Long-Term Holder Supply Accelerates

As the bitcoin price continues to consolidate and range below $50,000, we continue to monitor long-term holders in the market to assess their behavior and sentiment.

After a period of long-term holder distribution, a moderate decline in long-term holder supply throughout November into lower prices, the long-term holder supply is now showing signs of slight acceleration and accumulation. The 30-day percentage change in long-term holder supply is positive, up 0.1% over the last two days.

It’s hard to know if this is a sustained trend forming or a one-off type event. But long-term holders' net accumulating into a lower price is a positive sign right now of sustained demand at these prices. A more bullish sign for the market would be to see sustained distribution, selling to new participants and profit taking, from long-term holders into rising prices. A bearish sign would be to see more distribution into falling prices.

That said, long-term holder supply has paused its downward momentum for now, sitting at 13,340,590 BTC.

Here’s another way to visualize the above chart using long-term holder net position change which shows the change in supply over the last 30 days in absolute terms instead of a relative percentage.

The change in long-term holder supply shifting from distribution to accumulation has happened several times over the last five years. In the case of 2017, shifts to accumulation were one-off events in the middle of a bull run. In most other cases, the market shifted to a sustained period of accumulation lasting months. If there’s to be more upside to the market in Q1, we would expect to see long-term holders sell into new waves of buying demand.

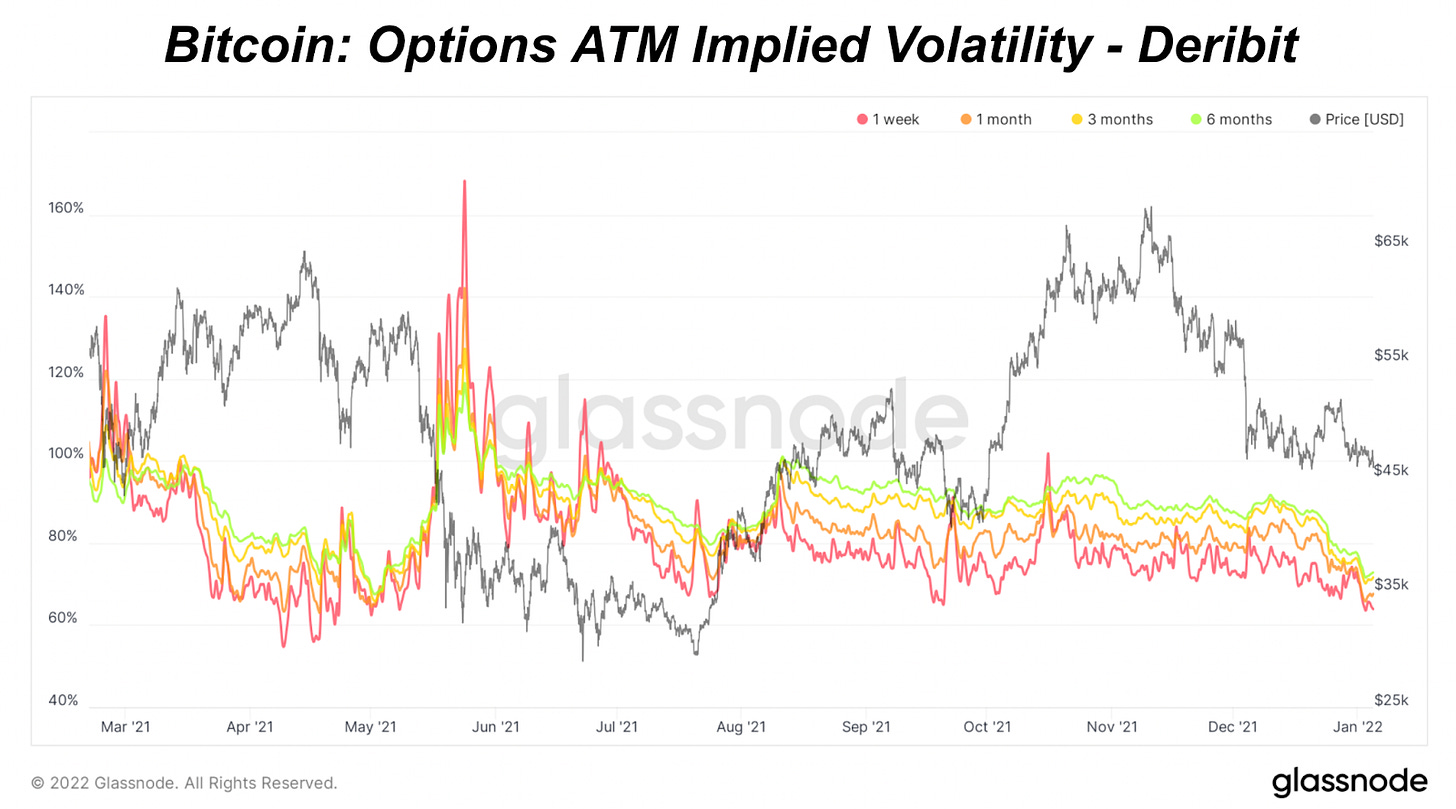

Options Market Expecting Additional Consolidation

With bitcoin consolidating around $45,000 to $52,000 over the previous month, the options market has been pricing in additional consolidation for the time being, with implied volatility for short-dated and long-dated strikes hanging around 70%. Implied volatility has been in a steady downtrend since the fall, displaying that market participants expect relatively muted moves.

It should be noted that market makers for options are often surprised by liquidation events and black swan market moves and adjust the implied volatility on their options pricing accordingly, but with the derivative markets looking to be quite healthy in terms of speculative activity (or rather a lack thereof), participants in the options market are betting on a quiet few months ahead.

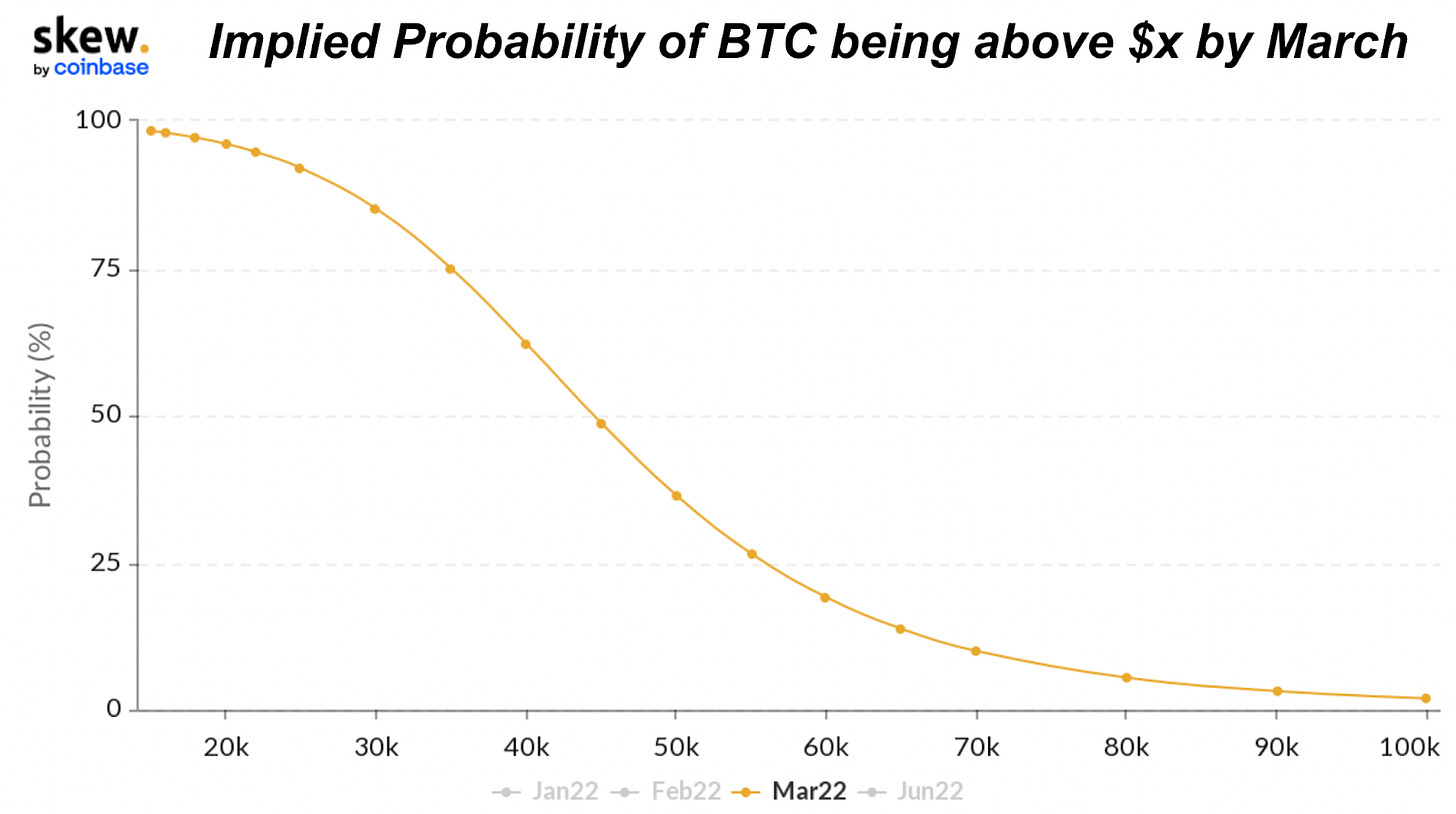

Below are the implied probabilities of various bitcoin prices by month, according to the options market today:

For additional information as to why consolidation for the time being is our base case, read this thread posted last month.

eventually, the number goes up. :)