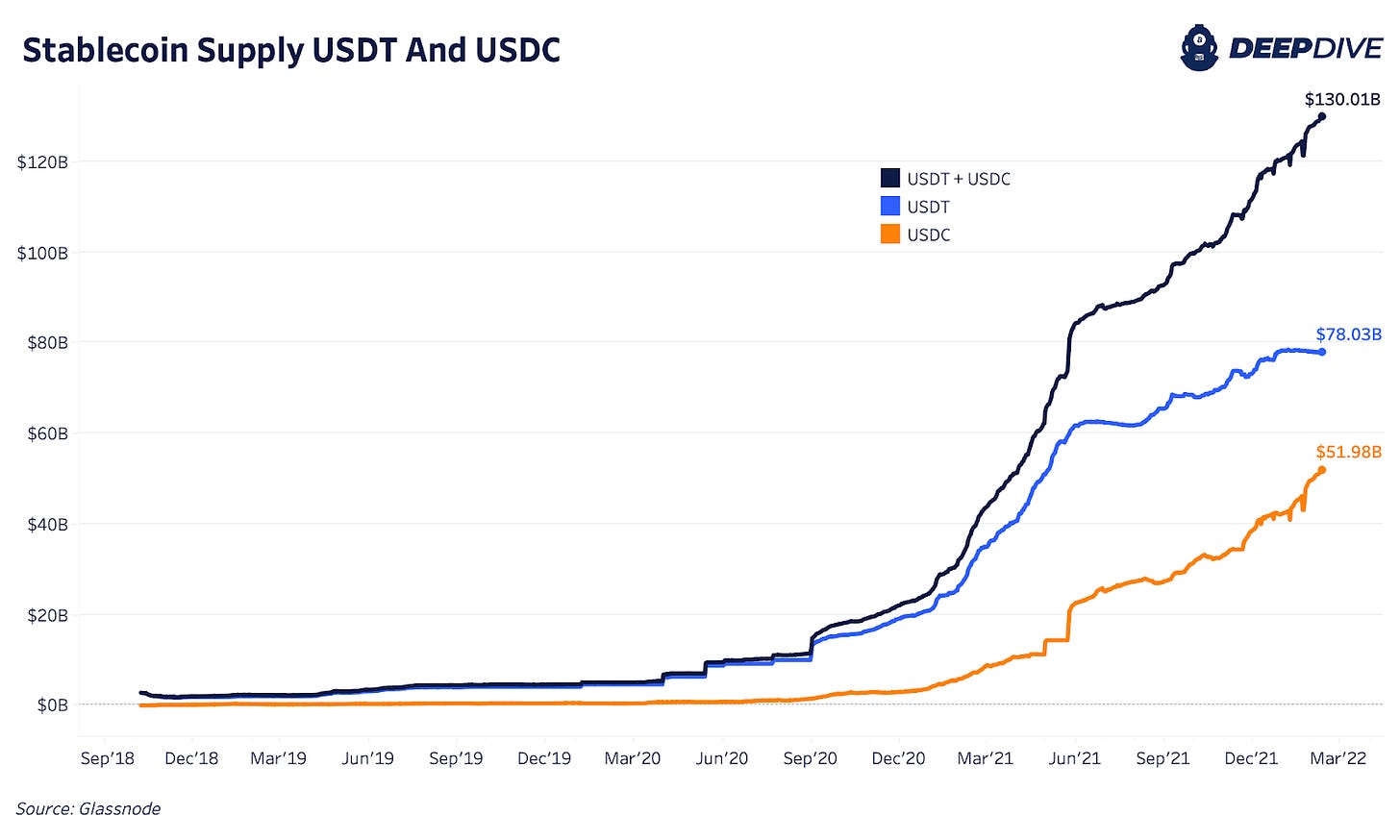

The first thing we will be looking at is the latest trends in the stablecoin ecosystem, where total supply continues to increase in exponential fashion. In particular we are measuring the growth of the two market-leading stablecoins, USDC and USDT, issued by Circle and Tether respectively. The two leading stablecoins make up approximately 72% of all stablecoin supply.

At the time of writing, the two stablecoins have a total of $130.01 billion of circulating supply, with USDT accounting for $78 billion and USDC accounting for $51.98 billion. Below are the 30-day growth rates of USDC and USDT supply since December of 2018 with total growth accelerating over the last month.

If we take the supply of stablecoins relative to the market cap of bitcoin, we can see that the growth of stablecoins has far outpaced the growth in the bitcoin market cap, which by no means is an unhealthy development. Stablecoins are simply an easier way to hold and move fiat capital than the legacy system, and thus the rapid growth is expected as the market matures.

The stablecoin supply ratio (SSR) was first introduced in this introductory article.

“When the SSR is low, the buying power for bitcoin is high, as the same amount of USD can buy relatively more BTC — an indicator for the increased potentiality to push the price of bitcoin higher.

“Conversely, a high SSR means fiat has weak buying power. Hence, even when the general sentiment is bullish, it becomes harder to move the price of bitcoin up — and even creates selling pressure.”

The upper and lower bands applied to the ratio are 200-day moving average Bollinger Bands to account for volatility, and breaks above/below the line signal trend significance. We can observe this relationship in the SSR oscillator, which is derived by the SSR’s positioning relative to its upper and lower bands. Currently the metric is slightly above its lower band, signaling that the supply of dry powder relative to the bitcoin market is large, an encouraging sign for the market.

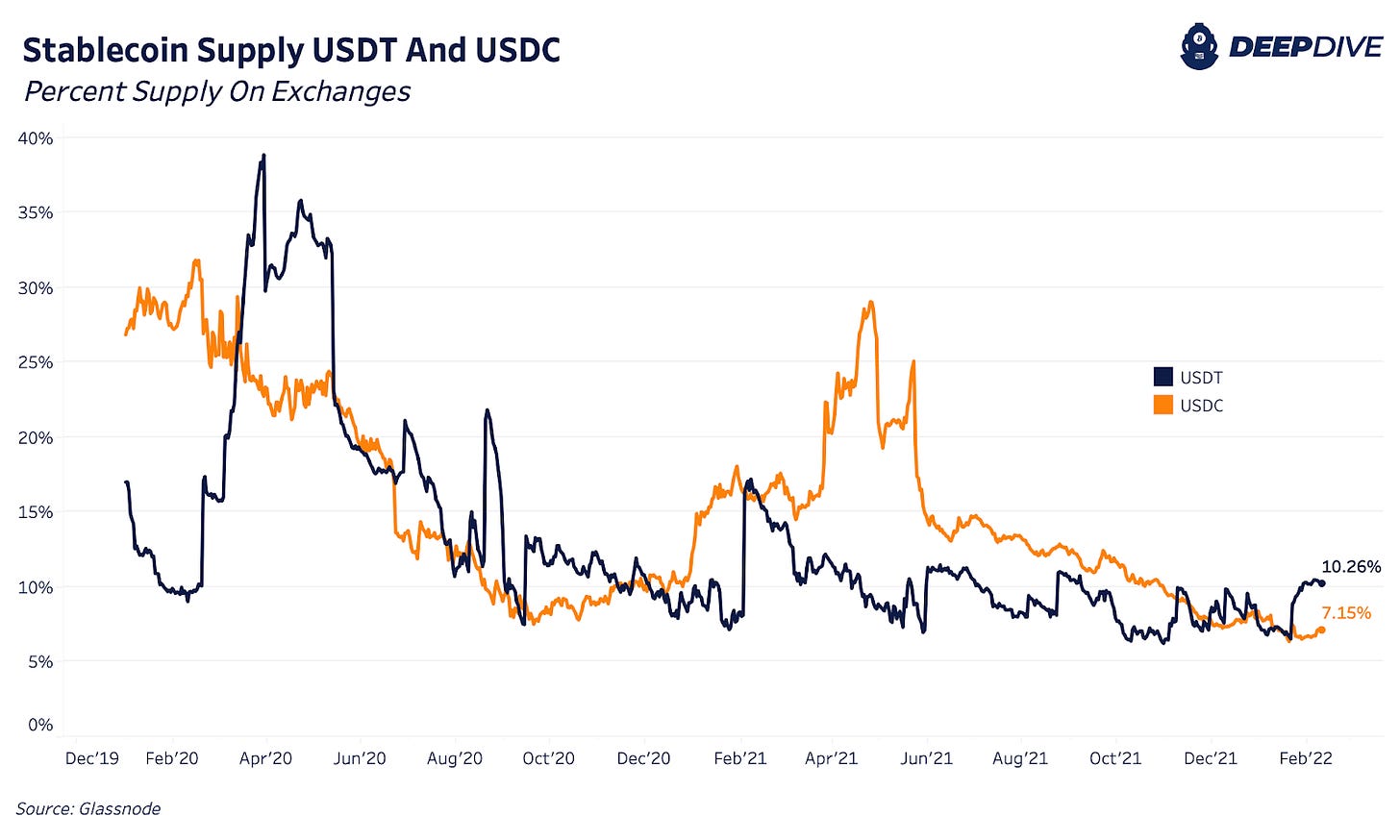

A caveat would be that the relative supply of stablecoin supply currently on exchanges is quite low compared to historical standards. This is most likely a result of growing uses of stablecoins outside of centralized cryptocurrency exchanges and representative of its potential market impact (which has grown significantly in recent years).

In another note, the relationship we have been monitoring closely over the following months with bitcoin and legacy markets picked up again today, with the VIX (S&P 500 volatility index) exploding upwards on geopolitical uncertainty and an increasing likelihood of Federal Reserve Board rate hikes in 2022.