The Daily Dive #143 - Exchange Outflows And Derivatives Update

Rising Exchange Outflows In January

As we’ve discussed in previous Daily Dives, March 2020 was a significant catalyst and turning point for bitcoin. We can see that in the behavior of exchange balances which have shown consistent net outflow over the last two years.

The two most recent periods of significant inflows were right before both 2021 bitcoin local price tops. These tops in April and November coincided with the previous month showing net exchange inflows of bitcoin in both March and October.

January was the largest outflow month since September 2021. Keeping an eye on exchange flow dynamics can help us track demand sentiment and when that is fundamentally changing for market participants.

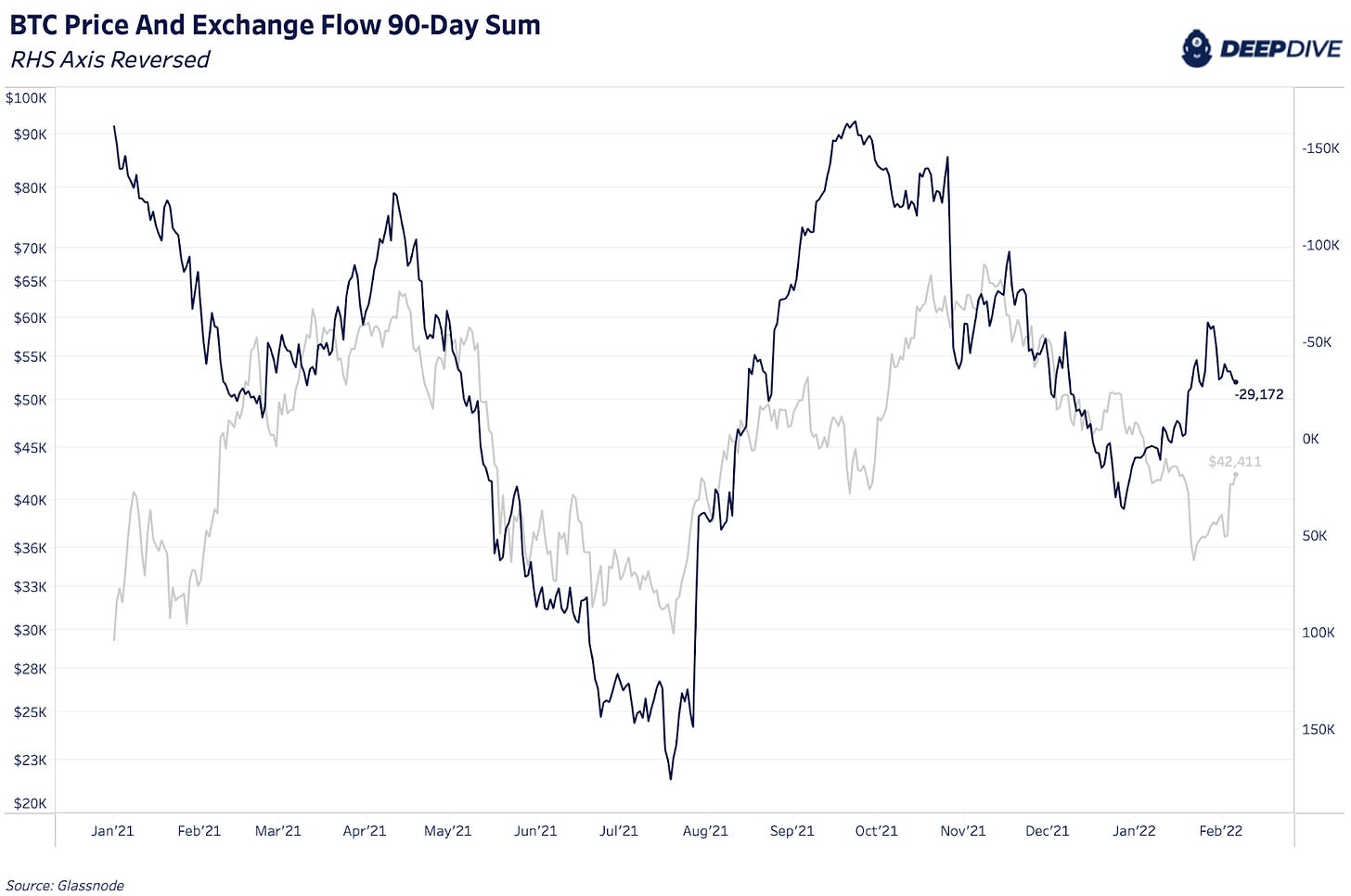

The 90-day cumulative exchange flow has consistently moved with price over the last year. In the chart below, the right-hand side axis is reversed to show how a decreasing net exchange flow correlates with a rising price and vice versa.

What we’ve seen in January is a turning point in the 90-day cumulative netflow with more bitcoin flowing out of exchanges. This signals increased buying demand over the last month and we’ve seen bitcoin price follow suit over the last few days. This is happening while we’re also seeing accumulation trends in long-term holders and whales over the last few weeks.

Looking at the 30-day change in exchange balances, we’ve seen a strong deceleration over the last two weeks.

Another way to view exchange volume dynamics is to look at the net exchange flow relative to estimates for adjusted supply. Adjusted supply removes coins that haven’t moved in 7 years which is an assumption to account for Satoshi’s coins and lost coins. Current adjusted supply is approximately 15.58 million bitcoin, 82.2% of the circulating supply.

When net exchange outflows are rising relative to adjusted supply, this can be a short-term bullish signal for price. When net exchange inflows are rising relative to adjusted supply, this can be a short-term bearish signal for price. Looking over the last 30 days, we saw this ratio overextend to higher outflows on January 27 and 28:

Over the last two years, we’ve only seen bitcoin’s price not follow suit once after outflows were overextended during April 2021. This is when derivatives markets were inflating price, overextended long and then ended in a liquidations cascade. Today, the derivatives market dynamics are completely different with the market leaning short while price is rising, suggesting spot market demand is driving the rebound from the January lows.

Derivatives Market Update

We have written about the positioning of derivative traders extensively recently, as it is such a key driver in bitcoin markets, and thus we will be providing another update today. In Friday’s Daily Dive as bitcoin broke above $40,000, we noted the persistent bearish positioning of perpetual swap traders, as funding remained negative despite the approximate 25% bounce in the price of bitcoin. At the time of writing, with bitcoin now $4,000 higher than our last update, funding in the perpetual swaps market is still negative (meaning that shorts are paying longs to hold a position).

Over the last twenty four hours, shorts have paid longs approximately a 3.3% annualized rate on their notional position size, which opportunistic bulls have happily taken advantage of.

Open interest in the perpetual swap market remains elevated, meaning that a meaningful amount of short interest would be forced to become buyers in the event of a sustained strong spot market bid (which has been the driving force in the market since the local bottom in January).

One of our favorite long term views of the market, the daily view of perpetual futures funding (which doesn’t include the recent 24 hours of market data) shows what over-aggressive bulls and bears in the derivatives market can lead to in terms of future price action.