CPI December Release

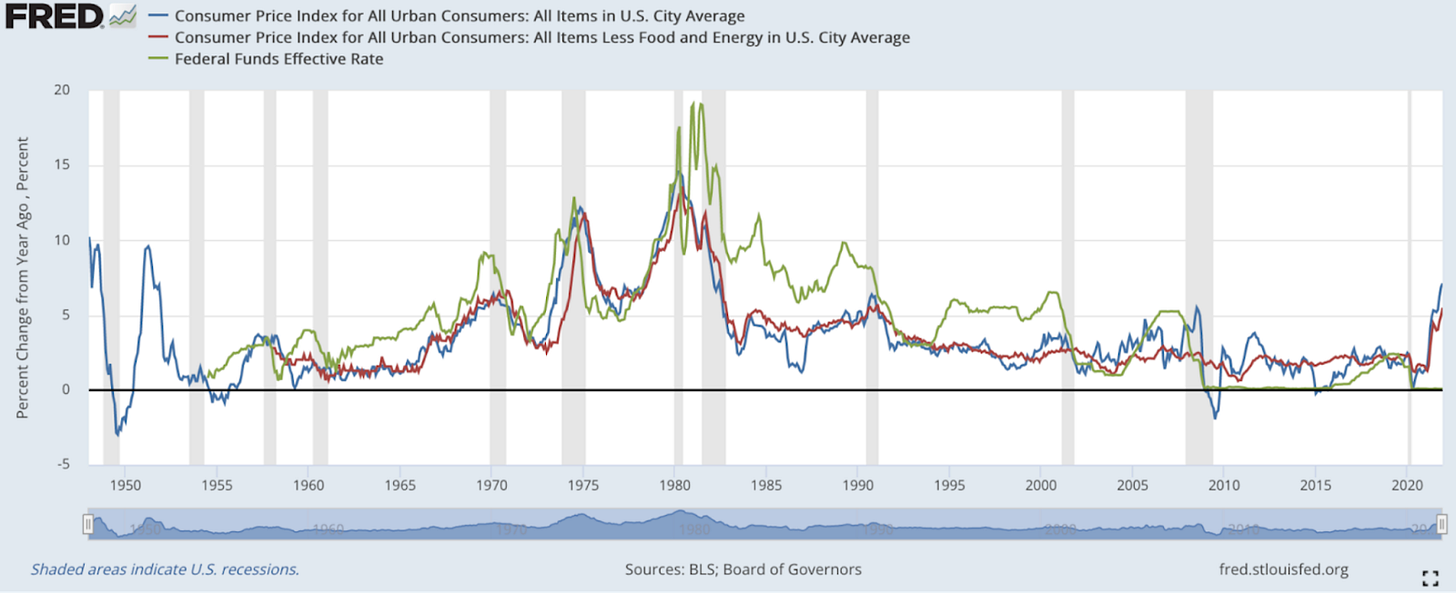

The news of today is the United States Consumer Price Index December release which came in at just over 7%. By many estimates, this could be the month that the rate of change in inflation peaks. If December is not the peak of acceleration, then it likely occurs in Q1. Our expectations for 2022 is that inflation remains significantly elevated but slows down.

As Wall Street consensus expected a higher CPI number, risk assets like bitcoin rallied higher on the release. Higher than expected inflation numbers are a higher cause for concern as this may accelerate the rate of change in the Federal Reserve Board’s monetary tightening policy.

Previously in the The Daily Dive #096 — Bitcoin: An Inflation Hedge, we broke down some of bitcoin’s price relationship with inflation and how the owner’s equivalent rent portion of the CPI was vastly underestimated.

Owners' equivalent rent, making up nearly 24% of the CPI, accelerated to 3.8% in December showing rent price inflation is still lagging higher housing prices. And compared to external data like Apartment List’s rent estimates, it’s well below a 17.8% 2021 increase. That said, Apartment List rent estimates are showing a slowdown in acceleration over the last few months, which signals the rate of rent inflation cooling off.

The chart below also shows owners’ equivalent rent compared to accelerating CPI categories for food growing 6.27% and commodities (minus food and energy) growing 10.72%. Both are highly weighted categories making up over one-third of the index. With owners’ equivalent rent, these categories make up nearly 60% and are key high level categories to watch for inflation slowing down.

Dollar Currency Index - $DXY

The DXY, which measures the strength of the dollar relative to other fiat currencies around the world, fell sharply today following the release of the CPI reading.

Bitcoin and the dollar have been inversely correlated to each other for the greater part of the last two years, and a falling DXY looks to have aided the recent bounce in bitcoin.

Perpetual Swaps Funding

The recent bitcoin bounce has occurred while funding has dropped negatively on the world’s two biggest derivatives contracts, the Binance and FTX USDT-margined perpetual swap.

The hold of the $30,000 level in spot markets accompanied by increasing bearishness in derivatives led to the explosive move upwards that followed. Similarly, with the recent hold of the $40,000 and the ensuing bounce that followed today, derivative traders are attempting to force price lower and fade the rally. A repeat of the summer price action could be in the works.

Good analysis Dylan. I enjoy your work.