Public Bitcoin Miner Holdings

Over the last year, we’ve seen the rise of public bitcoin miners as told by rises in market cap, production growth, hash rate projections and bitcoin holdings. This month, public miner monthly production and end-of-year updates are starting to come out which show a continued accumulation of bitcoin holdings.

The below chart shows collected data for public miner bitcoin holdings from their financial statements, press releases and monthly production updates. Throughout 2021, it’s a clear trend of miners rapidly growing their holdings. This group of eight miners now hold 30,759 bitcoin ($1.41 billion at a $46,000 price) which is likely understated pending new January updates from Riot Blockchain, Argo Blockchain, Hive Blockchain Technologies and Bit Digital.

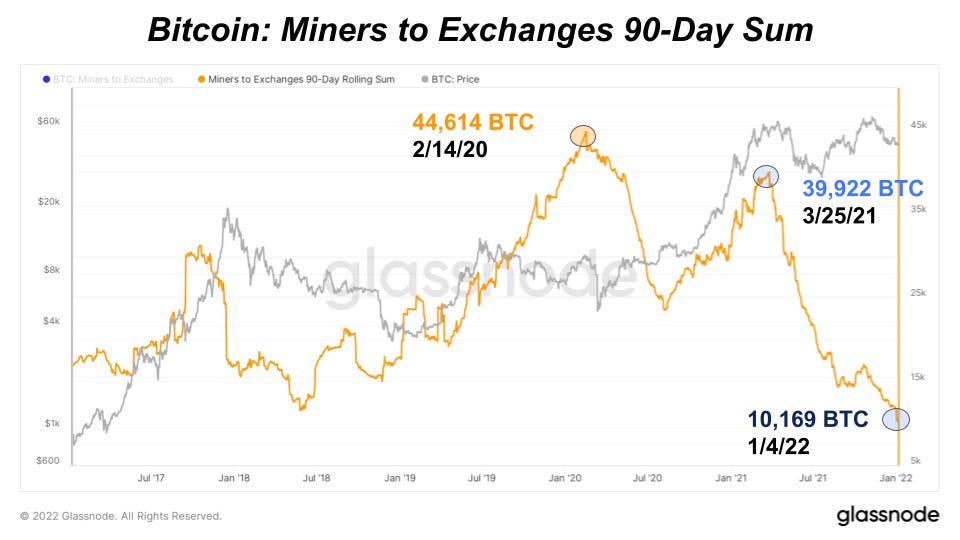

This rise in bitcoin holdings accumulation is consistent with what we’re seeing on-chain. Miners are transferring much less bitcoin to exchanges than they were at the peak of 2020 and the first half of 2021 looking at a rolling 90-day sum of bitcoin-denominated transfer volume. Overall, this leads to less sell pressure on the market and takes more bitcoin out of circulation.

Versus the groups of long-term holders, short-term holders, and exchanges, miners are estimated to hold around 9.61% of circulating supply.

Operational Updates And Projections

Because of the increased period of miner profitability, rising operational scale and growing access to traditional debt and equity markets, we expect miner accumulation trends to continue. Yet another announcement of a $100 million revolving credit line, backed by bitcoin, happened this past month with Bitfarms partnering with Galaxy Digital. We covered a similar move by Marathon back in The Daily Dive #071 - Speculative Attack And Realized Cap.

Bitfarms, like most top miners, are leveraging their bitcoin holdings to expand production capacity. Bitfarms CEO Jeff Lucas notes,

“Our new $100 million BTC credit facility adds another component to our diversified financing strategy and contributes significant non-dilutive capital to fund our global growth initiatives, which include four farms with 298 Megawatts mining capacity under construction.”

Bitfarms is already drawing $60 million from the line of credit at 10.75% annual interest rate. This is a popular financing strategy starting to unfold which sets market interest rate pricing for institutional bitcoin as collateral.

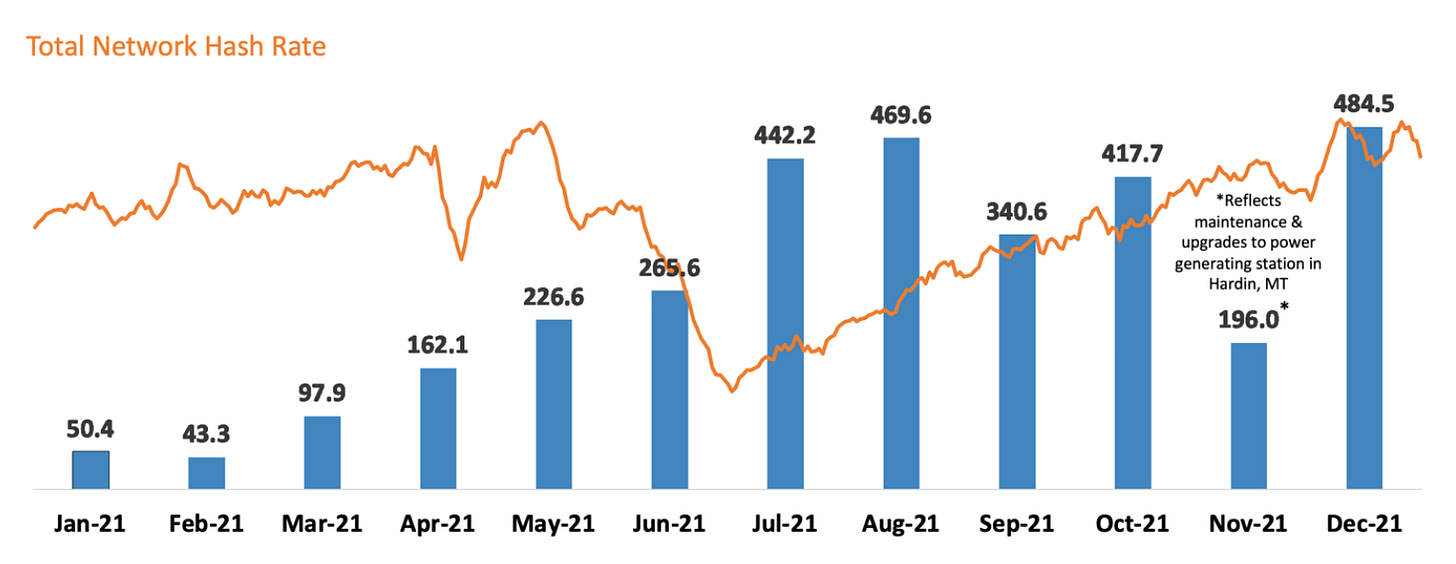

As for hash rate expansion, Marathon Digital Holdings announced their 2023 hash rate projections showing a 6.7x in hash rate over the next five quarters to reach 23.3 EH/s. In 2021, Marathon mined 3,197 bitcoin which is up 864% from 2020.

For other top miners, Core Scientific ended the year with 6.9 EH/s operating more than 80,000 ASICs. They are planning to more than double their hash rate into 2022 with 100,000 additional ASICs contracted for delivery.

Bitfarms plans to nearly double operational farms, triple operating capacity, and quadruple hash rate, projecting an 8 EH/s goal by end of 2022.

Hut 8 Mining grew their hash rate by 125% in December 2021 from December 2020. They are expecting to increase hash rate to 3.5 EH/s by the end of Q1 2022, up from their current 2.0 EH/s.

As of November, Riot had 3 EH/s capacity and updated their 2022 capacity projections to 9 EH/s, expecting to triple their machine fleet to 93,150 Antimers in operation.

For all top bitcoin miners, hitting delivery schedules on-time in a bottlenecked ASICs supply chain is still a key executional risk. But so far, most miners have only increased their future capacity projections rather than knock them down.

Final Note

We’re still in the early stages of seeing this hypercompetitive infrastructure industry take shape. Top bitcoin miners are building out capacity for the long term, and 2022 is shaping up to be one of their biggest growth years yet.

As a direct reflection of their bullish outlook on Bittcoin’s growth, they are accumulating as much bitcoin as possible, a trade for fiat. We expect to see this miner accumulation continue and have a more positive impact on bitcoin price in the future as miners increase their share of circulating supply.

btw i dig these miner updates -- lets keep em rollin!

miner's holding coin just accelerates / deepens the impact of supply... this is good for price.