The Daily Dive #142 - Bitcoin Breaks $40,000

Negative Funding And Short Liquidations

In the past couple months we have focused intently on the correlation between the equities market (specifically the Nasdaq) and the price of bitcoin. We noted that marginal sellers by macro allocators that have gained exposure to the asset class over recent years was the driving force behind the move.

Today bitcoin broke above $40,000 with force, decoupling with strength against the Nasdaq and other “risk-on” assets.

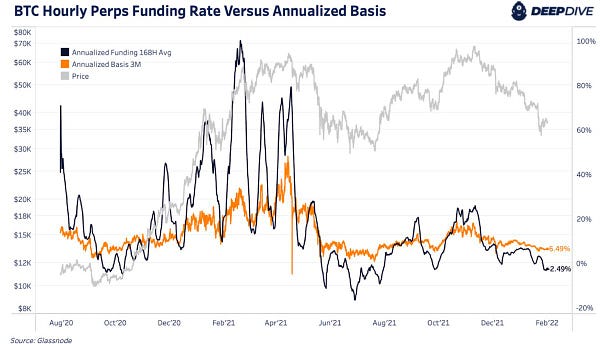

One of the reasons for the strength of the move was the large amount of short interest that had been opened in the $30,000 range, forcing bears to close their positions. In the derivative section of our monthly report we highlighted that previous bitcoin bottoms were marked by periods of derivative market bearishness, particularly when perpetual futures funding was negative for prolonged periods of time.

With the negative funding piling up, there was approximately $53 million in total short liquidations over the last eight hours helping to send bitcoin over $40,000.

Credit Markets Take A Hit

However, despite the recent strength of the bitcoin price action, a few causes for concern should be identified in the broader economy. Credit markets have been getting clobbered recently.

Treasuries along with investment and junk grade corporate debt have all been aggressively turning over as of late, a sign that borrowing costs across the economy are rising.

In particular, TLT (20-year+ Treasury bond ETF), JNK (high-yield Bond ETF) and LQD (investment-grade corporate bond ETF) have all been rolling over.

The consequences of the falling prices in debt instruments is higher financing costs in the broader economy, as a forty-year high in the consumer price index along with a slightly hawkish Federal Reserve Board has lenders looking for higher yields.

What should be watched going forward is how credit markets trade, as this has a direct impact on equity markets from a corporate financing perspective but also a market valuation perspective.

This is something we will keep a very close eye on over the coming months, into a potential Fed rate hike cycle.

im liking this price action dudes...lets see if we get a good run going until our next date with jerome