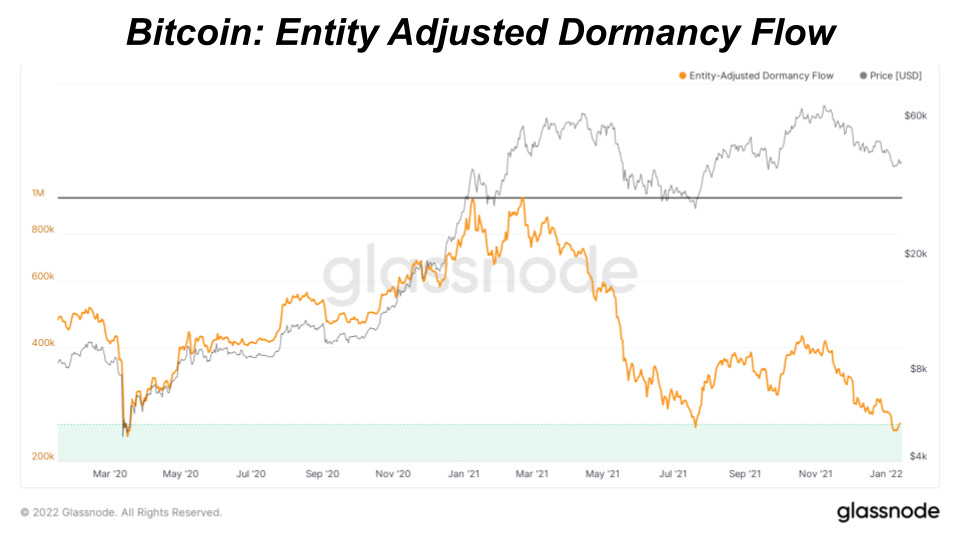

Dormancy Flow Signals Buying Opportunity

This week, a key on-chain metric indicated a potential bottom in the bitcoin price. Entity-Adjusted Dormancy Flow, developed by David Puell, is the ratio of market cap to an annualized dormancy value denominated in USD.

Dormancy, on its own, is measured as the ratio of the number of coin days destroyed over total transfer volume (change-adjusted). A lower dormancy, or lower number of coin days destroyed (destruction) relative to total transfer volume, shows less older coins (HODLers) moving. Higher dormancy shows more older coins moving or being spent.

To get an annualized dormancy value, the dormancy ratio is multiplied by USD price and then takes a 365-day moving average. When market cap compared to a higher annualized dormancy value (spending behavior) is at historic lows, the Dormancy Flow ratio signals a potential bottom with the market in full capitulation mode. Historically this has signaled great long-term buying opportunities.

Currently Dormancy Flow is below its fifth percentile and has only been this low six times in bitcoin’s history. You can read more on Puell’s Dormancy Flow here.

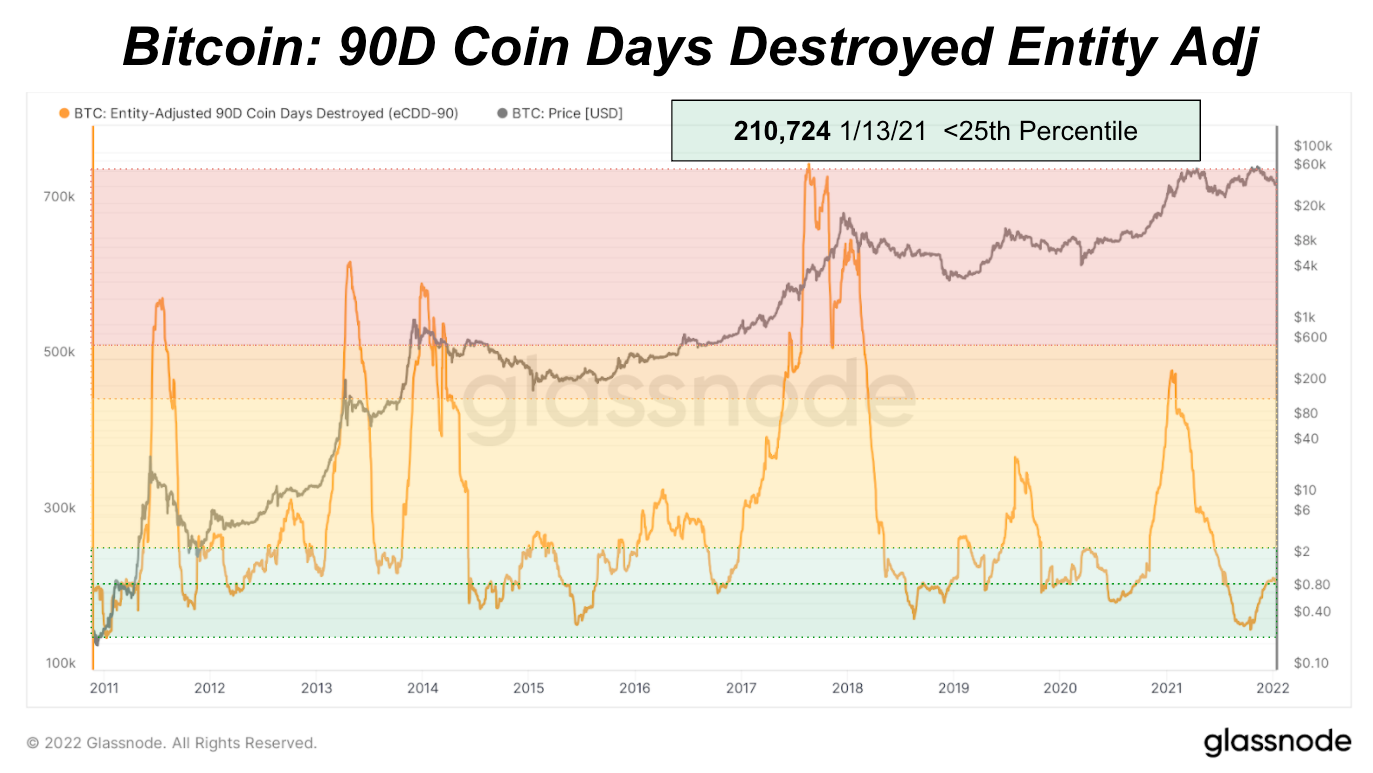

Similarly, we can get a view of spending activity habits in the market by looking at the 90-day rolling sum of coin days destroyed. Entity adjusted coin days destroyed is below its 25th percentile in terms of historical readings, a sign of strong HODLing behavior.

Still quite low compared to historic readings, the increasing reading has decelerated and begun to decline recently as bitcoin has fallen to the low $40,000s.

With metrics like coin days destroyed, we can quantify spending habits, but what about the incentive to sell? In the most simple form, that is price, as the more bitcoin appreciates the more attractive it becomes to realize gains. As it turns out, we have a metric to view this, called Reserve Risk.

Explained in depth in The Daily Dive #094 - Reserve Risk Overview, Reserve Risk quantifies the incentive to sell (price) against the cumulative opportunity cost of HODLing bitcoin that HODLers have experienced (using metrics like coin days destroyed).

Reserve Risk is currently below it’s 2021 low and just touched its buy indicator zone.

We can also look at the Value Days Destroyed Multiple, coined by analyst TXMC, which takes a ratio of the 30-day and 365-day moving average of value days destroyed (coin days destroyed multiplied by price).

“The Value Days Destroyed Multiple compares near-term spending behavior to the yearly average, as a means of detecting overheated and undervalued markets. Its effectiveness is due to the nature of how market tops are formed: via the increasing spending of older coins that eventually overpower demand, ending euphoric bull runs. Conversely, as older coins remain dormant and accumulation begins, this metric will decline and bottom during capitulation events and periods of accumulation.” - Glassnode

With value days destroyed multiple at 0.52, the metric is below its 0.75 threshold, displaying that holding and accumulation are the dominant forces currently.

it's boring. bitcoin, do something. fuck.

... :)