The Daily Dive #125 - ARK Invest On-Chain Whitepaper Summary

On-Chain Whitepaper Summary

In today’s Daily Dive, we’re highlighting the latest ARK Invest Bitcoin whitepaper, On-Chain Data: A Framework To Evaluate Bitcoin. The paper was authored by Yassine Elmandjra, analyst at ARK Invest and David Puell, on-chain analyst and market researcher. Both are leading analysts in the space with a history of exceptional work. We will summarize their recent whitepaper and provide some Deep Dive resources to supplement.

TLDR: The whitepaper’s aim is to help investors understand how to analyze and value bitcoin just like other traditional assets. The paper highlights Bitcoin’s real-time, global public ledger as a unique toolset and walks through some key on-chain metrics to understand.

Elmandjra and Puell start by breaking down on-chain data into three distinct layers across network health, buyer and seller behavior and asset valuation. Each layer is tailored to a different group of market participants.

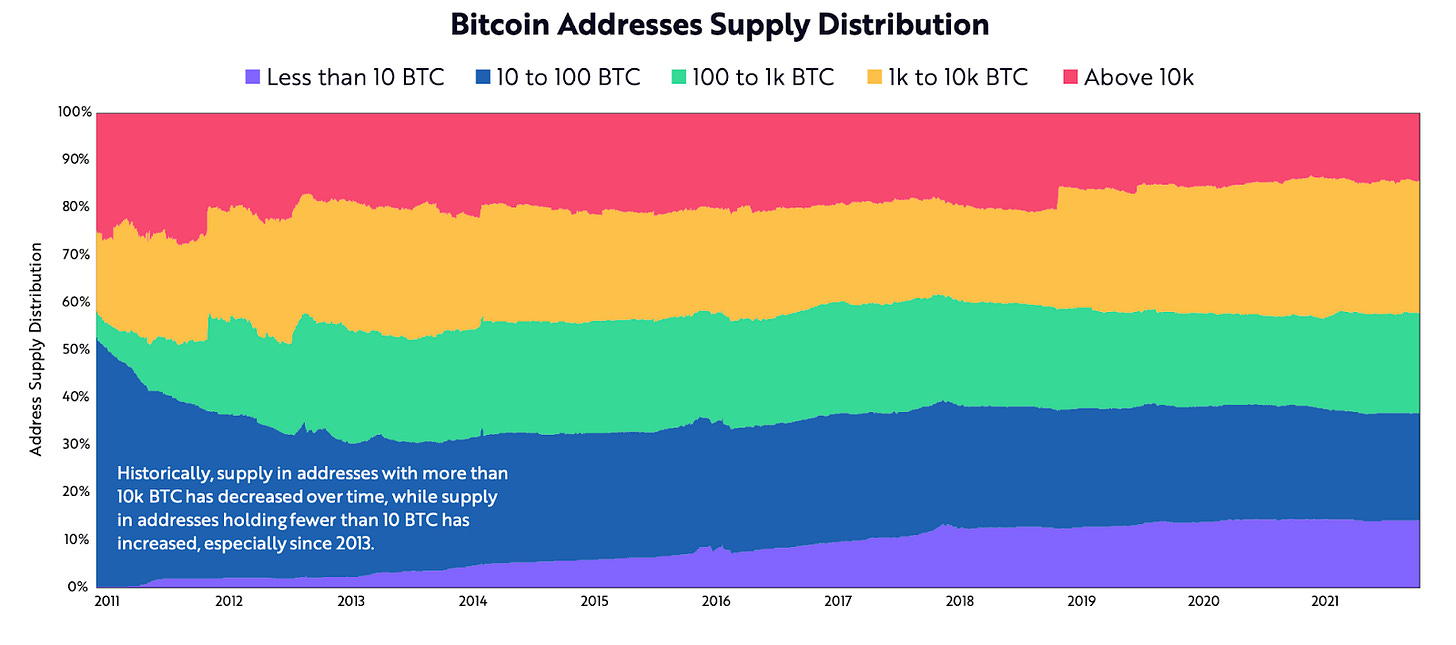

The network health layer covers monetary integrity, security and usage of the Bitcoin network. Evaluating address supply distribution, supply in addresses holding fewer than 10 BTC has increased since 2013.

Transaction volume and velocity are ways to measure the health of the network. Transaction volume is approximately $53 million per day. Annual velocity reached a bottom in April 2021 which could be a result of investors diversifying into other cryptocurrency assets or because transaction activity is moving back on-chain.

For a deeper look into the total transaction volume of the network and the efficiency of the network, see The Daily Dive #108 - Bitcoin: The Most Efficient Value Settlement Network.

Layer 2 of this framework covers buyer and seller behavior in which anyone can assess bitcoin demand, bitcoin holder positions and cost basis at any time. Bitcoin realized profits and losses can indicate periods of extreme market volatility.

Many are used to evaluating market capitalization for traditional assets but Bitcoin’s realized capitalization offers a unique view of the average cost basis, valuing each bitcoin at the price of its last movement.

Our latest update on realized price is The Daily Dive #123 - Realized Price Update with a deeper look into realized capitalization at The Daily Dive #071 - Speculative Attack And Realized Cap.

Layer 3 covers asset valuation metrics. Comparing market cap and realized cap to each other, the Market Value to Realized Value (MVRV) ratio has become one of the key metrics to assess when bitcoin is overvalued to the asset’s average cost basis.

Our latest update on Market Value to Realized Value can be read at The Daily Dive #106 - Whale Buying And MVRV.

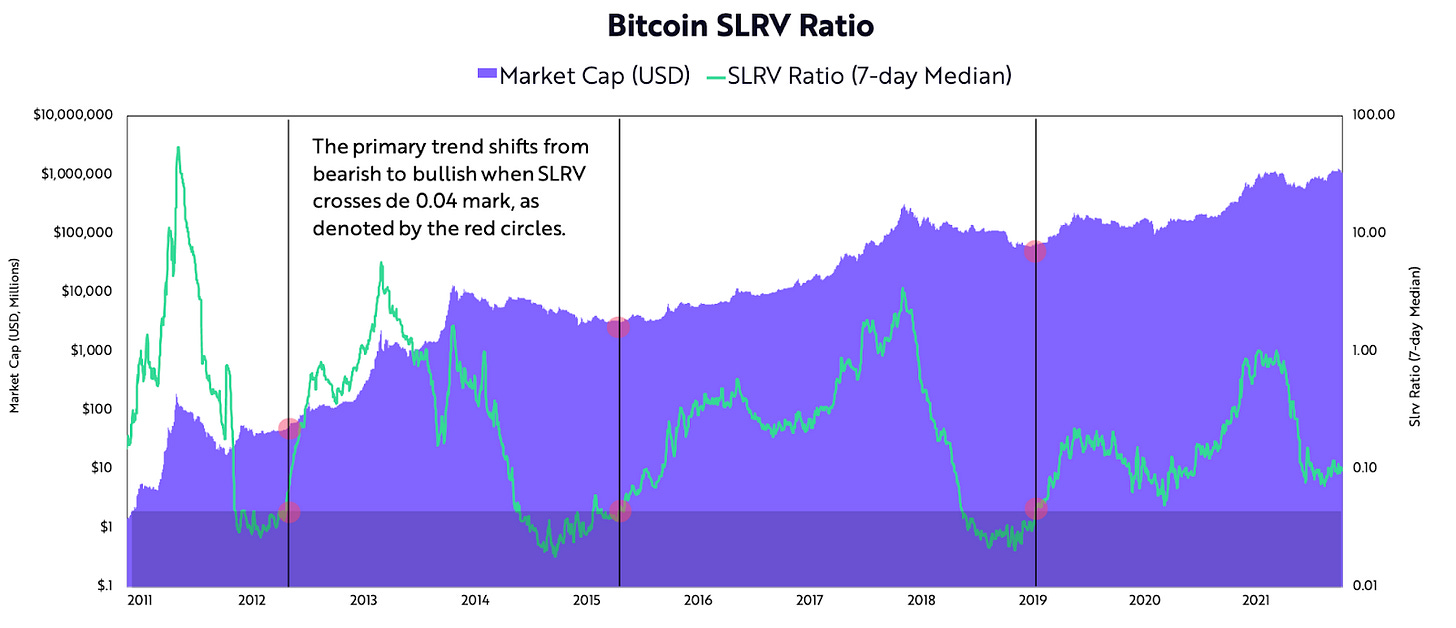

Most are familiar with HODL waves. The Short-to-Long-Term Realized Value Ratio (SLRV) uses the 1-day HODL wave divided by the 6-month-to-1-year HODL wave, both weighted by realized capitalization. This is a way to view short-term velocity relative to medium and long-term velocity. The market typically shifts from bearish to bullish when SLRV crosses a 0.04 value.

Final Note

This whitepaper is a valuable resource to start understanding how to leverage on-chain data in bitcoin’s valuation. It covers simple and more complex metrics in a concise manner.

Our position has always been that bitcoin’s on-chain data is unique, valuable, first of its kind and offers a view into market dynamics unlike any other asset. More individuals and institutions will leverage it into the future to generate insights and decipher market dynamics. Elmandjra and Puell have similar views, concluding with this:

“In the same way that a government statistical agency publishes data about a country’s population and economy, or a public company publishes quarterly financial statements disclosing growth rates and earnings, Bitcoin provides a real-time, global ledger that publishes data about the network’s activity and inner economics. Without central control, Bitcoin’s blockchain provides open-source data, its integrity a function of the network’s transparency. In our view, investors increasingly will appreciate bitcoin’s investment merits through the lens of a completely new framework: on-chain data.”

To read the full ARK Invest Bitcoin On-Chain Whitepaper for yourself, click here.